How to Use Apple Pay Cash for Person-to-Person Transactions

Apple Pay Cash is finally active in the United States, several days after the iOS 11.2 update that technically included it. Apple first announced it as a feature for iOS 11 at this year’s WWDC, back in June (see “iOS 11 Gets Smarter in Small Ways,” 5 June 2017).

Apple Pay Cash is the official name for the person-to-person Apple Pay feature that was still unnamed at WWDC. Like Square Cash, Venmo, and other services, it lets you send money to other people, assuming that they’re using iOS 11.2. It’s the easiest way to exchange money with other iOS users, beating out cash, gold, and chickens. To trade money with friends and family not on the Apple bandwagon, check out one of the other payment services Glenn Fleishman described in “Circle, Square, and Venmo: Payment Apps Let You Pay via iMessage” (3 October 2016).

Setting It Up — To enable Apple Pay Cash, you must first have Apple Pay set up. If necessary, iOS 11.2 likely prompted you to do so after the update process. If you ignored the prompt then, tap Settings > Wallet & Apple Pay > Add Credit or Debit Card. It’s a straightforward process, possibly except for verifying Apple Pay with your bank, which can differ by bank. Chase set it up automatically, while Ally made Josh call a special mobile payments department to authorize it.

You must also have two-factor authentication enabled for your Apple ID. In iOS 10.3 and later, you do that under Settings > Your Name > Password & Security. Regardless of whether you plan to use Apple Pay Cash, we recommend turning on two-factor authentication — it significantly enhances your security.

Once you’re set up for Apple Pay, just enable the Apple Pay Cash switch in Settings > Wallet & Apple Pay and follow the prompts. If that switch doesn’t appear for some reason, try restarting your iPhone by going to Settings > General > Shut Down, and then press the Sleep/Wake or side button to turn the iPhone back on.

Turning on Apple Pay Cash creates a new card in the Wallet app, called Apple Pay Cash. This virtual card stores money you’ve received via Apple Pay Cash; you can also add money to your Apple Pay Cash card, but note that it doesn’t earn any interest. The Apple Pay Cash card works just like any other debit card and can be used for Apple Pay purchases or sent to other Apple Pay Cash users.

Interestingly, if you go to Settings > Wallet & Apple Pay > Apple Pay Cash and scroll down to the Network listing, you’ll notice that it says Discover Debit. That’s right, the Apple Pay Cash card is actually a virtual Discover card, which means that you can use it only in stores that accept Discover and NFC payments. (You can also see your Apple Pay Cash card settings in Wallet by tapping the Apple Pay Cash card and then tapping the little “i” in a circle in the lower-right corner.)

If you’re not already on that Apple Pay Cash screen, go there to finish a few setup tasks. Skip past the stuff under Balance for now and look at the Accepting Payments header. The default is to accept payments automatically, which is likely fine unless you can imagine a situation that would be awkward if money was accepted on your behalf automatically (politicians, take note!).

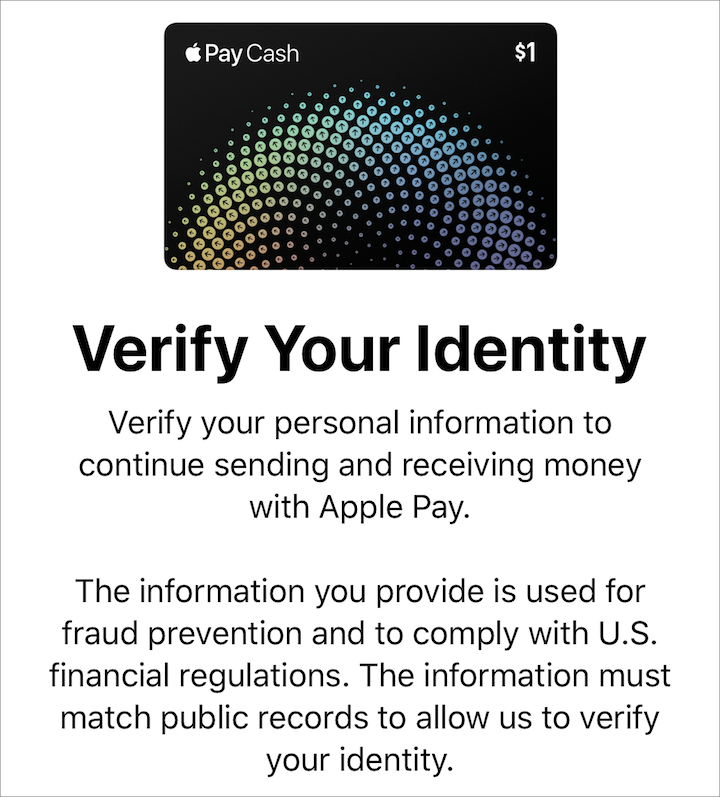

Scroll down and check the Billing Address setting to make sure it’s correct. Also look for the Verify Identity setting, which is important. On our iPhones, its description said, “Complete identity verification to continue using Apple Pay Cash without interruptions.”

Tap Verify Identity, and you’ll be prompted to enter your legal name, your residential address, the last four digits of your Social Security number, and your date of birth.

If you don’t verify your identity, Green Dot Bank, which is the bank Apple is working with for Apple Pay Cash, may close your account, allow you to use only the money that is in the account, or let you use it with transaction limits — see the full terms and conditions for details. Federal law sets these requirements to fight the funding of terrorism and money laundering activities.

Trading Money — Before you leave the Apple Pay Cash screen, I’d like to point out one more thing. If you tap the Add Money option near the top, you can add additional funds to your Apple Pay Cash card from a linked debit or prepaid card in Apple Pay. The amount entry screen offers a keypad, but for convenience, it adds quick buttons for $10, $20, and $50. The minimum you can add is $10.

Why might you want to add money to your Apple Pay Cash account? If you send money to someone and there isn’t enough in your account, Apple Pay Cash pulls it from your linked card. If you want to avoid seeing lots of little Apple Pay Cash transactions in your debit card’s account, pre-loading the Apple Pay Cash card will have that effect.

To send or request money via Apple Pay Cash, you use its Messages app, which is installed automatically when you turn on Apple Pay Cash. While in an iMessage thread with the person with whom you want to exchange money, make sure the app drawer is showing (tap the app button if necessary) and then tap the Apple Pay button in the drawer.

Note that if the recipient isn’t running at least iOS 11.2 or watchOS 4.2, you’ll receive an error message. Apple lists all sorts of things that could prevent an Apple Pay Cash transaction.

If your recipient can use Apple Pay Cash, you’ll see a panel with plus and minus buttons, a dollar amount, and buttons for Request and Pay.

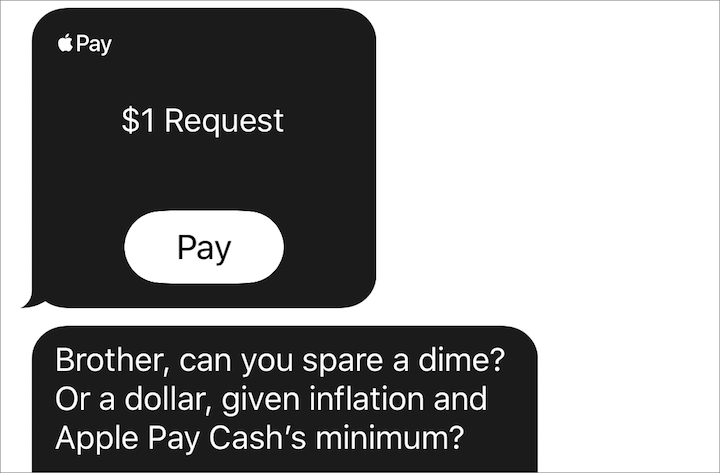

First, enter a dollar figure. The default is $1, but you can increase and decrease that with the plus and minus buttons, or tap Show Keypad to enter an amount directly. Use the keypad to enter amounts that include dollars and cents. When you’re finished, tap Request or Pay to insert the appropriate transaction into a message.

Don’t worry about accidental sends because the money or request won’t be sent until you tap the send button, just like any other Messages app. If you change your mind, you can remove the Apple Pay Cash attachment by tapping the little x in the upper-right corner. Like any other Messages attachment, you can also add a comment below the attachment. Interestingly, the message bubble will be black, and if a friend is working on sending you an Apple Pay Cash payment, there’s a special in-progress bubble for it.

When you send money, you get one last chance to verify the transaction, via a regular Apple Pay prompt. On Touch ID devices, you’ll be prompted for a fingerprint. The iPhone X will instead ask you to double-click the side button and be identified with Face ID.

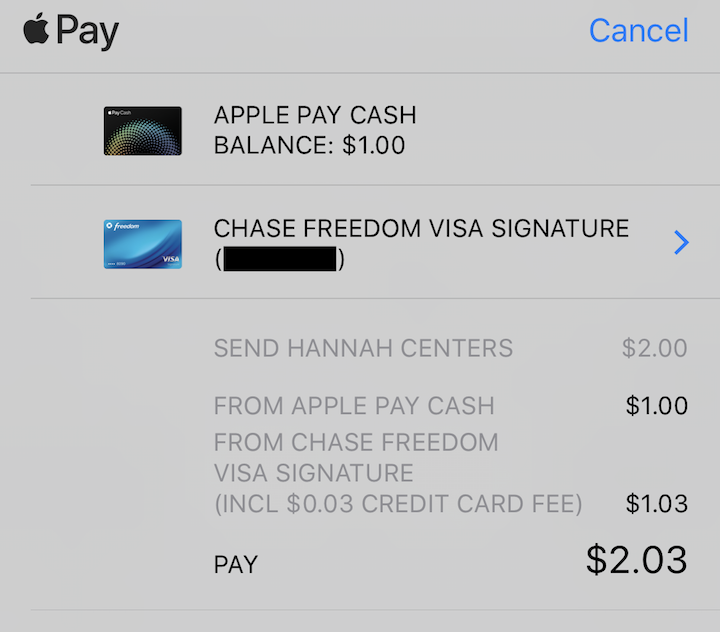

If your Apple Pay Cash balance covers the full amount, that is the only payment method available. But if your balance isn’t sufficient, you’ll see your default Apple Pay payment method listed at the bottom of the screen. If you have multiple payment methods set up, you can tap the payment method to change it.

Be careful here! If you choose to fund the transaction with a credit card, as opposed to a debit card or “eligible prepaid card,” you’ll be charged a 3 percent transaction fee. It’s not a lot, but if you plan on using Apple Pay Cash frequently, linking to a debit card makes more sense.

If someone requests money from you, you’ll receive a message with a Pay button you can tap to initiate the payment. Likewise, if your settings require manual approval to receive payments, you need to tap the Accept button that appears in the message attachment.

Another way someone can request money is just to mention a dollar amount in a message. Dollar amounts in messages are now links, and tapping one will either bring up Apple Pay Cash with that amount inserted or change the amount on screen. You’ll also see an Apple Pay button on the QuickType bar — tap it to bring up Apple Pay Cash with the amount pre-filled.

When you receive money, it remains on your Apple Pay Cash card by default, although you can withdraw it to a linked bank account.

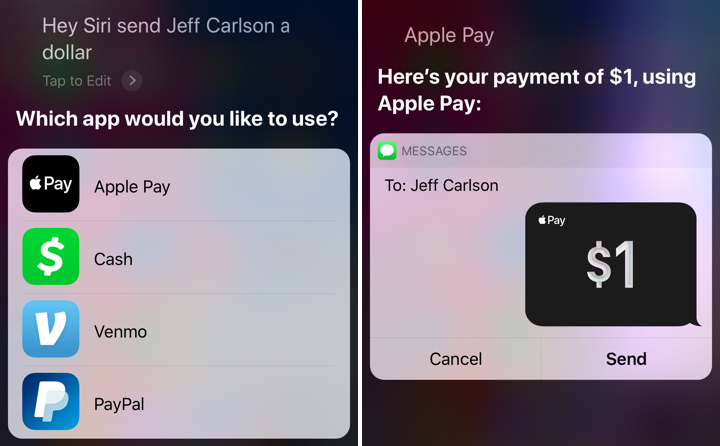

You can also use Siri to send cash. Tell it something like, “Send my mom a dollar.” If you have multiple apps that can initiate a payment via Siri, you’ll be asked to choose one.

In our usage so far, Apple Pay Cash has been easy to use and has performed flawlessly.

Apple Pay Cash on Apple Watch — You can also use Apple Pay Cash on your Apple Watch, assuming you’ve updated your Apple Watch to watchOS 4.2 (see “watchOS 4.2 Adds Apple Pay Cash and Moistens HomeKit,” 6 December 2017).

You may have to set up Apple Pay Cash in the Watch app after you’ve done so in iOS. In the iPhone’s Watch app, on the My Watch screen, go to Wallet & Apple Pay > Apple Pay Cash, and tap Continue to set it up.

Although others didn’t have to do this, Josh had to restart his Apple Watch by holding the side button until the Power Off switch appeared and then swiping the Power Off button to the right. Then he turned it back on by pressing the side button again.

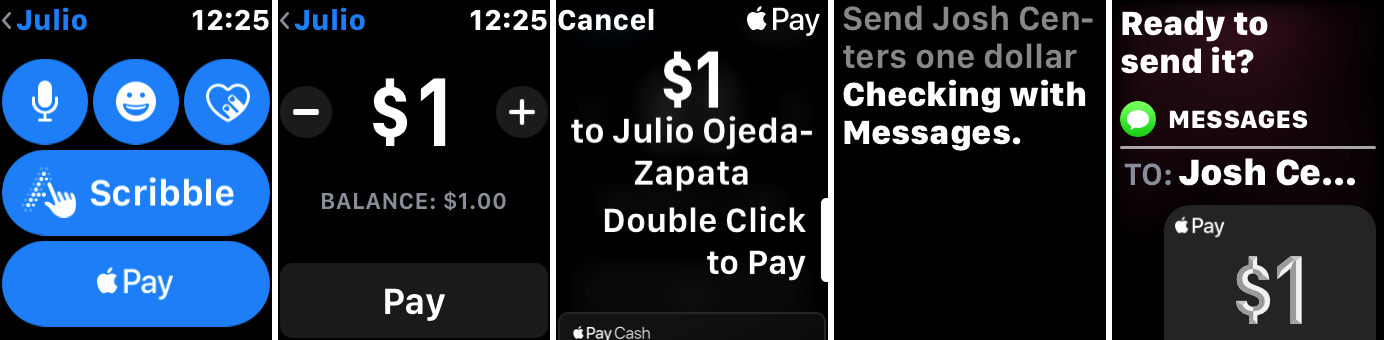

You can send money in the Messages app on the Apple Watch (screenshots 1–3 below), or use Siri on the Apple Watch to send or request money (screenshots 4–5). (“Hey Siri, ask my sister for a dollar.”) When you send money, Messages on the Apple Watch uses your default card, but you can tap it to select another card, which you might want to do if you prefer a credit card for Apple Pay but want to use a debit card for Apple Pay Cash.

Regardless, after you tap Send in the Messages app on the Apple Watch, you’re prompted one more time to double-click the side button to confirm the transaction, making it easy to back out if need be.

Cashing In — Money on your Apple Pay Cash card won’t do you much good unless you regularly pay others via Apple Pay Cash or buy things with Apple Pay. If that’s not the case, you can withdraw that money to a bank account by going to Settings > Wallet & Apple Pay > Apple Pay Cash > Transfer to Bank.

If you haven’t transferred money before, you’ll have to tap Add Bank Account to set it up — have your bank account and routing number handy. The hardest part is finding those numbers; Apple provides a handy graphic to help.

When it comes time to withdraw, the process works like any other Apple Pay Cash transaction — enter an amount and then identify yourself with a passcode, Touch ID, or Face ID.

Like many financial transactions, it takes 1 to 3 days for your Apple Pay money to arrive in your bank account. Apple doesn’t provide any automatic way to withdraw your money, but since Apple Pay Cash is just for person-to-person transactions, not small business transactions, that shouldn’t be a significant annoyance.

We do wonder how much interest Apple is earning from all the money users will store in Apple Pay Cash — even if it’s less than $20 per person, that could still end up being millions of dollars.

Do you think you’ll use Apple Pay Cash? Let us know in the comments.

Here’s hoping (in near future) it’ll work in other countries, as well as across countries, and across all devices, otherwise it will be too secular, and thus become too inconvenient to use.

I can’t imagine Apple not expanding this internationally, but I wouldn’t be surprised if there are fees to transfer money between countries (or payment networks). There may also be additional tracking or regulations for transactions that cross borders due to worries about money laundering and terrorism.

I started setting it up but got roadblocked with a 'Two-Factor Authorization Required' notification. Not sure yet whether I want Two-Factor Authorization. Sounds complicated. Why can't anything be easy?

Because easy is insecure. :-) You want two-factor, and Apple is going to keep requiring it in ever more spots to protect users from their poor security habits.

I can't use two-factor because it requires use of text messaging and I don't do text messaging; in fact I had it completely disabled on my phone years ago. Apple has apparently adopted Microsoft's "our way or else" policies and stopped being the company "for the rest of us".

I use different passwords for each place; I'd use 1Password's password generator but since each site has their own oddball ideas as to what is a valid password, most of the time passwords generated by 1Pwd don't qualify.

So I have 2 credit cards and a debit card in my wallet. It appears I can only use the debit card with Apple Pay Cash. Is there some way to find out what credit cards work with Apple Pay Cash?

The other question is other than the 3%, is taking money from a credit card (not debit) getting posted as a cash advance or a purchase. If it is a purchase, I can see many people abusing that. I send you $1000 from my credit card. That comes out as $1030 for me but now you send the $1000 back and I'm not paying the much higher cash advance interest rate. And maybe I also get some miles or cash back as well.

Still a lot of unanswered questions.

When you say that you can't use your two credit cards, do you mean that it won't let you select them when making a payment? I have only one credit card in at the moment, and it seems to work.

The Terms and Conditions do talk about this a little, saying "the issuer of your Supported Payment Card may separately charge fees and interest if your P2P Transfer is funded (either in whole or in part) with your Supported Payment Card and such funding transaction is treated by your card issuer as a cash advance or an overdraft."

I somewhat doubt there will be easy way to abuse it, though those people who know how to work credit card systems may identify particular cards that do let you accrue points or miles.

WARNING: If you have any devices running older Mac or iOS operating systems, be aware that two-factor authentication is going to cause problems. The new two-factor authentication is not supported in older operating systems, but it is still required by iCloud, so it creates an endless loop of requests that cannot be completed on the older operating systems. I recommend updating all of the devices and using two-factor, or don't update and don't use two-factor.

Dealing with two-factor authentication on devices that are too old to support it is a bit of a pain, but it does work.

The trick is that when you need to log in to an older device and you get the 2FA code on a supported device, you enter your password and then the 6-digit code on the older device.

So if your password is eggfreckles and the code you get is 123456, you’d enter eggfreckles123456 as the password on the older device.

Will I have to unfreeze any of my credit bureau accounts to get this set up? That can cost $$ too.

Family or friends come over for movie or football and pickup lunch or dinner on the way. Will be nice way to reimburse. Will work in restaurants too.

My bank won't accept linking to my debit card yet. The customer service rep told me that Apple will charge them for these transactions (as opposed to Venmo which does not).

I'd switch banks. At this point, even the little country banks in my town support Apple Pay.

Josh, that isn't so easy to do. I've been with the same bank for 40 years; there are 5 direct deposits set up that would have to be changed. Additionally, I have certain prerequisites that a lot of banks either can't or no longer meet. Last, if I COULD not have bank accounts, I would just go without them since they no longer pay any worthwhile interest.

Why would anyone outside of bookies, pimps and drug dealers need this instant money thing? There are many already existing ways to send money to people and businesses. Oh well, Siri, put 50 on milkdud in the fourth.

+1!

For the bookies, pimps, and drug dealers among our readers, I strongly suspect that Apple Pay Cash isn’t a good solution. Since it uses the Discover network, it’s undoubtedly as traceable as any normal credit or debit card. Bitcoin or another cryptocurrency would be a better choice.

Now, to answer your question more seriously, the reason is that most people have not already set up a way of quickly transferring money to friends and family for splitting restaurant tabs, paying people back for picking something up at the store, and so on. There are other solutions, but they aren’t nearly as easy or integrated as Apple Pay Cash for those who are using iOS 11.2. We covered a few of the main ones in the article linked at the top of this piece.

Happily, if you’re offended by Apple Pay Cash, you can just avoid using it.

Chase and other major banks now provide fast, easy and secure personal money transfers with Zelle. I've used this with my daughter and its worked fine. So why would I bother setting up Apple Pay?

Doesn’t sound like you should, since you already have a solution for the one person with whom you want to exchange money.

But not everyone banks with Chase or a similar major institution, or wants to transfer money with your daughter. ;-)

The variety of comments is entertaining. I remember thinking that text was a bad idea, as it allowed people to secretly waste time on their phones, such as people in meetings and children in school.

I still think that, but, I also realize text is a great way to notify someone without disrupting routine and/or thought with the ring of the phone or with having to check email.

I see Apple Pay in the same light. For those who find it useful, it's a wonderful application. For those who don't understand why a college student may need the money now, on the phone, to pay a debt or place a bet, it's a toy - fun but with no real practical use.

Most new applications are what Mark Twain called a necessary inconvenience - wonderful for those who want it, annoying for those who don't.

By the way, I still prefer the real thing - cash. Harder to steal or trace.

> That’s right, the Apple Pay Cash card is actually a virtual Discover card

But when I tried adding my own Discover debit card linked to my Discover Bank checking account it didn't work and a call to Discover confirmed that their debit cards do not yet support Apple Pay.