#1573: Apple’s record Q3 results, why Apple is “antifragile,” watchOS 7.6.1 fixes security vulnerability

Life intervened this week, so we have a svelte TidBITS issue for you. Apple finished off its operating system updates from last week with watchOS 7.6.1, which addresses the serious vulnerability fixed in the other updates—get those installed! The company also released stellar Q3 2021 earnings, and Michael Cohen and Josh Centers ran down the numbers to share charts that reveal just how well Apple performed. Spurred by Apple’s strong earnings during the pandemic, Josh penned a viral analysis about how Apple has become an “antifragile” company, or one that grows stronger in the face of adversity. How far we’ve come from the days of “APPLE IS DOOMED!” Notable Mac app releases this week include just ScreenFlow 10.0.3.

watchOS 7.6.1 Fixes Severe Security Vulnerability

Apple has issued watchOS 7.6.1 with a fix for the same vulnerability that sparked the iOS 14.7.1, iPadOS 14.7.1, and macOS 11.5.1 updates: a kernel vulnerability that may have been actively exploited in the real world (see “Apple Releases iPadOS 14.7.1 and macOS 11.5.1 with Security Notes for Recent OS Updates,” 26 July 2021).

You can install the watchOS 7.6.1 update, 64.2 MB on an Apple Watch Series 4, in the Watch app on your iPhone under My Watch > General > Software Update. Have your watch on its charger and charged to at least 50%.

Given the severity of the vulnerability and the fact that it’s in the wild, we recommend installing watchOS 7.6.1 sooner than later.

Apple’s Q3 2021: Still Making Money Hand Over Fist

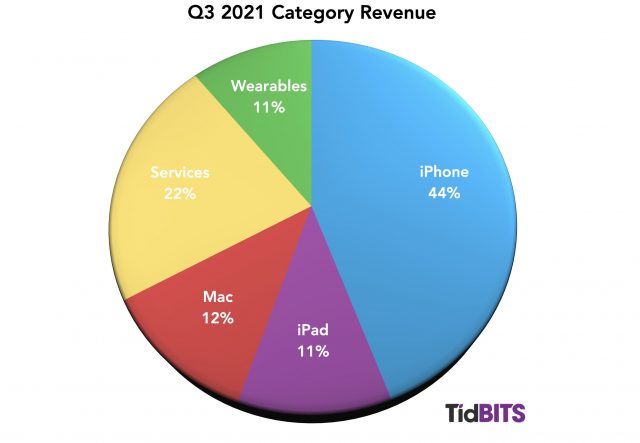

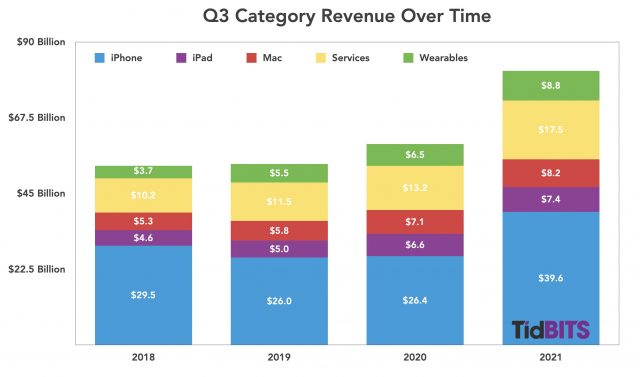

Even as the global pandemic grinds on, Apple continues minting money at a feverish pace. Reporting on its Q3 2021 financial results, the company has announced profits of $21.7 billion ($1.30 per diluted share) on revenues of $81.4 billion. Its revenues were up 36% compared to the year-ago quarter, with profits up an immodest 93% (see Apple Q3 2020 Breaks Records While the World Burns, Next iPhone to Be Fashionably Late, 30 July 2020). Apple reported all-time records in every geographic sector in which it does business and significant gains in every product category it reports; the phrase “all-time high” kept recurring in CFO Luca Maestri’s description of the quarter’s results. Ted Lasso doesn’t have to work very hard to “Believe” with results like these.

Apple CEO Tim Cook said Q3 2021 marked a new revenue record for the June quarter. He described a growing sense of optimism among the American public, boding well for future results, but he cautioned that a new wave of COVID-19 infections caused by the Delta variant could be a setback. In addition, he expressed some concern that foreign exchange rates and supply constraints could also slow future revenue growth. Offsetting those worries are signs of healthy growth in emerging markets, such as Brazil, Chile, Mexico, Poland, India, Thailand, and Vietnam.

iPhone

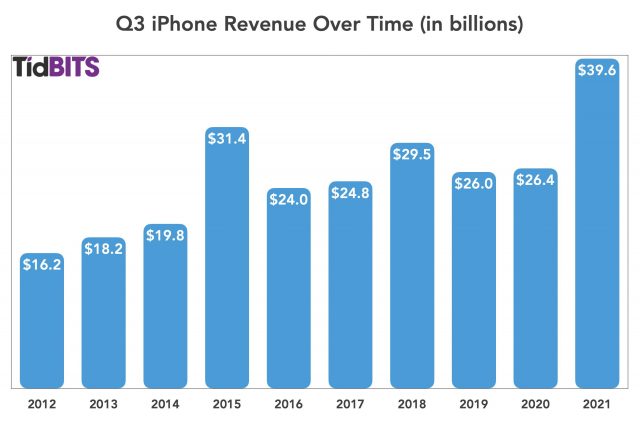

Q3 iPhone revenues shot up an impressive 49.8% year over year, from $26.4 billion in Q3 2020 to $39.6 billion this quarter. iPhone upgrade revenues achieved (here’s that phrase again) an all-time high for the June quarter. Cook noted that the introduction of 5G capability helped spur the demand for new iPhones and went on to say that 5G adoption worldwide is still in its early stages, auguring well for the product line in future quarters (see “Understanding 5G, and Why It’s the Future (Not Present) for Mobile Communications,” 11 November 2020).

iPad

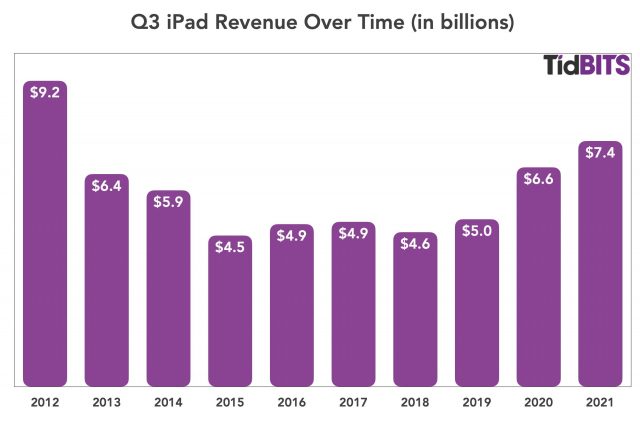

The iPad brought in $7.4 billion in revenue, handily beating the $6.6 billion it brought in a year ago, an increase of 11.9%. You would have to go back to 2012 to find the sole June quarter in which iPads brought in more revenue than this year. With new iPads introduced only recently (including a high-end iPad Pro that shares the same M1 chip as the latest Macs) and with more on the way, coupled with the possibility of continuing pandemic-related lockdowns that could spur continuing demand for the devices for remote work, the iPad’s financial future looks rosy.

Mac

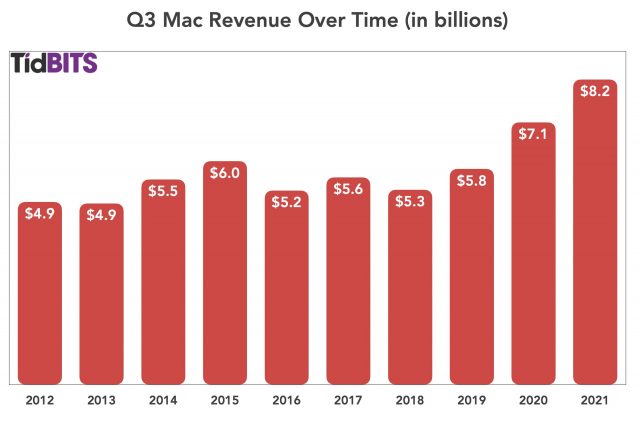

Apple’s Mac products also exhibited strong growth, with a year-over-year increase of about 16%, from $7.1 billion in revenue in Q3 2020 to $8.2 billion this quarter. Cook said this was a new Q3 record for the Mac, thanks to the new M1-based iMac.

“It is remarkable that the past four quarters for Mac have been its best quarters ever,” said CFO Luca Maestri. Maestri later added that the combined sales of the iPad and Mac equals the size of a Fortune 50 company, and customer satisfaction for both is over 90%. Maestri also noted a significant uptick in the adoption of the MacBook Air among corporate customers—given that the M1-based MacBook Pro doesn’t have much over the M1-based MacBook Air, we’re not surprised.

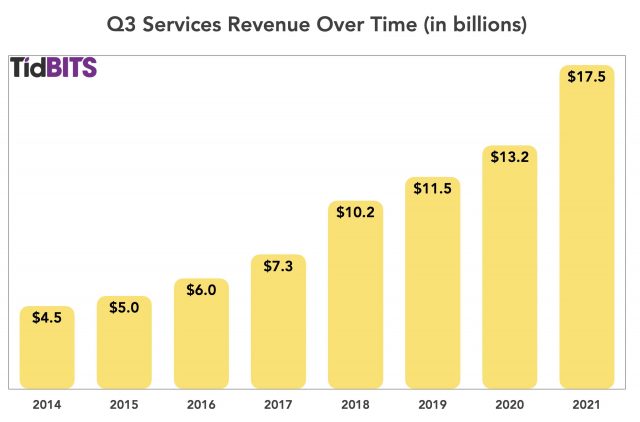

Services

Services experienced an impressive 32.9% year-over-year increase in revenue with $17.5 billion in revenue this quarter compared to $13.2 billion in the year-ago quarter. Cook said this was an all-time Services record, and he dropped in a mention of Apple TV+ and its 35 Emmy nominations as one contributor to the category’s success. In fact, many Apple services broke revenue records, either quarterly or all-time, including AppleCare, Apple Music, and the App Store.

Maestri boasted that the various Apple services now have more than 700 million paid subscriptions, up 150 million from last year. He credited much of the growth in this category to entertainment-hungry customers during the pandemic lockdowns.

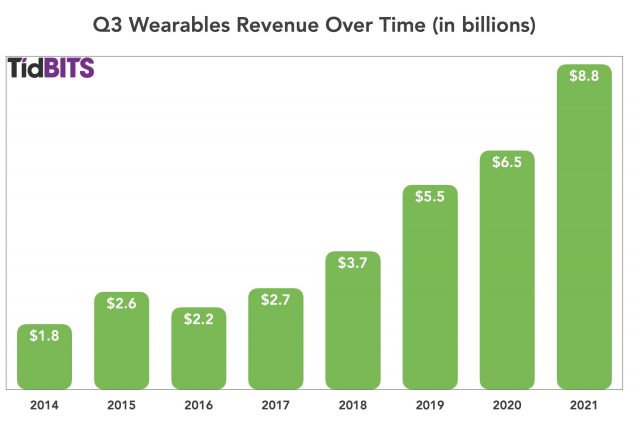

Wearables

The Wearables category revenue increase was even larger than Services, up about 36% over the category’s year-ago quarterly results. The Apple Watch, AirPods, and other wearables brought in $6.5 billion a year ago and $8.8 billion this quarter. Cook said this was a new Q3 record for Wearables, which also includes accessories like the new AirTag. With a new model of the Apple Watch on deck later this year, this category is likely to continue its upward revenue trajectory.

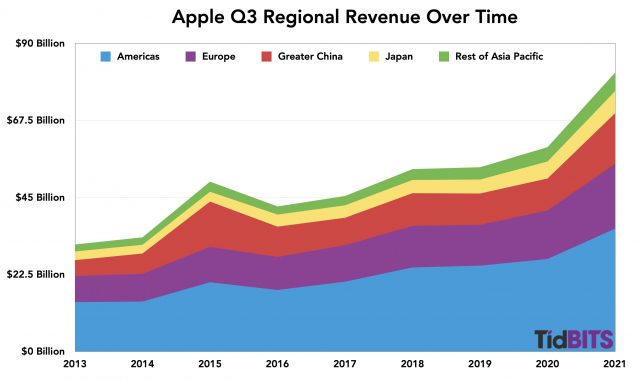

Q3 2021 Regional Performance

Apple saw impressive year-over-year growth in all five of its regions and set a new June record for Greater China, thanks largely to the iPhone 12:

- Americas: 32.8%

- Europe: 33.7%

- Greater China: 58.2%

- Japan: 30.2%

- Rest of Asia-Pacific: 28.5%

Add in the previously mentioned signs of growth in its emerging markets, and Apple should continue to post healthy worldwide revenues in the months ahead.

An Uncertain Future

Apple is trying to remain optimistic, and certainly, the company has no reason to be pessimistic—at least about its own health: Apple is shattering records and has $194 billion in the bank. But the specter of COVID-19 loomed large over this quarter’s investment call.

In a slight return to normalcy, Maestri offered guidance for the September quarter, something Apple has not done since the beginning of the pandemic. Apple expects double-digit revenue growth in the next quarter, but less growth than in Q3 due in part to the impact of foreign exchanges. Services growth will also appear slower because Q3 2020’s lockdowns made for greater contrast with this quarter. Finally, the most alarming harbingers of future revenue slowdowns brought up during the conference call were anticipated supply constraints.

Cook said of the supply constraints:

The majority of the constraints are of the variety that others are seeing. I would classify it as industry shortage. We do have some shortages in addition to that where the demand has been so great and so beyond our own expectation that it’s difficult to get the entire set of parts within the lead times that we try to get those. It’s a little bit of that as well. As I said before, the latest nodes, which we use in several of our products, have not been as much of an issue. The legacy nodes are where the supply constraints have been, on silicon.

In plain English, the chip shortage that’s affecting the entire supply chain is looming over Apple. While Apple said it was able to mitigate those issues in Q3, it’s looking less likely in Q4. But if anyone is up to the task of working through a supply chain hiccup, it’s Apple CEO Tim Cook, who, despite whatever shortcomings he may have, is a proven master of supply line management.

Apple Is Now an Antifragile Company

For over two decades, “APPLE IS DOOMED” was a common refrain in Internet discussions. Originally, it was meant in a literal sense, but once Apple was well on the road to becoming the tech titan it is today, the saying was parroted back, soaked in irony, as a rebuff to naysayers. But lurking behind those rebuffs was the very real concern that Apple was too dependent on the iPhone and that someday the world would move on, causing Apple’s business to come crashing down.

That dire prophecy seemed like it might be coming true toward the end of the last decade when Apple revised financial guidance due to lower iPhones sales in China. Apple first seemed to be running out of steam starting in Q1 2016 (see “Apple’s Q1 2016 Sets Records, but Just Barely,” 26 January 2016). The next quarter began the rockiest period of Tim Cook’s Apple (see “In Q2 2016, Apple Sees First Revenue Decline in 13 Years,” 26 April 2016) dotted with ups (see “Apple Sees Apparent Return to Growth with Q1 2017’s Record Results,” 31 January 2017) and downs (“iPhone Sales Kept Sinking in Apple’s Q2 2019,” 30 April 2019).

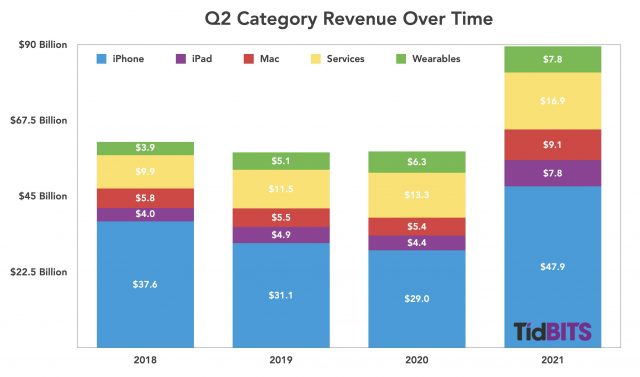

The cascading crises of 2020—with retail store closures, a shuttered Apple headquarters, and broken supply chains—were the ultimate test of Tim Cook’s leadership. In short, Apple not only survived, it’s once again shattering records (see “Apple’s Q3 2021: Still Making Money Hand Over Fist,” 27 July 2021). Mac sales are stronger than ever and have been setting records for the past four quarters. After a nearly decade-long slump, iPad sales are higher than they’ve ever been apart from their 2012 peak. The iPhone 12 continues to be a smash hit near the end of its product cycle. Services and Wearables both continue stratospheric growth.

Tim Cook has transformed Apple into a truly antifragile company that actually improves under adversity.

Fragile, Robust, and Antifragile

To understand antifragility, we need to delve into a bit of philosophy, specifically that of Nicholas Nassim Taleb, author of the Incerto series, the most notable entries being The Black Swan and Antifragile. Taleb’s central thesis is that bad things happen unexpectedly—the so-called “black swan events”—and he proposes that society needs to build systems that can survive or even grow stronger after unexpected setbacks.

Taleb puts systems into three categories:

- Fragile: Prone to break under stress

- Robust: Resilient against stressors

- Antifragile: Actually improve under stress

Imagine a heavy, cast-iron kettlebell. If you put it on top of a paper cup, it crushes the cup. Put it on top of a concrete block and the concrete block supports it just fine. But if you lift that kettlebell repeatedly (with good form), you will get stronger. The paper cup is fragile, the concrete block is robust, and your body is antifragile (even if it doesn’t always feel that way).

Robust Apple

First, let’s examine the ways in which Apple is robust. Many questioned, and still question, why Steve Jobs, ever the artist, chose a bean-counting supply chain wizard like Tim Cook to lead Apple. But the events of the past year have proven once and for all that Jobs knew what he was doing.

Have you tried to buy a PlayStation 5 or an Xbox Series X? Good luck, they’re still hard to get. No one can produce enough chips. The same goes for automobiles. Automakers have had to choose between producing cars with fewer features or not making them at all.

Apple hasn’t had this problem. You can walk into an Apple store right now and pick up an iPhone 12 or an M1-based Mac. Apple CFO Luca Maestri had warned in the company’s Q2 earnings call that Apple was expecting supply chain constraints, but in the Q3 call, he briefly mentioned that Apple had worked around them. He warned of more severe constraints in Q4, but knowing Apple’s habit of underpromising and overdelivering, I’m betting that it won’t turn out to be a major problem. Even if I’m wrong, I guarantee that Apple will be in a better situation than other silicon-dependent manufacturers.

Apple can do this because it spends billions well in advance to secure the parts it needs—precisely what the auto industry didn’t do. Apple reported that it plans to spend over $38 billion in manufacturing purchase obligations this quarter, up 26% from last quarter. Analyst Ben Bajarin said it’s due to Apple locking in its chip supply. Other manufacturers have been caught with their pants down while Apple guarantees its chip supply.

Locking in chip supply. Apple knows, what many of us have heard. Chip constraints are not easing any time soon. Apple's forward commitments, in bulk, are why they continue to get supplier preference. https://t.co/fduKdp4zDM

— Ben Bajarin (@BenBajarin) July 28, 2021

Another bold and prescient move was Apple’s decision to dump Intel in favor of its own ARM-based processors. With the switch to Apple silicon well underway, Apple is no longer at Intel’s mercy and doesn’t have to compete with other PC manufacturers for CPUs. Apple can take its designs directly to foundries like TSMC and buy up manufacturing capacity in advance. It helps that the M1 chip has already proven to be superior to Intel’s offerings in almost every way, driving record Mac sales.

As a result of this supply chain mastery, Apple can chart its own destiny. But the company also has an often-overlooked secret weapon: the nearly $200 billion in cash it keeps on hand. Financial “experts” have often derided or even loudly protested Apple’s cash holdings, insisting that money could be invested elsewhere or given to shareholders, but when Apple needs $38 billion to secure its product pipeline, it has the money ready to slap on the table. (Taleb, not a fan of experts, says of them in The Black Swan: “The problem with experts is that they do not know what they do not know.”)

Finally, Apple has a global reach unmatched by most competitors, most notably in China. Regardless of how you feel about Apple sellings its wares there, China’s early recovery from COVID-19 helped bolster Apple’s last few quarters. At the same time, when sales fell in China (see “Apple Warns of Lower Revenues, Blaming Slower Sales in China,” 3 January 2019), Apple’s strength in other regions buffered the hit.

Antifragile Apple

Apple is robust in that it tightly controls its supply chain, stockpiles the cash to do so, and has a global reach, but let’s look at how Apple’s diversified product line makes the company antifragile.

Most quarterly Apple investor calls are pretty dull. The only time they’re exciting—albeit for all the wrong reasons—is when Apple has a bad quarter. But this week’s Q3 2021 call was fascinating because so much of the discussion surrounded Apple’s COVID-related challenges and how the company was responding to them.

The key exchange was between Morgan Stanley’s Katy Huberty and Apple CFO Luca Maestri. Huberty asked if Apple was helped or hurt by the pandemic. (Thanks to Jason Snell of Six Colors for transcribing the call.)

Maestri’s responses and other comments during the call illustrated Apple’s antifragility. Most of Apple’s 500-plus retail stores, along with many of its partners’ stores, were shut down for much of 2020. Maestri said sales of the iPhone and Apple Watch were hurt by the store closures because those are more complex transactions in which customers need assistance. But more people working and learning from home created a boom in iPad and Mac sales. (We first saw this pattern emerge in “Apple’s Q4 2020 Marks Record Revenues but Lower Profits as Mac and iPad Boom,” 29 October 2020.) In other words, while some of Apple’s product lines may have been hurt by the pandemic, others actually benefited.

Store closures also hurt the AppleCare part of the Services business, and a slowdown in advertising hampered Services revenue. But those downturns were more than offset by a boom in the entertainment aspects of the Services segment (Apple Music, Apple TV+, etc.) due to lockdowns and restricted entertainment options. Again, some services were down, but others were way, way up.

Apple has not just a diverse portfolio, but a diverse portfolio of strong products backed by both physical and online distribution options that keep revenues balanced even in the toughest times. A brick-and-mortar retailer like Dollar General would be devastated by store closures, but for Apple, the slack was easily taken up by its online store. Netflix lives or dies by its subscriber figures, but a dip in extended warranty subscriptions would be mitigated by a music service, original video content, fitness service, and even a credit card. HP is nothing without PC and printer sales, but the Mac could coast along if necessary thanks to Apple’s other product offerings.

Even the iPhone, the linchpin of Apple’s renaissance, doesn’t make or break the company, as shown in the tumultuous Q2 2020, when the Services and Wearables category pushed Apple to very slight growth despite declines in every other category (see “Apple’s Q2 2020 Was a “Very Different Quarter” Than Expected,” 30 April 2020). The company can monetize the millions of existing iPhones with services and accessories, and then bolster its financial results with Mac and iPad sales.

The charts don’t lie: the stressors of COVID-19 only made Apple stronger (see “Apple’s Q3 2021: Still Making Money Hand Over Fist,” 27 July 2021). It’s not as though Apple cratered in Q3 2020 and Q3 2021 only looked good by comparison. The bars on the chart rose just a bit in Q3 2020, and then exploded in Q3 2021, towering over every previous Q3.

Forever Apple

Apple is robust because of securing its supply chain, and it’s antifragile thanks to a diverse mix of strong products. Does anything threaten mighty Apple? A few concerns:

- Government regulation: It seems increasingly likely that Apple may run afoul of regulators in some aspects of its business, particularly the App Store, but diversification should prevent that from being catastrophic.

- Post-Cook leadership: Tim Cook is 60 years old and will likely want to step aside in the next 5–10 years. It’s unlikely Cook will pick an incompetent successor, but he could choose someone who’s a bit too conservative.

- A fight over Taiwan: Many of the world’s chip foundries are in Taiwan, including those of Apple partner TSMC, and increased tensions with China could cut into Apple’s semiconductor supply. This is a global political issue that extends well beyond Apple, and governments around the world are already working to reduce reliance on Taiwan (see Part 1 and Part 2 of an analysis by The Diplomat).

- The zombie apocalypse: Even zombies need iPhones.

That said, Apple’s performance in 2020 and 2021 shows why I’m not worried about Apple’s future. As far as I’m concerned, APPLE IS DOOMED jokes are dead, even ironic ones. Apple may not always do what we want, but it does what it needs to survive—and thrive—even in the worst of times.