Robinhood Opens Stock Trading to All

I’ve been an investor my entire adult life, but I’ve always leaned toward mutual funds, and more recently, low-cost index funds. Trading individual stocks felt like gambling to me, though I often lament not buying AAPL when it was at $17 many years ago. (Editor’s Note: Of course, as journalists covering Apple, it would be inappropriate for us to own stock in the company. -Adam) But with high minimums and fees for every trade, trading in individual stocks seemed like a waste of money.

But a new iPhone app has changed my view a bit. Robinhood offers free trades with no minimums, all wrapped up in a friendly, attractive interface. It’s free in the App Store, but note that it’s so far only available for U.S. residents who are at least 18 years of age and have a valid Social Security number. Australian residents can sign up for Robinhood’s waitlist to get early access when it arrives.

Since Robinhood charges no fees, you may be curious as to how the company makes money. Steal from the rich? No, it’s more subtle than that; Robinhood collects the interest from the uninvested cash balance in your account. The company also plans to offer margin trading in the future, in which you will be able to borrow money to invest, and Robinhood will collect interest on what you borrow.

While Robinhood promises that “Signing up takes less than 4 minutes,” expect it to actually take up to a week to set up your account. Thanks to the Patriot Act, you must hand over your Social Security number, birth date, mailing address, and employer information, and wait to be approved, which takes about a day. Then, Robinhood will make two small verification deposits into your linked bank account, which again takes a few days. After verifying your account, you select an amount to deposit with Robinhood, and again the transfer takes a few days.

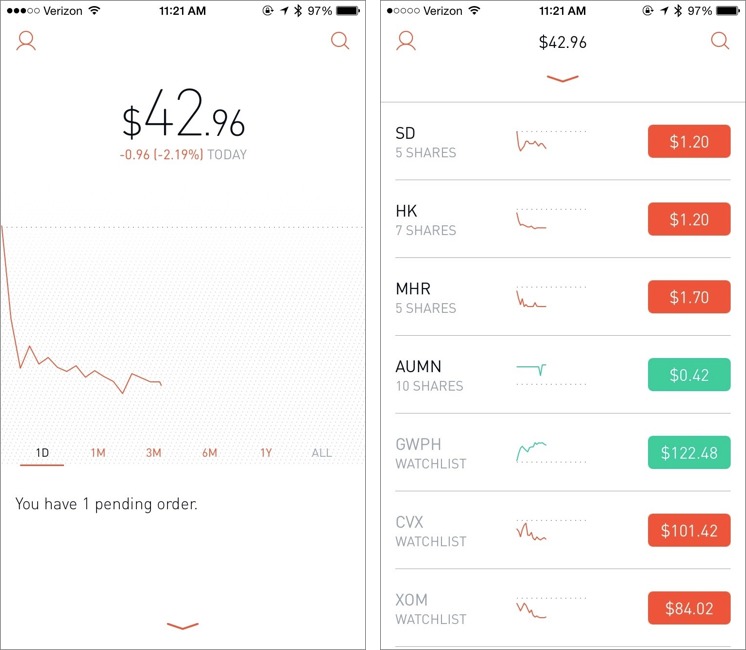

Thankfully, after that ordeal, Robinhood is about as simple as a stock trading app can be. The main screen shows the value of your portfolio, with a chart showing change over time. Scrolling down displays your stocks, along with your watchlist — which is composed of stocks you’ve searched for.

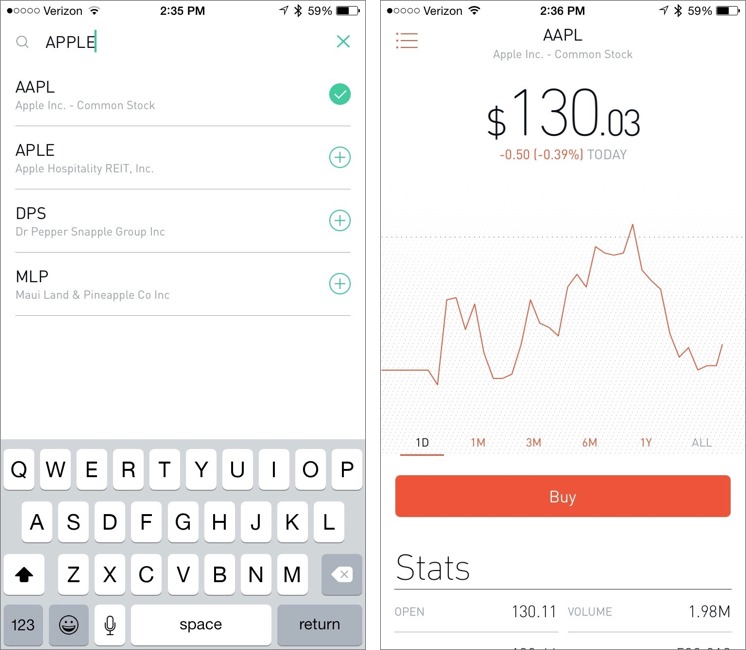

To search for a stock, tap the magnifying glass in the upper right of the main screen. As you enter a company name or stock symbol, suggestions pop up underneath the search box. Tapping a company shows you information about it and adds it to your watchlist. To remove a stock from your watchlist, search for it again, and tap the checkmark to remove it.

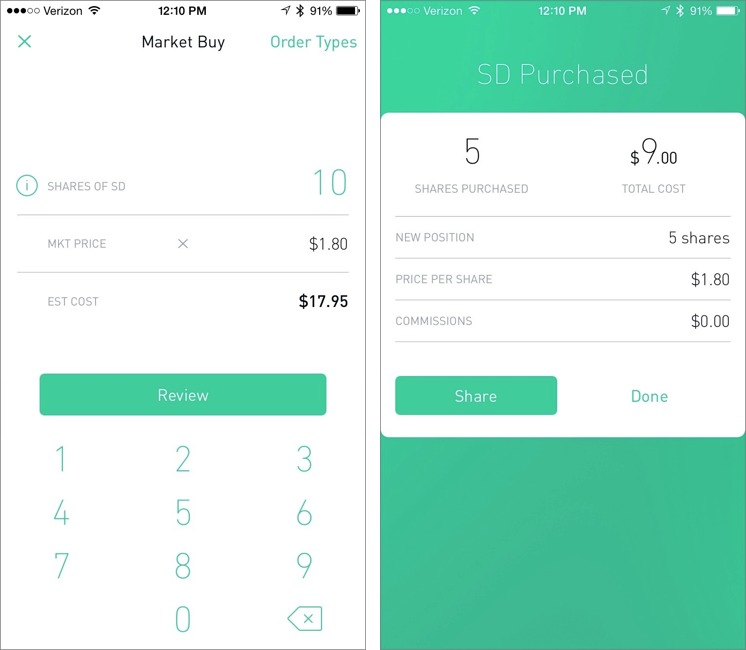

On the company information screen, you can tap the Buy button to purchase shares. Enter how many shares you’d like, tap Review, and then confirm your purchase.

You can also choose different order types by tapping that text label in the upper right:

- Market: A simple share transaction, executed immediately.

- Limit Price: Specify the maximum that you’ll pay for a share. The order will not be fulfilled until the stock drops to that price.

-

Stop Loss: The opposite of a Limit Price, in which a market order will not be placed until the stock hits a set price.

-

Stop Limit: A Stop Limit order combines the last two, so that a market order will not be placed unless the stock price is within a specific range.

Robinhood doesn’t yet offer more exotic orders, like Fill Or Kill or All Or None. And you can’t yet short a stock with Robinhood.

As for the stocks Robinhood offers, you can expect the usual assortment of stocks and exchange-traded funds. However, Robinhood doesn’t yet offer bonds, mutual funds, options, OTC equities, or warrants.

If you own a stock that pays dividends, those are processed automatically and credited as cash in your account, but not automatically reinvested.

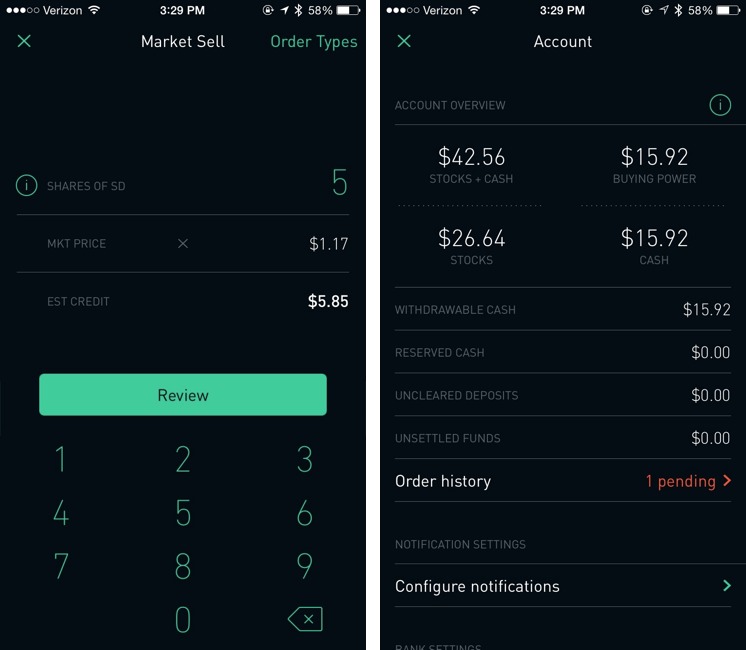

Selling stock is as easy as buying. Select your stock, either from the main screen or via a search, tap Sell, enter the number of shares you wish to sell, select the order type (Market is the default), tap Review, and confirm your trade. Note that there is a $0.02 regulatory fee per sell order, which is out of Robinhood’s hands.

Unfortunately, it takes up to three days for your funds to “settle” after selling a stock, so you can’t sell a stock and then use those funds to buy another immediately. Robinhood says it’s working on speeding this up. You can see your unsettled funds, along with settings and other information by tapping the person icon in the upper-left corner of the main screen.

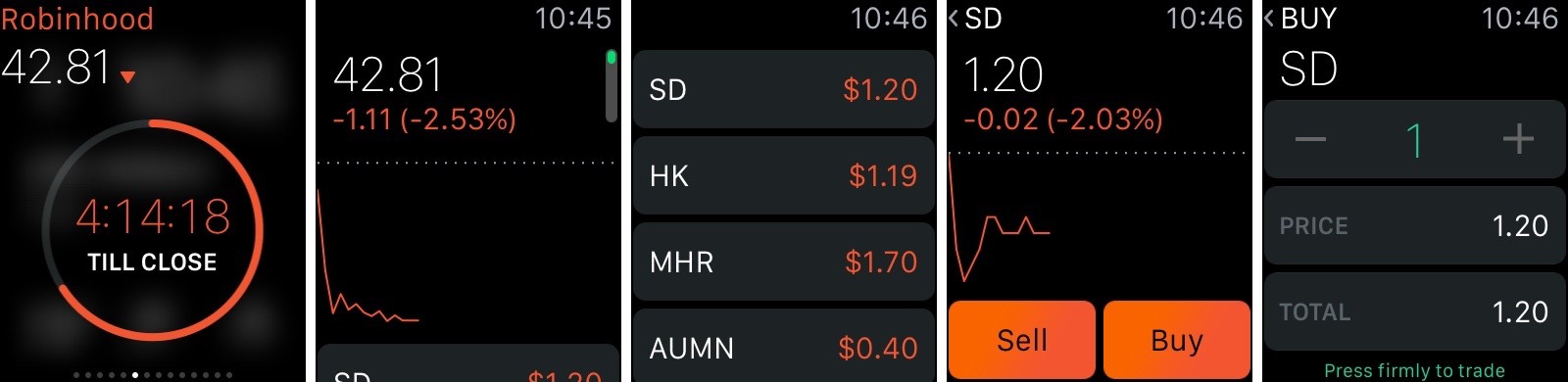

Robinhood also works on the Apple Watch, featuring a glance that shows your balance and a full-featured app that lets you buy and sell stocks.

One frustration with Robinhood is that it can’t yet notify you of changes to stock prices, so you have to keep a close eye on your stocks to decide when to buy or sell. On the plus side, the app can be secured with Touch ID, so a fingerprint is required to see your information.

Hardcore traders may be frustrated by Robinhood’s limitations, as well as its simplistic presentation of data. However, for those just dabbling in the stock market, Robinhood offers an easy, low-risk way to get started. If you’ve ever been curious to see how you could do in the market, give Robinhood a try. Personally, I think I’ll stick to index funds and burying gold.