Quicken 2015: Close, But Not Yet Acceptable

What I wanted out of Quicken 2015 for Mac wasn’t improvement so much as a path forward: I wanted to know that when OS X 10.10 Yosemite shipped, I wouldn’t be waiting for Intuit to issue yet another extension on life for Quicken 2007. I pictured myself setting up (as I had before) a virtual machine running an older version of Mac OS X just to keep Quicken 2007 alive. Horrors.

I have tried nearly every Quicken alternative over the last five years, including Mint and the terrible Quicken Essentials, and none suited me. Some couldn’t import the full 15 years of data from my Quicken file; others lost valuable information in conversion; and many just didn’t match the way I thought about recording transactions and running reports, something that Quicken had certainly shaped. (Quicken emulates the approach of paper accounting ledgers in terms of how transactions are entered and discretely represented as line items, but it isn’t skeuomorphic — no torn page edges or leather stitching.)

Quicken 2015 isn’t awful. That’s great praise given how bad Quicken Essentials was and Intuit’s long-running inability to update its flagship financial software for a platform of customers who desperately wanted a new version. At $74.99, Quicken 2015 is also not cheap, but given the small amount I’ve paid for minor updates to 2007 over the years, I was willing to plop my money down.

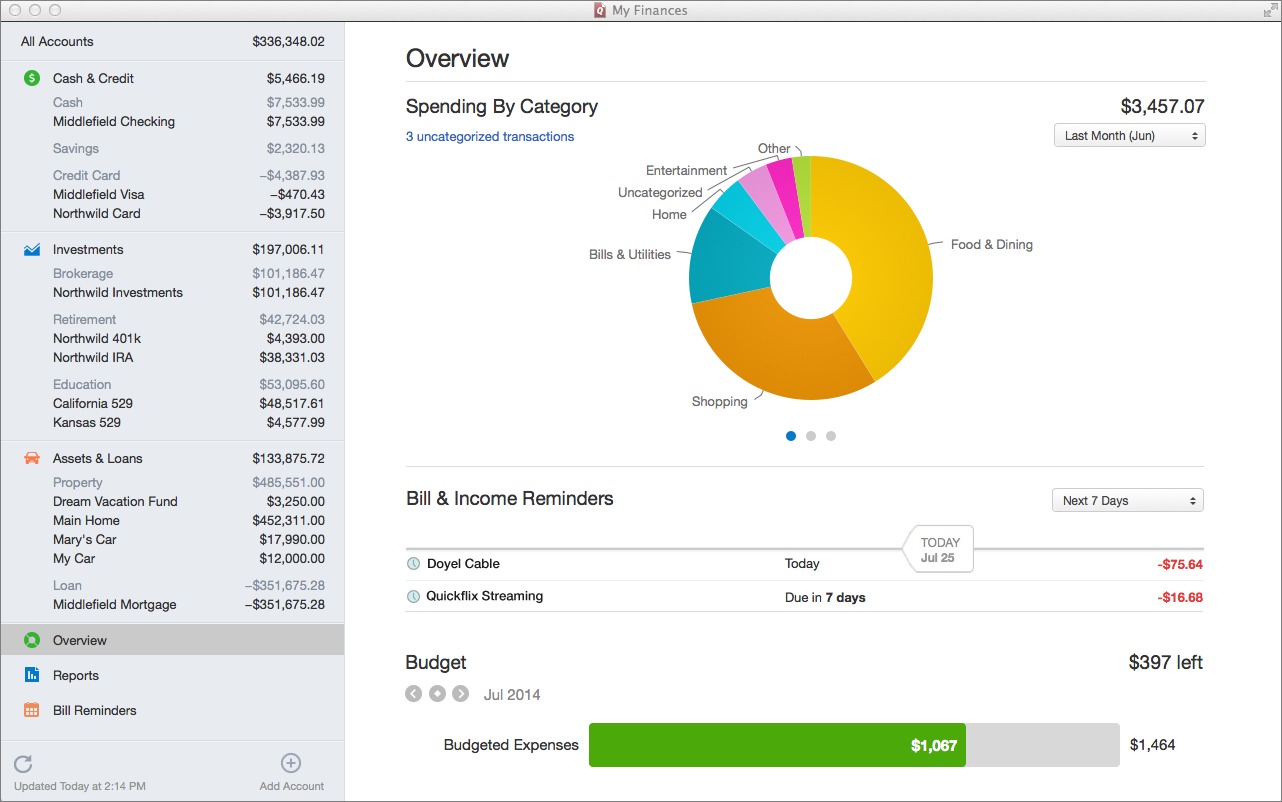

But for my purposes, Quicken 2015 still isn’t fully baked. After finding much to like about it, including a crisp interface, a better way to specify transaction details, and good connections to online financial accounts, its failure to import my Quicken 2007 reports (honed over 15 years for business and personal tax and other reporting) and its lack of report customization makes it a non-starter.

Quicken 2015 could be adequate if you don’t rely on its reporting or don’t mind its simple set of reports. That could be true if you don’t need detailed itemization and summation reports for tracking income and expenses as a sole proprietor or small corporation. Some people use Quicken just to enter or download transactions and then check them off, keeping their budget in line and ensuring there are no illegitimate charges. Because I use a large set of custom reports to manage my business — from tracking income to filing city, state, and federal taxes — I’m holding out to see if Intuit addresses the reporting limitations.

A bit later in this review, I’ll get into the missing features of importing and reconciling. (I didn’t test the mobile app, as I don’t plan to use this release, and the mobile app has extremely limited features.)

Critical Advice before Starting — Before I start on the review proper, if you’re converting from Quicken 2007, please read the following advice. I made mistakes so you don’t have to.

- Don’t leave Quicken 2007 running. I know Intuit already tells you that, but you really must close it or the import will mess up completely.

-

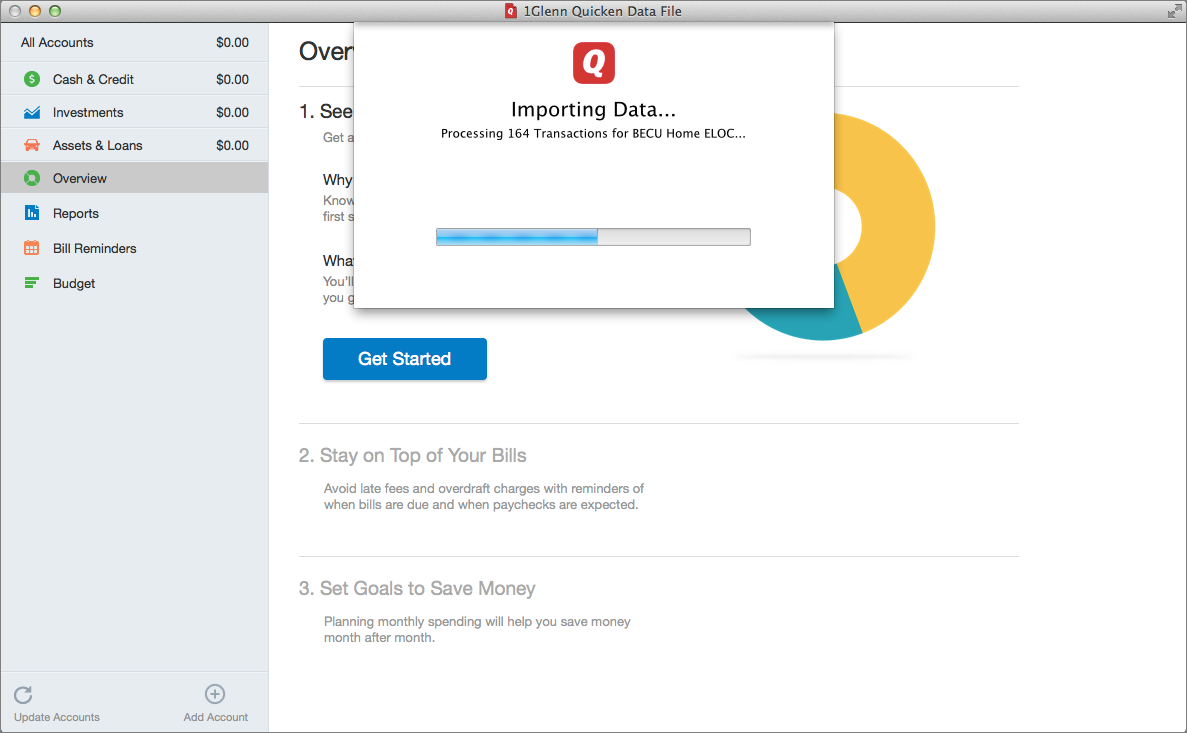

Have patience. It can take 30 minutes (with mobile sync) to import a large Quicken 2007 file and then sync everything. Intuit has done a lousy job with threaded and asynchronous operations. Despite many spinning rainbow cursors and apparent freezes, the program is working — I never saw it actually crash during multiple import tests.

-

Be careful when you set up connections to online banking, credit card, and other accounts. Quicken attempts to match up accounts you already have with ones on the financial server, but I found a number of mismatches. Had I clicked to proceed, I would have wound up with transactions imported into the wrong account and then had to back those out and relink. (Quicken 2015 offers multiple levels of undo, but not for every operation, and you can break the chain of undos across accounts and launches.)

-

Match transactions with care. If you create an online linkage in accounts that already have manual entries, you may be flooded with duplicates. I spent almost two hours manually matching transactions to be sure that my records corresponded.

Now on to the meat.

A Random Walk Down Quicken 2015 — This new release is crisper and cleaner than Quicken 2007. Intuit has created an up-to-date Mac program that looks like it was written this year, and that acts as expected. It’s generally stable, and clearly has some auto-save capability. After a crash — the only one across many hours of imports and intensive use — all my data changes were saved, but changes to the default column view in every account were gone. Clearly, Intuit needs to auto-save preferences, too. Also missing from Quicken 2007 is automatic backup on quit — you’ll need to rely on Time Machine, other backup software, or Dropbox to retrieve older versions of

your financials.

Quicken 2007 made heavy use of palettes and windows and menu items, which was common in older Mac apps. The 2015 version integrates the Accounts view directly into the main window, as well as reports, bill reminders, investment views, and budget. It’s a good approach, because you rarely need to see those elements in multiple windows at once. However, if you do want to bring up multiple items at once, you can right-click on any item in the list on the left of the main screen and duplicate the view into its own window.

Preferences are similarly slimmed down: many options are now gone and others are neatly integrated into contextually appropriate places. For instance, right-click anywhere on the header bar of any view and you can choose columns to show or hide. (You can also click a Columns button at the bottom right of the view.)

Entering and reconciling transactions in Quicken 2015’s simplified view is much the same as in the 2007 edition, but Intuit has made improvements in the amount of detail you can attach in this update. Click the New button to create a transaction or double-click on an existing transaction, and you can modify simple details: date, payee/payer, category, amount, and any other editable columns you choose to display.

(Massive irritant: the default view doesn’t show the Reconcile column, which would seemingly be the point of integrating online accounts with a financial app. And after this many years, there is still no keyboard shortcut to mark an item reconciled, my single most common mouse action in the program?)

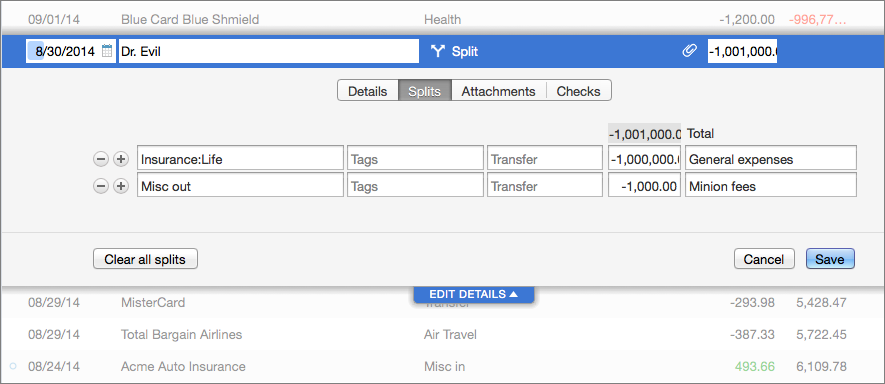

Click Edit Details, and you get a four-tab view containing:

- Details, which provides more information

-

Splits, a feature carried over from earlier Quicken versions to break a transaction into pieces

-

Attachments, for adding photos of receipts and tying into the mobile version

-

Checks, which let you set up check printing for transactions

Altogether, transaction entry and editing is improved, but it often requires more clicks or pressing Return than should be necessary. If I press Return, that signals “I’m done editing” in most software; in Quicken 2015, it advances to the next field if the cursor is in the date or payee/payer field, and accepts the transaction and records it only when the focus is on the category field.

If you’re familiar with Smart Payees from Quicken 2007, the change in Quicken 2015 may be maddening. Smart Payees used patterns or partial matches to identify similar items or rewrite them from imported online transactions or imported data files to improve reporting. For instance, one grocery store chain in Seattle shows up on my credit card bills as several because each store has a unique number. Quicken 2007 had “learned” all these, and they all collapsed on entry to a single line item.

In Quicken 2015, the Smart Payees set of rules has disappeared, and you’re left with a simple text entry. If there’s a way to edit these rules I haven’t found it, and if it’s really gone, that would mean that all imported entries from 2007 would have changed from storing both the original data and the display/report name to just the plain text of the matched name — reducing utility in my older records!

The category entry has also been simultaneously improved and made worse. Start typing in the field, and it pre-fills matching entries and also provides a useful pop-up menu with all the matching options. However, unlike in Quicken 2007, you can’t type a colon to jump to the next level in hierarchical category. For instance, if I have “Business:Hardware:In-State” defined, I can pull reports for Business, Business + Hardware, and Business + Hardware + In-State. In the past, I could type bus and then a colon to leap to the end and start autofilling the next level. Not so in Quicken 2015, which dramatically reduces my manual entry efficiency.

Linking to Online Accounts — One of the hardest parts of sticking with Quicken 2007 is that banks and other institutions gave up supporting it over time. My credit union dropped its legacy support two years ago, insisting that I could just switch to Quicken Essentials. No thank you. Happily, Quicken 2015 supported six different institutions that I entered, which reduces a lot of the manual work I’ve had to do.

The online connection seems to be among Quicken 2015’s strongest new components, although Intuit removed the familiar reconciliation screen in the interest of simplicity. That’s a good choice, but it means retraining this old dog.

Each Quicken account, like a bank account or loan, can be linked directly to an institution, but the first time you connect to a site at which you have multiple account numbers associated with a single login, the software prompts you to associate all accounts. You can opt to create a new Quicken account to associate, ignore it, or link it to an existing local account.

After a first failed attempt to set up Quicken 2015 and deal with duplicated transactions (the ones I had entered manually and those downloaded from my various accounts), I discovered that the app offers drag-and-drop transaction matching. You drag a downloaded transaction onto a manually entered one, and it merges the information into a single, confirmed entry. This is nifty, but because Quicken 2015’s online help is so terrible and there is, so far as I could find, no manual, I learned this only after complaining on Twitter and then searching the Web.

Intuit advertises this as a feature, too, but it’s unclear what the utility is until you drill down into what the company means by “drag-and-drop transaction matching.” This drag-and-drop interface replaces Quicken 2007’s wonky transaction-matching window, in which you viewed downloaded items and accepted them one at a time, as a whole, or worked to match them against manual entries. This new method is far superior, and if your accounts actually sync, you should need to use it only rarely.

With my accounts — including separate business and personal accounts at my credit union — I found that it wasn’t always possible to get everything to line up. This surely has something to do both with the cruft of previous data imported from Quicken 2007 and varying levels of support for Intuit’s online banking standards.

For instance, I was unable to get a home equity line of credit to match up until I realized that it probably had outdated information already stored. Even though I hadn’t linked it in Quicken 2015 and had been unable to sync for years in Quicken 2007, the account remained set to sync. Once I disabled and re-enabled online syncing for it, I was able to create the linkage. However, I was never able to get my home mortgage account to link correctly in all my testing, though I don’t know whether to blame the bank or Quicken.

The online sync, which is modal and cannot be canceled, includes a transaction upload stage if you have mobile access enabled. For some reason, on every sync, it wanted to upload thousands upon thousands of my transactions, even if none had changed. I didn’t put the time into figuring out which account was causing the error, or if the problem was with Quicken 2015 or the remote institution.

What’s Missing and What’s to Come — To Intuit’s credit, the company has been completely up front about what’s not yet in Quicken 2015 and how it may add popularly requested features. One expects, based on my testing, bug fixes and feature adjustments as well. A “compare” page at Intuit’s site shows two lists: at the top, it’s a “positive” list showing every major feature across current and past flagship products (Quicken 2015 for Mac, Quicken Essentials for Mac, Quicken 2007 for Mac, and Quicken Premier for Windows).

It’s odd to note when releasing new software, as Intuit does in the top item, “free feature improvements included,” but the company backs it up with a second list on that page which shows all the lacunae! These proposed features include everything that was dropped or needs to be added, most of which was found in Quicken 2007 and all of which is already in the Windows release.

This is bold and honest, and with the Vote buttons next to each item, I hope Intuit is serious about moving forward. Given that Quicken 2015 dropped amortization support (calculating loan principal for you), advanced reporting, and bill-pay support, there’s plenty of room to grow.

This is an idiosyncratic review, I admit. I have my set ways, which are undoubtedly different from how others have used Quicken over the years. Quicken 2007 was sufficiently rich and robust that everyone was able to choose a different approach, and thus some people will find this new release adequate.

People like me, however, need Intuit to bring Quicken 2015 into closer feature parity with Quicken 2007 so it’s not just a compatibility upgrade with fewer capabilities, but a full-featured financial package that allows us to move forward. For now, I’m sticking with Quicken 2007 as Quicken 2015 is not ready for my version of prime time, but I’ll be keeping a close eye on updates to see when it will meet my needs. If you’re in that subset of users who just need sophisticated tracking and reconciliation, but not reporting, Quicken 2015 may work for you as it currently stands.

Perhaps I am too forgiving. After so many years and so many missteps since Quicken 2007’s initial release, I should have given up on Intuit. (Do all Quicken users feel like Charlie Brown, taking yet another run at Intuit’s football?) But since I still can’t find a comparable package that meets my modest needs for entry, sync, and reporting, I have to hope Intuit succeeds in rebuilding a full 2007 house on 2015’s new foundations.

One problem I have with Quicken Essentials is how slow it is—and I'm wondering if Quicken 2015 has made any speed gains.

I do have 15-plus years of data, but each time I mark a transaction as "entered" or "reviewed," I get at least 10 or 15 seconds of spinning wait cursor. When you enter text in the search field, the program completely locks up for 30 seconds or so.

Before buying Quicken Essentials in 2011, I ran Quicken 2006 and Quicken 2004 before that and they both had very little or no lag—and I was running them on far less powerful Macs.

On a MacBook Air (2011 model) it's fairly zippy. Quicken 2007 is rather slow for me on a 2011 Mac mini with 16 GB of RAM.

Excellent. Thank you, Glenn. And thank you for this very informative review.

"I pictured myself setting up (as I had before) a virtual machine running an older version of Mac OS"

How does any long-time Mac enthusiast who has reached midlife avoid doing this anyway?

I belonged to the group of disgruntled people who had to hang on to Q2007 (8 years of records!) until I found Moneydance, about a year ago. Happy with the change (cross platform app; easy to sync; reports ok; poor budgeting though) I don't miss Quicken. At all.

I tried Moneydance last night. Like iBank, it has a fundamental flaw for me: It doesn't connect to Bank of America! (Which is only the second biggest bank in US.)

my iBank DOES connect to Bank of America. don't understand your problem. Perhaps it is the type of connection that does not work.

I use Moneydance, and have for many years. It connects to Bank of America for transaction downloads from checking account and Visa account - no problem - try again.

My iBank also connects to BofA via the web. You cannot download directly using OFX. However, it works perfectly to download transactions from the BoA website using the browser inside iBank.

Just checking that you all realize that Intuit updated Quicken 2007 a few years ago to run with Mac OS X, right?

It came out in 2012 and is literally a maintenance release of Quicken 2007 updated just to work on modern day OS X. There's nothing fancy, but it works great, and it's just $15. And I can confirm it works on everything from Lion on up.

Yes, I didn't realize this would be confusing, but I note in the article that I'm still a Quicken 2007 user. It has always worked on Mac OS X. I believe you mean the Mountain Lion upgrade. Intuit has shipped various updates since, as well, which is very nice as it's allowed me to use it in Mavericks. I'm hoping it works in Yosemite, too.

I'm hoping it works in Yosemite also. Quicken 2015 leaves too much of Quicken 2007 functionality out. For example: you can not even manually enter mutual fund prices which is a necessity for certain annuity funds which have no ordinary stock symbol.

I'm very sorry I bought the new version. Quicken has never been perfect but this is a disaster for me. I keep finding duplicate transactions in the wrong accounts, balances that don't display properly and accounts that won't reconcile. At least if they had decent support I might be able to sort out the problems.

I gave up and had Quicken-Intuit refund my money. When they improve the functionality enough to match Quicken 2007, I might take the plunge again.

I'm in the same boat, Bill and gammachickie, and I just asked for a refund on 2015 myself. The fact that I have used Essentials more or less happily for all these years will prove that I am a very undemanding Quicken user. I don't use bill pay. I don't track stocks. And yet, Quicken 2015 can't even show me my net worth properly, and has tons of little glitches like "nbsp;" crap where the dollar signs are supposed to be. Really, Intuit? Your QA team let that through? Did anybody even use this program before you shipped it? Believe it or not, I'm going back to Essentials.

Well, I for one do feel like Charlie Brown…

I feel like I could have written much of this article from my experience. I've been using Quicken since it first came out for the Mac and have active data from 1992 (who knows why). Although I've tried all the other Mac solutions, for the last few years I've been living with a Windows version of Quicken running in Parallels or CrossOver so I was very happy when I heard about Quicken 2015. Unfortunately reality didn't match my desires. While I agree with Glenn's conclusions I'm toughing it out and will continue to use the program in hopes that Intuit will fulfill the promise of this program and remedy its defects. Their webpage soliciting priorities for future improvements gives me some (perhaps foolish) hope.

Charlie Brown

Glenn, when you say Quicken 2015 doesn't have bill-pay, do you mean it doesn't have Quicken 2007's Online Payees whom I can pay through my bank? If so, that would make it a non-starter for me. That's how I pay all my bills.

I'm also nervous about how it will import my investment accounts. I have a couple decades' worth of transactions over a couple handfuls of accounts. If it doesn't do a clean transfer, I could be in for an unbearable amount of cleanup.

I don't use the Quicken 2007 feature, but there is no way to pay bills within Quicken 2015. It's one of the potential features they are asking people to vote on to be returned in an update to Quicken 2015.

I share your concern about the import of a huge number of records. If it does a bad import, how would you know without reconciling years and years of records?

I almost think when I'm ready to do the import, I create a new Quicken 2007 file, and truncate everything at January 1 of the year in question. I keep a 2007 backup and dump it to PDF and paper.

Same here. Used BillPay since the mid-nineties, still need it = NonStarter. Voted for it as an essential feature on the Vote page Glenn referenced as well as 1-2 years ago in a long discussion with Quicken about upgrading to Q2007. They haven't figured it out yet, or won't, or are to cheap to do so. Thank you very much, Glenn, for this article. Dr. Johnson

G'day Glenn

Have you had a look at/tried MoneyWorks from Cognito (http://cognito.co.nz)? I've used it for many years starting with MoneyWorks Express and now MoneyWorks Gold for the last 5-odd. Highly customisable, multi-currency, cross-platform, iPhone compatible, etc. very happy with it.

Cheers, Gobit

I have not. When Intuit kept supplying Quicken 2007 updates to keep it working with newer versions of OS X, I stuck with 2007 longer. I was hoping to stay with it because of how my brain is organized.

I was a beta tester and was disappointed at what I saw. Report customization is so far behind what 2007 has that it is a joke. I use subcategories and you can only select them one at a time. You can't use any kind of inclusion/exclusion algorithm. It is hard to believe that development progresses at a snails pace. And yes, it barfed on importing my Quicken 2007 data.

Just use iBank, Imported all my Quicken stuff from 1988.

Stop supporting companies that won't work on Apple products.

It works! It's just not that good.

Then try Moneydance. I have used it for many years and was glad to get away from the Intuit sphere of influence.

I totally agree. I was a member of the Beta group for Essentials. It was called something else before it devolved in the crap product they finally published over tons of complaints and objections from our group.

If you read the reviews for this new app on Amazon, it is a deja vu of the story we experienced with the Essentials Beta group -- a virtual massive disregard for our feedback and suggestions. It was then and is still like talking to a STONE WALL.

After the Essentials debacle, I moved on to iBank. I have been more than happy with it (and I have a pretty complex financial situation). I am not turning back now... certainly not for more poorly designed, incomplete software from a company that thinks it can insult the Mac community over and over.

I've been using Quicken in Parallels for several years now, and it's the only reason I run Parallels. I'd love to be able to run a version of Quicken for the Mac that meets my needs, and this version looks like the first that might actually do that, since almost all the complaints about Quicken 2015 in this article are equally applicable to Quicken 2014 for Windows. And when I go to Intuit's comparison site, I find that the Quicken for Windows features still missing from Quicken 2015 are the features I use barely or not at all.

Quicken is a disappointing product on both platforms. But for what I do and what I need, it's the only choice.

Yipes. Thanks for the warning re Windows Quicken 2014...I'm still using Quicken 2001 Home & Business (also via Parallels, also the only reason I use a VM), and was thinking of upgrading to Q-2014 for personal accounts (where I don't need invoicing or business-type reports). But if it's as lacking as Mac Q-2015 is, I'll keep waiting. [sigh] Duplicating the capabilities of 14-year old software...is that too much to ask? Very frustrating.

I switched to Quicken Essentials for Mac (it hasn't been perfect, but does accurately reflect Tax items); do you know whether Quicken Essentials and Quicken 2015 are/will be compatible with Yosemite?

For $14.99 Intuit will sell you Quicken 2007 for Lion at http://quicken.intuit.com/personal-finance-software/quicken-2007-osx-lion.jsp which is how I keep Quicken 2007 running on MacOS X 10.9.5. Quicken 2015 is reported to have problems importing QIF files which I need to do regularly.

I never upgraded from Quicken 2005 to 2007. Will I be able to jump to 2015?

Glenn, Thanks for the excellent review. I haven't had a problem with Quicken 2007 in the Yosemite beta. After reading your review, I'm going to stick with Q2007 for a while. I like the easy data entry and importing a bank web connect file isn't too painful.

I am not able to import Chase data files into Q 2007 since upgrading to Yosemite. Any thoughts?

I waited for a good update of Quicken 2007 and finally tried Quicken 2015... and I had a problem. When I discovered that Quicken discontinued telephone support in May 2014 in favor of a horrible chat line with people who don't understand and simply have learned friend phrases. I had enough and switched to iBank 5. And it works and has excellent support in the USA by email or chat.

I've been using iBank for over a year, and I still don't find it intuitive (pun intended). I used all versions of Quicken through the awful Essentials, and I just can't acclimate to the other programs. Still, $80 is a lot to pay for my minimal banking needs. Mint would probably do it for me.

Years ago I moved completely from Quicken4Mac to PocketMoney; this is the BEST personal finance app I found bar none for my purposes. Unfortunately, the developer passed away in May 2013 so no further updates appear to be coming. Since iOS 7 broke the iOS version of PM, I've been looking for a replacement. I bought the $10 Quicken for Mac 2007 (Lion) to get my accounts ready for the new Quicken4Mac 2015, but re-discovered the things I did NOT like about Quicken. I'm back trying other apps and it looks like MoneyDance comes closest to my Gold Standard, PocketMoney.

BTW, don't hold your breath expecting Intuit to make Quicken4Mac2015 equal to the Windows version. They did not even make it equal to Q4M2007!

Quicken's treatment of the Mac platform in the past means that I would never, ever trust any data to Quicken every again. There's absolutely nothing they could do to the platform to change that. I'm surprised that anyone would consider using it, but it is, of course, an individual decision. Myself, I'd use a spreadsheet or pencil & paper before I tried Quicken again.

I switched over to SEE Finance from Scimonoce Software when Rosetta support in the Mac OS ended. It imported my Quicken data flawlessly (I had importing trouble with both iBank and Moneydance).

SEE Finance has a few quirks, but it also has features Q2007 didn't, such as accounting for employee stock options.

I briefly considered reverting to Quicken 2015, but the new version isn't as good as Q2007 was.

I decided to try going back to Quicken. I've been using iBank. It's Ok except it is painfully slow. SO I plunked down my money and guess what! Quicken 2015 can't import anything but Quicken files. Their solution was for me to buy Quicken 2007 which can. Possibly one of the stupidest designs ever. Asked for and got a refund.

Slow? iBank? Really? Something else must be causing it to be slow for you. My iBank (ver 5.2) is lightening fast (Macbook Pro, OS 10.9.5, 16GB ram).

We're still using Quicken 2006 on a G5 iMac. :) I was part of the beta test for Quicken 2015, and for me the killer exclusion was investment support. You can't pick which lots of shares you are selling! Seems like that's a pretty basic feature for anyone who is tracking investments.

Q 2015 is not ready for prime time. I gave up and reverted to Q 2007.

I do not like the hokey interface at all.

Bill

Is there an add-on report writer for Quicken?

I find their reports terrible.

After many years of trying different programs I always come back to quicken. currently installed program is Quicken 2013 - which made a mess of the reporting. I will not buy another quicken release until they improve the report generation - it does not look like Q2015 changed anything in this feature

As a current QMac 2007 user, my main reason for not choosing an alternative money manager has been the lack of features I need, mostly things like detailed stock tracking, splits, etc. I am assuming that the new Q15 for Mac does import all of that information correctly. I see it is already missing one feature noted above, the ability to manually enter prices for annuities (like retirement funds) that don't have stock symbols. Any other glaring details on the stock side missing? I would want similar reporting options to Q2007 as well.

For those running Quicken for Windows via Parallels, is there an easy import of Q2007 to Q for Windows that maintains all the old stock information? Due to brokerage changes, many of my stock basis prices are only available in my Quicken files, and that is critical come April 15. Thanks.

DJ

I made the Yosemite 10.10 update yesterday and now no account will download in Q2007. It gives the OL-290 error. I tried Q2015 and it is noting like Q2007. I would have to give up too much.

My Quicken 2007 (with the update from a couple years ago) is working fine with Yosemite on my Macbook Air 2011. Only little glitch is the open account window is 1/4" below the Quicken toolbar and can't be moved up, like something invisible was added on to the toolbar!

SEE Finance has worked wonderfully well for me. In imported my old quicken transactions back through 1997., lots of old accounts. it was the only option that gave me full compliance with he investments accounts I had in quicken.

Been using if for a few years now and I haven't run into a single problem.

I hadn't come across this one in my long ongoing search for a Quicken 2007 replacement. Sounds very interesting -- I'll have a look at it. Thanks for posting.

It is incredible to me that Intuit abandoned Quicken for the Mac for so many years. In it's day, Quicken was the first truly useful program that I found for my Mac. (There was lots of fun stuff but Quicken was a big help to me). I've been struggling along on 2007 and hoping that Intuit would finally redo Quicken so that it was great again. Due to my disappointment with Quicken, I explored an alternative to Macintax/Turbotax and have settled on TaxAct online for doing my taxes and find it is just as good as and far less expensive than TurboTax. I tried H&R Block one year and it made a few very annoying mistakes which were very hard to work around but TaxAct is excellent for me. I would love to see Quicken return to excellence but there is a market opening for a hungry competitor to eat Intuit's lunch.

Multi-currency conversion and incentive stock option support are missing, and are deal killers. I guess I'll stick with running Q4PC via Parallels Desktop for now.

Intuit sucks. I have been using Quicken since 1992 and have upgraded time and again, but I am holding firm at QM 2007. Quicken 2015 doesn't port over custom reports!.. I've created dozens of them for tax, investments, and property inventory for insurance, etc. Really? And no, I don't want to speak with "Chad" in Mumbai for customer support on a half-baked software release.

Your marketing folks realize that Macs cost way more than PC's, yes? Ergo, we're probably much more likely to be market investors and would like to keep track of our investment performance with your software, like we used to before you "improved" your product with 'Quicken (non) Essentials'. Pathetic.

Intuit: See also Microsoft on taking your customers for granted and how quickly they'll jump ship the moment something competitively viable arrives.

I'm still using Quicken Mac 2007 (PPC version) with Rosetta translation in Snow Leopard 10.6.8. How does it compare to the "Quicken 2007 Lion Compatible" version? Are all of the features the same, does it operate 100% the same, does it look the same? Is it faster than running the PPC version under Rosetta emulation?

I'm tempted to purchase the $14.99 Quicken 2007 Lion Compatible version and give it a try. Do you know if the Lion Compatible version will work ok in Snow Leopard and how about Yosemite?

I've been using Quicken since 1992 on the mac. Lots of data, stock transactions, loans, etc.

The Lion Compatible version is pretty indistinguishable from the PPC version. It drops MobileMe support, which doesn't affect anyone since MobileMe is long gone. I switched a while ago. I also have tons of investment transactions and historical data and it was seamless. I'm running it under Mavericks. I haven't tried Yosemite yet.

I bought Quicken 2007 so that I could upgrade to Mavericks and it is still working fairly well. A minor quirk is that sometimes an account window freezes. The work around is to close the window and reopen it. That solves it. I think it is worth is. I won't upgrade to Yosemite until either Quicken gets well upgraded better than the review above or I know that Yosemite will run Quicken 2007. You will probably think Quicken 2007 is OK but not sliced bread.

I have also used Quicken for many years and am now using 2007 -- the requirement to do that was bad enough (since Apple gave them a few years notice about Rosetta going away) but now online banking is getting OL-290 errors because banks are now not allowing access due ssl concerns. I sounds like Intuit is not anxious to fix it and it is a critical capability for me. 2015 (according to what I have read here) does not even allow uploading of payments -- Oh My!!

The OL-290 errors went away for me a couple weeks ago. I'm using 2007 under Mavericks. I'm once again successfully downloading transactions and sending payments with Wells Fargo, Chase, and TD Ameritrade.

I just got an update notice in Quicken 2007 for version 16.2.0. The release notes: "Upgraded network security protocols to resolve issues with Direct Connect transaction downloads caused by financial institutions that recently dropped support for the older SSL v3 protocol". I wonder if they talked the financial institutions into temporarily re-enabling SSL v3 until they got this update done. I guess I could not install the update and see if I start getting the OL-290 errors again, but I'm not that altruistic.

It's a little later now.

Glen, have there been any updates since you wrote this review that are worth pointing out?

It's made some progress — see https://quicken.intuit.com/support/help/new-to-quicken/improvement-list-for-quicken-2015-for-mac/INF27072.html — but I don't see enough improvement in areas that are non-starters for me, primarily in detailed, customized reports. I can't pull the data out I need even with these changes.