Circle, Square, and Venmo: Payment Apps Let You Pay via iMessage

It was easier to pay a friend back for lunch 17 years ago than it is now, at least if you had a Palm PDA. That’s finally changing with the release of iMessage apps that allow peer-to-peer (P2P) payments directly within Messages. Integrating payment into Apple’s iMessage service solves several of the largest problems with paying P2P: addressing a payment to a recipient and making it easy for the recipient to collect it whether or not they already have an account.

We’re still in the early days of iMessage apps, but two prominent payment apps have added iMessage integration: Square Cash and Venmo. A third, Circle, was launched on multiple platforms by entrepreneurs with deep Internet roots. Oddly, PayPal hasn’t yet updated its app to support iMessage payments, but the company often lags putting improvements in its native software.

The Shape of Payments — In 1999, PayPal — then a product of a company called Confinity, headed by one Peter Thiel — launched a personal payment system on the Palm platform. After you registered on a Web site, you could send a payment via a Palm device’s infrared transceiver. It was ahead of its time and didn’t last long.

PayPal persisted beyond in-person payments. eBay bought the company in 2002 because it drove a ton of the auction site’s transactions, but it later spun PayPal off in 2015. Until relatively recently, PayPal was the powerhouse of P2P payment, especially across national borders. When I ran an electronic periodical, The Magazine, PayPal was the only reliable and sensible way to pay contributors outside the U.S. and Canada, since it charges tiny fees and complies with banking rules in 202 countries across 25 currencies.

But challengers have risen, all trying to score a piece of a roughly trillion-dollar-a-year global market for moving money between individuals — almost $600 billion of that is in money sent home by foreign workers alone. Before these new companies appeared, most of PayPal’s putative competitors charged fees to move money around, and those fees could be significant when shifting cash across national boundaries. PayPal charges nothing for most personal transactions within or between the U.S. and Canada using a PayPal balance or withdrawing from a bank account, and collects from 0.3 to 3.9

percent for transactions crossing other international borders, sometimes with an additional fixed surcharge. The upstarts typically operate only in the United States, and emulate PayPal in having no fees for personal transfers. Circle is so far unique in also including UK residents in its system.

These P2P payment systems are distinct from business-focused credit-card processors, like Stripe (for apps and Web sites), Square (for in-person retail transactions), and dozens of others. Credit-card processors enable merchants to participate in the global payments network; they charge about 3 percent of every transaction, plus another 30 cents when it’s not face-to-face. Anyone can get a Stripe or Square account, but then you’re subject to all the limits and rules present in those systems. (Square operates both credit-card services and P2P payment services as separate parts of the same business: the former is just Square; the latter, Square Cash. Each requires a separate account.)

These new P2P payment services face a challenge relative to credit cards and PayPal: signing up enough people that they become a preferred alternative to other payment methods. Once they have substantial user bases, they can then tap into the small-business retail market and eventually expand to work with big businesses, which are more lucrative arenas. In such a scenario, the P2P service would charge the merchant around 3 percent of the transaction. That’s comparable to credit-card fees, but these P2P services have fewer restrictions and are easier for merchants to work with. Plus, these debit-based P2P services may appeal to people who never use credit cards.

Some payment outfits have tried to solve the problem of acquiring a lot of users by paying bounties. Venmo used to offer $5 for new account signups to both the referrer and the new user, and Square once offered $10 each way and still offers $5. That’s expensive, but necessary to build a network. That’s where iMessage apps can help.

Chicken, Meet Egg, or Vice-Versa — If someone tries to send you money with one of these systems and you don’t have an account, you get an invitation and instructions on how to sign up to receive the money. An email or text message explaining how to give up personal financial details may seem dubious, even if you know it’s coming. A few years ago, I tried to pay a friend via a service offered by my credit union that would deposit money into the recipient’s bank account. But between the weird message sent by the service and my friend not wanting to give her banking details to a random site, we chose a different method.

These new P2P payment services are easier and more familiar than my credit union’s system, but there’s still friction. iMessage integration breaks through the chicken-and-egg problem. When you receive a payment notice via iMessage:

- You’re getting it through Messages, which gives it the patina of trustworthiness you assign to that blue-balloon text.

- A person ostensibly known to you sent the message, or you’re already having a conversation with them.

- The link to install the app, if you don’t have it, points to Apple’s App Store, which adds trustworthiness.

- Instead of sending you to a Web site via an email message, a P2P iMessage app lets you sign up within iOS, a generally safe environment.

Before we get started with the experience, let’s go over the limits and costs for personal use of the three services we tested: Circle, Square Cash, and Venmo. (Is Circle’s name a joke on Square? We don’t know, but Circle obtained circle.com, while Square uses squareup.com for its main site and cash.me for Square Cash.)

All of these services keep a balance for you, like a savings account. You have the option with each to transfer your balance out to a linked account that accepts deposits or credits, which can happen automatically (called “sweeping”) or on request. Here are the details:

- Circle charges no fee to receive payments from bank accounts and debit cards, but it might charge you to receive credit-card payments. Circle holds your money until you withdraw it to a bank account, credit card, or debit card — a second factor code is required to withdraw amounts over $30. You can only deposit into your Circle account up to $300 per rolling seven-day period initially, but with verification, you can request a limit of up to $3000 per week. That limit doesn’t apply to receiving payments from others. You can spend up to the total that’s held in your Circle balance. There’s no limit on withdrawing funds. Circle works with U.S. and UK Visa and MasterCard credit

and debit cards and U.S. bank accounts. (Circle also supports sending and receiving Bitcoin, which is a whole other kettle of fish and beyond this article’s scope.) - Square Cash has no fees when you deposit money from your debit card and it charges a flat 3 percent for adding funds to your account via credit card. You can withdraw money automatically, and withdrawals are free with a wait of 1 to 3 days, or cost 1 percent if you want an instant transfer. There’s a $250 a week outbound payment limit to other Square Cash customers, unless you verify your name, birth date, and the last four digits of your Social Security number, which can raise your limit to $2500 (in most states, Square says). The app includes a virtual credit card that lets you spend from your account balance with sites that accept only

credit card payments. Square supports only U.S. cards and customers. - Venmo charges no fees for your inbound transfers from bank accounts, debit cards, and prepaid cards, and withdrawals are free, but only offered to a bank account. Credit card payments incur a 3 percent fee. Venmo has different limits for unconfirmed accounts and accounts confirmed with the last four digits of your Social Security number, your birthdate, and your ZIP code. Unconfirmed accounts can send payments up to $300 in a rolling seven-day period, and withdraw up to $1000. Confirmed accounts can send up to $3000 (in one

or more payments) plus spend up to $2000 at Venmo-supporting merchants in the same rolling period, and withdraw up to $20,000 in sums of no more than $3000 each. Like Square, Venmo is available only for U.S. residents.

Show Me the Money! — With each of the services, you can set up an account either via the service’s app or associated Web site, but you need the app installed and logged-in to proceed.

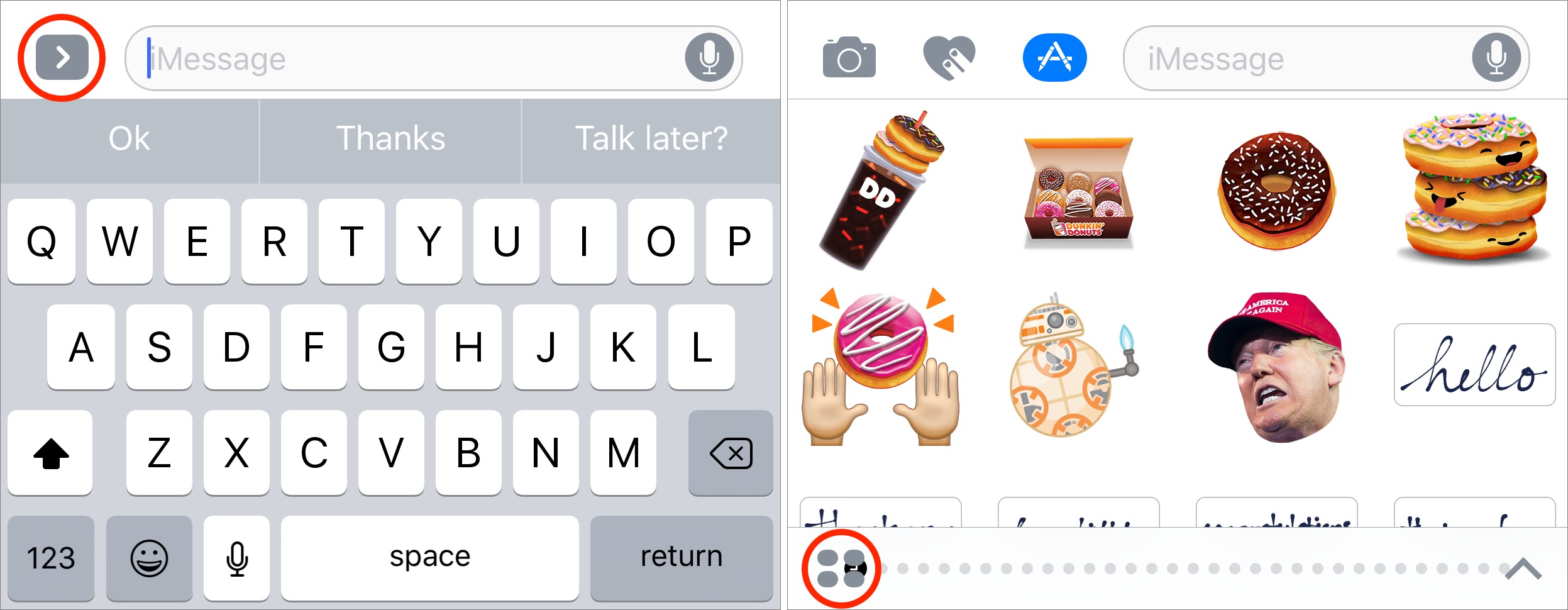

Once it’s installed, you must activate it in Messages to send payments. This works the same as any other iMessage app:

-

- In Messages, tap any conversation, and then tap the App icon. (Tap the right-pointing arrow next to the message field if the App icon isn’t showing.)

-

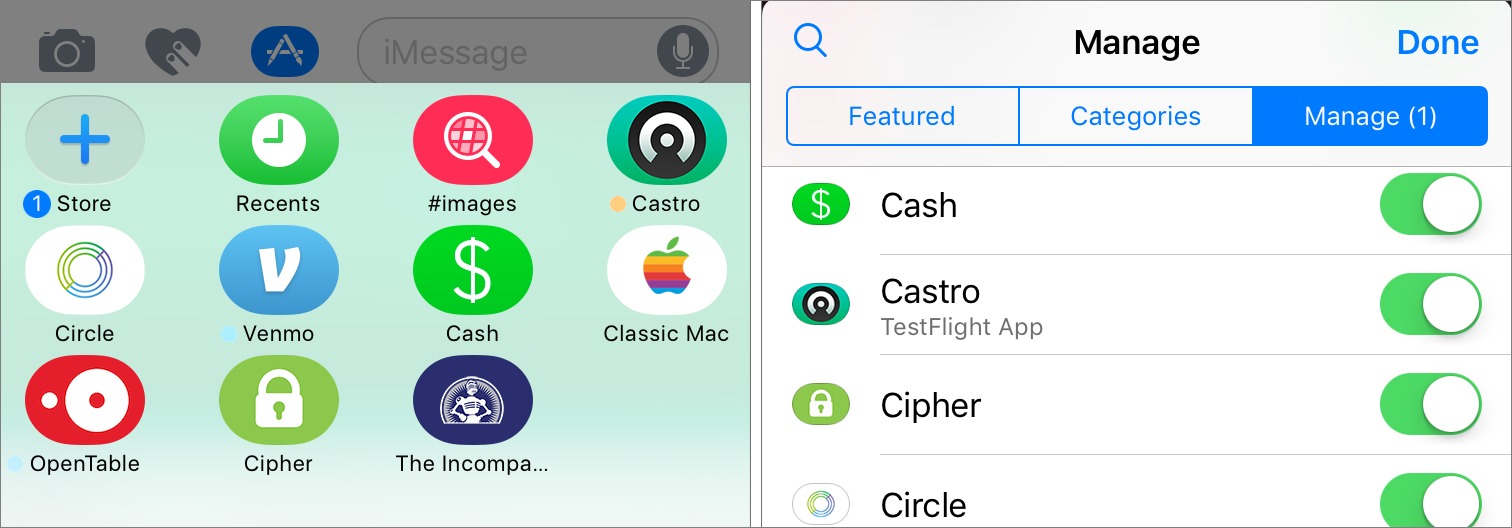

- Tap the “show apps” icon in the lower-left corner, which looks like a two-by-two grid of gray ovals.

- Tap the Store (+) icon.

- Tap the Manage tab.

- Tap the switch next to each app you want to appear.

- Tap Done.

- Tap the “show apps” icon again, and swipe between pages until you find the app. Tap it to open it in Messages.

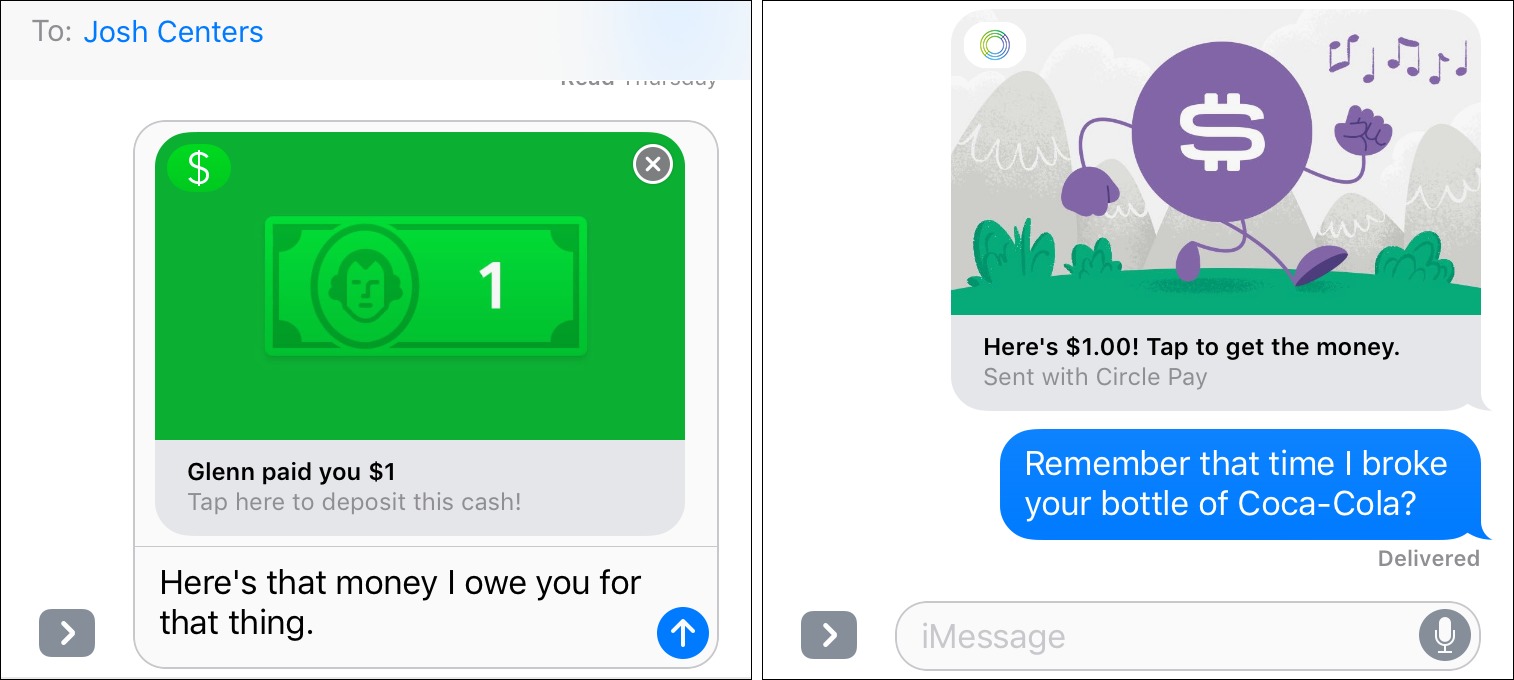

TidBITS Managing Editor Josh Centers and I tried Circle, Square Cash, and Venmo. Circle and Square are both straightforward, showing a field in which you can swipe to select payment amounts and, with Circle, one of the supported currencies. Circle lets you send any amount by penny increments, down to $0.01, and then tap Send. Square Cash focuses on whole dollar amounts — you have to tap an App button to pay to the penny, which is odd, since I expect many people will use this feature to split bar and restaurant bills. Tap Pay to send the payment.

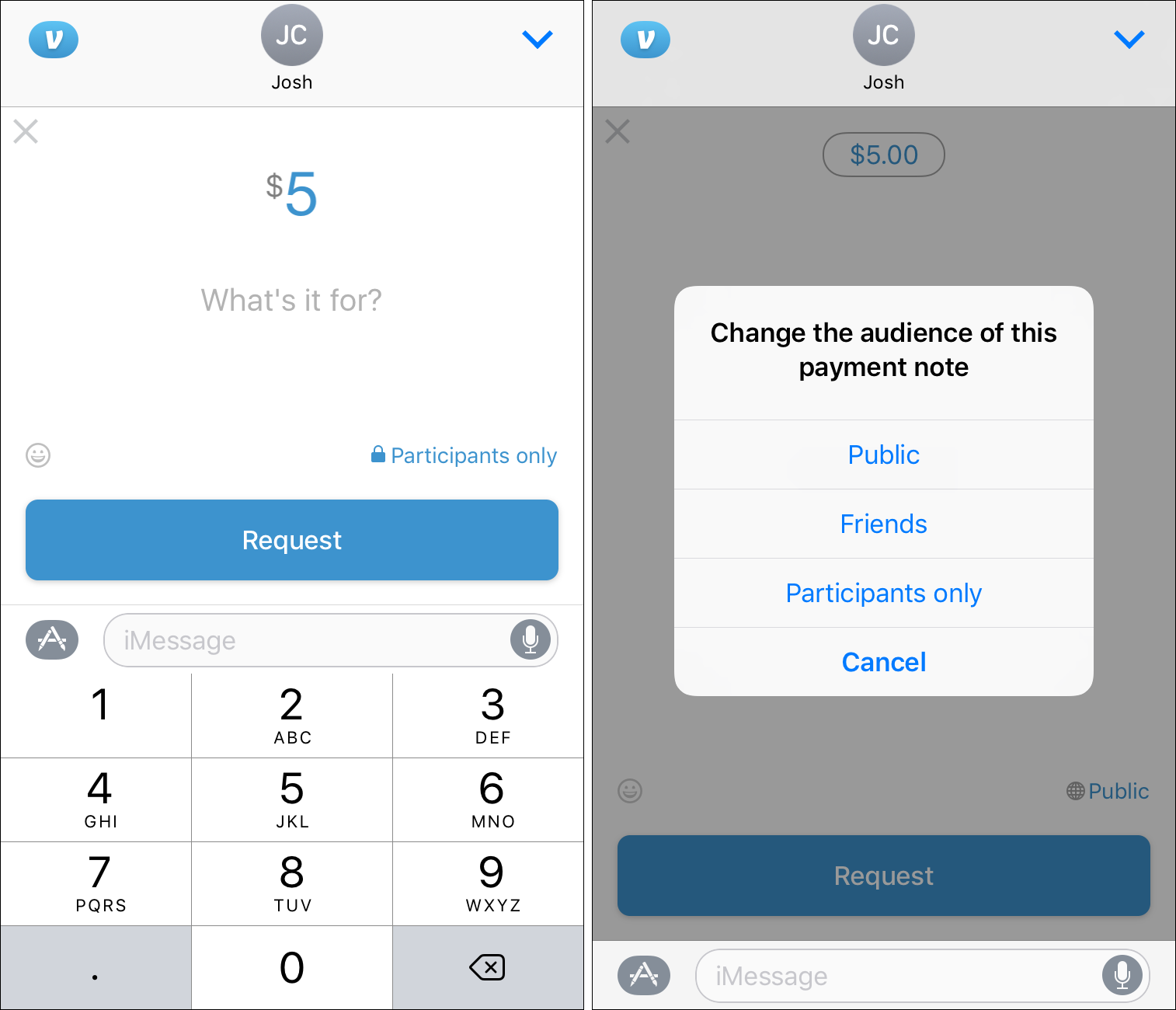

Unfortunately, Venmo hasn’t optimized its iMessage app to the small screen size. You have to tap one of two buttons, Request or Pay, both of which result in the same full-screen view. Tap the down arrow at the upper right to reduce the view, and Venmo stops working until you tap the up arrow to zoom it full screen again. The company needs to make a more Messages-appropriate view, rather than shoehorning its full app approach into that space.

Venmo also has the strange notion that small payments you make should be public record by default — that’s right, Venmo posts the participants and the amount of the transaction to a public stream. I have no idea why this would be desirable. Maybe to prove to others that you’re honorable? You can avoid this oddity — in the Pay view, if the tiny link above the Pay button says Public or Friends, tap it to switch to Participants Only.

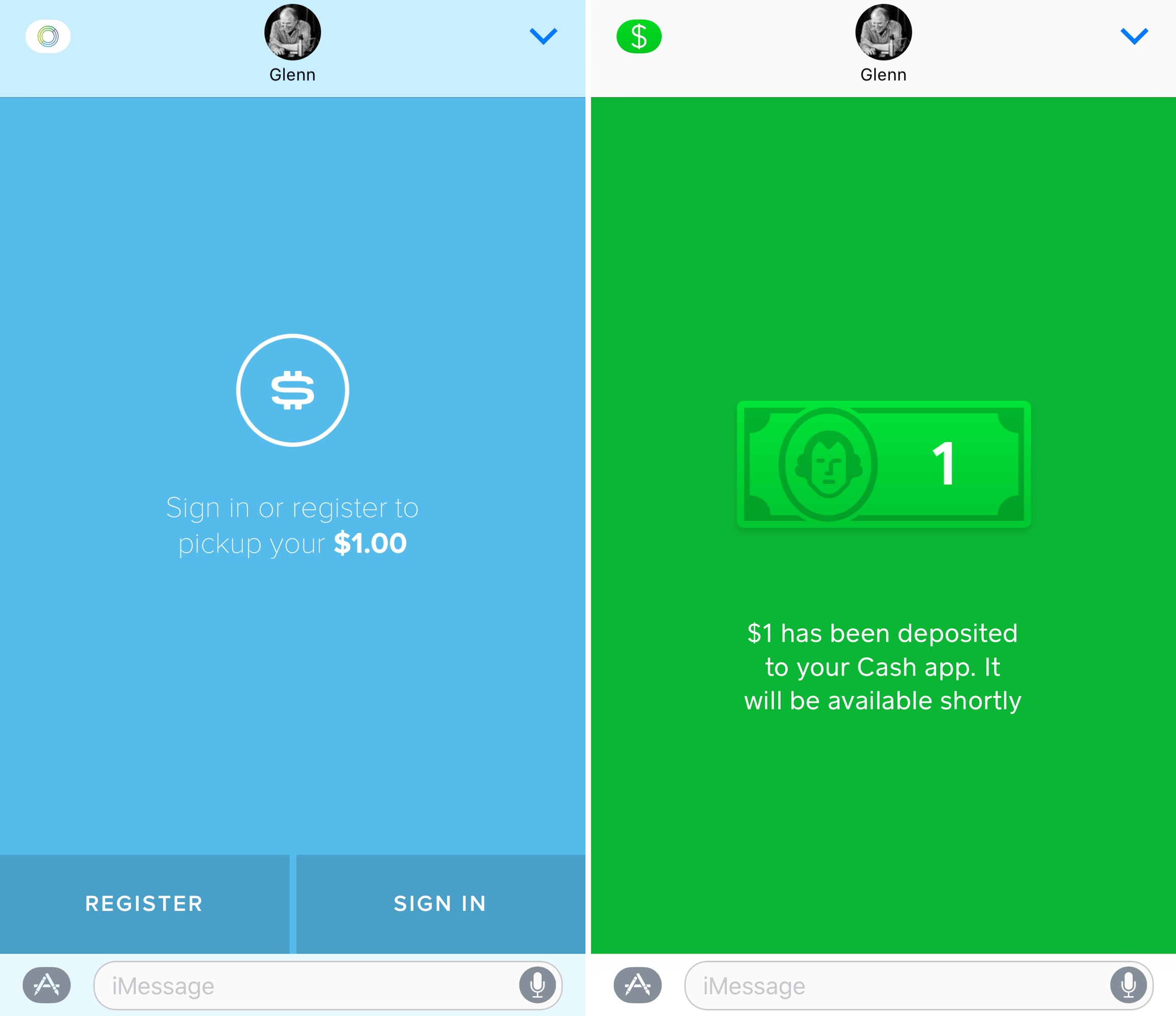

A recipient of any of these three payment messages gets the nice capsule view designed by the app maker: Circle is jaunty, Square bland, and Venmo boring. The receiver taps the part of the lozenge that explains they need to tap, and this launches the app, if it’s installed, or takes that person to the App Store to retrieve it.

All three systems worked well. I had already set up Square Cash and Venmo, and added Circle weeks ago. Josh had to set up Venmo and Circle and had no problems. Venmo is more awkward than the others, but it has been popular for years, so you may have more friends and colleagues already using it.

You can theoretically use Square Cash and Venmo with Siri, by saying something like, “Send $1 to Josh Centers using Square Cash.” (You must first enable each app for use with Siri via Settings > Siri > App Support. Circle doesn’t yet work with Siri.) In my testing, Siri couldn’t do this. With Square Cash, it said I had to open the app. With Venmo, it just said it couldn’t. You can also say, “Send $1 to Josh Centers” and Siri will prompt you with eligible apps. Josh had no problems sending money via Siri, so perhaps there’s something wonky with my iPhone.

Do These Services Solve a Problem? — I’ve hoped for the return of the Palm’s PayPal-style system for years. I long resented PayPal, because of how difficult and poorly maintained it was, in addition to the terrible way it treated merchants. But since eBay spun it out, PayPal’s Web site has improved, and the horror stories have abated, so I was surprised when PayPal didn’t leap into Messages on day one. Given its enormous user base, it will be interesting to see what the company eventually offers.

Square Cash has been my top pick for personal payments since it launched, and I’ve used Venmo willingly when I’ve needed to work with people who had committed themselves to that system. Circle is a new entry, but its multi-currency approach and desire to expand beyond the U.S. and UK make it an interesting option for people working and playing across borders.

Having these payment apps inside Messages simplifies making person-to-person payments, because you don’t have to look up recipient addresses or explain to people how to receive cash. They also make it easier to be notified of and receive payments than it was in the days of standalone apps or (horrors!) email notifications and Web-focused systems. Next time you need to split a restaurant tab with a friend, give one of them a try!

All these systems are fraught with fraud issues, particularly venmo. Don't use them with people you don't personally know and trust implicitly, as it's easy to get scammed. And paypal are scumbags, none of their transfers have been free for years; someone always ends up paying the fee, just depends on which side, and it's minimum 2.9% + a fixed amount (40 cents or something).

This article is about paying people you know, so it’s good advice to remember to not pay people through this mechanisms you don’t know, as there are fewer protections about reversing transactions than with credit cards. I’d be careful to not say Venmo is rife with fraud when you’re talking about people who use Venmo as a way to receive payment, as that’s not the same thing; maybe they could do more to fight fraud, but I haven’t looked into that.

PayPal, I’ve had my issues with in the past, but that’s incorrect about their fees. Business accounts pay a fee for all incoming transactions, as has long been the case. PayPal has no fee when you make a personal payment from your balance or a banking-account transfer. When you use either credit or debit, they charge. (It's 2.9% plus $0.30 for all the methods that require a charge.)

For someone who only wants to pay via debit card and not link a checking account, that makes some of the PayPal competitors instantly more attractive, too.

From the description of Venmo in the App Store: "Venmo is a service of PayPal, Inc., a licensed provider of money transfer services." So it looks like this is what PayPal offers.

Color me slightly uninformed! I missed their acquisition. Though they're run as separate businesses, so I don't know if that would explain PayPal being behind. Thanks!

We owed our son about $900 for gas and a rental car he got for our benefit. My wife was going to "transfer" him money from our account which involved electronically produced check. Three days for the payment to process. Three days to retrieve the check, and a few days for it to clear. I sent him the cash via Square immediately. I had signed up with Square Cash a few days before because of iMessage, and he already had a Square Cash account. I tried using it via iMessage, but I would have to tap the "+" button 900 times. Square Cash was wonderful way to pay. Square Cash via iMessage didn't work for me in this instance. My bank has Pop Money (which is a pain for the recipient to use. I may try Facebook's P2P system since most people have Facebook. My big issue: P2P is nice, but am I going to have to sign up for a 1/2 dozen systems just so I can use it? It reminds me of the early days of "chat" when I had a Jabber account, a Google messenger account, a AOL Messenger account, a Hotmail messenger account, a Yahoo Messenger account, etc. Maybe this is something Apple could do with iTunes.