Finding a Replacement for Quicken

Unlike the death of the classic Mac OS, which came with a full-blown funeral service officiated by Steve Jobs himself, the passing of Rosetta, Apple’s software that allowed PowerPC applications to run on Intel-based Macs, took place without any public acknowledgement from Apple at all.

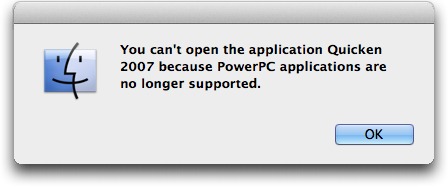

The first that many people learned of Rosetta’s demise was when they installed Mac OS X Lion and, upon attempting to launch a PowerPC application, saw a rather distressing dialog like this one:

Though many PowerPC applications have newer Intel-based versions that will live happily in Lion-land, one popular application, Quicken 2007, does not. Sure, Intuit offers a version with a reduced feature set, but Quicken Essentials isn’t a direct replacement for Quicken 2007. Instead, it’s just another alternative financial package, one that may or may not be a suitable replacement for Quicken 2007, depending on your needs.

Intuit itself makes this very clear.

So what is a long-time Quicken user, with years of accumulated financial records stored in Quicken, to do?

Two Preliminary Pieces of Advice — My first piece of advice is obvious: Don’t panic. There are a lot of personal finance packages to which Quicken users can turn. For nearly all Quicken refugees, one or more of them is probably right for you.

That said, my second piece of advice is the crucial one: Don’t upgrade to Lion until you have exported your Quicken data, imported it into a replacement, and tested it. That’s because the export feature in Quicken 2007, unsurprisingly, requires Rosetta to run. Although some Quicken alternatives may be able to read Quicken data directly, many more require that information in Quicken Interchange Format (.qif) files. You don’t want to lose your ability to run Quicken until your financial data has found a new home, moved in, unpacked, and had a little time to get comfortable. Lion can wait.

Some Candidates — Ah, but which new home? That’s not an easy question to answer. Among the many candidates that might replace Quicken for you are the following, listed in order of decreasing cost:

- QuickBooks 2011 for Mac from Intuit ($183.96)

- MoneyWorks from Cognito ($99 to $1,999, depending on package)

-

iBank 4 from IGG Software ($59.99)

-

YNAB (You Need a Budget) from Jesse Mecham Steine LLC ($59.95)

-

Fortora Fresh Finance from Fortora ($49.99)

-

Liquid Ledger from Modeless Software ($49.99)

-

Quicken Essentials from Intuit ($49.99)

-

Moneydance from The Infinite Kind, LLC ($49.99)

-

Moneywell from No Thirst Software LLC ($49.99)

-

moneyGuru from Hardcoded Software ($30 suggested contribution)

-

SEE Finance from Scimonoce Software ($29.99)

-

iFinance from Synium Software ($29)

-

PocketMoney from Catamount Software ($19.99 for computers, $4.99 for iOS and Android)

-

Money 4 from Jumsoft ($18.99)

-

GNUCash (Free)

-

Xero Personal (online, $19 per month)

-

Mint.com (online, free)

These are not, by any stretch of the imagination, the only possible Quicken replacements around, merely the ones I’ve taken a quick look at or that readers have suggested.

Also note that you can keep your Rosetta-requiring Quicken 2007 if you are willing to partition your hard drive so you can reboot and run Snow Leopard when necessary; you could also transition to Quicken for Windows if you are willing to run Windows in Boot Camp or a Parallels- or VMware-based virtual machine. These seem like stopgap options to me, but if you want to learn more, Joe Kissell discusses them in “Take Control of Upgrading to Lion.”

But, in any case, I’m not going to recommend any one of these replacement options in this article. Instead, I have a bunch of questions for you to answer. Your answers to these questions will put you in a much better position to examine the available alternatives and find the one that’s right for you.

Quicken 2007, its predecessors, and its Windows-based edition, all offer a variety of features and capabilities. It’s a rare Quicken user who needs all of them. What you need to figure out is how you use Quicken, which of its features are essential to you, and which you can live without.

Where You Come In — But wait! We need your help! First, if you know of viable Quicken replacements not in the list above, please share that information in the comments, so we can add them. Second, after you’ve read the rest of this article and thought about the questions suggested, let us know in the comments if you have any additional questions for people to consider.

Here’s why. We’re planning something new with this article. Once we’ve compiled a full list of products and questions, we’ll be contacting the developers of each of the products and asking them to explain how their products will meet your needs. We’ll then make an edited version of each developer’s response public for everyone to read.

On to the questions!

Do you use Quicken primarily as a smart checkbook register?

If so, most available packages, including Quicken Essentials, may fill the bill. Questions related to this category include the following:

- Do you reconcile your checkbook with your bank statement each month? No, don’t laugh: lots of people don’t. In fact, I don’t (a brief pause while my mother, a retired bookkeeper, stops sobbing in shame); as long as my bank thinks I have more money than I think I have, I’m not worried about any small discrepancies. But if you are wiser than I, and your bank enables you to download monthly statements and import them so you can reconcile your records, you need to find a package that allows such imports and that provides the capability to reconcile your information with the bank’s.

-

Do you tag or categorize various expenditures and deposits? Many people don’t, but I do. It makes my life much easier come tax time if I can find my deductible business expenses quickly and hand them to my accountant. If this matters to you, you need to find a package that can import Quicken’s categories and that can present you with a report of your transactions sorted or filtered by those categories.

-

Do you use Quicken to print checks? If so, and if you can’t live without this feature, you need to find a package that supports check printing.

-

Do you use Quicken to pay your bills online? If so, you may need a package that provides this capability. But you may not if your bank (like mine) offers such a service online and you don’t mind flipping between your finance software and a Web browser when you’re paying bills. A tip here: if your bank supports OFX (Open Financial Exchange) protocols for online bill paying, look for a package that also supports those protocols.

-

Do you use Quicken’s reminders? I use them, but I don’t rely on them; I know when my rent is due without Quicken’s help, and my estimated tax payment dates are already in iCal, so Quicken’s reminders are a convenience only. But if you can’t live without them, you have to find a package that has a similar feature.

-

Do looks matter? Surprisingly, they do for some users. If the financial software package is hard on the eyes – the type is too small, the layout is confusing, the color scheme is obnoxious — that might be enough, all else being equal, to disqualify a contender from being your Quicken replacement.

Do you use Quicken to track investments, loans, budgets, and net worth?

Now we’re getting into some serious financial stuff, stuff that’s beyond my personal experience. Fortunately, my younger brother has a complex financial portfolio, and he has clued me in on some of the questions to ask related to this overarching question.

- Do you need to track the details of your investments? For example, Quicken Essentials can track the values of specific holdings and their overall value, but it won’t track individual purchases or sales and calculate things like capital gains nor manage stock splits. If this sort of thing is essential to you, then you need to look elsewhere.

-

Do you have one or more outstanding loans that you need to track? Loans come in all shapes and sizes: credit cards, mortgages, personal loans, business loans. If you need to track outstanding loan balances, and principal owed versus interest, and if you want to coordinate your loan information with your checkbook ledger, you need to look for a package that offers such amenities.

-

Do you use Quicken to set up and stick to a budget? Some packages can show you where your money has gone; with others you can set up one or more budgets and track your expenditures and income against them. Ask yourself just how much a budget feature matters to you, and how fine-grained the reports have to be.

-

Do you need to know readily what your current net worth is? Some packages provide enough information for you to figure this out, others do not, and some actually do it all for you. If knowing your net worth at any given time is of critical importance to you, find a package that provides it.

Who else needs access to your financial information?

It turns out that there are several audiences who may have to be considered when you adopt any financial software: yourself (obviously), a spouse or significant other, possibly an accountant, almost certainly the Internal Revenue Service in the United States (residents of other countries have similar governmental organizations who may have a burning need to examine your finances from time to time).

- Do you do your own taxes with the aid of tax-preparation software? If so, you need to make sure that your chosen Quicken replacement and that software can play nicely with one another. At the very least, you need to make sure your replacement for Quicken can export the necessary data in a form that the tax software can handle.

-

Do you and your life companion maintain separate accounts, but need to use the same software (possibly because you file joint tax returns)? If so, look for a package that can handle multiple accounts without mingling the information. Surprisingly, some don’t. Also consider whether you can maintain separate account information that your companion can’t easily access: although many couples don’t like to keep secrets from one another, you may not want your spouse to discover the purchase details of the holiday or birthday gift you bought.

-

Do you have an accountant with whom you exchange financial information electronically? If so, find out what your accountant needs to be able to get from you and give to you, and look for a package that can handle such exchanges. Possibly you can get away with being able to export and import Excel files or even tab-delimited or CSV (comma separated value) text files. (I give my accountant paper. Paper is always good, but, of course, you will probably get charged more if your accountant has to engage in manual data entry tasks that an electronic transfer of information could have avoided.)

-

Is the IRS watching you? I have a cousin who recently published several well-received novels and who just got audited by the IRS. She told me that the IRS agents were astonished and a little appalled to discover that she kept all of her records manually on paper. They told her that electronic financial records were, if not essential, strongly encouraged in the case of audits. While there may be no official government mandate that requires taxpayers to keep electronic records, when you choose a Quicken replacement you may want to consider choosing something that won’t make the government angry at you. A package that can export your information in a standard format, such as previously mentioned QIF files, or Excel spreadsheets, can

help you get through the trouble of an audit more easily.

How to Choose — Okay, you’ve answered all my questions (and, I hope, others that have occurred to you). Now what?

First, prioritize the features you need based upon your answers. Some features may be essential, some may be nice to have, some are almost certainly irrelevant.

Next, you may want to wait until we’ve published the developer responses to our questions to start looking for a replacement. If you’d rather get going right away, or if you’ve read the developer responses and need to move on to personal testing, start with the list of products I provided above. Explore the Web sites for each of the candidates you have in mind, just to see if they offer the features that you need. Focus especially on the ones that offer a free trial version: With the exception of Quicken Essentials, all of the ones in my list do.

After that, download one or two candidates that offer free trials and try to import your exported Quicken data into them. If that works out, try them out for a couple of weeks, putting them through their paces, while still maintaining your “real” information in Quicken.

Once you have found your replacement, do a final export of your Quicken data, purchase the replacement, and bring your data into it.

With only a small amount of luck, you should be able to cut your ties to Quicken and finally move on to Lion.

Does any alternatives have Bill Pay? None that I could find.

Maybe not under that exact name, but MoneyDance, for example, does claim that it "can automatically download transactions and send payments online from hundreds of financial institutions." Sounds like bill pay to me.

Moneydance is the only one that I've found to have online bill pay. Unfortunately, it's so clunky that you might as well just use your bank's web interface. For example, you can't schedule a payment reminder that becomes a bill pay transaction. You have to go enter the payment by hand again, even though all the details are in the reminder.

This has come up in the Moneydance forums, and IIRC the developers have promised either to consider it or to implement it, I forget which.

I'm still using Quicken 2003. I never saw any reason to update. It is important to me to know if any or all these programs will import my data and not just Quicken 2007.

It's not a hard experiment to run. Use your copy of Quicken to export your data, and try to import the exported data into a candidate for a replacement.

Additional alternative: Pocket Money by Catamount Software

Added, thanks!

For completeness, a couple others I briefly tried: Money4 (beta) and Liquid Ledger

A very thoughtful and complete article, but one thing is missing. None of the alternative programs allow for downloading of data from Charles Schwab. The only solution I can foresee is to load Snow Leopard on a separate, small partition and boot into that once a month when I need to access Quicken 2007.

iBank 4 claims to be able to do it.

When I talked with the reps at Charles Schwab they said "no." I've emailed iBank for clarification.

Quicken Essentials does download Schwab data.

MoneyDance does. I tested it with a family trust account, which I had not yet set up with stock positions, but without contacting Schwab I set up online banking and it downloaded two years worth of brokerage transactions.

My test was brief, so there may be issues. One such issue might be with checking accounts there (as I've heard is the case with Fidelity) where it treats the account as a brokerage account rather than a checking account.

Cheers

iBank4 downloads from Schwab with ease. A lot smoother than Quicken. I've been running parallel for a few weeks now and have no trouble at all downloading from Schwab, BofA or Amex.

iBank 4 and iFinance (you didn't mention this one) both failed to correctly import my Quicken data. Quicken Essentials was spot on - it's not my first choice for the software, but I didn't want to lose 10 years of historical data.

We're using our bank's website for billpay now.

Like I said, there's lots of software out there; I listed just a sample. Thanks for adding iFinance to our growing list.

I've seen anecdotal reports that say Quicken Essentials messes up imports and others don't. That's why you did the right thing by testing: every person's data is unique, and what works for one user may well not work for another. When financial data has been accumulating for years, and possibly been manipulated by several different versions of the software (and maybe on different machines) over time, Weird Errors Can Creep In.

Some programs are *much* better at importing .qif data than others. I believe that the two best are Moneydance and SEE Finance.

You would think that Quicken would be able to eat its own dog food, but it can't. When I was forced from Mac to Windows several years ago, my first thought was to switch to Quicken on Windows. But Q/Win did such a horrible job of importing the QIF export from Q/Mac that I went looking elsewhere, and ended up with Moneydance, which did much better. And in the long run I've been glad to be out from under Intuit's thumb -- a lot of us (including me) liked a lot about Quicken but hated Intuit.

I have 20+ years of Quicken 2007 data and I've tried all of the apps above, other than QE, plus several others. Not one did a perfect import except for SEE Finance (more later). Most of the problems are with transfers among accounts, especially when the transfer is within a split transaction.

It may be possible to get perfect imports some day, but in my experience it is worth spending the time to fix the import problems with the application that will serve you best once you fix them.

SEE Finance gets imports right by not linking the two sides of transfers at all. And this is true for manually entered transfers as well as imports. To edit a transfer, you must find and edit both sides separately. A deal breaker for me.

For the record, I've been running MoneyDance in parallel for a couple of months. The transition took time, but it replaced almost all of my needs as well or better than Quicken and does even better with online transaction downloading.

I also have 20+ years of Quicken data. Neither iBank nor Moneydance was sufficient. I downloaded each program and discovered these known problems:

IBank does not import old prices; 20 years of prices lost.

Each price must be manually entered and iBank does not save price from a transaction to the price list.

IBank cannot do search on memos.

Reports cannot be edited for content, memos, etc

Moneydance does not accurately search memo list, especially if there was a split transaction. For example, all individual credit card expenses listed in split transaction were IGNORED on the reports.

When I imported my Quicken 7 data to Quicken Essentials I lost a lot of data. I've been using Quicken Essentials for months now without many problems. For some things there support is good. For others they refer the problem to another department and you get no answer.

I have 10 years history also and switched to Quicken Essentials not realizing it was a step down. iBank won't import from Essentials. Not sure what I'll do, but am not rushing to Lion.

iBank imported over 30 years of my Quicken data with only two minor errors that were easily corrected.

I've been using Checkbook for several years now: http://www.splasm.com/checkbook/

There is also a Pro version: http://www.splasm.com/checkbookpro/index.html

I used Quicken for Windows for so many years. When I switched to the MAC, I kept an old PC just to run Quicken. I finally tried Quicken Essentials and have come to accept its many limitations and use it all the time. My Financial Institution refuses to adapt the new download format Quicken uses, so I gave up on tracking investments. Never used bill pay or printed checks so do not miss that.

I tried them all and MoneyDance was the best alternative but I am still with QE and will probably stay with them. Intuit is terrible and so transparent when it comes to supporting OS X.

Perhaps I missed it in the article but finance programs need to be able to import and export data directly from another financial program – QIF, etc. Selecting a finance program is like a marriage, a long-term commitment, and if you need a divorce you don't want your ex to end up with all your stuff especially if you have decades of data you want or need to keep.

Absolutely correct: make sure you can get your data OUT of your replacement as well as INTO it. Excellent advice.

Great point. The problem is that .qif is a "lossy" format, even though it's the de facto interchange format. Quicken Essentials for Mac may be the worst in this regard, but Moneydance can import from it. But Moneydance itself has a flawed .qif export (at least as far as stock splits are concerned).

*sigh* Yes, I've noticed issues with the MoneyDance exports. That's one reason I have not yet pulled the plug on Quicken.

One consolation is that MD has APIs that allow extensions to be written in Java. I had never written a line of Java code and am half finished writing an extension that exports all my data to MySQL where I can search and report from my browser. (I previously did this via qif.)

So worst case if the MD folks don't get exports right, I, or someone else, could build a better exporter.

MD, however, can export in XML. Also, its main database is a text file which could if necessary be parsed. Both formats are lossless, unlike QIF, which by definition is incomplete.

I have been using Quicken since 1994 and don't know if I could live without it. I am currently running Quicken 2011 with CrossOver and it works great. I previously used VMware Fusion but wanted to get away from Windows completely. I am also testing SEE Finance. It imported all my Quicken data without a hitch.

Quickbooks Pro works with Lion. And it can be upgraded to a multiuser version.

I like using Quickbooks Pro much better than Quicken. It has more features, more flexibility, etc. etc. etc.

I wonder why go to fairly simple alternatives when you can go to a far more robust one in Quickbooks Pro.

For some users with complex finances, it might well be the way to go. For others, it may be serious overkill. And, with a purchase price just short of $200, it is more expensive than most other candidates for Quicken replacement

When it comes to financial tracking software, one size does not fit all. I should also point out the one of the big reasons that Quicken has such a large market share on the Mac in the first place is that, for many years, Quicken was provided free to purchasers of new iMacs--the version that I have, and the one I had before it, came with Macs that I bought.

Yes. Quickbooks Pro can be overkill for most. Quickbooks Pro is Quicken ON STEROIDS.

But the alternatives are as limiting as or are worse than Quicken.

Once I switched over to Quickbooks Pro, at least I knew I never had to turn back, that Quickbooks Pro has so many features, it will have the capacity to grow as my needs grow. Certainly this is true with the new multi-user version.

Can Quickbooks pro do billpay? Can it handle complex investment tracking?

Quickbooks Pro can do bill pay.

Quickbooks Pro can absolutely handle complex investment tracking.

Quickbooks Pro is Quicken ON STEROIDS.

Check it out. Quicken is so limited compared to Quickbooks Pro.

I am planning to update to QuickBooks since I have business, investment, and 20+ years of data from Quicken 2007. However, "live chatting" with a sales consultant at Intuit, he stated that "we recommend that you can call our QuickBooks Data Conversion team to convert your data." I don't really want to share all that info.

I couldn't find Quickbooks Pro for Mac; does it exist?

Yes. Go here: http://quickbooks.intuit.com/mac/

Michael, That is a link to Quickbooks, not Quickbooks PRO. Thx.

That's the Mac offering. Quickbooks Pro is a Windows application. So, to answer your original question, Intuit does not offer a package called Quickbooks Pro for the Mac.

Quickbooks comes from Intuit. For many of us, avoiding Intuit is a primary consideration. I liked Quicken when I used it, but came to detest Intuit.

I use Quicken almost exclusively for the Bill Pay service. I have yet to find another program that offers a similar feature.

I see that most banks now offer online Bill Pay too. Does anyone have any experience with those services that they can share?

I used Quicken for the same reason, but when Lion was announced, started looking for alternatives. (I wish this article was published a few months ago.)

To answer your question, I only have one bank that I use for paying bills, and they offer bill pay on their website. It's not as flexible as Quicken's Bill Pay is, but it does work well. In fact, many of the bills I receive allow for ebills, and the banks Bill Pay interface allows me to automatically pay the bills based on the ebill. For example, my credit card has a balance of a certain amount, and I can either pay the entire amount, pay a fixed amount that I choose, or I can set a rule that if the balance is at a chosen threshold, I can either pay the full amount or an amount that I choose. I find it much more useful than Quicken's Bill Pay just because of the ebill feature.

I chose iBank for my needs. One of the features I like is the built in browser, where I can view the bank's web interface within iBank's window.

I migrated from Quicken 2006 to Ibank and it went pretty painlessly. Its not a perfect alternative, but the best of those I sampled. I don't love its user interface, and its reports aren't as easy to customize as I'd like -- but it works well for me managing many accounts, stocks and mutual funds etc.

What ultimately sold me on it was the very nice Iphone app that synchs with it. This made all the difference. I'm able to update my credit card records at the exact time I make a purchase in a store. The data is all waiting for me on my computer when I get back.

I switched to Moneydance in the past couple of weeks and like it. Just like Quicken, Moneydance has online bill pay for my bank.

I've discussed all of these alternative financial apps on my blog at this link:

http://scottworldblog.wordpress.com/2011/05/23/why-does-intuit-hate-mac-users-and-why-doesnt-apple-save-us/

Unfortunately, none of them live up to Quicken... they all have major flaws, including iBank.

Another solution could be to run Quicken on Snow Leopard running virtually under Parallels or VMWare Fusion, but the Snow Leopard EULA doesn't allow it. Lion can be run virtually, so Apple isn't against the concept. Will Apple change the EULA? Maybe someone with an understanding of what's involved can comment. It's keeping me from upgrading.

I've tried running lion virtually but it will only work on a computer that has lion installed on it. So that doesn't work. The only versions of either lion or snow leopard that will work virtually are server versions. (I don't have either.)

I used Quicken from about 1990. I finally got dissappointed enough to switch in summer 2008. I tried most of those listed here. I went with MD and am still using it.

I gained cross-platform capability and support that, at least, responds. I lost some investment capability. I am not regretting it.

There is some difficulty in transfering years of Quicken data, but I have been able to moved what I needed.

G'day

I've been using MoneyWorks by Cognito for years and can happily recommend it. Comes in three flavours:

MoneyWorks Cashbook – a simple cashbook and general ledger for cash based users

MoneyWorks Express – simple, singe user accounting system

MoneyWorks Gold – comprehensive, multi-user accounting and business information system.

Website is: http://cognito.co.nz/

Cheers, Gobit

I recently left Quicken 2002 behind. I have been using YNAB alongside of it for several months because I was drawn to its budgeting focus (it has a decent UI as well which continues to improve). I couldn't let go of Quicken, however, because YNAB cannot presently generate the kind of detailed reports I need at tax time. A few weeks ago, I downloaded iBank. It generates better reports than YNAB but not as customizable as Quicken. The UI needs work since tabbing through the register fields doesn't work well, especially in split transactions.

trying out IBank, was kind of unhappy not having "on-line bill pay" but my bank one works great and cost less. Plus I found out I'm not doing that many bill pay checks anymore, most things can be done on-line, utilities and so on. So far very happy with IBank.

You should try GNUCash. It imported my .qif from Quicken without an error compare to others I tried. I recommend it and its free.

I was hoping for a free alternative, but I wasn't as lucky. After clicking "Forward" 19 times, I got "A bug was detected while converting the QIF data." when the progress bar showed about 20% complete. No additional info.

My solution is to use Quicken 2010 for Windows running in Crossover. I can also run the same program with the same data using Parallels running Vista. I migrated over a year ago and haven't had any problems. When I discovered Crossover about six months ago using Quicken-Win "almost" frictionless on my Mac.

Recently I've tried several of the Mac finance alternatives but each has been inadequate in some way or another and unless there is a major new or improved program I'm sticking with Quicken for Windows.

Additional questions 1

* Does your target program support the reports you need to generate?

I tried Quicken Essentials and found its reports were far too limited for even my relatively modest needs.

(other questions in separate comments, since I ran out of characters).

Did you take time to explore its reporting features thoroughly? What sort of reports do you think it is unable to generate?

Yes, I purchased QE and then got a refund when it failed to meet my needs. It could not generate the reports I needed to complete my quarterly business activity statement (BAS).

Additional question 2:

* If you enter receipts religiously (as I do), it your target program efficient at entering receipts?

Quicken is (for all its flaws) incredibly efficient at this. Enter "t---" for three days avon in the date field for example. I've settled on iBank, but its far less efficient at this, with minimal support for date field adjustments (worked around with Keyboard Maestro) and frequently requiring multiple Tab keystrokes where only one is necessary.

Additional Question 3

* If the target program has flaws or difficulties, is the company responsive?

The iBank support team have been incredibly responsive,in fact I can't think of another company that has responded as promptly and as detailed as they have - full marks.

Time will tell if that responsiveness in terms of support translates in to streamlining the program and knocking off the remaining rough edges, but I'm pretty hopeful.

And one final comment:

On the issue of "getting your data back out" - I tried this, but unfortunately discovered that my 20 years of Quicken 2006 data (which iBank imported with only issues related to category conflicts, probably fixed in the latest version) cannot be successfully imported by Quicken 2006 - that's right, Quicken 2006 couldn't import its own generated QIF data accurately. Sigh.

That's weird. But SEE Finance or Moneydance may be able to do it better.

Be sure to compare speed when looking at these programs. In my case, with 16 years of data on a 13" white Macbook, Moneydance and SEEFinance were incredibly fast and responsive, with Moneydance being the most impressive; searches complete instantly, and the GUI (though ugly and often awkward) is very responsive in terms of raw speed. iBank was unusably slow in all respects; import took about 30 minutes, searches were glacially slow, and the interface was in general slow and balky, even when only displaying a couple years of historical data.

I find iBank definitely not as fast as it should be, but not quite unusably slow. Certainly for some things its almost unusably slow with 20 years of data.

Does the application have a mobile component that would allow me to enter my transactions while on the go?

I second the OFX file format support, It is better then QIF for downloading my transactions from my bank website.

What would also be nice is the ability to scan or photograph (with my iPhone) and associate receipts with my transactions.

I have tried iBank and YNAB.

I created a Snow Leopard (10.6.8) bootable disc partition using SuperDuper before upgrding my System disc to Lion. The SL partition is on an externl HD and It's name is Quicken. This allows me to continue using Quicken by restarting my Mac via the Quicken drive.

I did this after trying nearly all the alternatives and finding none were Quicken 2007's equal.

I have to believe either Intuit will license Rosetta and rewrite Quicken 2007 around Rosetta or somebody, most likely iBank, will produce a full featured Mac compatible Quicken 2007 alternative, something that currently does not exist.

When this happens, I'l retire my Quicken drive.

The above said, I guess my comment about this article is that one does not need to go to second best at this time just because Apple are yet to cut a deal regarding Rosetta. One should wait for the production of a real Mac alternative to Quicken 2007.

No, they won't. A few years ago Intuit SAID they were going to rewrite Quicken for Mac to bring it up to parity. They started (I was a beta tester) but then they stopped responding to our input and releasing beta updates. Next the web page was shutdown. All of a sudden, QE4M was released in 2010, but it wasn't anything like what had been promised for Quicken 2010; just a stripped down bare-bones checkbook. Intuit also said that was it, to take it or leave it, and they have no plans to improve QE to parity with Quicken 2007, much less Quicken for Windows. Intuit has long wanted to drop Mac support for their products.

Looks like Quicken Essentials is no longer being offered at the 50% discount. At least it isn't when I follow the link in this article.

The discount was there when we posted the article, but has vanished today. However, on this page there is a link near the bottom that still takes you to the limited time offer (although, of course, that could change): http://quicken.intuit.com/support/articles/getting-started/upgrading-and-conversion/8207.html

Meanwhile, I've updated the software list in this article accordingly. Thanks for the alert.

Quicken Essentials can be found for 50% off at this link.

http://quicken.intuit.com/personal-finance-software/mac-personal-financial-software.jsp?priorityCode=8209063746&cid=int_qkn_faq_mac_os

I use Quicken Essentials and think it is really nice, but if you are a hardcore user you would probably be fine using Quicken for Windows in under Parallels Coherence mode.

I am also looking but for the extra reason that I want my data to be readable on an iPad and an iPhone and would prefer it to be useable via Dropbox (at least until we see what the Apple cloud will allow). Thanks to Adam and all those who have offered ideas.

I do use both the Mint app and PageOnce (the former because PageOnce won't work with my Credit Union). PageOnce also keeps track of more than bank accounts - frequent flyer, travel bookings, etc.

A financial management program's content and utility are dependent on the needs of the user. And obviously these requirements vary markedly. I had twenty years of data stored on QMac97. I tried a number of programs and settled on iBank. It isn't Quicken but it does a very serviceable job after a seamless download. And I use it for everything including portfolio management. Doggone Intuit, anyway!

I've explored iBank, MD, and SEE Finance and all three are very credible alternatives to Quicken EXCEPT none of them allows category budgets to vary by month (semi-annual property taxes, quarterly tax payments, utility bill variations by season, etc.) For those of us who take budgeting and category tracking seriously, this is a deal killer with all them. For now, I'm forgoing upgrading to Lion to be able to stay with Quicken, while hoping one or all of the three above will add this non-at-all-complex feature.

Hoping is one tactic; contacting the developers and requesting the feature is apt to be more effective, however.

Yep. Done that long ago. Little indication of action or even much interest from any of them.

In Quicken 2007 I use accounts, categories, subcategories, and classes. (I understand that iBank converts classes into sub-subcategories. I use memorized, scheduled, and split transactions. I use Quicken to write two-dimensional reports of selected data with categories down the rows and classes across the columns, then export the resulting report to a file that I can import into a spreadsheet. I use Quicken's manual reconciliation tool to reconcile accounts to statements. I enter transactions into Pocket Quicken on my Palm phone, then synchronize transactions in both directions between Pocket Quicken and Quicken. (This is one of the main reasons I haven't yet migrated to an iPhone.)

Of all the things I use, classes and two-dimensional reports may be the hardest for a replacement program to supply.

Yep, I've found that none other than MoneyDance has anything like classes (in addition to hierarchical categories). iBank, Money4, and MoneyWell made enough of a mess of the category and class import that for testing I had to delete all classes from a copy of my Quicken file in order to get a reasonable import.

If preservation of classes is important, I'm afraid MoneyDance is the only option at present. Instead of hierarchical classes, MD has tags, which are not hierarchical, but you can assign multiple tags to transactions. Not to get too far into the weeds, but after importing, I used the Find and Replace extension to fairly easily convert imported classes such as "10:China" to tags "10" and "China". This might not work for everyone, but for my needs it actually works better than hierarchical classes in Quicken.

Check for HBCI/FinTS/EBICS. This is a transaction standard used in Europe. Very important for us. For a list of software: http://www.apfelwiki.de/Main/Finanzen

I establish an annual budget by category and then quarterly track expenditures against the annual categorized budget items. IBank says they don't have that feature. Anyone know who does?

How about a Tremendous Grasp of the Obvious. Thousands of us are suffering from Intuit's lack of updating Quicken 2007 to run with Lion. Why don't they smell the coffee perking and do the upgrade and sell hundreds of thousands of dollars in new software. I'm really tired of people begging Intuit to do the obvious. Their arrogance is astonishing.

I second this opinion. Wondering why Quicken threw Mac users only a small and stripped down bone with QE. Promising more for the Mac since 2008...promises, promises???

Reports are key fro me. Like others, I have 20 years of Data in Quicken, since long before Intuit bought it.

Quick Reports for Payee, category, memo, amount, make it very easy to find out just who you bought that hard drive from 2 years ago, if you can remember any of those things.

Tax reporting is a requirement. I don't care if I can import it to tax software, I'm a CPA and never trusted Intuit or anyone to get that right for consumers, I just want a solid transaction report.

I want to hide accounts That are closed, but be able to search for data in them in my reports.

I have been concentrating on iBank, MoneyDance and See Finance. Data entry is ugly and to complicated on all of them. Tab, type, + key - key, what is so hard about implementing those things?

I want to cull my Payee list from time to time. Businesses close or I no longer use them. I don't want every transaction that used that payee to be deleted. I forget which program wanted to do that... See I think.

Frustrating.

So far I've yet to find a QuickBooks replacement that displays multiple checkbook-style account registers (a must have UI for me), and lets me manage both personal and (very) small biz in a single data file. I'd love to, but both AccountEdge's and MoneyWorks' UI's feel stiff and foreign if they even sow me the minimum I need to see, as above. When we published our 3 books I switched from Quicken to QB even while losing keyboard entry shortcuts and gaining tons of biz-related stuff I don't need. But both sales receipts and invoices are mission-critical now, and I manage personal vs biz reporting via classes. Yep: QB is buggy, and the lack of data-entry and search elegance remains a drag. I still don't see contenders, unfortunately.

Moneydance allows you to open multiple registers in different windows. I ran a very small business using only MD and only one file. It does not have receivables features, but I was able to kludge up a system that was OK for two invoices/month. The kludge would have been too cumbersome for two per day. I have not used QuickBooks, but AFAIK it's the low end for real business bookkeeping.

Responses: 1) Yes, I used Quicken for 24 years... up to last Fall. Became sick of endless updates, design flaws and horrible customer service. Yes-tags. No-print checks. Yes, paid bills online, but NOT thru Quicken. Yes, used Reminders. Participated in endless beta testing for what became the less than robust Quicken Essentials. End of story.

2) Yes, I used Quicken to track investments and net worth. No, the budget section of Quicken never worked for me.

3) No one else needs access to my data. We use Quickbooks for our business and give that data to our CPA.

4) Key features: Speed, stability, ease of use, robust/custom reports, investment tracking, fast transaction downloading, easy data entry, fast & easy reconciliation, pleasant look and feel.

Best option? I tested them all. iBank. It's not perfect by a long shot, but it works.

Additional Questions:

Can a program do a reconciliation from a printed bank statement? How hard is it to do?

Can a program print a report of reconciled items after completion of the reconciliation?

Can the program be run without any electronic input, only manual keyboard input?

Currently running Quicken 2004 Windows via Parallels.

All I want to do it download transactions, pay bills from within the app, and generate reports for my accountant. quicken 2005 worked fin for that. If Intuit doesn't want my money for an upgrade, I will go elsewhere.

the feature I require most is downloading transactions directly from my bank. Any software that doesn't do that is a no go. I don't write checks. I use a debit card and my bank's online bill pay.

Recently I imported 15+ years of multiple accounts into Q for Windows running via Crossover just to see if it would work. What a pain, with hundreds of mixed up transactions. I got that corrected, so Q for Windows seems to be an option for me, but I reverted to Snow Leopard and will happily stay with that for a long while if need be.

Well, thanks to this article and comments thread I gave iBank another try this morning. It seems they have fixed the Wells Fargo qif import bug that I fought with in an earlier version. I was able to do a perfect import of 11 years worth of old and current accounts, get connected to my bank and directly import new transactions. Then I went back into Q2007 and imported the same new transactions and it continues to screw up transfers between accounts. I think iBank is going to work well for me, and I will be beyond happy to dump Intuit and Quicken!!

Nobody has yet mentioned one of the best-reviewed Quicken alternatives out there: Fortora Fresh Finance. I use it and it's fantastic. It does everything one would want of finance software, and imports Quicken files with no muss, no fuss. Plus it has outstanding support. Also check the reviews over on MacUpdate.com which say the same thing I'm saying (4.5 stars). THERE IS LIFE AFTER QUICKEN!

http://www.fortora.com/mac-money-management-software/

Could someone please summarise for me & other puzzled readers why any of us should want to switch to Lion? It seems a of of hassle for no gain.

I have recently been using Splasm's CheckBook, and have recently upgraded to CheckBook Pro. CB Pro is now on sale for $19.95. It is a simple check book program, but does its job well. I find its reporting ability is plenty for my small business. Does not print checks, but they are thinking about it. Very responsive support, and imports/exports to/from the major formats. I haven't been using it long, but long enough to recommend it if your needs are for just a check book program, with ample ability to issue reports. http://www.splasm.com/

This was a great (and overdue) article. I was hoping that there would be a chart or table at the end that showed the criteria for consideration aligned with the many different programs mentioned in the article and follow up comments. That way one could cut to the chase on which of the software choices should be given further consideration. How about an update to the article to consolidate the feedback and lay it out in a much simpler format than the wordy text.

I'm not certain a table could do the topic justice (and remember, most people read TidBITS in plain text email anyway, so we shy away from complex tables).

However, the goal is to get the developers of these apps to respond to the questions in an interview-style format. It won't be a simple comparison, but this isn't a simple topic.

CheckbookPro ($19.95) http://www.splasm.com/checkbookpro/index.html

seems worth some attention.

A few more questions:

1) Are you using Quicken for small-business accounting? I'm a free-lance writer and it's been working for me since the early 90s. One big issue is tracking receivables.

2) Do you use your old financial records as a database, e.g., to recall the name of the contractor who painted your house 7 years ago? THat means you need good report generation.

3) Do you trust the Cloud for secure storage of financial data? I don't.

4) What happens if the new software fails or you need a way out? Can it export usable data?

I run my life with Quicken. I use it as a fancy checkbook for all of my accounts and know the balances of all to the penny at all times, including net worth. This matters. Lion matters not at all.

Is there some compelling reason why when I am completely happy with 10.5.8 (whatever that is called) I should ever upgrade to Lion?

I concur completely.

As an aside, I just tried Fortora Fresh with a Quicken 2007 qif export and it came up with a negative networth. It also has a spinning wristwatch instead of beachball which makes me think it's using Rosetta and not Lion compatible anyway.

There's also the delightful MoneyGuru, which is released on a "fair ware" basis. http://hardcoded.net/moneyguru/

I call it delightful, because, compared to other apps, it is always a delight for me to use. It has no bells and whistles (fancy reporting, or investment tracking or bill paying), but for entering massive amounts of transactions, or better, editing a batch of imported transactions, it's unbeatable. I like GnuCash and paid for MoneyDance, but I just love MoneyGuru.

A thought... When investing, the wise advise diversifying your investments, yet it seems everybody puts all their eggs in one financial app basket. Why? IMO, that's disaster waiting to happen. Such happened to me in 2008, when my Quicken file corrupted after a crash. From that point one, I have used my banks' web sites for bill paying, and other sites for investment, and MoneyGuru for transactions. A one-stop solution for banking seems a recipe for disaster to me...

I use PocketMoney Desktop from Catamount. I came to it via the iOS app which I started using in 2008 as a replacement for Pocket Quicken (Intuit refused to allow Landware to make an iOS version). In Setember 2010, Catamount released a desktop version, that while not as full featured as older versions of Quicken, did allow me to finally abandon Quicken in January 2011.

Regarding complex financial tracking. Another question to ask is: "Will the program allow direct download from your financial institution? This is not only a financial program issue but one that your institution must answer because financial institutions do not allow download to all programs.

I actually found Mint to be quite handy, although it seems like every third day i have to relog in and enter my details.

The only alternative application that I tried to love has been iBank 4. The export/import appeared to go okay, EXCEPT for investments. That was a nightmare and, the most frustrating part, was that iBank would ONLY allow me to delete the offending equities rather than simply editing (correcting) them. The other Quicken alternatives did not appear to have it's capabilities AND the ability to import data and history.

For the time being, I have relegated an old Mac Mini (PowerPC vintage) to be my "Quicken machine". It is located in another room of the house and connected to my wired network. I use Screen Sharing from my primary Mac. It is a little bit less responsive than I'm used to but certainly very workable … and I don't have to re-boot into another partition. I also don't have to give Intuit any of my money for a Windows version … they won't get any of my "Quicken" money until they get their head out and PROPERLY upgrade the full Quicken application for the Mac.

And for the record, it is not Apple's fault that Intuit doesn't like Macs!

I have years of Quicken data. Tried SEE finance for 3 months in tandem with Q07 & did not like the feature set. Tried Quicken Essentials & like the feature set except for the REPORT function.

Q07 allows reports of year to date, current month, quarter, year; last month, quarter, year; last year to date & all transactions. One can also select payee, category, class, menu & account parameters.

If QES had the feature set of Q07 reporting I would be a happy camper.

For those with basic needs... My finances are simple enough that trying to find a good program for Mac was too much of a headache. I just use Mint.com. No hassle to get all my bank info in one place. I see exactly how much money I have. I see a comparison of what I earned and what I spent. I can do a monthly budget. Frankly, I'm not using it to its full potential. I export to Excel and sort and do a bit of organizing in tabs for my taxes. How does Mint.com compare to desktop apps and online programs?

I decided to try a go with the evil empire so I could stay with Quicken (15 years of data to access). I bought Windows and Parallels and Quicken for Windows. OMG... three weeks later I am still fixing things. Some accounts decided 2000 didn't exist. Some accounts changed all 2000-2010 transactions to 1900-1910. I had to fix thousands of records. In investments, no MISC transactions were transferred. Hopefully at the end of the fixes I'll be back in operation (after I deal with all the anti-spam software needed to run windows.

Q/Win is totally incapable of importing Q/Mac QIF exports -- or any other QIF files. Intuit cannot eat its own dog food.

Also, Q/Win is a very different program from Q/Mac, not the same program on a different platform. I liked Q/Mac, tried Q/Win and was very disappointed in the UI -- but never tried to adjust to it because it could not import from Q/Mac. (I ended up using Moneydance.)

Additional questions...

Do you need to track Business income and expense for either yourself or your spouse?

Is the new software similar to what you know with regards to interface design? ie. is command S still save, etc, etc?

Will the software handle micropenny amounts? Round them properly? You need this for proper investment tracking these days.

I still use Managing Your Money 7.2 in Classic for my personal finances, I know, I know..... but, point being, you don't have to upgrade, what I lack in new features I gain in not having to constantly relearn an new interface every few years, and security! Lion won't read my files? Great!

I'd love it if some of the online financial tools were considered alongside the more traditional Mac apps. Specifically, I'm thinking of tools like Mint.com and Xero Personal.

http://mint.com/

https://www.xero.com/personal/

I got QE for 50% off when I told a phone rep, at Intuit, of my displeasure at having to downgrade from a full Quicken program. It's a little clumsy but does what I want it to do. I use it for business as well as personal.

I am currently using Quicken 2006 on a G5 Power Mac via Screen Sharing from my iMac. I also need the Power Mac for using my HP Apple Talk Laser Printer (connected via Asante Adapter and Ethernet). The power mac is using the Leopard OS. I have Lion OS on the iMac.

I use Quicken for tracking income and expenses, but not for investments. I use the budget feature for estimating cash flow. I often download credit card information from my banks, but find downloading checking account data useless since I want to work with the check register and not just the cleared data. Categories and Accounts are important to me. I use the reporting features of actuals versus budget and actuals listed in each category. I find the results especially useful for income tax planning and reporting. I do my taxes using Turbotax. A while back I using Taxcut until Mac support was temporarily dropped. I never returned to Taxcut.

In the long term, I would like to do all this on the iMac with iBank or Excel or?

It seems that the main reason for having trouble with this transition is that the user is a long term user of Quicken with usage in the ten to twenty year range and has investments to track. Those people have stuck with Quicken 2007 or one of it's earlier flavors. Intuit is making a very bad business decision by abandoning these users because people in that category are able to buy the products they want to use. They not only make these decisions for themselves but they most likely make purchasing decisions for their business and employers. Whatever decision they make most likely it will not be for an Intuit product because they have to make this choice because they are left with an orphaned product. I think Intuit has lost thousand of dollars in sales with this decision.

Personally, I went with SEE Finance. The only product which I found was able to import 19 years of data without me having to spend days or more correcting errors.

First of all a disclaimer:I have not explored all of the candidates, but I have explored alot of them and find them all wanting i some degree or other. I also have not read all of the comments, but intend to do so and maybe I will find a solution.

What I need is a program that will send checks as in Billpay as opposed to the extra method of sending checks from banks and then having to download the transactions.

In Quicken, I have all my investment accounts in one window and all the accounts and investments are downloaded in one click. The other programs you have to update each account separately. also the other programs that I have looked at will not transfer old transactions. They have to be recorded anew. That is a lot of work in my case for mutual fund dividends, etc.

Downloading transactions from credit cards is much harder or nonexistant.

QuickBooks-too expensive and overkill. mostly for business

MoneyWorks-same

YNAB-only for budget

Quicken Essentials-needs a lot of work

First, this topic has already been beat to death at macintouch.com. There you can read about dozens of alternatives, people's direct experiences with them, and the nuances of every feature that is present or impaired.

For my part, I intend to keep Snow Leopard running under VirtualBox in Lion, until both Quicken and Eudora have viable replacements. This configuration has been tested, works, and is free. Apple's license may or may not allow doing so (the text is ambiguous) but to hell with them anyway. It does not harm anyone, solves a problem they created, and the Corporation can't (yet) enter our homes and businesses to check.

Another option is to run Quicken for Windows using the Wine emulator. This also has been tested, and does not require licensing Windows.

Hope this helps someone else get through the transition.

P.S. Crossover and PlayOnMac are user-friendly packagers for Wine. Here's a page that lists them and other packagers:

http://wiki.winehq.org/ThirdPartyApplications

I spent some time researching Virtual Box. The docs say that only OS X Server is supported on a virtual machine as a guest. This restriction exists both for Lion and for Snow Leopard. From the doc: "Also, only the server versions of Mac OS X are designed to be used in a virtual environment; as a result, VirtualBox does not support client versions of Mac OS X as a guest." Have you found that the non-server versions of OS X work on Virtual Box?

You say that to reconcile your account you need a package that will "download monthly statements and import them." This is not true. It is not necessary to import a statement in order to reconcile.

I chose to "upgrade" from Quicken 2007 to Quicken Essentials. The import worked, but a strange problem arose. The most essential menu item, "write a check" was grayed out. I could sort of hack a check using New Transaction, but that did not allow putting a mailing address on the check. I connected by CHAT to Intuit Help and got treated as an incompetent idiot when I kept responding to "click on Write A Check" by saying "I can't." Finally, a supervisor was called and he suggested that I Create New Account. You should click on the "not on the list" button when it asks you what bank. The new account had an active "write a check' and when I switched back, it was active in the real account. That defect has occurred once again and the New Account creation fixed it again.

Mint is owned by Intuit. It works great, and integrates securely (one-way) with all of my bank accounts. Best of all, it's online and it sends me updates as to how I'm doing against budget. Love it!

This article posts very good questions (what do you need in a financial app) UNFORTUNATELY, I was VERY disappointed that it left us to hunt down the answers as to which of these Programs contain these features.

It would be a great service if there'd been a chart mapping features of each of these programs.

As I've replied to another commenter, the number of variables is way too high, and the specifics of how each individual would want particular features to work too detailed. We're compiling the developer responses to the questions now, so that will provide more information soon.

Yes, please follow up with developer comments or any practical synthesis of this material. It will help narrow down the exploration of alternatives to Intuit's lack of responsibility to the people who have supported them through all of their many for decades of existence.

Very nice article. I've been hoping somebody would do something like this for sometime. I look forward to developer responses.

Quicken came with my Mac clone, how years of records ago ago is that? I can see from the extensive comments that the options are not great. I rarely try software from newer vendors now because I don't want to get stuck. When a major vendor does this, especially now that Apple is no longer a niche player, it is more than depressing. Eventually we will all have to upgrade our OS because some of some other app that we need to run. Quicken Essentials does not do what I need. I doubt if our pressure will change their minds. They've had plenty of time to upgrade Quicken. I hope I am wrong.

I'm a bit late to the comments here, but I don't see anybody with a key question to a very small minority of users:

MULTI-CURRENCY support. Of course, Quicken never handled this so maybe it's out of scope for a direct replacement...

In Quicken, I use split transactions heavily, also categories and the subdivision of categories, such as Leisure: Music|Sports|Periodicals and so forth. Also several classifications under Insurance. I make heavy use of this feature. Customized reports also. These are especially needed at tax time. I do not import Quicken data to Turbo Tax. I do not use online bill pay but instead use the the bill pay feature of my bank's web site. I use the Net Worth feature that shows net worth over time. I use the budget feature, including automatic generation of a budget based on past transactions. I do not have nor will I purchase a copy of any Windows OS just to run Quicken. I actually would rather buy an extra Mac rather than run anything important on Windows. Intuit, do you realize how many people would spend like that just in order to keep Quicken?

Quicken Premier 2011 running on Windows 7 in Parallels - all the goodies Intuit leaves out of their Mac version.

Does it import Quicken 2007 data files correctly?

I'm still struggling with finding a quicken 2007 replacement. I need to manually reconcile statements. See Finance was confusing when it came to reconciling. I spent far to many hours and still wasn't successful. Also I need reports for taxes.

I tried Moneywell and MoneyDance today. Moneywell was confusing as I didn't get the purpose of all the "buckets". I tried the free version of MoneyDance and imported my files. They wouldn't all come in so I bought it and imported. It seems easy to use. The reconcile is a little odd as it doesn't have a popup box for dates, just start and end balance. I did get it to work and balanced my accounts. I never did get my accounts balanced on See Finance or Moneywell. I wish MoneyDance had good tax related reports.

I spent time today with SEE Finance, Moneydance, and Fortora Fresh Finance. As I grappled with exporting from Quicken, I realized that I don't want all my data. I have a lot of closed accounts and categories that I don't use any more.

I tried exporting Dec. 2010 through the present. My old accounts came through into each of program, but they were deletable, or at least hidable. However, many starting balances came in wrong, and I couldn't figure out how to reset them.

I am now thinking that I'll start fresh in a new program, with new accounts and a modern rethink on my categories/tags.

I liked Moneydance the best, as I figured out how to add transactions and reconcile without trouble or reading directions and it makes a nifty cash register sound as you "record" a new transaction. Since I am going to start fresh, though, I may quickly look at a few other choices.

I will do a full QIF export before leaving Quicken, in case I need the data later, plus run a few reports to PDF.

Today I looked at iFinance and Liquid Ledger. Liquid Ledger seemed a little too basic.

I like the way you can customize colors and columns in iFinance, and iFinance has particularly good documentation, both within the interface and in the manual.

I figured out, however, how to reset my starting balance to the correct number in Moneydance (select the account in the sidebar, choose Account > Edit Account), so now I can import recent transactions from Quicken, and that's what I plan to do. For my simple needs (enter transaction, reconcile, occasional search for something) iFinance seemed close to Moneydance, but the features I'll use the most are more elegant in Moneydance. And I adore that cash register sound that Moneydance makes upon completing entering a transaction.

I'm sure that I could look at still-more programs, but as a working Mom, there's a limit to how much time I can spend on this (I've GOT to move my main Mac to Lion ASAP), so it's Moneydance for me, at least for now.

It is a simple, and silly, feature, but I, too, find the cash register sound in Moneydance oddly pleasing.

You may need those old closed accounts if they have transactions that relate to accounts you still use. That's likely why your balances are out of whack.

The most recent versions of MD have the ability to mark accounts as inactive, which hides them in most contexts but keeps the history available. Some cleanup is still needed (inactive accounts still show in some places where that's not desirable), but this has already made it a lot easier to keep all that history just in case. And there's certainly no effect on speed.

I've narrowed it down to iBank (no BillPay, ugh!) and Quicken Windows running under Crossover. For now I plan to keep those two and Quicken 2006 in sync (staying w/SL) until I can make a final decision...or Intuit comes out w/Quicken 2012 ;)

I converted from Quicken to Moneywell a couple of years ago and have been fairly happy with it. The interface works for me and I can do the things that are important to me (downloading transactions, reconciling, tax-related reports).

I've had to contact the company a few times and they have been very responsive and helpful, which is also a BIG plus for me.

Does any package other than Quickbooks handle complex investment tracking especially investment transaction buys and sells ?

Moneydance can track lots. I doubt anyone would say it handles "complex investments", but if lot tracking is what you need, MD does it. I can't vouch for how easy that is to use, as I don't use it. (Most of my investments are in IRAs, where lots don't matter.)

I guess all I'm really looking for is the ability to track investment transactions (e.g. buys, sells, etc) and lots.

Ok, I've given up on iBank. I'm sticking with Quicken Windows running under Crossover. Really not a bad alternative to Quicken Mac. If you're used to Quicken MAc, only Quicken will do...and Quicken windows is the closest thing. Crossover is fairly cheap and works well.

Anyone use MYOB (Mind Your Own Business) by Account edge?

Yes I do, for years in fact and it's great. Originally an American product, the Australianised version was so much better they took over and now it is an Australian product. I guess there is a version for the American Tax System?

What does this signal concerning Turbo Tax?

Great discussion. I've been using Quicken for about 15 years, and my file is understandably large. So far, I've tried out iBank and Quicken for Windows under Parallels, but I've run into lots of problems in getting my file converted. I'm still running Snow Leopard until I can resolve the conversion problems. The support staff at Intuit was no help, and the IBG folks say they're overwhelmed at this time. Any ideas to make conversion easier?

I've been using Budget from Snowmint for almost a decade now.

I've been using quicken since about 1992. I have liked the way it integrates with TurboTax. Do any of these other applications play nice with a tax program?

While this article is wonderful, a note really needs to be added to the top to refer readers to recent news:

Intuit Plans Lion-Compatible Quicken 2007 Update

http://tidbits.com/article/12689

Look in the right column of this page for a box labeled "Related Articles." It's already there, along with other related articles.