Apple Sees Apparent Return to Growth with Q1 2017’s Record Results

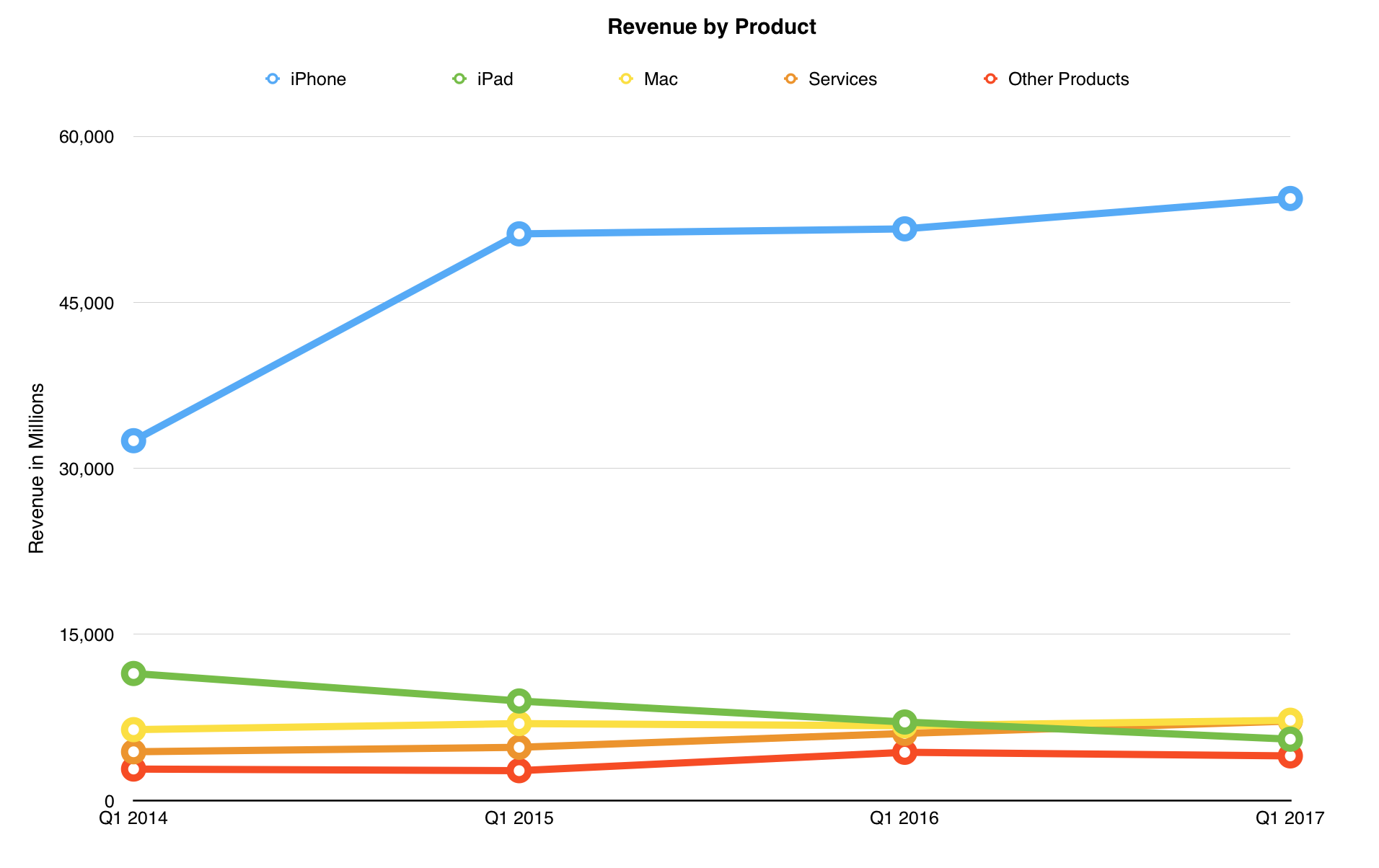

Reporting on its Q1 2017 financial results for the quarter ending on 31 December 2016, Apple has announced net profits of $17.9 billion ($3.39 per diluted share) on record revenues of $78.4 billion, beating the company’s guidance for the quarter. These results mark a return to growth for Apple after it fell short last quarter (see “Despite $9 Billion Profit, Apple Revenues Slump Again in Q4 2016,” 25 October 2016). The company took in revenues that were up 3 percent compared to the year-ago quarter (see “Apple’s Q1 2016 Sets Records,

but Just Barely,” 26 January 2016).

However, as Jeff Johnson of Lap Cat Software points out, Apple omitted the fact that Q1 2017 was one week longer than Q1 2016, due to the necessity of occasional “leap quarters.” Johnson estimates, based on weekly averages, that Apple would have had another down quarter if not for the extra week. Daring Fireball’s John Gruber thinks Johnson dings Apple a bit much, but agrees that some correction is needed. We’re curious to see if Apple maintains growth in Q2 2017, or if Q1 was an anomaly.

Apple shareholders will receive a dividend of $0.57 per share on 16 February 2017 as part of Apple’s $250 billion capital return program, which also includes $140 billion in stock buybacks.

The iPhone delivered happy news for Apple, as unit sales and revenues increased by 5 percent year over year, with 78.3 million units sold. Sales were spurred by the availability of the new iPhone 7 models and the holiday shopping season. In Q4 2016, Apple had seen a 5 percent year-over-year drop in unit sales (the iPhone 7 models had been available for pre-order for only two weeks), so this increase should help alleviate investor fears. Of special note, and one which Cook referred to several times during the call, was the

“exceptional demand” for the iPhone 7 Plus models, even though supplies were constrained throughout the quarter and came into balance only after the quarter ended. Customer satisfaction ratings for all iPhone models reached 97 percent, and Apple achieved an extraordinary customer satisfaction rating of 99 percent for the iPhone 7 models.

Sadly for Apple, after appearing to stabilize in Q4 2016, the iPad’s decline in unit sales and revenue continued this quarter. iPad revenues fell by a whopping 22 percent year over year, and unit sales were down by 19 percent. That’s especially painful given the resources Apple has poured into the iPad, especially with the iPad Pro models. Although it has been accorded prominent placement at the Apple Store, that hasn’t seemed to boost sales.

Wall Street had expected a sales and revenue upturn for the iPad, so the continued decline may trouble investors. Steve Milunovich of UBS asked Cook to comment about that, and Cook responded with a number of excuses about channel inventory and a lack of new products. That said, it appears that a supplier shortage leading to constrained shipments was a real factor in the iPad’s disappointing quarterly results.

Apple CFO Luca Maestri added that the iPad does have an 85 percent share of tablets over $200, and purchase intentions for the iPad are four times higher than for competitors, with the iPad Pro in the lead. However, there isn’t much movement on the tablet front as a whole, so it might be a category in decline for all manufacturers.

Mac sales, however, were yet another bright spot. In a market segment that has been declining for years among most technology manufacturers, Apple nonetheless saw a revenue increase of 7 percent year-over-year for its desktop and laptop lines. Despite the complaints about the new MacBook Pro models, they appear to be a hit, perhaps due to pent-up demand. These results raise the question of how the Mac could have done had Apple updated other models as well. Cook said that the Mac generated its highest revenue growth ever, and it saw double-digit growth in the international and education markets.

Apple’s Services segment, which includes AppleCare, the App Store, Apple Music, iCloud, and third-party subscription services, tallied an impressive revenue increase of 18 percent year over year. The Services category is becoming increasingly important each quarter, and we don’t expect that to change: the Services business is driven by the installed base, which grew by double-digits worldwide. Tim Cook reported that the App Store saw $3 billion in sales in December 2016 alone and that AppleCare and iCloud storage subscriptions are at all-time records. Over 150 million customers subscribe either to Apple services or to third-party subscriptions provided through the App Store. Apple expects Services alone to be the size of a Fortune

500 company this year. Cook also took pains to point out that App Store revenues were more than double the revenue of Google Play, and that’s despite Android’s significantly higher market share.

Thanks in part to expansion into four new countries, Apple Pay use continues to grow, with a 500 percent increase in transaction volume and three times as many users compared to last year. Apple also announced that Comcast would soon allow its customers to pay their bills with Apple Pay.

Apple predicted that Services revenue would double over the next four years, considering App Store growth (particularly in China), plans to grow the developer community in international markets, the success of Apple Music, increased demand for iCloud storage, the growth of AppleCare, and an ever-larger installed base of Apple devices.

In contrast to its growing Services revenues, however, Apple reported an 8 percent year-over-year decline in Other Products revenues, which include products like the Apple Watch, Apple TV, AirPods, iPods, Beats headphones and speakers, and various accessories. The reason for the decline may be a collapse in Apple TV sales — Maestri told Tim Bradshaw of the Financial Times that year-over-year sales for the set-top device were down. In contrast, Cook stated that the Apple Watch set an all-time revenue record and that Apple could not produce enough of them to meet demand in the quarter. Cook also spoke glowingly about the AirPods, as well as the continued success of Beats.

We’d like to see Apple break out more details about the Other Products category so we can better understand how each product family is performing.

On the CarPlay front, Apple reports that over a million people are now using it, with every major automaker committed to supporting the platform. Although that may seem high, U.S. car sales topped 7 million in 2016 and worldwide the number exceeded 76 million last year, so the claim of 1 million CarPlay users isn’t as impressive as you might think.

Cook mentioned HomeKit, but only in the context of saying that it’s unmatched in home automation security, and he went on a long digression about the many ways he uses HomeKit in his own home. He also mentioned new accessories in the pipeline, such as a water leak sensor, something we’ve discussed internally as a no-brainer addition to any home automation setup.

Other optimistic notes include enterprise growth, which increased 70 percent over the previous quarter, and international sales increases “despite a very challenging environment” caused by the stronger U.S. dollar.

Apple closed out the quarter with $241 billion in cash, with 92 percent of that money held outside of the U.S. Asked whether more of that cash might return to the U.S., Cook mentioned the possibility of “some type of tax reform this year.” In addition, he alluded to Apple’s growing efforts to create original content for its music and television businesses.

Overall, Apple seems to be starting 2017 on solid footing, with successes for the iPhone, Mac, Apple Watch, AirPods, and the company’s various services. However, the iPad continues to be a sore point, and the Apple TV results are distressing. However, the Apple TV is in no danger, since Cook mentioned its importance to Apple’s overall content strategy. And no matter what, Apple seems committed to pushing the iPad as the next step in technology. Since Apple is committed to these products, it needs to do more to make them the best they can be.

I don't feel like Apple is committed to the iPad beyond telling us how great it is. iOS 10 had no iPad-improving features. The app chooser for split-screen mode is still the cobbled-together proof of concept that came with iOS 9. They should be embarrassed. Instead of developing useful features, they were more interested in adding stickers to Messages. I've been a big Apple supporter since I got my Mac Plus in 1986 but their current priorities are baffling to me. So much so that I sold all my shares in AAPL last week.

I agree that the iPad software could be better. However, the "cobbled-together" split screen mode does work well for me, as does picture-in-picture. Also, apps like Scrivener for iOS and hardware like the Smart Keyboard have turned it into a very powerful lightweight portable writing studio that I use almost as much as I do my desktop for writing long-form fiction. In addition, the Procreate app makes it the best drawing tool I've ever had.

For really heavy lifting (writing Take Control books and TidBITS articles, or working on my finances, for example), I use my desktop Mac, and gladly, but I have to say I prefer my iPad for casual Web browsing, responding quickly to emails, editing my novel-in-progress, and drawing—as well as watching old movies late at night. If the iPad doesn't work for you, fine, but for me it has been a welcome addition to my workflow and playflow. I'd be almost as unhappy to see the iPad discontinued by Apple as I would be the Mac.

Don't get me wrong, I love my iPad. I'm looking forward to the next one which I'll most likely buy to replace my iPad Air 2 which I'll give to my wife to replace her iPad 3 which is still working fine for her.

For me, the iPad is great for mobile web access and reading books. My work doesn't involve writing or drawing (mine is programming and bookkeeping) so I don't get to use it for work. I also don't find myself watching video aside from short YouTube stuff. My wife and I watch video together on the big TV with surround sound.

You may have misinterpreted my split-screen mode comment. Split-screen itself works great, but choosing an app by scrolling through a single-column list of all apps is cumbersome at best. That's the aspect I find cobbled together. That should not have been allowed to exist in iOS 10.

As far as CarPlay, I would have loved to have gotten it with my new Prius, but Toyota doesn't seem to be on board. For a long time their logo was conspicuously absent from Apple's CarPlay page. I see that it's there now but when you look at the list of available and upcoming models, Toyota is still a no-show.

I also feel that doing a bit more on the OS front could generate some more excitement and more sales. So far, iPad improvement has been mainly on the hardware side (and extremely impressive); it may be time to redress the balance.

Without new iPad hardware in all three sizes, AND new iMacs/Mac Minis/MacPros Apple is risking massive loss of their customer base.

I'd like to replace my iPad Mini 3 in particular but if Apple bails on the iPad lines then I'll have to consider a Kindle Fire.

Also Apple discontinuing their monitors and AirPort is a negative sign. Keyboards, trackpads, and mice will probably be next. iPod is already pretty much gone, too.

"Without new iPad hardware in all three sizes, AND new iMacs/Mac Minis/MacPros Apple is risking massive loss of their customer base."

Thank you. My original iPad Mini (w/ ATT chip) has been a big part of my life. Now that it's been orphaned I'm desperate for an upgrade and lately heard that may not happen. Reading magazines and books, watching movies and YouTube, navigating in the car - the Mini is (was) the perfect size for me. It goes in my Hall of Fame, next to my SE/30 and iPod Touch.

The reason Apple doesn't break out Other sales, like the Apple Watch, seems obvious to me: If they were actually proud of the numbers they wouldn't hesitate to show them.

Clearly iPod sales have been cannibalized by the iPhone and, to a lesser extent, by the iPad. People who have an iPhone are unlikely to carry around an iPod as well—accept, perhaps, for use in the gym. And, while the iPod touch has gained in capacity—and price—and other specs are impressive as well, the screen size and the CPU haven't followed the iPhone. I imagine Apple has it's reasons for this, but it still makes the iPod touch seem stunted. The 128GB iPod Touch costs $399, so a larger screen version may be prohibitive. If you're going to spend that kind of money you might as well get an iPad mini 4, which is only $499 with similar features and a much larger screen.

Interestingly, except for screen size, the iPhone 7 models have better specs than the iPad Pros, including a newer version of the CPU. Which indicates how iPad development has lagged. Indeed, the iPhone 7 Plus is just a notch below the size of the smallest iPad and surpasses the largest iPad Pro in most other respects. Which is to say that a large iPhone is closer to a real computer than a large iPad. This seems bassackwards to me. Given this tepid development Apple has no one else to blame for diminished iPad sales. I mean, if it can't even keep up with the iPhone, what else can they, or we, expect?

As for the value of Apple Services, have you tried to use iCloud lately for anything other than syncing your calendar? Their cloud services lag far behind the competition at Microsoft, Google and Amazon. Even Dropbox is easier to use. If you want to compare the value of Apple services, compare them to the competition, not to some vague Fortune 500 benchmark. Someone needs to poke a whole in Tim Cook's smoke and mirrors and take a look at what's really going on.

Steve Jobs used to hide Apple's development plans because he savored the surprise those developments engenderd when they came to fruition. Tim Cook is hiding Apple's plans because there's so little going on that people would only be disappointed. The proof is in the pudding. Apple's pudding is stale, approaching rancid.

You asked, "As for the value of Apple Services, have you tried to use iCloud lately for anything other than syncing your calendar?"

Yes, I have. I use it for reminders, for notes, for books, for photos, for music, and for file and data exchange with apps like 1Password, PDFpen, Pixelmator, Pages, and Numbers. Very rarely do I have problems with it. It isn't perfect, but it works as reliably as other cloud services I have used.

What everyone is forgetting is that the sales of Macs and iPads will never keep up with iPhone sales. The service providers (Verizon, Sprint, AT&T etc.) all have different deals to make it relatively easy to upgrade to the next iPhone. So many users will upgrade every 2 years or so. With Macs and iPads it is more expensive so many of us will keep these devices (which work perfectly well for much longer than 2 years) much longer. I can bet most people upgrade their Macs and iPads about every 4 to 6 years. So you really can't compare the sales of these to iPhones.

You should know that Apple releases new iDevices in autumn well in time for the Christmas sales, and Q4 is traditionally their best quarter. Samsung on the other hand releases new devices in spring, hitting the summer sales instead. Year-over-year Samsung grew faster than Apple in 2016, despite the Note 7 recalls. The iPhone is not actually on a comeback curve, instead it's losing market share. (Whether this is a problem or not for Apple is up for debate.)

The "leap week" theory is ludicrous, you need to correct the article. By definition Q1 starts on Jan 1 and ends on Mar 31 every single year and it has either 90 or 91 days (the latter is exactly 13 weeks). Probably the weather has more influence on sales than one leap day.

Further, *all* quarters have approximately 13 weeks! If there was exactly 12 weeks in a quarter, there would be 48 weeks in a year. Funnily enough, there's 52. You do the math.

Crap, I just realized that the reason nobody has cried out about the weird calendaring is that it's actually true! If you use inches, feet and degrees Fahrenheit, rather than SI units, then why not define your own time units? And so Apple's fiscal 2017 is five days longer than the calendar year, making it 53 weeks.

Also Q1 doesn't start on Jan 1. Corporations can decide the date on which their fiscal year begins. That's why it's a fiscal year and not a calendar year. Apple's Q1 ends on December 31.