Apple Wraps up a Record-Breaking Year in Q4 2015

Reporting on Apple’s Q4 2015 financial results, CEO Tim Cook jubilantly announced “a very strong finish to a record-breaking year,” citing net profits of $11.1 billion ($1.96 per diluted share) on revenues of $51.5 billion. The company’s revenues are up more than 10 percent compared to the year-ago quarter (see “Apple Posts Record Profits for Q4 2014,” 20 October 2014). Apple also posted higher gross margins (39.9 percent compared to 38 percent a year ago, largely as the result of lower component costs). For the full 2015 fiscal year, Apple reported revenues of $234 billion,

a 28 percent increase over the previous year’s take.

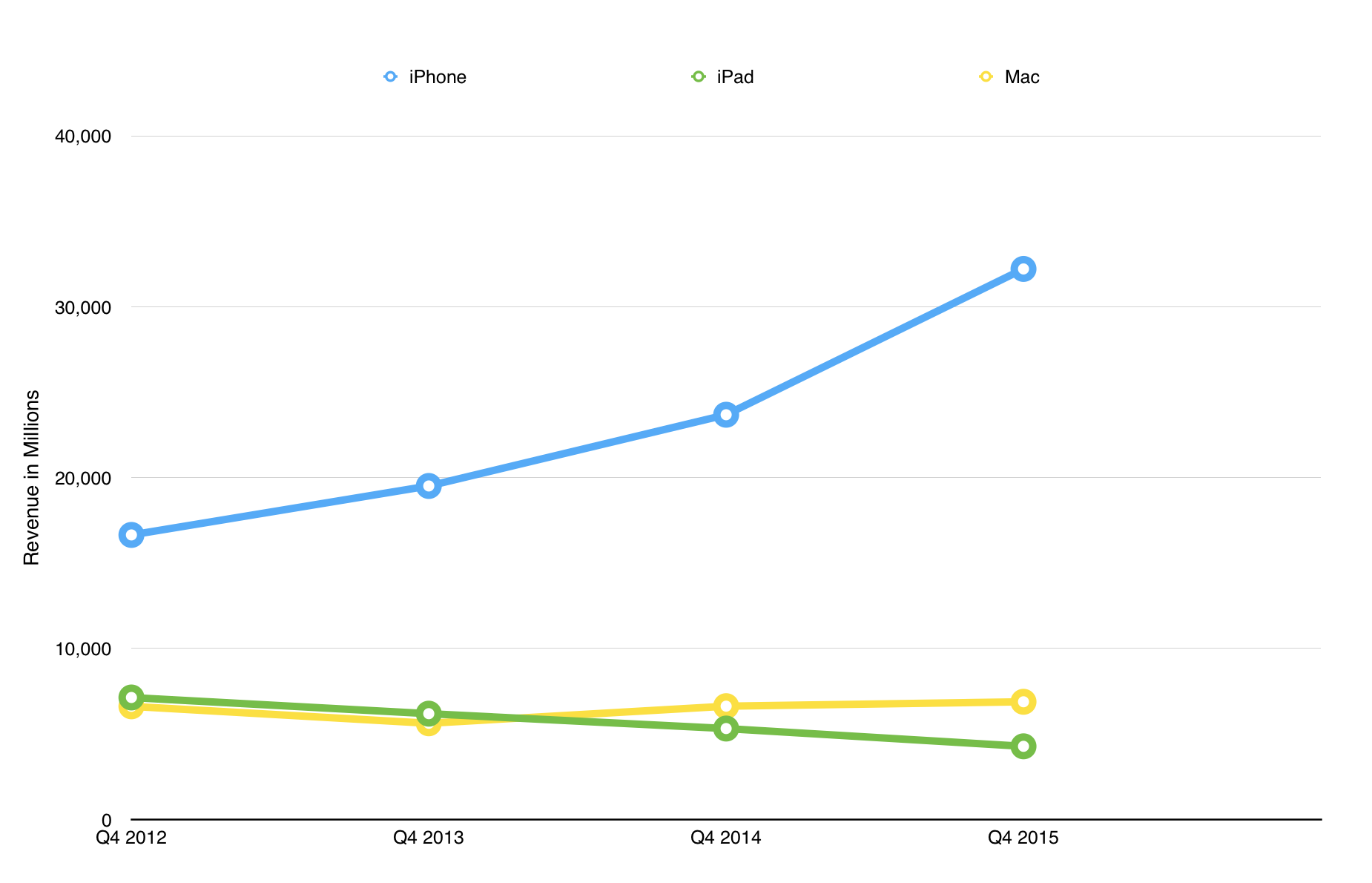

It now seems clear that the end of mobile phone subsidies hasn’t hurt iPhone sales at all (see “Comparing U.S. iPhone Plan Costs in a Contract-Free World,” 11 September 2015). Apple sold 48 million iPhones in Q4, with a year-over-year revenue increase of 36 percent. The newly instituted Apple iPhone Upgrade program has so far had “negligible impact” on revenues, according to Apple CFO Luca Maestri, but Tim Cook said that both Apple’s program and those offered by carriers do have a positive effect in the market because such programs effectively create more price points for the iPhone product line, which in turn helps boost sales.

Apparently, the iPhone 6s is doing some damage to Samsung, Google, and other Android smartphone makers, as Cook reported that 30 percent of iPhone buyers in Q4 were converts from Android, a new record.

On the other hand, and surprising no one, the iPad continued its slow decline, with a year-over-year drop of 20 percent in both units sold and revenue. We’ll have to wait until next quarter to see if the upcoming iPad Pro will turn the tide (see “iPad Pro with Smart Keyboard and Apple Pencil Announced,” 9 September 2015). iPad sales could also be boosted by enterprise sales: Apple cited its ongoing partnership with IBM and its new partnership with Cisco as possible drivers for future iPad sales growth. Despite the decline in sales, the iPad product line still commands 73 percent of the market for tablets costing more than $200.

Apple’s revenue across all world segments was up, with a breathtaking rise in Greater China from $6.29 billion to $12.51 billion year over year. iPhones, in particular, are popular in that region, with sales increasing by 120 percent.

The Mac is hanging in there, chalking up a modest 3 percent increase in revenue year-over-year. On the other hand, in light of the 11 percent overall contraction in the PC market, the Mac is doing great, and it brought in more revenue than the iPad once again.

The Services category is seeing the benefits from Apple Pay, growing 10 percent over the past year and bringing in over $5 billion for the quarter. Apple Music likely wasn’t a factor here, since the first wave of three-month Apple Music trials didn’t end until 30 September 2015, 4 days after the end of Q4. However, Apple claims that the service has 6.5 million paying subscribers, which isn’t bad given its many problems (Apple Music competitor Spotify boasts

over 20 million subscribers). Subscribers are certain to increase shortly, as Apple Music, along with iBooks and iTunes Movies, is being rolled out in China this quarter and is coming to the new Apple TV 4 this week.

Apple announced during the call that American Express users around the world will soon get access to Apple Pay, first in Australia and Canada, and followed by Hong Kong, Singapore, and Spain in 2016. Cook also said that Starbucks will soon support Apple Pay.

Apple continues to be cagey about Apple Watch sales, though year-over-year revenues in the Other Products category, which includes Apple TV, Apple Watch, Beats, iPod, and accessories, were up a whopping 61 percent. This figure does not include sales of the fourth-generation Apple TV model, as Q4 ended a month before pre-orders for the new set-top box began. However, Cook said that the new Apple TV had a “huge first day” of preorders. Even though no numbers were given regarding the Apple Watch, Cook did say that sales of the device were up and had exceeded expectations. While Other Products remains Apple’s smallest revenue category, it still brought in $3 billion in Q4, which would be a pretty good business on its own.

For anyone worried that Apple is doomed and will keel over at any moment now, fear not. Apple has added an additional $3.5 billion to its Smaug-sized cash hoard since Q3 2015, bringing its total stockpile to $206.4 billion. At this point, Cook couldn’t run Apple into the ground if he tried — though in fact, he’s doing quite the opposite.

This is a very well-written article with much better "numbers" reporting than most other sources. Also, I love the last paragraph references!

Thanks for the kind words - Michael and Josh did a bang-up job, as always. We figure that Apple's results are interesting in a broad way, but we try to avoid getting too far into the weeds of financial reporting. :-)

For all the flack that Apple gets about "not getting services", their services business is approximately a $20 billion a year business. Not too shabby for a company that "doesn't get services."

Services, along with iPads in the enterprise, are long term projects. It will take more than a few quarters to see how successful they will be. And competition in enterprise from Microsoft's now mature Surface Pro business will be stiff going forward. Now that MS has eliminated the worst features of Windows 8, their hybrid tablet computers may begin to match Microsoft's expectations.

What I find interesting is that the iPad, which was once presumed by many to be a threat to the Mac, and to computers in general, has not turned out that way. For the second quarter in a row Mac revenues have surpassed the iPad.

iCloud was supposed to replace the Mac, at least to some extent, as excess storage for iPhones and iPads, but that is one service that has not been doing all that well. The Mac is still the most reliable location for consumer data storage. Bandwidth continues to be one of the prime issues with cloud services of any kind. Security is even more problematic. Then there's the question, for those with more than one Apple device, of where, exactly, there data actually lives. Since iCloud performs many operations behind the scenes, including downsampling your photos (and, if you're not careful, deleting them), that's not a trivial question. Nor is the complexity of the whole services business a minor concern. Apple has yet to achieve it's vaunted simplicity in that area. Until they do, iCloud will remain a hit or miss proposition.

Apple music may eventually provide at least a partial solution for younger people in particular who favor renting music to owning it. If your Apple Music subscription becomes just one more routine expense in your digital lifestyle, rolled in their with your internet, phone and data plans, all you'll need is a good playlist strategy to get the music you want, when you want it. That may not serve us old fogies, who are accustomed to owning music, but we are a declining demographic. And, of course, that's where the real money is for Apple and the cellular providers. If you use your data plan to listen to music rather than WiFi, the providers will get rich off your lack of discretion. And Apple Music subscriptions will provide Apple with a stable, ever expanding revenue stream.

Unless the economy crashes again, this seems to be a good reason for Tim Cook's optimism. At the same time, those who make their livings forecasting Apple financial results are generally too short-sighted to see what's really going on. While those banking on Apple's always pending failure are, well, bankrupt, living off clicks on their blogs from the never ending futility of anti-Apple fan boys—the very definition of a circular firing squad.