Photo by Sharon McCutcheon on Unsplash and Apple Card image by Apple

How to Get the Most from Your Apple Card Benefits

Apple Card invites are rolling out for those who signed up for the preview of Apple’s new credit card. Coverage has been intense—Macworld has a FAQ that covers all the details, and Jeff Porten wrote about its implications earlier this year for TidBITS in “Apple Card: More Than Just a Credit Card” (28 March 2019). Rather than cover such heavily trodden ground again, I wanted to explain how you can maximize your Apple Card benefits.

The Apple Card’s signature perk is daily cash rewards, which vary depending on what you buy and how you buy it. You’ll receive:

- 3% back on purchases made directly from Apple, including the Apple Store, the App Store, iCloud storage, and iTunes

- 2% back on Apple Pay purchases made from non-Apple retailers

- 1% back on all other purchases, including those made with the physical Apple Card

Use Apple Card for Your Apple Services

An easy way to get that 3% cash-back is to use your Apple Card for all of your Apple services. Apple provides a shortcut in the Apple Card settings to do just that:

- Open the Wallet app.

- Tap your Apple Card.

- Tap the ••• button in the upper-right corner.

- Scroll down and tap Make Default at Apple.

These steps make your Apple Card the default payment method for all of your transactions with Apple, including app purchases from the App Store, Apple TV subscriptions, iCloud storage, your Apple Music plan, and even AppleCare if you choose to pay per month.

You can double-check that Apple Card is your default by going to Settings > Your Name > Payment & Shipping. Your Apple Card should be listed as the first payment method.

If you have an Apple Watch, you can check to see if the Apple Card is its default payment method by opening the Watch app and tapping My Watch > Wallet & Apple Pay > Default Card.

Use Apple Pay

Of course, Apple wants to incentivize you to use Apple Pay, which is why the company gives you 2% cash-back on every purchase you make with it through Apple Card. Apple Pay is well-enough established at this point that I won’t bore you with a complete guide, but here are some quick pointers on using it:

- To make sure your Apple Card is the default Apple Pay method, go to Settings > Wallet & Apple Pay, and scroll down to Default Card. If it’s not Apple Card, tap it and choose Apple Card.

- To use Apple Pay in a store, double-press your iPhone’s Home or side button and authenticate with Touch ID or Face ID. Alternatively, activate it from your Apple Watch by double-pressing the side button. Once you’ve activated Apple Pay, hold your device near the card reader.

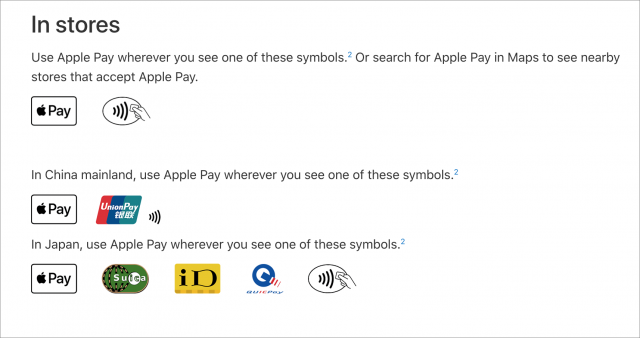

- Figuring out what stores take Apple Pay can be tricky. Apple has a list of Apple Pay partners, but your best bet is to look for one of these symbols around the register. If you’re not sure, ask the cashier.

- Remember that you can use Apple Pay in some iOS apps like Lyft and on some Web sites when viewed in Safari, like the new, improved Take Control site. You don’t have to use Safari to use your Apple Card online, but you’ll get only 1% cash-back instead of the 2% that comes with Apple Pay purchases. Look for your card number, date, and security code in Apple Card settings under Card Information (remember, tap the ••• button in the card’s listing in the Wallet app).

- If you suspect your Apple Card number has been compromised, you can request a new card number from the Card Information screen.

Use Apple Card with the iPhone Upgrade Program

If you subscribe to Apple’s iPhone Upgrade Program, you can switch your payment method to the Apple Card to get that 3% cash-back with every monthly payment. But how you change your payment method isn’t obvious, and Apple doesn’t explain it.

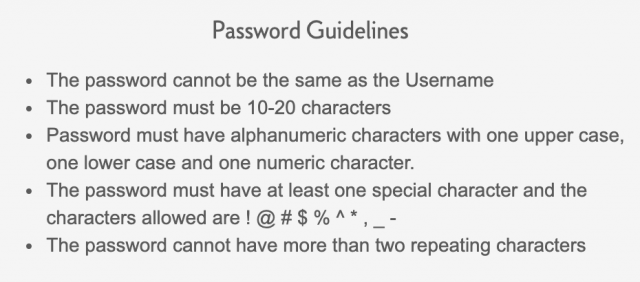

The iPhone Upgrade Program is managed by Citizens One, so if you need to do anything with it other than buying or trading in an iPhone, you’ll have to create a Citizens One account. As I discussed in “The iPhone Upgrade Program: A Year in Review” (30 November 2017), the hardest part is creating a password that conforms to all of Citizen One’s byzantine requirements. You’ll also need your loan number, which you can find in one of your monthly email receipts from Citizens One.

Once you’ve set up your account, log in and click Change Payment Account under your current balance. Click the dropdown list labeled Change My Payment Account, and choose Add a New Payment Account.

Again, you can find your Apple Card number and other information by opening Wallet, tapping your Apple Card, then the ••• button, and finally Card Information. After you click Confirm, your Apple Card should be the default payment method for your iPhone Upgrade Program subscription.

Claim Your Cash

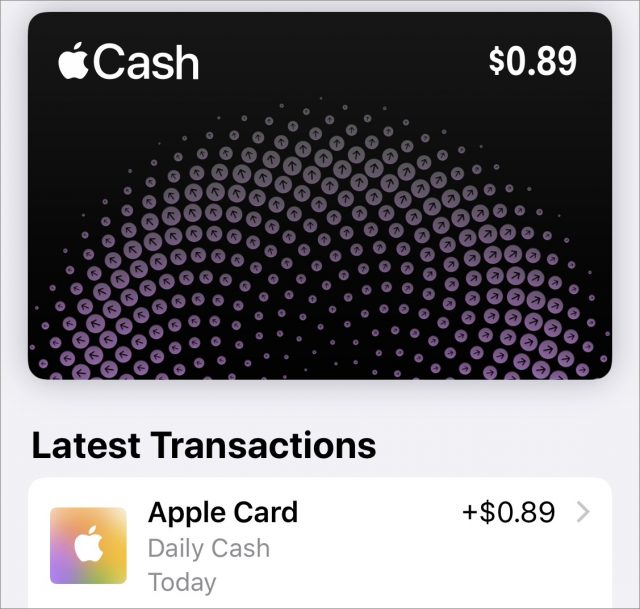

One of the unique benefits of the Apple Card is that Apple credits you with your cash-back payments every day, but it’s not immediately obvious how you access that cash. Apple pays you through its Apple Pay Cash system and puts the money on that virtual card.

If you look at your cards in Wallet, you should see Apple Pay Cash in the stack, along with its current balance if you have one. Tap that card to see your latest transactions, including your Apple Card’s Daily Cash rewards.

You can use Apple Pay Cash to send money to friends (see “How to Use Apple Pay Cash for Person-to-Person Transactions,” 7 December 2017), but if you want to spend that money anywhere else, you’ll have to withdraw it first. While viewing your Apple Pay Cash card, tap that ••• button and then Transfer to Bank. You’ll need to have a bank account tied to Apple Pay Cash if you don’t already.

Avoid Interest Charges

There are no fees associated with the Apple Card, which is great, but that doesn’t mean it’s free to use. If you carry a balance, you’ll be paying an annual percentage rate of anywhere between 12.99% and 23.99% on the balance. Your payment is due on the last day of every month, and although you’ll receive a notification to pay it, it’s all too easy to miss or be unable to complete the transaction. For instance, if you lose your iPhone, there’s currently no way to pay your bill otherwise!

Thankfully, you can set up automatic payments so you’ll never be charged interest:

- Go to Apple Card settings by opening Wallet, tapping your Apple Card, tapping the ••• button, and tapping Scheduled Payments.

- Tap Continue.

- Tap Pay My Bill.

- Tap Next.

- Keep “When Payment Is Due” selected and tap Next.

- Authorize with Touch ID, Face ID, or your Apple ID password.

You’ll also need to have a bank account set up in Apple Card settings > Bank Accounts. If you already have a bank account linked to Apple Pay Cash, you can link that to your Apple Card with just a couple of taps.

What are your thoughts or first impressions about Apple Card? Let us know in the comments, and tell us what your plans are in our quick one-question survey.

Nice article Josh. Just two questions.

Are there any fees associated with transferring from your Apple Pay Cash back to your bank account? If not, can’t it be configured so your Daily Cash goes straight to your account? (I have no idea why I’d otherwise use Apple Pay Cash)

If you set up to autopay your Apple Card balance when payment is due, can you still initiate an individual (partial) payment by hand before that date? Or is it an either-or setting?

Finally, coulnd’t find a suitable option in your poll. I’m definitely interested in getting an Apple Card (no foreign transaction fees, great for all my travel!), but I’m not signed up anywhere and I don’t plan to either. I’ll just get it when it becomes available to the regular public via simple button press in Apple Wallet.

There should be no fees for transferring funds from Apple Pay Cash to a bank account.

I am waiting for the first bill until I actually can confirm how payments will work. My initial thought is to let the rewards accumulate in my Apple Pay Cash account and then pay the bill by first using the funds there and then from my bank account. By my reading of the documentation and the wallet prompts, I think that I have set that up to happen. I will probably manually pay the first bill and then try auto-pay in subsequent months.

To me, the major problems is that it appears that the only format for exporting statement and transaction data is a pdf of the statement. If a format like qfx (easy import for personal finance programs) is not available, I will charge only a small number of items to the Apple Credit Card, as I will need to manually duplicate the data in my finance program.

I should have worded that slightly differently—just vote for the middle “I’m waiting” answer. The point is to separate out the early adopters from the eventual adopters from the never adopters.

That’s a big one, and another is that as far as I’ve been able to see, the card is only for individuals—you can’t share one with a spouse. Maybe that’s old-school, like sharing a landline, but we’ve always shared credit cards for simplicity’s sake. (And yes, I realize lots of couples don’t do that. To each their own.)

I never received an invitation, but when I opened Apple Wallet, the option to apply was there. And the process is as quick and easy as has been described; it took only a few seconds to verify my name, address, email, etc., and get approved.

The physical card should arrive in five to seven days.

Just checked. No option yet for me. Maybe you are an early invite. Enjoy!

Enjoy!

Did you click Continue? I had heard you press the + button in Wallet to see the invite, but never pressed the Continue button. I assumed the invite would be on the first screen. Today I pressed Continue and among the choices on the next screen was AppleCard.

The process was straightforward from there. The only annoying part was that my bank app wouldn’t let me select and copy my routing and account numbers, so it took me several tries to manually enter them correctly. But at least it’s now set up with auto-pay and AppleCard is my default for Apple/iTunes purchases (3% back). Pretty sweet.

Yes, I sure did. The only thing to come up after that is the option take a picture of your card or enter a new card manually.

I received an invitation the day after I was approved for the card.

Making a payment on line without using ApplePay gives a 1% return, just as if you used the physical card.

When there’s a balance on the card, the image of the card in the Wallet app changes from silver to red.

I can’t figure out how to change the default card for App/iTunes Store.

2 equivalent methods:

In IOS, Go to Settings -> [Your Apple ID (at the top] -> Payment and Shipping. If it says ‘Apple Card’, you’re done. If not, tap the item. You can then add the Apple Card and add it to the list. I’m not sure if you’re asked if you want it to be the default. If not, you can edit the list and move it to the top.

In MacOS, go the Account page of the App Store, iTunes Store, or Book Store and access the Account Quick Link. The selection is under ‘Manage Payments’ and the process is similar to IOS from here. Note that the card number is different from the one shown in the Card Information screen associated with the card. It is the last 4-digits of the umber used with Apple Pay (which you don’t see elsewhere).

One more thing I’m curious about but no review seems to mention is how you can get a limit increase if what you’re assigned early on is not satisfactory.

The support document at https://support.apple.com/en-us/HT209228 says "You can see your account Credit Limit, Available Credit, and APR. Credit limit increases are not currently supported.” However, I suspect you can use the contact buttons in the card tab of the Wallet ((Message and Call)) to explore that with a support rep.

Thanks for the clarification, Alan

The 3% discount on App Store and iTunes purchases is OK, but you do even better by watching for sales on gift cards. I’d rather save 15-20% upfront on a gift card, than get back 3% on individual purchases.

I have to admit, I’d be a bit leery of such gift card sales after reading about how this guy unknowingly bought a stolen gift card from an online discounter and ended up getting his Apple account locked for several months.

I concur. But there are reputable places like Costco that sell $100 iTunes cards for $94 (and sometimes less) and occasionally Apple has a sale (typically something like a $100 card gets you $110 credit).

If you buy on sale from Apple with the AppleCard you’d get even more of a discount, which would be pretty cool.

I was an early adopter of Apple Pay. I traded in my iPhone, which worked just fine, in order to get one that would work with Apple Pay when it came out.

When it became available. I set it up on my phone immediately and then started trying to find places I could use it. Whole Foods had it but not Fresh Market, or Kroger or my local small produce/grocery store. Fresh Market finally got it and I talked my local market to get it, too. It has now dropped it as no one but me ever used and it was expensive. A few other small businesses have also dropped it.

I have to admit that I know no one other than myself who uses Apple Pay. I don’t understand why - it’s easy to set up, safe, and so fast to use anywhere. Ones phone is always more easily accessible than ones wallet where credit cards are stored!

I guess it’s the same reason I know no one who uses their hands free phone in their car, has their address book/music synced. They all drive around with their phone at their ear, in cars where I know this feature is standard. Many also never program their garage remote controls - just keep the old remote opener/closer in the car.

I also don’t know anyone who uses their bank to pay their bills - they all still sit down and write checks and pay for a stamp and mail them. They think that’s “safer”.

I think tech companies assume that way more people are not only tech-savvy but interested in tech making their life easier, than there actually are. Most use their computer to read emails and do an occasional search and for social media. Kind of pathetic, isn’t it…

Is it possible to expand this discussion - and many others on TidBITTS - beyond the USA? What experience, benefits and problems, do users of Apple Card have in Europe - or in Africa? Such a discussion might even be useful when US citizens want to reflect on their own national services - or lack thereof.

Not yet. Apple Card is currently in pre-release, invitation only in the US and dates for other countries don’t even appear to have been publically announced.

Apple just released it to all US customers today, but still no word about other countries. I’ll bet financial regulations vary everywhere, so it may be a slow spread internationally.

My wife and I just signed up for our Apple Cards today. It was so easy that only until after we were already signed up did I realize that EACH CARD is a different account and must be paid separately. This is unlike Capital One and Citibank and American Express. Those companies permit additional users to be added to an account and additional credit cards are issued to the additional users, BUT IT IS STILL ONLY ONE ACCOUNT THAT MUST BE TRACKED. I spoke to an AppleCare Senior Advisor for Apple Card today and he told me no, Apple Cards cannot be combined. One card per Apple ID. So I asked what about Family Sharing? Can I use Apple Card the way I use Family Sharing? The answer is again NO. He put an Apple Card advisor at Goldman Sachs on the phone and she also confirmed that it is not possible. Both persons did say they would provide feedback about this issue.

BTW, when you call AppleCare and you are asked what product or service you want help with, ‘Apple Card’ does not work. You have to say ‘Apple Pay’.

I don’t think we’re talking about the same iTunes gift card sales. I agree that the “online discounters” look shady. I have often purchased iTunes gift cards for myself and as gifts from online sites of regular retailers for 15-20% off. These retailers seem to have these sales 3-4 times a year. I have purchased multiple times from:

PayPal Digital Gifts

Target

Best Buy

Walmart

Costco

I’ve never had a problem with them and the ecards are emailed within a couple of hours.

The arbitration clause is a concern. See https://twitter.com/businessinsider/status/1163893942003404800?s=20

how to get out of the arbitration agreement