The Apple Card is now available to every iPhone user in the United States. The company said nothing about when it might become available in other countries.

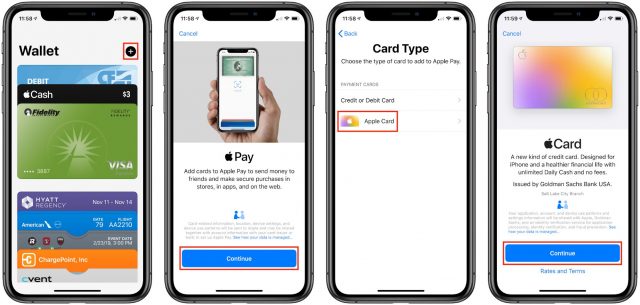

You can apply by tapping the plus button in the upper-right corner of the Wallet app. Your application is subject to credit approval, but I haven’t heard of many rejections, and some people are being approved for the Apple Card with relatively low credit scores—CNBC had an article about how Apple and Goldman Sachs were dipping into the subprime lending market. If you apply and are rejected, let us know in the comments.

As we’ve noted before, the Apple Card carries no fees, but you’ll be subject to an APR between 12.99 and 23.99%, depending on your creditworthiness.

Once approved, you can begin using the Apple Card immediately through Apple Pay and in non-Apple Pay online transactions. You can find your Apple Card number and other information by opening Wallet, tapping your Apple Card, then the ••• button, and finally Card Information.

In addition to accessing your card through Wallet and Apple Pay, you’ll receive a titanium card in the mail a few days after your approval. If you regularly engage in gunplay with international terrorists, note that it is bullet-proof.

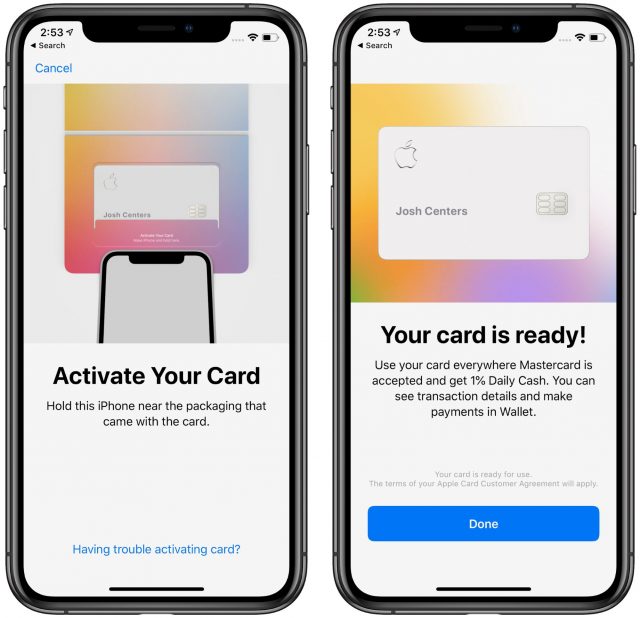

Activation of the physical Apple Card is as easy as tapping a few buttons on your iPhone and placing the iPhone against the packaging, which contains a hidden NFC tag.

The shiny titanium card is lovely, but Apple advises you to keep it away from other credit cards, leather, and denim. Perhaps your best option for storing the physical Apple Card is to put it in a nice frame on the wall and stick with Apple Pay. Or maybe Apple will introduce a $30 Apple Card case.

Apple Card’s main draw is its daily cash-back rewards, which are as follows:

- 3% back on purchases made directly from Apple, including the Apple Store, the App Store, iCloud storage, and iTunes

- 2% back on Apple Pay purchases made from non-Apple retailers

- 1% back on all other purchases, including those made with the physical Apple Card

Additionally, Apple has announced that all Uber services, including Uber ride-sharing and Uber Eats, qualify for the 3% reward. Apple said it “will continue to add more popular merchants and apps in the coming months.”

To further maximize the benefits of your new Apple Card, check out “How to Get the Most from Your Apple Card Benefits” (14 August 2019).

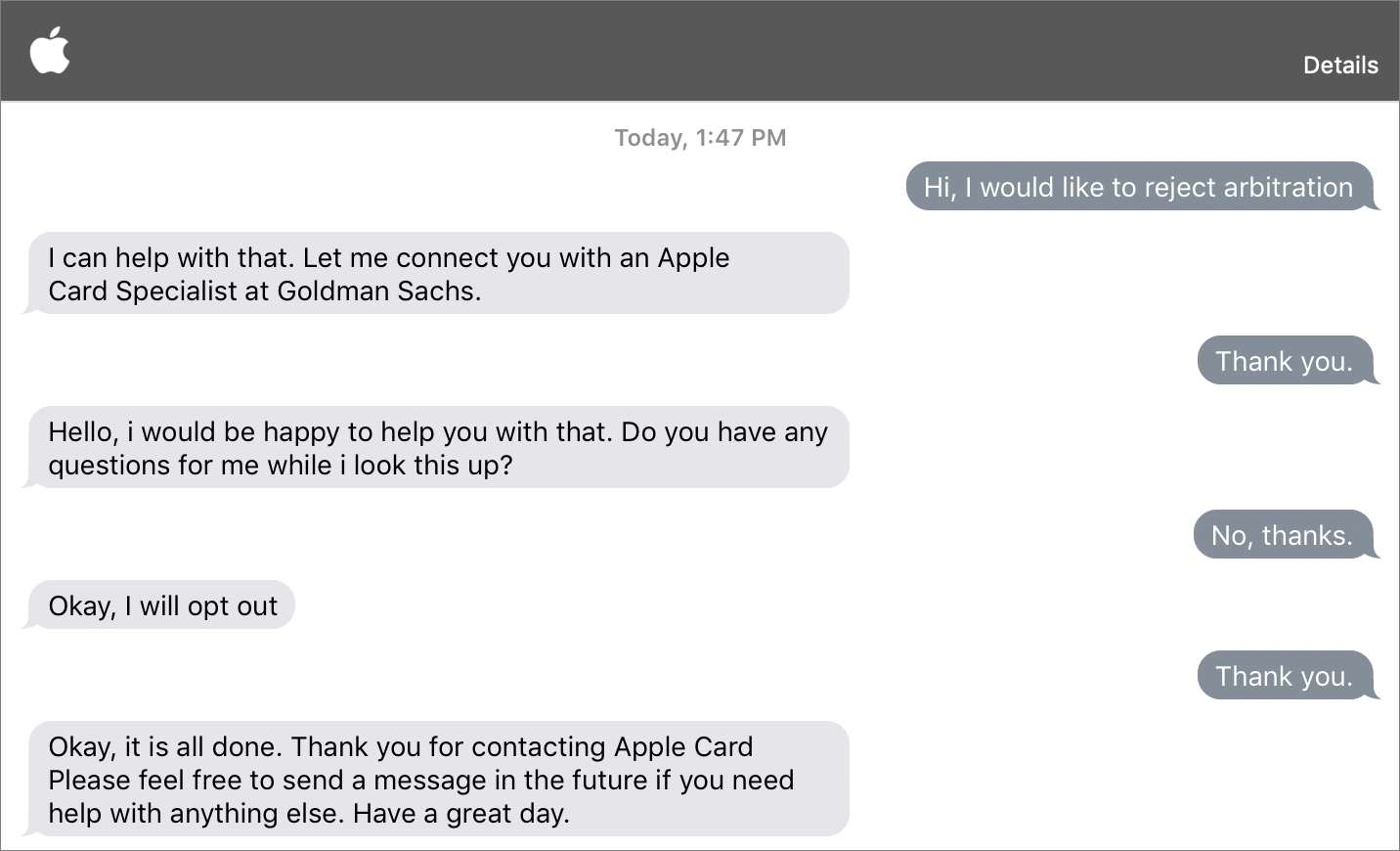

Opt-Out of Arbitration

One last tip: You have 90 days from the time you open your Apple Card account to opt out of Goldman Sachs’s arbitration clause, which prevents you from participating in a class-action lawsuit against Apple and Goldman Sachs regarding the Apple Card. It says:

Credit is being extended to you and you are being provided access to and use of your Account on the basis of the inclusion of the following arbitration provision. By accepting this Agreement or using your Account, unless you reject arbitration as provided below, you acknowledge that YOU ARE GIVING UP THE RIGHT TO LITIGATE CLAIMS (AS DEFINED BELOW) AND THE RIGHT TO INITIATE OR PARTICIPATE IN A CLASS ACTION. You hereby knowingly and voluntarily WAIVE THE RIGHT TO BE HEARD IN COURT OR HAVE A JURY TRIAL on all Claims subject to this Agreement. You further acknowledge that you have read this arbitration provision carefully, agree to its terms, and are entering into this Agreement voluntarily and not in reliance on any promises or representations whatsoever except those contained in this Agreement.

Thankfully, it’s super easy to opt out:

- Open the Wallet app.

- Tap your Apple Card.

- Tap the ••• button in the upper-right corner.

- Tap Message.

- Send a message like “Hi, I would like to reject arbitration.”

The Apple representative will put you in touch with someone from Goldman Sachs in the same message thread. It’s a painless process that takes only a few minutes and lets you retain your legal rights.

Survey Results

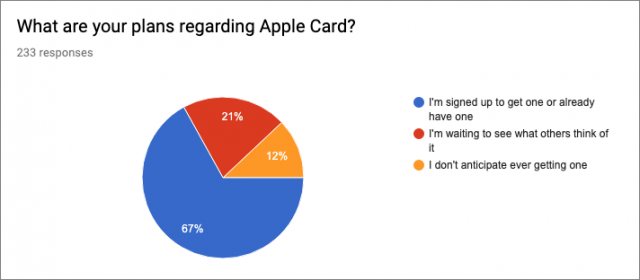

It looks as though TidBITS readers are generally bullish about the Apple Card. In our recent survey (see “How to Get the Most from Your Apple Card Benefits,” 14 August 2019), 67% of respondents said they already had it from the early access program or were signed up to get, and another 21% were waiting to see what others thought. Only 12% of respondents said they had no plans to sign up for the Apple Card.

I was unable to complete my application for the Apple Card because I had frozen my credit reports. They apparently check TransUnion. ―Ken

The card’s available to iPhone 6 and above users running 12.4, so not exactly “All US iPhone Users” or, “All US Customers” as Apple says. I’ve owned numerous Macs and iDevices over the years but I guess I’m still not included in “All US Customers”.

I was just approved - though with an interest rate of 18.99% (which is very high for my credit rating and debt - none), I’ll forego it for now, and try again later.

BTW: I also was unable to complete the application, due to having locked my TransUnion credit report - however that was easy to unlock, complete the application, and then re-lock – kudos to TransUnion for making that system work well. I can’t recall exactly how I signed up, but here’s the site: https://membership.trueidentity.com/

I also was blocked because I have my credit records locked. After two identity theft events I locked them all

Haven’t seen the benefits yet of an Apple Card to unlock even if only for a day. But Im unlikely to spend much at Apple anyway

I have mine locked as well. You can go to TransUnion and temporarily unlock it. I did that, it was immediate and I immediately got my Apple Card. An extra five minutes. The unfreeze link is on this page: https://www.transunion.com/credit-freeze

If you get the Apple Credit Card, you have 90 days to opt out of the arbitration clause (and the end of the credit card terms). It’s very easy to do using the Messages option under the Apple Card IN THE Wallet app. For details on doing this, see this article from the Verge

I can’t understand how there’s no way to export transaction history or statements for Apple Card. No way would I consider it until this is offered (if ever). I don’t mind managing everything on my phone, but absolutely want to be able to export the data for analysis or record keeping.

Pretty shocking that they’d reject someone with a credit score over 800. Congratulations?

I’ve added a bit about opting out of arbitration, which I strongly recommend.

I was an early adopter of the Apple Card and I’ve enjoyed using it online and at local retailers (mobile version). Today, I received the physical card and had trouble activating it even though I have an iPhone XR. However, one can go to the Apple Card in the Wallet app and activate via the Wallet. This page explains various methods of activating the card: https://www.igeeksblog.com/how-to-activate-apple-card/

The trick for quick activation of the physical Apple credit card is to leave it in the the little folder that it comes in while you bring phone close to the package. If you have already taken the card out, just slide it back in.

In order to slickly activate the card, you must have it in the folder.

I activated mine just fine with it out of the package. It just took a few seconds of bringing the phone close to the package and then it came up and said it was done.

I used the physical card twice today and both places it received positive comments. :)

I have really good news: I received a call from a nice lady at Goldman Sachs a short while ago asking me to reapply for the card. I did so and was approved. I asked if her call was related to my e-mail to Tim Cook and she hinted that Apple had asked Goldman to re-look at my situation. All is well. The squeaky wheel gets the grease.

I tried several times to activate it with card still in the little folder. For some reason the NFC just didn’t work. Would have been fun to do it that way. Nevertheless, I was able to get it activated by going to the Wallet App. Only after I had successfully activated the card via the Wallet App, did I take it out of its nifty folder. Can’t wait to try out the physical card tomorrow, although I do enjoy the convenience of Apple Pay.

I’ve updated the article to mention Apple’s advice to keep the Apple Card away from other cards, denim, and…leather. I guess you should only store your Apple Card in a vegan wallet.

I applied for the card yesterday and it was approved in a minute or so. I have all three credit rating company accounts locked, but unlocked TransUnion for the application - and then locked it again after the card was approved. What is odd is that later that day I got a notification from TransUnion saying that Goldman had checked my account and was blocked. It seems like they ran the credit check a second time - probably a mistake. They haven’t told me I have been rejected yet!

David

You’re storing it wrong.

Axios has some interesting back-end details about the Apple Card.

Looks like it will cost merchants more to accept than many other cards, not that they get a choice.

I am intrigued, I must say, that Apple consider leather a “fabric”.

Fairly certain Goldman Sachs, not Apple, is responsible for you being declined.

I tried to use Apple Pay with AppleCard for the first time last night at a restaurant. It wouldn’t work via my watch or my phone. The terminal kept saying I needed to insert a chip card even though cashier said it was set to accept wireless payment.

I finally saw a message on my phone that said something like “Can’t use this card with Apple Pay” which is bizarre since that’s the whole point of AppleCard. It reminded me of the message you get when you try to use Apple Pay linked to a credit card at a place that only accepts debit cards. I used the physical card and it went through fine. I’ll have to try it someplace else that accept Apple Pay.

Marc Zeedar

Publisher, xDev Magazine and xDevLibrary

www.xdevmag.com | www.xdevlibrary.com

I agree. Not being able to download my transactions is a non-starter for me

I wonder how the approval process really is. On all credit card applications I have seen a social security number is required. I never gave Apple my number. I wonder if they have it any way

Why this credit card? Others have cash back too. Cuz it’s “cool”?

Any other advantages worth applying and unlocking TransUnion for?

I don’t have one yet. I don’t care about cool or the card’s design or the fact that this fancy design apparently won’t do well in leather wallets.

But I do very much like the idea of zero foreign transaction fees and improved privacy. I don’t like Goldman Sachs behind it – not that I believe most other banks are much better. I plan on trying it out. The worst that can happen is I decide to close it.

Great find. This was the detail that I wanted to find out. At this point, I see more and more merchants offering discounts to folks who pay in cash - nearly all the local gas stations have a 5-10 cent cash discount and some restaurants have a 5% surcharge for credit. I’ve found many foreign merchants will give an excellent discount for cash also. Many charities ask for a 4% or so surcharge to deal with the processing fees. Even Amazon offers a 2% discount for the ability to route directly to your bank account. So if this card was going to offer something different that would be useful to me, it would be better acceptance by merchants. But that is clearly a big NO. I think that everyone needs to realize that services that only have credit card payment options are certainly adding several percent to each bill in order to pay for the transaction.

I think the improved privacy is a big win. It would be lovely to be able to get a new credit card number with the tap of a button. (Hmm, that raises the question of what happens if you’ve set up an auto-pay with that number for a monthly subscription. If it’s not Apple Pay behind the scenes, I’d think the auto-pay would fail due to the number changing.)

For quite some time the availability of Social Security numbers has been a wide open gateway to identity theft and fraud. It’s why the US government discontinued the use of Social Security numbers on Medicare and Medicaid cards and as an identification factor.

An interesting aside to the whining/usability thread, I did a search for facial recognition jobs at the Apple site, and there are quite a few facial and handwriting recognition opportunities. Here’s one for Computer Vision Engineer:

https://jobs.apple.com/en-us/details/200090881/computer-vision-engineer?team=MLAI

Security has always been important to Apple, and is becoming an even more important selling point. Facial and handwriting recognition for security purposes can maybe be as important to Apple as it will be to AR/VR, gaming and creative.

Thanks for that, Josh. I stopped reading and flipped into Wallet when I saw that. The experience was, as you said, painless. I suspect that first-line inquiries are handled by an AI-bot that read a lot like Siri. The human customer service seemed to be handled by an off-shore service center. The person was polite, but a few deficits in language construction slipped in.

Nevertheless, easy and quick, and even an implied tone of congratulations that I had been successfully opted out of arbitration.

Denied, despite a credit score of 840. But expected. Goldman Sachs: “Your monthly debt obligations are too high given your income - examples may include credit card, loan, or housing payments.” [Emphasis added.] Oh, well.

Both MasterCard and Visa offer a service to merchants that allow them to be notified of customer card number changes. It’s not perfect as there are a few links in the chain, so doesn’t always work (depending on who provides your credit card, who the merchant is, etc.).

https://tamebay.com/2017/02/how-visa-account-updater-mastercard-automatic-billing-updater-works.html

Automatic Update of Credit Card Info for Recurring Billing Merchants

I applied and was granted a card. Sort of. At this time Goldman-Sachs is unable to send a physical card to a PO Box. The only place I can receive USPS mail is my PO Box, so no card for me. I can still use it via my phone and watch, and supposedly, my complaint about the lack of PO Box support has been registered. Hopefully, that support is added soon.

So, I got my card, activated it, and then did Make Default at Apple. When I then go look at my iTunes account, it shows that my Apple Card is indeed now my default payment method, but the last four displayed digits of the card number do not match the card number displayed in Wallet’s Card Information. What’s up with that?

One of the features is you get a different number for every online transaction. That number you are seeing only works in the iTunes store and nowhere else. Pretty cool.

What iPhone do you have? Listening to the ATP.fm podcast recently, it sounds like only the latest models have background NFC capability which allows you to simply bring the phone near to the card to activate. Earlier models (e.g. iPhone X) need you to be running Wallet for the activation to work.

For those of us who had Apple Card transactions in August, the first monthly statement is now available.Sure enough, it is only available as a PDF. Tap the Total Balance button and then tap the August 2019 button in the Statements section. The bottom button is ‘Download PDF Statement’. When you access the statement, it is displayed on the iPhone in microscopic type with a share button in the upper right corner. Among the options are Airdropping it to another device, emailing it, printing it and several others.

I chose to Airdrop it my iPad, so that I could easily read the transaction log and enter the transactions in my Personal Finance program. Of course, if a .qfx version had been available, I could have Airdropped it to my Mac and then loaded the file directly into my personal finance program. Hopefully that option will be made available.

It appears that I was optimistic about a $30 Apple Card case. Third parties are selling them now, from $39 all the way up to $900!

I’m late to this but:

I got the Apple Card in the public beta phase. I immediately went to Europe, and used it on Apple Pay wherever my preferred card (Amex) was not accepted, and where I didn’t need to use a physical card (TMI but my Chase Amazon Prime card also gives 2% in restaurants and gas stations, and does not differentiate on how payment is made).

But, in Italy, I came across my first problem: a PIN. I am very familiar with this, and cannot for the life of me understand why most US card issuers have chosen to conflate a desire to leapfrog current technologies and go to tokenization etc., with a refusal to issue PINs. Chase will issue a PIN on request. Amex will not. And, neither will Goldman Sachs on Apple Card. And that’s OK: they’re not alone.

I wanted to mention it here because of what I perceive as the narrative of how easy it is to text and manage the account, using the example of opting out of arbitration. I found myself getting irritated very quickly as I was asking about a circumstance I come across frequently, being the kiosk. In Italy, it was gas pumps. In Germany, it is (maybe was) often train ticket machines. But the idea that the machine can just be “told” that no PIN is required does work some of the time, but not all of the time. I was forced to use my bank’s debit card to buy gas on several occasions.

The rep kept trying to school me in how I might tell someone, in another language, in effect how they might configure their own terminals, with a bald refusal to accept that this circumstance was arrogant if the terminal was staffed at all, and of course impossible where it was not. It was, as I noted with increasing anger, very Apple: a credit card version of “you’re holding it wrong.” This was Goldman, to be clear—but there has been a lot of commentary about how simple and clear everything is, and I found if you scratch the surface, people may find that the clarity and simplicity is not deep.

My second experience was a ghost transaction. It was valid and I was actually expecting it, and I was billed properly—which is to say the total owed increased—and I also got Apple Cash back, at 2%. But the transaction itself refused to appear in the list. Here Goldman Sachs bounced it back to Apple, and Apple Support was patchy. The first person did understand said they’d need to investigate: fine.

But, I asked how I would pick up the thread, and they said not to worry, using the chat a future person would be able to follow it. 48 hours later, I chased it—and got advice about restoring my iPhone from a backup and other such voodoo that takes literally hours, on something that couldn’t have been more obviously at “their” end if it tried. Again expressing displeasure, I was told I had at least done enough to get it escalated, and someone would phone me. They never did, but shortly thereafter the transaction appeared, as expected. Someone had fixed it, which is nice, but I have no insight into why this transaction didn’t appear in Wallet to begin with, or whether this was a freak edge case not worth worrying about, or whether the circumstances are eminently repeatable. I have literally never had this with any credit card transaction, ever: and on those, I am not solely reliant on one app.

What’s the conclusion? Yes, the UI is better. In fairness, Amex in Apple Pay is hardly awful, and I was never confused by my payees, but this is better.

Support by text is I think not better, at all. Sure, to change your address or do something very mechanical, I am sure it’s fine, but if I need to contact my card issuer it’s usually something that I cannot do on the website and is by definition higher-touch, and my experience over three weeks is that two-for-two I am seeing why I am not cutting up my Amex card. Most concerning is the idea that in some set of transactions that may be narrow (in this case I was in the UK, and it is early in the period of differentiating Apple Pay / tokenized charges from contactless, the latter being capped at £30, or about $37, so merchants may be surprised that a “contactless” transaction goes through when using Apple Pay for amounts above that), you might not see it in anything other than the total amount owing.

Apart from the aesthetic—and we’re Apple fans, that does matter!—this could mean that you owe the money, but would have no actual transaction to dispute. While fraud on Apple Card is technically difficult, it means there is some set of transactions where you might not be notified. How big is that set? How do you report it if support defaults to a script assuming you have a software issue and is unwilling to engage further without a nuke-and-pave?

It’s OK if there are teething problems, but I am torn between acknowledging that this is new, and that there will be issues, to also knowing the this is a very mature industry, and if I have two issues in three weeks, that’s… disappointing?

Does the card work, and would the texting support work, if you go out of the country and put in a local SIM? Is it based on your phone number or your phone ID?

Phone ID (like all of Apple Wallet). Support asks for the phone’s serial number as a security check. And, the text support is iMessage-based so linked to the iCloud ID: apart from basic set-up I don’t think the SIM and phone number would make any difference.

@alexjohnson, thank you so much for this detailed post. This is the sort of real-world experience that’s extremely valuable to know about in advance of a trip or before fussing with a ghost transaction.

I’d heard that you can put in 0000 if you need a PIN and one isn’t assigned to your card, but I never tested this when I was in Europe last year as I found that using ApplePay was vastly easier than any card.

Interesting! Thanks for the tip. :) I’ll have to try that next time I’m in Europe. One of my CCs has a PIN, the other doesn’t and the issuer refuses to assign one.

Very simple question, can you use your Apple Cash balance to pay off your Apple Card balance?

No, you can’t directly use Apple Cash to pay Apple Card. I plan to transfer Apple Cash to my bank and pay the card from my bank account.

Thanks, Doug.

One more question, is this an NFC vs. Apple Pay thing or do payments with Apple Pay in general not show up to confirm at the bottom of the screen? I was under the impression you get alerted to merchant and amount at the bottom of the screen (like the panel you get when you pay off your balance or purchase on the iTS) when you’re asked to authorize payment. Instead, when I tried it for the first time yesterday, I simply was asked to touch my TouchID. Only after I had authorized the purchase did merchant and amount show. I realize you can check the NFC terminal’s display for amount, but seeing it right on the iPhone when authorizing to me would feel more natural.

To keep my financial records in order, my general plan is when adding the statement information to my personal finance program (Moneydance), to also transfer the Apple Cash earned to my checking account (classifying it as a Bank Credit (like rewards from other cards)) and schedule payment later in the month.

I have no idea; I have never paid attention to what the iPhone screen says beyond it showing that it’s ready for a tap and that the transaction is completed. As far as I know, Apple Card works like every other Apple Pay transaction I’ve made in the past.

Thanks, @ddmiller.

Just as an update, I did an online transaction on my MBAir today, paying with Apple Pay from my iPhone, and the amount and retailer did show up on the bottom of the iPhone display before I approved it. I’ll pay attention next time that I make a transaction at a point of sale terminal.

Oh great. So I wasn’t imagining things after all.

I wonder when that shows up and when not. So far I get the impression that payments with Apple Card at a NFC terminals unfortunately doesn’t trigger it.

You can pay off your Apple Card balance using Apple Pay after all.

When you choose to make a payment to Apple Card, there is at the bottom an entry with your bank account. If you click on that there is the option to choose other sources of payment. There you’ll find an option to use Apple Cash. Once that is selected, your Apple Pay balance will be used first and the remainder of the Apple Card balance is then charged to your bank account.

I noticed on my wife’s iPhone, that feature only becomes available once you’ve verified your identity for Apple Cash. Before you do that, the slider for using Apple Cash to pay off Apple Card balance is grayed out.

Nice find. I didn’t use the card until after Sept 1, and my first payment isn’t due until Oct 31, so I just hadn’t done a full payment cycle yet. Thanks for the instructions.

Has anybody else here run into trouble using Apple Card for payments abroad?

I recently ran into an issue when trying to book a hotel in Japan. The hotel received my card no., CVC, and expiration data. They came back saying there was an issue with my card and they could not charge it. We then tried giving them my wife’s Apple Card no., CVC, and expiration date. They returned again saying they could not charge the card.

Since this happened twice with different Apple Cards I feel rather certain we got the card details right and that it wasn’t just a momentary glitch. I proceeded to then give them the details of another Visa credit card I have with my bank and that worked just fine. So WTH?

It’s not just you. Tom’s Guide’s Caitlin McGarry had trouble too.

Thanks for that link, Josh.

Interestingly, like in that report I was also told by the Apple Card specialist (who I contacted later) that my card had actually not been declined at all, or at least it wasn’t showing that way on their end. So I also had this suspicion that it was related to card network issues, rather than my actual card being declined. I’m a bit surprised, because I used to use a Mastercard all over Europe and that worked just fine. Maybe Japan is different. Indeed, in the past in Japan I tended to use Visa. I also wonder if maybe not all Mastercards are created equal. I’ll definitely be carrying both a Visa and a Mastercard in addition to my Apple Card. Because I know we are still a far way from being able to tap our phones everywhere. Sit-down restaurants in the US is a nice example.

On a related note, this weekend I just experienced another Apple Card issue at Banana Republic and a nearby hotel while on a business trip. BR allowed me to tap my iPhone just fine at the cash register, but their mobile units that they use to check you out when they have long lines at the cash registers do not work. Those devices don’t support NFC so they need an actual card for that. Of course that also means 1% vs. 2% cash back. At the hotel I later ran into another issue. I had a prepaid room so they only needed my card for incidentals. They couldn’t use Apple Card there either because they didn’t actually swipe the card. Turns out they enter the card no. into their terminal and then also manually enter exp date and CVC. Of course none of that is printed on the Apple Card. Sure, that information is displayed in Wallet, but how comfortable would you feel dictating all that information to a clerk while he punches it into his system? Anybody within earshot could take note. I guess I could have showed him my iPhone screen, but it was easier to just hand him my Visa.

The same thing happened to me last night. A few hours after I reestablished the freeze on my credit report, TransUnion reported a second inquiry by Goldman Sachs was rejected. When I was opting out of arbitration, I asked about the second inquiry, but the customer service rep seemed kind of clueless, suggesting I contact TransUnion to find out what was going on.

Anyway, the article below might explain what’s happening. When you apply for the card, only a soft inquiry, which doesn’t affect your credit score, is made. I think that after you accept the card offer, Goldman Sachs does a second, hard inquiry to indicate you applied for new credit.

Today I noticed that while every merchant gets listed under Apple Card with an exact location and time of purchase, Apple itself just bills as Apple. No mention if it’s Book Store, iTunes Store, App Store, physical Apple store, nothing. Just Apple. Well we have Family Sharing on which has this annoying habit of charging everything to one card and that before an email receipt is sent out. So if my wife makes a purchase, I’ll have a charge show up on my Apple Card out of the blue with just “Apple” but zero indication of what or who.

Either Apple should specify in Wallet more exactly what they’re charging or they should ensure their receipt emails go out before charges get invoiced. Ideally they should do both. But their present method is junk.