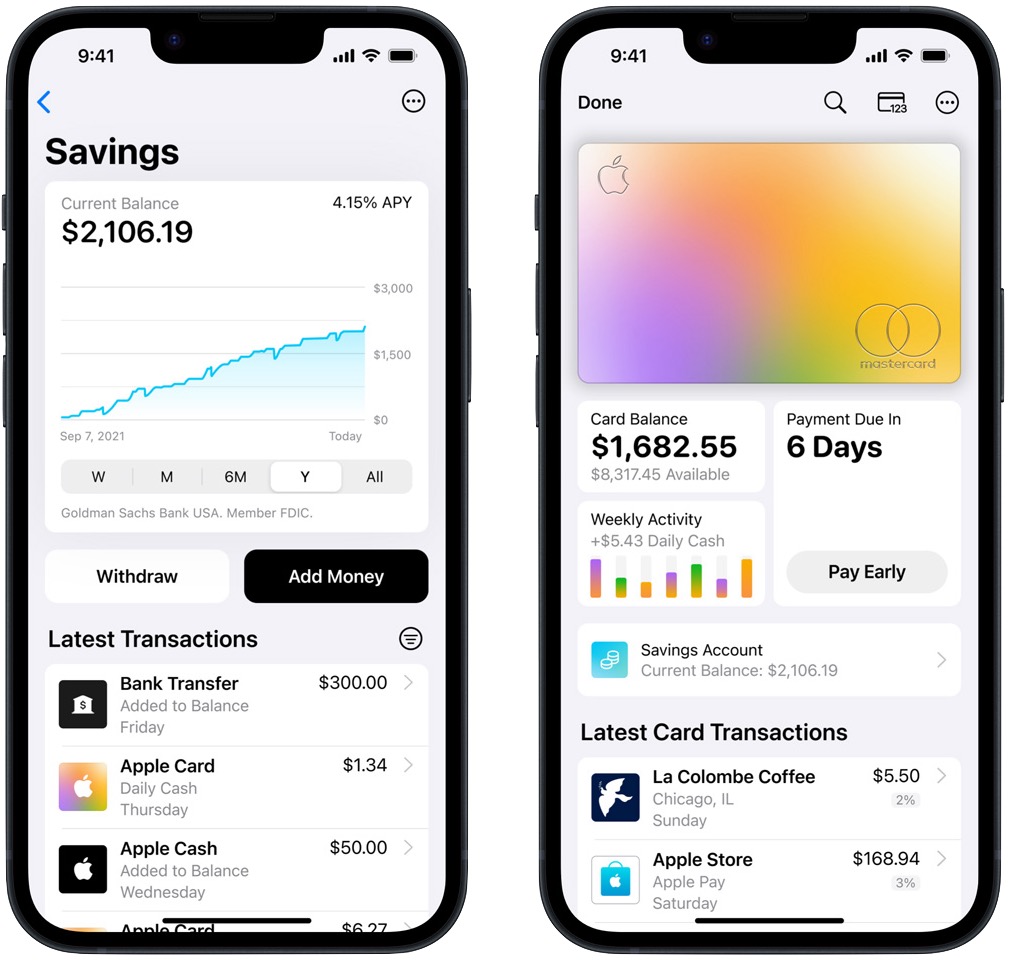

New Apple Card Savings Account Offers 4.15% Interest

In a Newsroom post, Apple writes:

Starting today, Apple Card users can choose to grow their Daily Cash rewards with a Savings account from Goldman Sachs, which offers a high-yield APY of 4.15 percent — a rate that’s more than 10 times the national average. With no fees, no minimum deposits, and no minimum balance requirements, users can easily set up and manage their Savings account directly from Apple Card in Wallet.

Savings account interest rates have been woefully low for years—a friend commented that his teenage kids recently asked what “interest” was—but have started to rise. Apple’s 4.15%, though it will likely fluctuate, is competitive with the best alternatives right now and is a more lucrative holding area for Daily Cash rewards than Apple Cash. It might also be worth using in favor of current savings accounts—my local banks are currently offering rates between 0.02% and 0.10%.

I’m not signing up for it until Tonya gives me the go-ahead. She gets grumpy about adding financial accounts that prove difficult to manage. While the Wallet app may be easy to use, it’s problematic when the other member of a couple manages most of the banking. Plus, Apple has a weak track record of integrating its financial services with personal finance and accounting packages.

Either this is very popular and overloaded, or it isn’t yet available. I get an error message:

edit

now (a few hours later), seems to work. I got an email from [email protected] saying my account is open…

My money (hah!) is on overloaded.

Same here. I’ve tried a few times during the day.

As a UK reader, what’s the US Fed base rate at right now? (Useful for comparison’s)

EDIT 2: 4.83%.

4.15% seems quite competitive against other banks too.

Worked fine for me, but I had to upgrade my iPhone to 16.4.1 before the option presented itself. I clicked the “Setup” button (under Apple Card’s Daily Cash section in Wallet), put in my SS# (required for tax purposes), and in a few seconds the savings account was active. Very nice!

I typically use American Express Personal Savings, which is offering 3.75%. Very tempting. But what are the odds it’s some promo rate that will take a dive after they’re happy with the adoption numbers…?

Is there a simple transfer option between accounts and banks, such as Zelle?

Is there any minimum (monthly) deposit?

No minimums or fees. You can pay your Apple Card balance, transfer to your own bank, or instantly transfer to Apple Cash, and send money to others via Apple Cash (nothing has changed there).

Well I don’t see a “Savings account” in my Wallet, but there is a prompt to create an “Apple Account” in there. Unfortunately, after successfully adding it, there are no details that I can find about how to direct Daily Cash to it.

Maybe tomorrow all will be revealed.

If you intend to use the account as a true savings account, beware of the withdrawal limitations:

“Apple Cash Transfers

You may deposit or withdraw funds from your Account into or from Apple Cash. Transfers must be at least $1.00 and can be no more than $10,000. You may transfer no more than $20,000 per rolling 7-day period. We may place additional limits on the amount and frequency of transfers for the security of your Account.” ( page 7 of the Deposit Account Agreement)

Note that the savings account does not appear directly in your Apple Wallet. Instead, you must open the tab for your Apple Credit Card and find a button for the savings account there. To access the agreement that I quoted above, tap the circled ellipsis in the upper right corner and then the Account Details item. Scroll to the bottom to see the Terms and Conditions button. Tap that to open the PDF, which you can then share back to your computer to read it.

The Savings Account is accessed via a button in the Apple Credit Card Wallet Entry.

That support article says that the Savings Account requires “the latest version of iOS,” which I presume explains why I don’t see the button you refer to; I’m on only iOS 16.4. (I always hold off upgrading an operating system until after it’s been out a week.)

Still, I wonder what an “Apple Account” is.

Oh. Nevermind. Tab the Apple Card → (… button) → Card Details → Daily Cash bar chart → View Daily Cash link → Savings → Set up → “Saving Unavailable. Apple Pay services are currently unavailable. Please try again later.”

Tried again … enter social security number … confirm, confirm, and … application rejected!

Tried again … Success!

Savings Account seems to work.

But that pesky “Apple Account” card is still in my Wallet.

Oh. Apparently it’s an empty gift card.

UPDATE April 18, 2023 5:50 PM

These are them most comprehensive instructions for settting up an Apple Savings account that I’ve found:

I already had a Marcus savings account at Goldman Sachs. Apparently I cannot use that same account, so it’s not worth it to me to set a new account for Apple Cash. But I do wish that I could use the Marcus account…

FWIW, I was able to sign up overnight (Pacific time). I’ve seen no indication this is a promotional rate or that it’s variable, tied to some indicator. Anyone have more info on that? It’s tempting to move some of the cash from my 0.69% APR savings account into this account.

I would think it is a current rate based on what other online banks are paying but once interest rates start to fall, it will probably adjust just like other banks do all the time. There are higher paying banks but one has to look around and a lot of times, the catch is it has to be new money as opposed to shifting funds in the same bank.

In a footnote in Apple’s announcement, the company says:

That maximum balance limit is $250,000, which is probably to match the FDIC limits for insured accounts. I checked because I wanted to make sure it wasn’t limited in some unusual way.

For anybody thinking of opening a new account with Marcus, something to know is that Marcus has not been meeting Goldman Sachs’ performance targets. As a result, Marcus is receiving less atttention and resources from senior management and even may be up for sale.

This has been the case over the last several quarters and continues today:

“Goldman is exploring strategic options for its consumer platform business, which has lost about $3 billion in three years, executives told investors in February.

[…]

Goldman reshuffled its businesses in 2022, leaning into its traditional mainstays of trading and investment banking, beefing up its asset management arm and stepping back from its consumer aspirations.”

Great news, Adam “I read the footnotes so you don’t have to” Engst!

I’ve been wondering if GS’ disappointment with Marcus and perhaps their Apple collaboration could be part of the reason Apple Card usability appears to have degraded. Unreliable notifications, slow balance updates, and odd outages are some of the things I’ve seen here that I did not encounter when the service launched and I signed up. I was wondering if perhaps enthusiasm has waned and with it dedication (and resource allocation) to the project.

Always a good idea to read the terms of service, but these are typical of a savings account. A checking account is a “demand deposit” account (give me my money, now) but a savings account is not. That’s why savings accounts pay more interest than checking accounts do (if at all).

Primarily intended for you to allocate/budget spending with other family members. You can put money in the kid’s “Apple Account” so they can buy apps, IAPs, and so on without freely hitting your credit card.

Depends on what you mean. The current US Federal Funds rate is 4.83%. This is effectively the cost of money to US banks.The current Wall Street Journal Prime rate is 8%. This is a derived benchmark based on the current rates most banks are charging their customers, and is typically around 3% higher than the Fed rate. However, the rate banks pay their depositors is completely up to them, and varies widely. At this moment, for funds in a demand deposit account (checking, savings…as opposed to a CD, for example), a rate between 4 and 4.5% is about as good as you can get. For more rates and info, check out…

Ah OK, thanks for clarifying that Jeff. The US may have different rates for certain things, but likely the Fed Funds rate (currently 4.83%) is equal to the UK main ‘base’ rate (currently 4.25%) – with other less used rates within the banking industry.

Anyway, as you mentioned, 4.15% is a pretty good headline rate for however long it lasts. Although most likely wouldn’t use it for tens of thousands upwards, me thinks, due to the limited cash withdrawal amounts allowed, regardless of it being instant access.

Here is an interesting article related to the Marcus issue mentioned above:

I am definitely not seeing any of that. I use my Apple Card a lot, and have been as I’ve been traveling the last two weeks and using touch less payment almost exclusively.

The interest rate is comparable to that of other “high yield” savings accounts. Ordinary bank savings accounts pay much less. The Capital One “Performance Savings” account is currently paying 3.5% APY. The PNC “High Yield Savings” account is currently paying 3.93%. These sorts of accounts tend to have limits on the number of withdrawals per month. If you’re using the Apple Card Savings account as a temporary holding place for Apple Cash, it’s obviously a good deal. I shouldn’t think that most people would have a large balance in Apple Cash.

Though as per Adam’s post above, one could add extra funds up to $250K into it:

But then withdraw only limited amounts over time ($10K per transaction, $20K max. every 7-days):

Hence:

Can I transfer money out of my Wells Fargo savings into the Apple savings account? If so, is the only way to do it on an iPhone?

I wonder if they’ll have a way to import the account activity into Quicken and/or download PDF statements, as they do with Apple Card.

To answer my own questions:

Yes, you can transfer money from linked bank accounts into Apple Savings. I’m closing my Wells Fargo savings account that pays some ridiculous fraction of a percent interest and transferring it all over.

Transfers can be done on an iPad under Wallet & Apple Pay in Settings. It makes no sense to me why it would be under Settings.

My wife and I both signed up for Apple Savings. We have a family Apple Card. I was prompted to move my Apple Cash Card amount into Apple Savings. My wife, however, was not prompted. There seems to be no way to move the money in her Apple Cash Card into Apple Savings. I can move money all around on my account. Hers cannot. It seems like the Daily Cash is going it but no way to get it out! It says to contact support to get our bank joint account authorized for her, too. That may be the key to unlock her ability to move money to/from the Apple Cash Card.

I got the movement between the Apple Cash card to Apple Savings working. What I did was

a) Go into Wallet on her iPhone

b) Go into the Apple Cash Card

c) Go into the three-dot menu and select Card Details

d) Select Verify Identity down the screen a bit. This was not done previously

After that, “Apple Cash Card” appeared as a possible destination for Apple Savings withdraw and add money.

I still don’t know how to make it so our shared credit union account that is attached to her Apple Cash card can be used with her Apple Savings. Both Apple Cash and the credit union account work fine on my iPhone.

Adam - I don’t see any replies to your question “will it be easy to integrate into your personal finance app?”. The reason I don’t use the Apple Card very much is because it does NOT integrate with eMoney like all my other credit cards do. I don’t want to download and upload which seems to be the only suggested workaround. If Goldman Sachs doesn’t integrate the Apple Card with personal finance apps, I highly doubt they will do so with a savings account. I use my 3% cash back Amex for everything because it integrates with eMoney.

Unfortunate bug: After transferring all my Apple Cash to the savings account, my Wallet continued to show the full balance in Apple Cash. It wasn’t until I quit the app and restarted it that the correct Apple Cash balance showed.

That didn’t occur here. Cash went to zero immediately with no need to restart anything.

Now that April has ended, we have an answer. You can indeed download PDF statements and transactions.

Are the downloads in QFX and OFX formats as well as PDF?

Yes. The process is the same as the credit card.

Do you have to download to the phone and then transfer to your computer if you are using a Mac based financial package?

Diane

Yes. See View and update your Savings account information in Apple Wallet - Apple Support

For both Apple Card and now Apple Savings, I open the PDF and click the OFX files and save them to iCloud Drive by sharing them to the Files app on the phone. (Apple Card you can download statements but not transactions from a web page, but Apple Savings doesn’t yet have a web page.

For the statement, I open it on the phone and then tap share to use Airdrop to send it to my Mac. For the QFX file, I select Export Transactions and seclect QFX and select the Airdrop option.

One thing I did forget to mention. Since the Savings account must be accessed through the Apple Credit Card wallet entry, the procedure for getting to the statement is a bit different–you first tap the Apple Savings button from the Apple Credit Card Wallet itme and then tap the circled ellipis in the upper right corner. You select Downloads and then Stalements from the dropdown and select the current statement. You can then select View PDF Statement or Export Transactions and proceed as above.

My workflow (to get the transactions onto my Mac where I can drag-and-drop into Quicken) is: Wallet > Apple Card > Balance Details > Statements > (Tap the statement I want) > Export Transactions > Quicken Financial Exchange (QFX) > (AirDrop to my Mac). Maybe we’re accomplishing the same thing via different routes?

[Edit: I think I just said the same thing as @aforkosh at the same time. Sorry if it’s redundant.]

Yeah, I’m generally doing this when I’m not sitting at a Mac, so iCloud Drive is a better option for me. I get the notification that the statement is ready and just take care of it wherever I am.

It seems nuts to me that the only way to download a file to import into Quicken, a Mac app, is on the phone. Am I the only one?

Anyone have experience with opening an Apple Card/Account when buying a Mac? I was considering biting the bullet on the Mac Studio and saw I could just finance with 0% but read somewhere that they ding your credit score. Is this true? I’d rather not drop $3K right now, but can deal with $290/month for 12 months with no interest (no missed payments). Thanks.

That’s the current state, correct. Goldman Sachs (the bank behind Apple Card) is a bit behind the times in terms of their Consumer Banking division. One would hope direct download (like with, well, every other major bank) is up near the top of their to-do list.

I agree! Thanks to everyone who chimed in, that’s what I thought but figured there was an easier way!

Diane

I didn’t finance a Mac, but a while back I did an watch for my Mom (zero percent interest, why not). I noticed that they show the amount you financed as “used” credit. So say you were approved for a $5K credit limit and spent $3K on that new Mac, they’d show $3K of your limit being used and it would slowly decrease as you paid it off.

As long as you don’t miss payments the hit to your credit shouldn’t be too bad – mine was just a few points – but since my purchase was just a few hundred dollars I paid it off rather than have the amount drag on my score each month.

Apple Card is meant to be applied for on an iPhone and I think Apple is really leaning into that - you can use it on other iCloud synced devices, but you get it on the iPhone. Also, these days I’m just happy I can actually get a QFX or OFX file to import at all.

But, sure, it’d be great to have a web interface as well. It would save a few steps.

As for the credit score question, I currently have installments for an iPhone, MacBook Air, and Apple Watch Ultra and my credit score remains essentially the same.

I apologize if this is a naive question, but since the current U.S. inflation rate is somewhere over 5 percent, wouldn’t it make sense to use Daily Cash to reduce the monthly Apple Card statement balance instead of parking it in a savings account where it is earning only 4.15 percent and therefore losing value over time?

David

If you are paying interest on your Apple Card balance, paying it off makes better sense than putting Daily Cash into the savings account. But if you have a 0% balance from purchasing Apple gear or you pay off the Apple Card balance every month it makes more sense to put it into savings.

Personally, I moved my Wells Fargo savings account that was paying 0.25% into Apple Savings. I don’t use the Apple Card for much, just App Store subscriptions, and I pay it off every month so I don’t pay any interest.

If you open the Savings screen on your phone and then tap the “…” icon in the upper right corner, you can get to Account Details where the Routing and Account numbers are located. With those numbers you can direct deposits to your Savings account from another bank’s website or app without using your phone in the process.

From that same “…” icon, you can get to your Statements, which can be viewed as a PDF document or be exported in various standard export formats.