Melio Makes Payments for Small Businesses Easy

TidBITS has long paid our writers. That’s easy to say, but when you have to send money to a number of people in varying amounts each month, the mechanics of how the payments actually happen matter.

In the early days, we wrote checks. Or, rather, Tonya did, as part of her CFO duties. Between TidBITS writing and Take Control royalties, we were paying up to 25 people per month. At the time, we relied on MYOB AccountEdge for our accounting, and it made sense for Tonya to handle everything within the app, which could also print checks on our blanks. I still remember her sitting down with the stack of envelopes and a little tube she could use to moisten the glue strips because she hated licking 25 envelopes.

After we sold Take Control to Joe Kissell, the number of people we had to pay each month dropped to just TidBITS writers. Tonya kept writing checks for a while but eventually discovered that the CFCU credit union where we bank allowed her to do direct deposit payments via ACH (Automated Clearing House, a system banks use to transfer funds electronically) using a free service called Popmoney. Its interface was old and ugly, but it did what it promised, and direct deposits made life easier for our writers, who didn’t need to handle physical checks. Plus, before Tonya moved to direct deposits, a check would occasionally go missing or be ignored for a while, and resolving such issues generated even more work for her.

Throughout all this, I was largely and blissfully ignorant of the payment mechanics. However, once Tonya got a job at Cornell and we moved our financial books to Xero (see “Switching to Xero from AccountEdge,” 10 May 2021), she delegated all the regular payroll work to me. That’s when I discovered that Popmoney had an odd limitation of $1000 per day. If we had multiple payments that exceeded $1000, we had to schedule some of them for the future. It wasn’t just the next day—Popmoney wouldn’t let us schedule the additional payments until the first ones had time to clear, usually 3 business days.

I realize this sounds like a first-world problem, but for a while, the Popmoney interface made me guess which date would be open for payments. That was annoying and forced me to pick who would get paid later and alert them separately as to when the money would arrive. The limitation made no sense—these were ACH transfers we were initiating from our account to known people, so it seemed unnecessary for CFCU or Popmoney to protect us from spending too much. I tried to get the limit raised, but CFCU’s support referred me to Popmoney, and then Popmoney said it was a CFCU setting, and I eventually gave up.

My problem was eventually “solved” by CFCU dropping Popmoney entirely, with a vague claim that it would be replaced in the future. (That hasn’t happened yet.) We considered moving to another bank that offered such a service, but that’s more easily said than done, given how many auto-deposits and auto-withdrawals we have.

Instead, we started looking for a third-party service that would allow us to send ACH payments to our writers. They tended to be expensive, such as the case-challenged Bill (compare its lowercase logo to its uppercase text branding), which charges $45 per month. I’m not opposed to paying for such a service, but it wasn’t worth much to prevent me from having to write four or five checks per month.

Then we found Melio, which promises ACH payments for free and has no transaction limits (banks may have their own). Melio makes its money by charging for rush payments, credit card payments, paper checks, and what are essentially payment loans. While those upsell opportunities are always visible in the interface, there’s no problem with using it purely with ACH for free. Note that Melio doesn’t do wire transfers.

Using Melio to pay people is simple after a one-time account setup and configuration step to connect your bank account. First, you create a vendor for each person, which requires a company name and optional contact name, email address, and phone number. The email address may be optional, but it’s necessary if you want Melio to send them email requesting their bank information to set up the ACH connection. You can also import vendors using a simple CSV file that collects the same information.

Everyone I pay regularly said entering the necessary routing and account numbers to receive payments was easy, although they were all in the US. When I looked into paying Kirk McElhearn, who lives in the UK, I found that Melio supports international payments, but that requires getting the recipient’s SWIFT or IBAN number and costs $20 per transaction. (I resorted to PayPal to pay Kirk for a recent article.)

Once you have your vendors set up, you create bills to pay. Because I’m paying only a handful of people a variable amount once per month, that’s most easily done by hand. Melio also lets you upload a PDF invoice or image, then parses it to create a bill, which is quite slick, or you can sync with QuickBooks. A quick search revealed that there’s also a Melio Payments integration with Xero, but reviews suggest it has synchronization problems. I don’t need more integration with Xero than seeing the payment come out of my CFCU checking account, so I haven’t looked into that more.

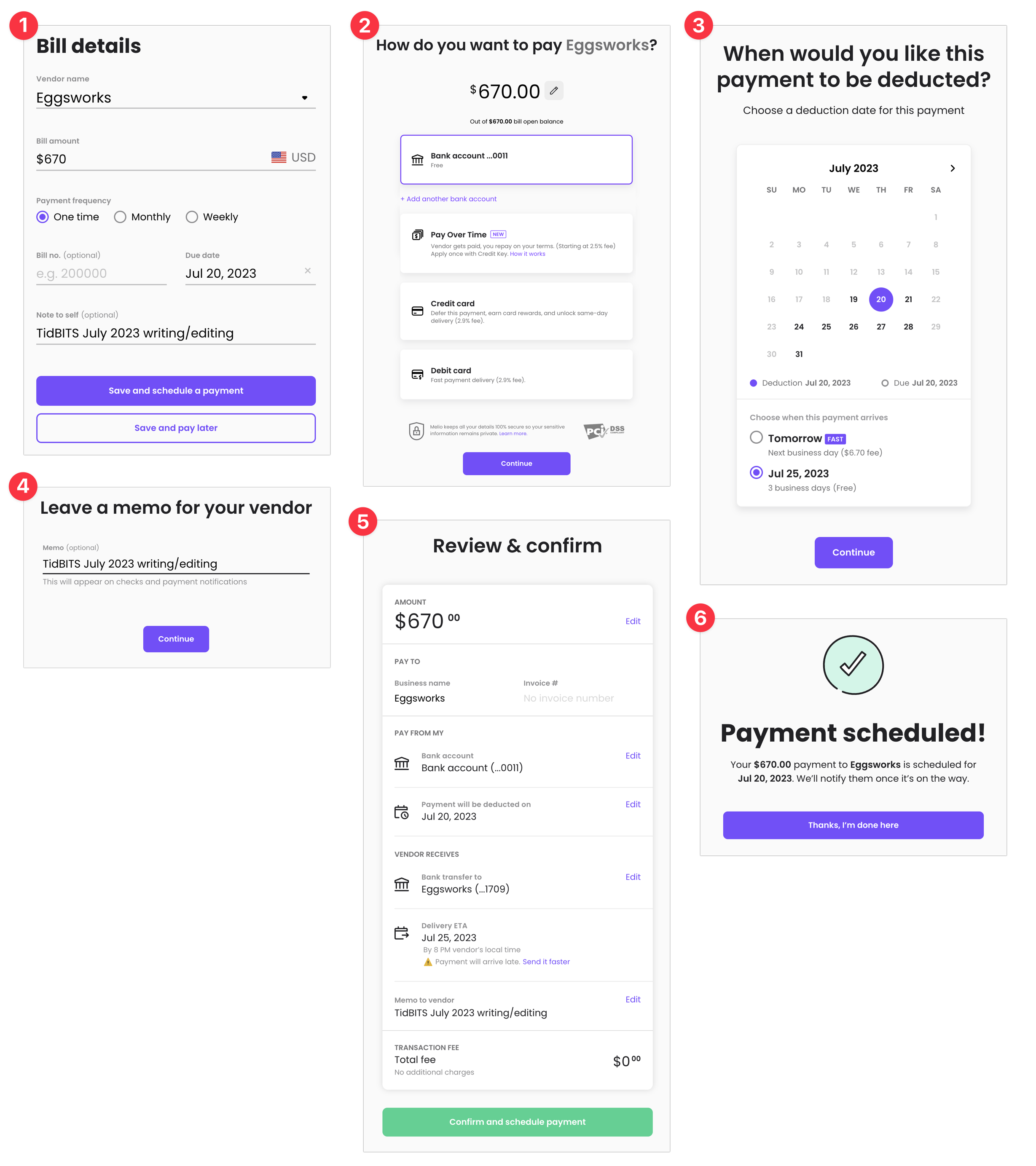

Creating a manual payment is easy, if a little chatty, with a six-step process that collects small amounts of information at each step.

- Enter the vendor name, amount, payment frequency, and due date. I always choose the next day as the due date, even though I know that won’t be the date the money actually transfers, as you’ll see.

- Specify how you want to fund the payment. Again, funding the payment from your bank account is free; the other options trigger a charge.

- Set when you want the payment to be deducted. Regardless of when you said it should be due, Melio gives you the upsell option of deducting right away for a fee. I always go for the free 3 business days option.

- Enter an optional memo. I’m a sucker for metadata, even though I haven’t noticed any benefit to entering information here.

- Confirm the details of everything you’ve entered so far to ensure you haven’t made a mistake.

- Acknowledge that you’re done.

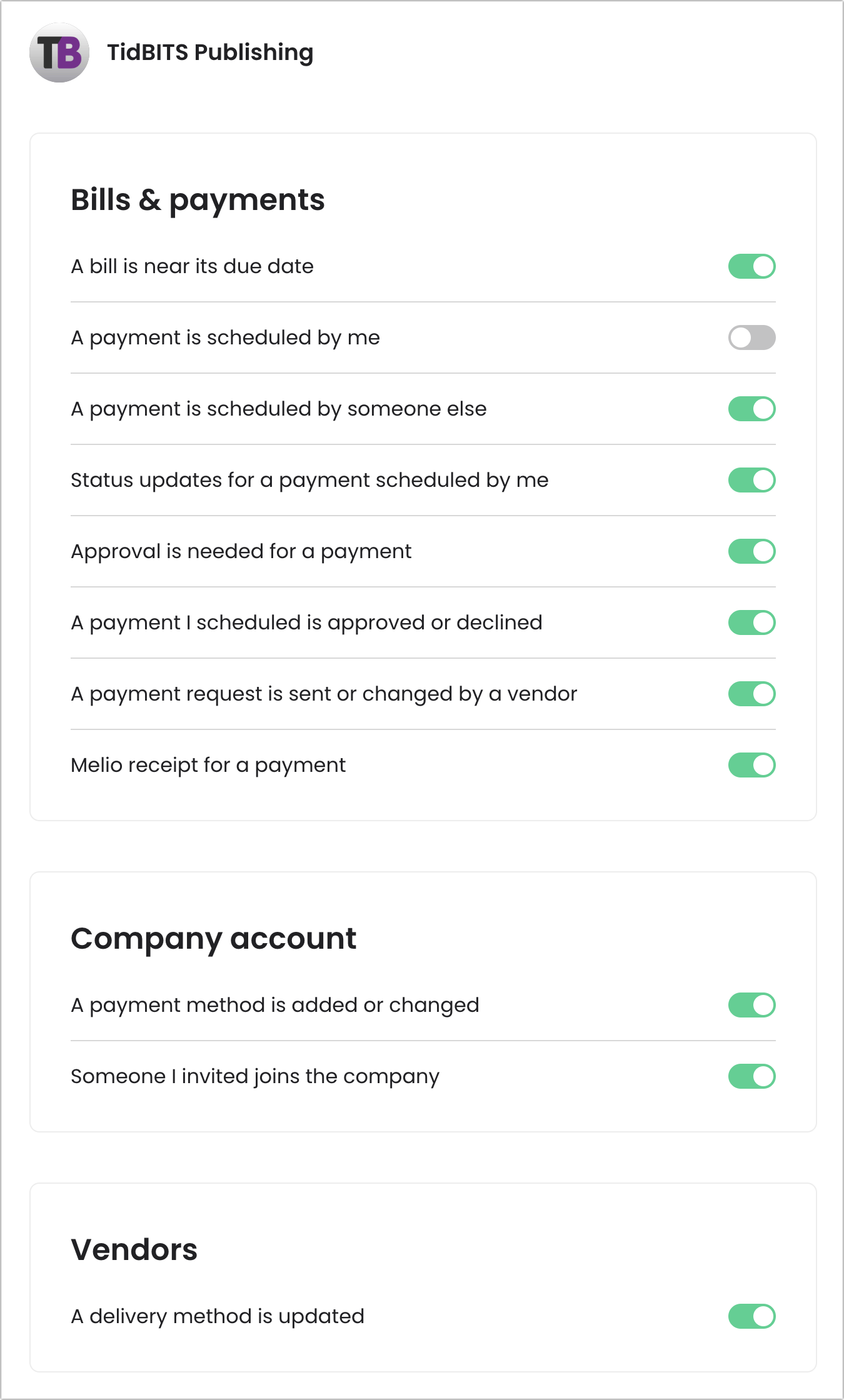

Melio’s chattiness extends to email, too. Immediately after you schedule a payment, you receive an email confirming it, and once the funds transfer, Melio sends you another message telling you that the payment has been processed successfully. You can turn off different types of notifications.

However, Melio’s notifications and other options would likely be welcome for larger companies. You can add collaborators with admin, accountant, or contributor permissions. Payment approval workflows let organizations decide who needs to approve payments and can even separate them by payment size, so, for instance, the CEO would approve payments over $1000 and the office manager everything smaller.

I’m ignoring the other half of Melio’s feature set, which offers a similarly simple approach to getting paid. You can create customers and invoices, and when you link your bank account, your customers’ payments flow in directly. On this side, too, Melio provides the option for you to get paid earlier in exchange for a 1% transaction fee. I’ve long used Stripe when I’ve needed to generate invoices for occasional consulting or other work, but I might try Melio next time to see if its promise of free ACH transactions pans out or if people prefer to pay using credit cards.

Finally, I’ve focused on the Melio website here, but the free Melio iPhone app appears to provide the same capabilities for creating vendors and making payments (but not getting paid), with the advantage of letting you use the iPhone camera to scan invoices. The app also lets you track what you’ve done, so it might be worth downloading even if you plan to set up most of your payments on a computer.

Other payment services may also offer ACH payments for free, but I have no complaints about Melio that would encourage me to switch. My only slight concern is that I would prefer Melio to offer two-factor authentication for its website in addition to the two-step verification that it employs at account setup. (The iPhone app does allow biometric login using Face ID or Touch ID.) Otherwise, the company’s security stance sounds good.

If you need to make regular payments to contractors, freelancers, or other small businesses, I encourage you to try Melio.

PayPal is very expensive way to send money across currencies or borders. If you need to do this in the future, I recommend Wise (that’s my referral link which gets you your first transfer for free). Their rates+fees are generally the best you’ll find, and the interface is excellent. I’ve been using them for many years (they were formally called TransferWise). And don’t be fooled by ‘no fees’ from PayPal and similar – it’s all in the ridiculous exchange rate they use!

Looks some general improvements are in the works, though it could take a few years even barring politics. The FedNow instant payment system is in active pilot mode:

“Fed’s new instant payment system could be trouble for PayPal, Venmo”

Oh, interesting. I wonder if @kirkmc has run across them before, since he deals with this a lot.

Someone like @kirkmc (frequently dealing with multiple currencies) might also find the Wise account useful – it provides local account details for several countries (US, UK, Eurozone, etc.). So people in those countries can make transfers to your account as if it were a domestic transfer.

I second this, wise.com is the best option by far for international transfers. Depending on the currencies involved many (but not all) transfers are also instantaneous these days. I’m a freelancer myself but a translator, and international transfers are a frequent need in this sector.

The FedNow system seems like it has potential, but it requires the banks to build the tech into their portal to allow business payments to be made faster. I think the only business payment provider in the USA that currently offers instant payments to businesses is Forwardly. They were at Scaling New Heights last month and had just launched before the conference. They can’t do cross-border yet though, it’s only domestic.

I also recommend Wise. Much cheaper than PayPal for international payments.

Another vote for Wise here. Covers the major currencies, not much use for local currencies in Africa or Asia. Use the right transfer method and you’ll not pay more than around $3 in fees, exchange rates are usually very close to mid-market rates too. All you have to decide is which currency the transfer is made in as USD and GBP accounts are available. We use it for holiday payments in local currencies that we change into GBP our end. Your payee may not be happy with the exchange rate risk in receiving USD payments.

This whole payment system sounds overly complicated, as a UK citizen.

Over here, someone emails you a pdf invoice with a reference on it (eg. “Invoice 1234”) to pay, listing Account No, Sort Code (aka Routing No, in the US), plus Bank Name. The payer then just logs into their online banking, adds those three details and a reference note (eg. “Invoice 1234”, so both sender and recipient knows what the payment is for) into a Make Payment screen, and hits the Pay button. The recipient’s details are saved for future payments, and you just change the reference note on subsequent payments to a new one (eg. “Invoice 4321”).

These payments are all free, go over an inter-bank system called FP (Faster Payments) to hit recipients account within 2-hours, with most banks accept upto £20k via this method. There was an older system called BACS which did the same thing for free, but took upto 3-working days.

I suppose most US folks don’t have such free conveniences, even in the 2020s, which is quite weird.

+1 for WISE. I also use it in the US for purchases using direct payment. Better than Zelle, or at least less fraud potential. I use it for several currencies, and am just now in the UK (which is Not Europe, and don’t you forget it!) and the Eurozone. Later this year for Turkish Lira. The dynamic quality, that is the ease with which you can move from $s to € to New Turkish Lira or whatever means that you needn’t get stuck if the dollar (my home currency) plunges against the Zloty or whatever. In the past I lost some money in euro and pound accounts so I am shy. Wise is great! Also pretty good customer service. ATM use is a bit expensive IMHO. Visa card use is really a top-up service: you can spend what’s in an account. The derisive remarks about the US payment options in the 21st century are entirely deserved. But things like WISE compared to the gyrations of getting money in London (not to mention Syria, Yemen, Egypt and elsewhere) used to be insane. Now—not so much. BUT phone service—no top-up accounts for Apple’s 14s, that have only an eSIM: the provincialism of Apple is legendary.

Yes! As an expat living in Sweden, I’ve found wise to be extremely valuable, especially for international travel. You can set up over 50 different currencies in your account, and use their (inexpensive) Visa card. Wise automatically draws from the currency offering the best exchange rate if you don’t have enough of that countries currency in your account)!

Lots of praise for Wise here. Don’t think anyone has mentioned that they also offer (multiple) digital as well as physical Visa cards. Both the physical and digital cards also have multiple settings payment methods.

This is what FedNow will be, assuming it achieves escape velocity. I hope it does.