Switching to Xero from AccountEdge

About 25 years ago, Tonya took over the accounting for TidBITS from me. I don’t remember what we used originally—possibly MacMoney—but when it came time to set up a proper business accounting system, a financial adviser friend helped us configure and learn MYOB. Over the years, MYOB went through numerous corporate transitions, and the app itself became known as AccountEdge. It was capable but clunky, never really evolving beyond its 1990’s heritage. While Tonya could get it to do everything we needed, particularly after taking an online accounting class in 2018, it was neither easy nor enjoyable to use. The main alternative was Intuit’s QuickBooks, but we had seen Intuit jerk Mac users around too many times with canceled Mac apps to trust it.

Unfortunately, AccountEdge was built on a 30-year-old, 32-bit code base that wasn’t compatible with macOS 10.15 Catalina. MYOB tried and failed to update AccountEdge to be a 64-bit app, and eventually stopped selling it. Tonya didn’t mind keeping one of her Macs on 10.14 Mojave so she could keep running AccountEdge temporarily, but we clearly had to switch accounting systems. Such transitions are most easily done at the start of a year, so in late 2020, we started evaluating the alternatives. Two choices immediately presented themselves:

- AccountEdge Pro: You have to give MYOB credit for trying. The company’s engineers figured out a way to embed the Windows version of AccountEdge in a custom emulation wrapper, and they made that the official migration path for orphaned Mac users. However, for $15 per month, we weren’t interested in using an emulated Windows app.

- QuickBooks: The 800-pound gorilla of the small business accounting world is still Intuit’s QuickBooks. Although the company seemingly sells a $399 desktop version for the Mac, Intuit’s focus is on various cloud versions of QuickBooks Online, with plans starting at $12.50 per month. After her online accounting class, Tonya started another one on QuickBooks, since it is so popular, but gave up on it, noting that QuickBooks came off as being too “helpful” in all the wrong places, papering over the debits and credits with interface terms that didn’t always make sense to her. We were also troubled by the idea of working with Intuit, and the company seems to be up to its old tricks, having just announced that it was discontinuing the Mac app that provided direct access to QuickBooks Online without having to use a Web browser. No thanks.

As we discussed the options further, we realized—or rather, Tonya gently suggested—that I should take over the regular bookkeeping tasks so she could focus on more complex tasks like managing cash flow and working with our tax accountant. That pushed us more toward the concept of a multi-user system. With QuickBooks Online out of the running, we decided to test two alternatives:

- Zoho Books: Zoho doesn’t get a lot of attention, but the Indian company provides a robust suite of Web-based apps, including apps for email, online file management, project management, meetings, help desks, remote support, and much more. In the end, we choose not to use Zoho Books because it was slightly more expensive than Xero at $15 per month and because it couldn’t automatically split a transaction into different line items. (It was possible to do manually, but our payroll transactions require splitting a transaction into 3–7 line items every 2 weeks.) It wasn’t an easy decision because Zoho Books had a lot going for it.

- Xero: Our eventual winner was Xero, a highly recommended online accounting package from a New Zealand company of the same name. It’s known for its modern approach to financial management through integration with over 800 external services and over 200 financial service providers. As of 2019, Xero had over 2 million customers. In short, Xero has met all our needs and been vastly more enjoyable to use than AccountEdge.

Xero was clearly designed during the current app era. Its interface has a spacious feeling and focuses on what you need to see and do at the appropriate moment. Overall, its design draws you in and makes you feel like spending more time in the app, rather than making you dread the tediousness of your bookkeeping sessions. You can use it on the Web or in a tablet- or smartphone-based app. And yes, to address the puffy white elephants in the room, Xero requires a subscription and is cloud-based. I’m sure some reading this will consider one or both of these facts anathema, but we see them as advantages.

As far as the subscription goes, we’re happy to pay $11 per month for a powerful accounting package, particularly because Xero’s big win for us is its integration with our financial accounts and the development necessary to keep up with the changing financial landscape. In contrast, AccountEdge costs $499, and although it wasn’t necessary to pay for its pricey upgrades every year, we were uncomfortable skipping too often. We expect Xero will be cheaper. And Xero has what looks like robust export capabilities, so there’s little worry about being locked in by a subscription.

We’re also happy about Xero being a cloud service because it lets either of us have full access to our finances at any time, on any of our devices, with our individual preferences for Xero’s customizable dashboard and menus. Previously, catching up on accounting work forced Tonya into her office on weekends since that’s where her iMac was, and she couldn’t do anything with that data while traveling. Now it’s something that we often work on together in the dining room on a weekend afternoon, with each of us signing in on a laptop or mobile device. Security is, of course, a question, but Xero has multi-factor authentication and certainly claims to be doing all the right things with encryption and security. All our banking and investment accounts are accessible online—it’s hard to be any more worried about our financial books.

Setup and Integrations

To test Xero, we started with its 30-day free trial. First, we exported a chart of accounts from AccountEdge, complete with a starting balance for each account. That imported into Xero reasonably well, although we ran into several confusions. Some of the starting balances ended up on the wrong side of the credit/debit seesaw due to formatting issues with AccountEdge’s export. Zoho Books did a somewhat better job with that and proved to be helpful in tracking down and fixing the discrepancies in Xero.

The other problem took a few sessions over several weeks in January to understand and resolve. Our goal was to switch to Xero as of 1 January 2021, but since we had been working with it and AccountEdge concurrently in December 2020, a few discrepancies arose between the two systems. After some sleuthing, we were able to identify and understand them. We finally solved the problem by manually adjusting the starting balances in Xero as of January 1st so that they matched what we had as final numbers for 2020 in AccountEdge.

Crucial to the eventual decision was our discovery of an advanced accounting feature Xero calls “tracking categories,” which contain “tracking options.” In AccountEdge, we used “jobs” to differentiate between revenue and expenses for TidBITS, the TidBITS Content Network, and my occasional consulting. In Xero, we called our tracking category “Media Property” and created tracking options for TidBITS, TCN, Adam, and General. As necessary and obvious as this feature is to us, it’s apparently not widely used, given the difficulty we had in determining which packages had it, what it was called, and where to find it. (Zoho Books calls it “tags” and uses “categories” for something else entirely.)

Regular Usage

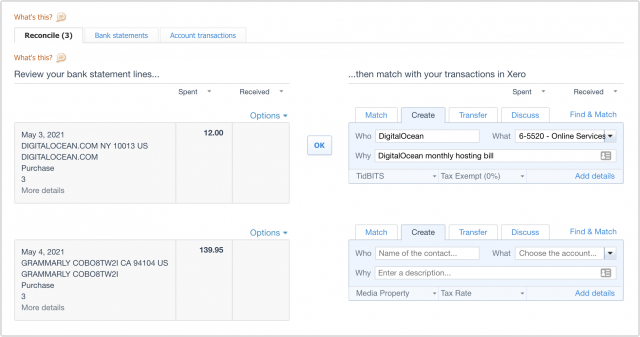

In AccountEdge, Tonya had been entering all transactions by hand—or, when possible, using AccountEdge’s recurring transactions to ease her effort. Xero has an entirely different model. You connect it to your various bank and credit card accounts, and it automatically imports all transactions. Then you go through and reconcile all those transactions, assigning them to particular contacts (Who, on the right in the screenshot below), accounts (What), and tracking categories (Media Property), and entering descriptions (Why). Xero tries to remember transactions based on the payee, and when it does, reconciling is as simple as clicking an OK button. It’s much easier and less error-prone because you never manually enter dates or dollar amounts.

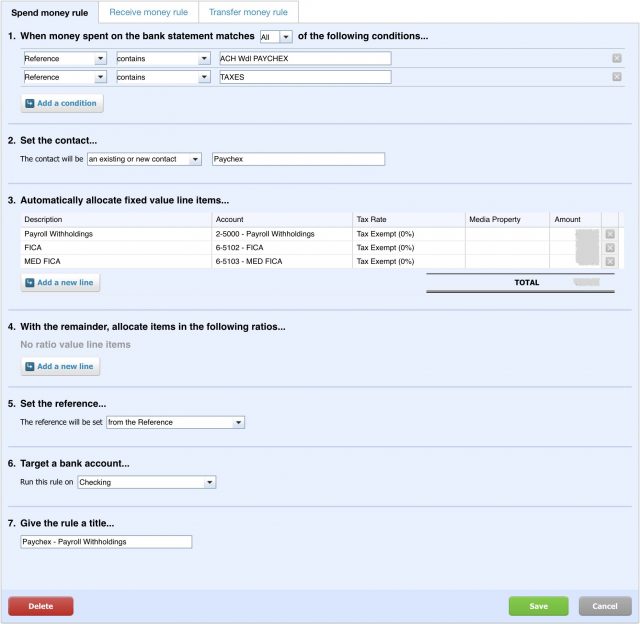

Some transactions are too complex for Xero to fill in automatically, and for those, you can create bank rules. In our setup, payroll transactions require bank rules. When our payroll processor, Paychex, deducts money from our checking account, the transaction isn’t necessarily the same as the previous one. Bank rules let us separate out the different Paychex payees and accounts and record them appropriately.

Bank rules even include options to specify fixed value line items and then allocate the remainder in various ratios. However, I often have to edit the bank rule for our payroll withholdings (shown above) because the details change based on how much we’ve contributed to various unemployment insurance funds or how much New York State has decided to increase the amount to cover shortfalls. It’s slightly irritating, but not so much that we were willing to pay an additional $8 per payroll run to link Xero and Paychex.

These bank rules are also an example of two heads being better than one. Tonya will generally recognize when automation or macros could be helpful but tends to get stuck and frustrated when trying to implement them. However, I was determined to make using Xero as automatic as possible and had the patience and mindset to create the necessary rules. What I lacked was the bookkeeping know-how to understand what some of the rules should do. Together, we got the job done.

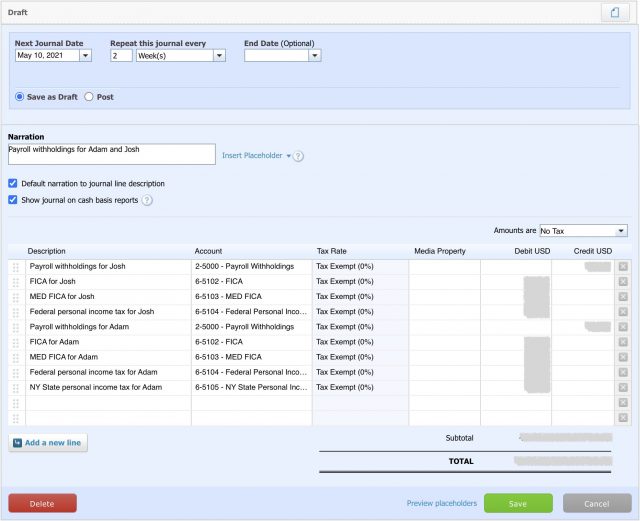

The bi-weekly payroll reconciliation is also where I smile and nod and do what Tonya tells me to do. Apparently, we need a general journal entry to split apart all the payroll withholdings behind the scenes. I was able to use Xero to create a repeating journal entry that posts every 2 weeks. I have to remember to go into the draft Xero creates, verify that the numbers haven’t changed (they sometimes move by a penny, annoyingly), and then save the entry.

During setup, we learned that Xero couldn’t connect to two of our accounts: an investment account and an Apple Card. Xero’s interface claimed it could set up bank feeds for our investment bank but seemed to stumble over our account’s use of two-factor authentication. It took some trial and error and discussions with Xero support to discover that Xero can’t actually connect to investment accounts. That makes sense—Xero does business accounting, not personal finance—but it took a while to understand the distinction. Tonya kindly volunteered to enter that account’s transactions manually, and we’re exploring how to use repeating journal entries to speed up her data entry on the handful of transactions that occur each month.

The Apple Card issue was more clear-cut. Despite all of Apple’s claims of innovation in the credit card space and sporadic data export improvements (see “You Can Now Export Apple Card Statements to Quicken and QuickBooks,” 5 June 2020), there’s no online access for systems like Xero. Instead, I export the transactions in OFX format from the iPhone’s Wallet app every month, using the share sheet to store them in a Google Drive folder from which I can then import them into Xero. It’s clumsy in comparison with all the fully connected accounts, but it works.

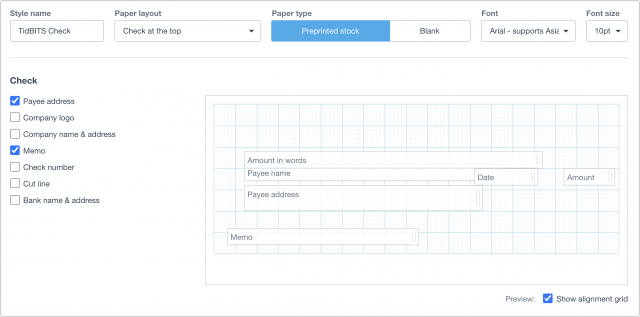

It’s increasingly uncommon for us to write business checks now that we’ve figured out how to pay our authors using ACH from our credit union. But we do write checks now and then, and it wasn’t challenging to use Xero’s check template editor to match the pre-printed business checks that we run through our laser printer. (The trick is printing on regular paper and putting the printout against a check held up to a light to see if everything is in the right spot.) Needless to say, Xero can tell when the recipient deposits the check and makes it trivially easy to reconcile the withdrawal from the checking account.

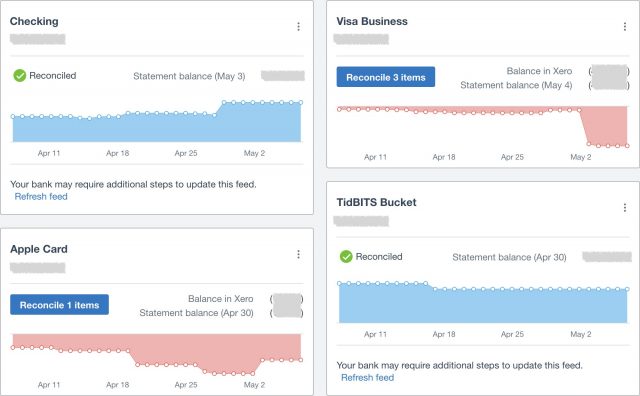

Of course, part of the reason for accounting systems is to provide information about the financial state of the business. Xero’s top-level view is a customizable dashboard that shows every account with a chart of changes over the past month. You can rearrange the various panels that appear, plus add boxes that help you pay attention to certain expense accounts, invoices owed to you, bills you have to pay, payroll that’s managed through Xero, and more. Most of these aren’t relevant to our business, so we hide them.

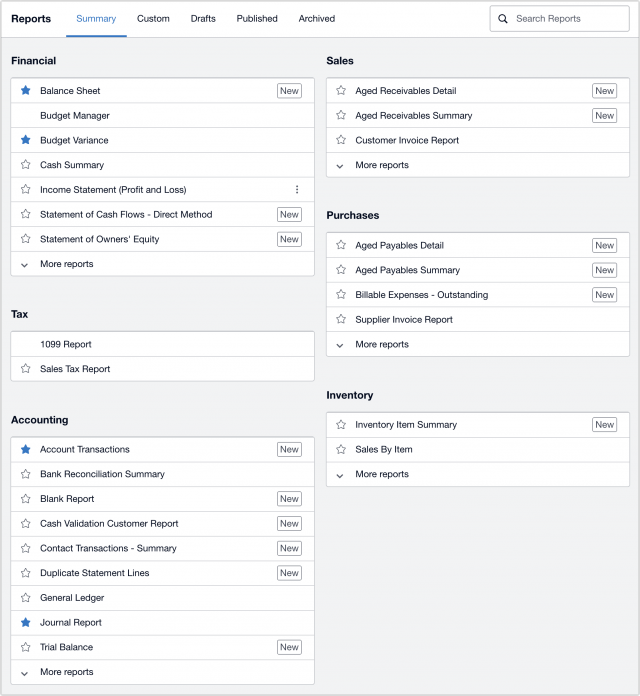

Xero provides a slew of reports, starting with the all-important balance sheet and profit and loss statement. I leave most reporting to Tonya since she has a much better idea of what the different reports convey, plus she gets requests for specific information from our accountant. So far, we’ve been able to extract all the information we need from Xero. Starring a report promotes it to the main Accounting menu for easy access, and you can also customize and save (“publish”) reports for later access.

In that vein, Xero can generate 1099 forms for independent contractors, a category that includes most of our authors. This option requires a bit more setup. Whenever I reconcile a transaction that reflects an author payment, I make sure to set that person as the contact. The first time I pay an author, if that person needs a 1099, I add them to a special contact group in Xero. When we have to generate 1099s next year, Xero can collect all the appropriate payments to those people and produce the 1099 forms.

Finally, I’ve just discovered that Xero offers flexible budgeting. You can specify a monthly budget for anything in your chart of accounts and then bring up a budget variance report that shows how your actuals compare.

What We Don’t Do in Xero

It turns out that we have a somewhat unusual way of using Xero, or potentially a slightly unusual business. As a result, we have little or no use for some of Xero’s high-profile features. Your mileage may well vary.

We receive revenue almost entirely via Stripe: from TidBITS memberships, TidBITS Content Network subscriptions, and TidBITS sponsors. Seldom do we generate a standalone invoice, and we have no desire to track revenue on a per-member or per-subscriber level within Xero—we can do that within Paid Memberships Pro or Stripe if need be. However, Xero devotes significant effort to helping its users generate invoices, link to Stripe to accept payments, and track them within the system. It works well—we tested it with one of my infrequent consulting invoices—but it’s not a big win for us.

Similarly, Xero emphasizes its bill-related capabilities, allowing you to pay one-off or repeating bills and track the payments. These features don’t help us because we pay all bills on time via a credit card or automatic bank withdrawal, and we don’t use special bill-tracking features.

One of Xero’s claims to fame is that it can integrate with a dizzying array of other services. You can sense the breadth of the integration options from Xero’s app categories: Accountant Tools, Bills & Expenses, CRM, Conversions, Custom Integration, Debtor Tracking, Documents, Ecommerce, Financial Services, Inventory, Invoicing and Jobs, Payments, Payroll HR, Point of Sale, Practice Manager, Reporting, and Time Tracking. If you use any online business service, it’s worth seeing if it integrates with Xero. For us, the integrations don’t make a difference; the only one we’ve set up is for Stripe, for use with Xero’s invoicing system.

We use our credit union’s free payment service to pay our authors by ACH, and it works well enough, but we sometimes run up against its per-day and per-month limits. We hoped that Xero would have an integration that we could use, but Xero’s technical support reps said that such a feature exists only for a couple of New Zealand banks.

Finances Made Fun

I’ll admit to some trepidation when it became clear that we needed to switch to a modern accounting system. The first few sessions were a little rough, as we struggled to figure out where everything is in Xero. That’s still our main hurdle, but it’s getting easier as we gain a better sense of the underlying logic behind the interface. Xero’s support documentation is also quite good, and the few times we’ve queried the tech support reps, they’ve been responsive and generally helpful (though our inability to connect with our investment account required them to escalate to Yodlee, the partner company that actually manages the bank feeds).

Now that I know what to do every week when I reconcile transactions, I’m genuinely enjoying using Xero. It provides that ineffable sense of completion when you reconcile all the transactions, and there are times I’ll even swing through the easy ones using the iPhone app if I have a few minutes to kill in the middle of the week. I tend to dive into more involved tasks that require downloading of reports and fiddling with payroll amounts on weekends when we’re sitting around so I can ask Tonya for clarification on any transactions I don’t know how to categorize or anything else that seems odd. Even then, I seldom spend more than 15–20 minutes on it, which is both a lot less time than it took Tonya to fuss with the manual data entry in AccountEdge and sufficiently little that I never feel like it has become onerous.

I’m sure every business has its own necessities and quirks, so I can’t begin to tell you if Xero would be appropriate for other situations. But it has been a positive experience for us—vastly better than AccountEdge—and if you’re unhappy with what you’re using now, it’s worth exploring.

I used MYOB as well during my brief period running a standalone business in the 1990s. I did learn double-entry accounting in all its meticulous glory, which has served me well ever since. Having put away those toys so many years ago, I was a little jolted by your story…especially the part about it never really evolving from those early roots.

There may be something there about what happens once a developer specs a new application and constructs it. With something as mission-critical as accurate financial accounting, early decisions and technologies may end up remaining with the system unchanged, because they can’t be altered without bringing the whole house down.

I was in a Church meeting and one of the members asked me “what software do you use to do the Church books?” I smiled and got to deliver THEE line … “Mind Your Own Business!” She looked back startled to which I then added “The name of the software is Mind Your Own Business” … fortunately she was a good egg and cracked up!

I just checked and I have data sets going back to 1992 for MYOB. Now we run AccountEdge NE 2019 which is multi-user and runs just fine but has kept us at Mojave. The nice thing about AE has been a reasonable price, a network edition and for the most part it’s stable both as an app and in terms of data corruption. Obnoxious is persistent bugs in the software and the idea that such a simple program couldn’t be recompiled to 64-bit or isn’t already operating on a shared code base (lots of tools out there like LiveCode that could accomplish this and add web support.) Thanks for reviewing alternatives as we will definitely be exploring those!

One detail I didn’t put in the article but that I quite appreciate is that Xero can do two-factor authentication with a custom Xero Verify app that uses a push notification to confirm you’re logging in. And it even works with the Apple Watch, so I can just tap a button on my wrist to authenticate.

I used Accountedge for over 28 years to manage 5 businesses sucessfully and really enjoyed its versatility, it has been a challenge to change old habits and reproduce what I could to do in MYOB. I have been able to achieve the transition with great result using Moneyworks Gold which offers many option from stand alone to multi user and cloud solutions for Mac & Window. Because I like to keep control of my datafile and don’t like the the adds on cost of XERO plus the fact that Xero is only cloud based. I encourage you to test Moneyworks they offer 45 days full functional file, great software. They offer an Myob template to import your existing data. https://www.cognito.co.nz

In the 1980s I developed a comprehensive accounting package for my father-in-law, who was spending a couple of evenings a month doing his company’s payroll. I used the brilliant DOS suite Open Access

( Shattered Wiindoze )

When I started my consulting engineering business in 1990 I used the same package. As Australian tax requirements have changed over the decades I have added or modified modules to try and keep the process as simple as possible.

I have transitioned through DOS, Windows 95, windows XP, Mac OSX to Mojave and still managed to run my software in a DOSBOX window. Now that DOSBOX is available as 64-bit I suppose I will keep using it. The only tricky thing is that all output has to be saved as text files and converted to PDF for printing & archiving.

I have looked at products like MYOB over the years and have (easily) resisted the temptation to switch. I don’t suppose I will ever need a list of invoices and payslips from 1990 but they are still there in my system (in archive files - I was restricted to working files well under a megabyte).

So thank you for documenting the woes of using commercial software.

Have to say I am a retired CPA, have been using AccountEdge since it was Accountant Inc, before it was MYOB. Went through the same process for figuring out how to transfer my brothers construction firm.

Unlike you, I will not use a cloud based accounting system, and the last thing I want is all his accounts and credit cards attached to another company. He posits his day to day transactions, I do his bank and credit card reconciliations, and prepare financials for his tax accountant.All easy enough to download from his bank and and import into AccountEdge.

We are very happy we waited and quite content with the Windows version in its wrapper. We have data back to 2002 that can still be upgraded and read should we need it. I don’t have to rewrite or adjust the chart of accounts.

Quick books is god awful and always has been. Perhaps having started my career on 13 column ledger sheets and 10 key adding machines, my need for new and clean isn’t as great. Using the current version at $15 a month is less than we paid for yearly tax table updates before.

I looked at every, and I mean, every, other package out there, including Xero, and wasn’t willing to fix what wasn’t broken for us. Everyone’s mileage may vary, but I am glad we waited and saved a good 40 hours of messing around to make something else work, and then taking another 40 or so to teach my brother how to use it.

Switching accounting packages is one of the most painful things you can do, so congratulations to you both.

My guess is that many folks reading this thread won’t need a business accounting package, and a lot of them won’t be happy with subscriptions and/or cloud-based services. I’m one of those. For personal accounting I carried on using MacMoney until long after it was sensible, then moved to Moneydance and the world got a lot brighter. Anyone looking for a personal accounting package should definitely look at Moneydance, and if they do choose it, be sure to add on the Money Foresight extension from Mahana Road Software, which takes an infinitely more sensible approach to budgeting than any other personal accounting package I’ve seen.

The concern with Xero for our purposes was handing over access to accounts to a third party. This is seeming more common, but still makes my security spidey sense raise.

Can you comment on the security concerns and how you were able to justify the risk?

Hello; I too am a long time (~20 yrs) AccountEdge user. Since needing to upgrade to Big Sur, I’ve had to shift it to my laptop to keep using it but that is not a permanent solution. I am a freelance digital artist/instructor whose business dropped dead in 2020 of course. I do not have employees, payroll, payroll tax, inventory, recurring transactions etc. I just need to keep track of Revenue, Expense, Profit/Loss, Balance Sheet, A/R, A/P, chart of accounts, etc. for my accountant. I do not want to pay (especially on a subscription basis) for all other features I will never use. I’ve looked at Moneyworks (Express package $249) and tried the MYOB template but wasn’t able to get it to work. Of course in my present state, maybe I could start my accounts from scratch I guess. My ideal product would be a one time purchase, non-cloud based. Would you say Moneyworks Express is my best fit? Thank you.

Ah, those puffy white elephants in the room, which I tried to dispense with in the article. At the risk of repeating myself, here are my thoughts about security and subscriptions.

Security

As I noted, Xero makes all the right noises about security. It maintains a list of phishing attempts aimed at Xero customers, it offers two-factor authentication, and the only “breach” I’ve been able to find related to it seems to have been the company encouraging users who had been phished to change their passwords back in 2015. Considering that Xero has 2 million users with no high-profile problems, I have every reason to believe its security team is doing a good job.

We want access to our finances from multiple locations, such as if we’re traveling. Obviously, that could be accomplished by putting files on a laptop, but then you’ve exchanged risk related to online access for risk related to physical access. The two risks aren’t the same, but it’s a fallacy to assume that physical security isn’t always a concern.

We live in 2021. Online access to sensitive information is a given for nearly everyone who participates in modern society. Your bank accounts provide online access, and if they don’t, there’s no reason to use Xero at all, since you’d lose its prime feature. In other words, Xero is, if not the least of your worries, well down on the list from things like your bank accounts, email, Apple ID, Google, Amazon, Social Security, and medical records accounts, all of which could be used to steal your money or take over your digital identity. Everyone should enable two-factor authentication for all such accounts.

Unless you maintain a backup strategy that includes a physical off-site backup, your financial records are at very real risk from fire, theft, flood, or other natural disaster. Of course, an Internet backup service like Backblaze also solves that problem, but if you’re too concerned about online security to use Xero, I would have to assume you don’t trust Backblaze either.

Subscriptions

Money is fungible. It’s the same money if you pay it out on a monthly basis or an annual basis. It’s entirely rational to compare prices. If the app you’re looking at costs $250 and charges $100 per year for upgrades, your 5-year bill would be $650 if you upgraded every year. If you pay Xero $11 per month for 5 years, that’s $660, and you get the equivalent of all those upgrades. If you choose not to upgrade, you pay less and you get less.

Subscriptions offer a predictable cost that can be built into a budget. A one-time purchase plus occasional upgrades might be predictable, or it might not be, and if it’s unpredictable, it might come at a bad time. It’s just the cost of doing business.

Subscriptions have a lower cognitive load than having to evaluate every upgrade to determine if it offers something you want or not. Upgrades usually have bug fixes, security fixes, and minor tweaks along with big new features, but it’s a lot harder to evaluate if the smaller improvements are worthwhile—they may not even be described.

I’m very interested in having companies I choose to work with be successful so they can continue to provide me with the products and services I want. If the people in charge of the company have determined that a reasonably priced subscription offers the best chance for the company’s success, I’m OK with that.

All that said, if you don’t feel comfortable with either the security of an online service or ongoing subscription fees, so be it—that’s up to you.

But I personally am completely comfortable with both, based on 31 years of covering the industry, running online businesses, and using all these apps and services.

FWIW, when I travel, I create an encrypted disk image on my laptop and copy my financial files (Excel spreadsheets) to it. I make a point of not storing the image’s password in the computer’s keychain and always eject/unmount the image when I’m not using it.

If you’ve encrypted your laptop’s drive (e.g. FileVault), what do you gain by putting your files in an encrypted disk image?

In my case, there’s a problem with the laptop’s SSD. When I tried to encrypt it, the encryption never completed. It was chewing up 100% CPU cycles for over a week before I gave up, wiped the storage and restored a backup. So this specific computer does not and will not have FileVault running. And since it’s a 2011 MacBook Air, there’s little point in my trying to fix the problem (probably by replacing the SSD).

But even if FileVault was in use, I would still continue to use the image file.

The reason is because I don’t think it is wise to assume that any single solution is perfect. For instance, there have been prior FileVault exploits. Apple fixed that one, but I have no way to know if there are others that have not yet been fixed.

Using an encrypted disk image when you’re traveling to an untrusted location is a cheap and easy way to add an extra layer of security to the system’s existing security model.

If someone has a small consultancy then this is probably all that is needed, but once there is any complexity then it is probably easier to buy an off the shelf system. If I was doing this now I would probably write the programs in R, the free statistical program, and use an SQL database. That way I could set the system to summarise billable hours on different projects.

I agree that, these days, it would be better to buy an off-the-shelf package. However in the 1980s we needed modules to track service calls, overtime, holidays and, in Australia, state payroll taxes. Multi-user access over a DOS network was also needed. Very advanced for its time, Open Access had (has) networking (e.g. record locking), SQL database and a brilliant high level programming language for managing data and the user interface. Equivalent commercial accounting software at the time needed a " mini-computer" (e.g. Burrows or HP) and was not easily customised.

As I indicated above, I still use my OA package and from time to time modify the code to deal with yet another tax office change (e.g. Business Activity Statements and Goods and Services Tax, superannuation…).

I am continuing to use AccountEdge in Mojave in a VMWare Fusion VM. my AccountEdge company files are in an encrypted disk image. i just applied the 2021 upgrade.

my needs are simple so this works for me. it’s just me that i have to account for and i keep everything on my laptop. actually that’s not true. my wife has a small company but i do her accounting for her in a separate company file.

reportedly, the windows version of accountedge works great in CrossOver, even on Apple Silicon Macs. I don’t wish to go there unless forced to by going to an Apple Silicon device.

i deliberately bought a top of the line Intel MacBook Pro immediately after the Apple Silicon announcement (replacing my previous laptop earlier than i wanted to), because i was worried about the transition and its possible effect on VMs.

One thing that we were just reminded of that has long been a major annoyance with AccountEdge is that every year, it wants you to close out your books and start a new file. As a result, there’s no way to look up information from previous years without knowing which previous file to open, and there’s no way to compare data across years. We’ve long had to maintain external spreadsheets to track data across time, which is just a waste of time, and just last night, we had a question about the last time we received a payment from some vendor. Tonya couldn’t find it in the 2020 file, and by that time, I’d determined the last payment was in 2018. So she would have had to open and search through 2019, then 2018 before finding anything.

Although we don’t have a full year in Xero yet, none of that would have been a problem as far as I can tell.

I’m glad to see the recommendation for Xero! I ran my own consulting business for several years about a decade ago. I went through a similar evaluation process to @ace and Tonya. I had an aversion to anything from Intuit, and software like MYOB seemed to me to be far too clunky for modern times, and headed for a dead end technologically.

I trialed Xero and another cloud-based product (I forget which) side by side for a bit, and ended up choosing Xero. I was surprised to find myself enjoying using it, given how dry and tedious bookkeeping can be. But put simply, it’s well made, well designed, and I knew that if I decided to grow beyond a 1-person business, Xero had the capabilities and integrations I’d need to keep things running smoothly.

For bookkeeping, I agree with Adam when it comes to both the cloud-based & subscription aspects. I also want to mention what I consider to be a significant security advantage: if you have an accountant, it’s far more secure to add them to your Xero account than to be emailing records to them. (I’m also a proponent of owning your data, and as Adam mentioned, it’s easy to export any data you want from Xero, which I did on a regular basis.)

In short, I was very happy with Xero during the years I ran my own business, and strongly recommend it.

I’m glad you called out the feature of sharing your account with your financial advisers—that could save time in generating reports, make the accountant’s life easier, and reduce costs by streamlining the entire process. Since we’re pondering switching to a different accountant this year, having them familiar with Xero might be a big win.

FWIW they have an accountant finder tool, if you don’t know someone who works with Xero through your own word-of-mouth network: Xero Advisor Directory: Find Accountants, Bookkeepers & More | Xero IE

The real elephants in the room with Xero is trying to download all your data and making a proper backup.

To my knowledge there is no easy and simple one-click way of making a backup directly in Xero. And should Xero go “pop”, and we have seen that with companies, then so does all your data and financial records.

Not a good thing and I am sure my tax office would take a dim view if I said the equivalent of the “dog ate my homework” (i.e the software company took my data).

So I use https://www.getboxkite.com to automatically download backups of data and invoices etc etc from Xero to my Dropbox.

Anyone moving to Xero should budget for, and use that service – or one of the similar ones that are offered.

I’m curious what you see as the disaster situation here, and how you’d use the backup that these services would provide. For the most part, Xero is just pulling data in from other accounts, so the backup would largely involve categorization of transactions, at least for us (since we’re not doing invoicing or billing in Xero).

So if Xero goes under as a company and millions of people were forced to switch to some other service, it’s not entirely clear to me how useful data exported from Xero would be, beyond lists of contacts and a chart of accounts. The other service would still have to connect to all your accounts and pull the data in from them. Perhaps it would support importing the Xero data, but that seems like a big assumption to me.

If the disaster scenario is instead that Xero has somehow deleted all your data, having a backup might make it easier to import data back into a fresh Xero account, for sure. However, in that case, I think I’d be very leery of continuing with Xero and would be looking for an alternative immediately.

When we switched from AccountEdge to Xero, the only thing we imported was our chart of accounts with starting balances. Admittedly, that was at the start of the year, so we were starting fresh. But having other data in AccountEdge certainly didn’t help us in any way.

I run a small business and I use Xero as a full accounting package dealing with invoicing, billing, VAT (a UK sales tax), payroll etc. Unless you are meticulous in keeping records and copies of all the receipts, invoices etc before they are entered into Xero then you are relying on Xero keeping all of these records secure. In UK law you (not Xero) are responsible for keeping full tax records for (I believe) x7 years and that includes copies of all receipts, invoices, expenses claims, bank account records, VAT returns etc.

Now, Xero say in their T&Cs that you are responsible for maintaining backups of records (https://uptakedigital.zendesk.com/hc/en-us/articles/360000096036-Do-I-need-to-backup-Xero-). Yet Xero gives you no easy “one click” way to export all your records. You have to do lots of exports: Xero Central

If Xero were to fail, go bust or disaster should strike, and all my data in Xero were to disappear, then UK tax authorities would say that liability for my records lies with me. Which is why I use the third party backup service that I previously mentioned as this backs my data up daily in a way that another accounts package or accountant could easily work with.

Yes all the original data my still be found in lots of different places, but Xero is where all my receipts, expenses, bills were uploaded, and that is where I generate my tax returns, VAT returns and invoices etc. So I am amazed that Xero does not offer a simple built in way of backing up all my data I have entered in an easily accessible form and I am surprised that you seem “relaxed” about this – I thought your data was only as good as your backups

It does sound like backups would be vastly more important for a business that was using as much of Xero as you are. In our case, Xero has very little unique data since it’s just reading the data from the actual sources, which would remain accessible. If we were forced to switch to another accounting package tomorrow, it would be annoying, but with a chart of accounts and recent account balances, it wouldn’t take long to bring it back into sync. It sounds like that would very much not be true for your business.

From what you’re saying, the key for Xero backups is to make sure they’re being made in some sort of format that could be imported into a different accounting package. Perhaps I’m as “relaxed” about this as I am because AccountEdge did nothing more to help us in that regard—we switched to Xero with just the chart of accounts and opening balances.

This is a topic near and dear to my heart, @ace. In the past year, I have used just about every major and most minor bookkeeping packages for MacOS, as well as a few cloud solutions. I’ve been thinking about Xero (as well as waveapps) but haven’t made the leap yet.

I agree with your assessment of AccountEdge - it’s very 1990s, and just so clunky. For my personal finances I live on GnuCash, which is also clunky but allows me to keep everything offline. I also had a brief flirtation with the “plain text” accounting programs ledger and beancount, but disliked how unstructured entering data was.

I have been thinking long and hard about the cloud issue. It’s certainly true that the cloud luddites (I’m one!) tend to be individuals - businesses, by and large, have flocked to the cloud in droves, so I think this may simply be a case where we as individuals are magnifying the risks past what they actually are.

Lately I’ve been experimenting with manager.io (in fact, I just made a video about it), which is a multi-platform package that supports both cloud and local use. Like Xero, it’s very focused at business. Unlike Xero, it doesn’t have the tight integrations to banks. I suspect that once you’ve gotten used to those integrations, going back to a package without them is going to feel like lighting a fire by rubbing two sticks together.

It is not unusual that double entry accounting programs don’t have good support for investments - GnuCash is really the only one I can think of with first-class support, and even there you run into the impedance mismatches between how we as individuals want to think of our investments (“My BIGCO shares are worth $50,000!”), and how the ledgers want to think of them (“You paid $200 for your BIGCO shares, so that’s what they’re worth.”)

Thanks for the deep dive into your migration to Xero! It gives me a lot to think about.

Sounds like you’ve put a lot of thought into this indeed, @peterb1! I hadn’t heard of manager.io before, but it looks like it might be a good alternative for those who were using AccountEdge and want to stay off the cloud.

I will say that since I wrote this article, I’ve continued really liking Xero. The reconciliation aspect is just so satisfying.

The real question I have is why is it so impossible to port data from one accounting package to another. We have the .qbo format, but it’s fairly primitive. There should be a portable document format that all of these types of software adhere to. I guess the incentives align against it, though.

I HAVE SO MANY THOUGHTS ON THIS TOPIC, I’m sorry sorry for continually necroing it!

Moneydance is my “It’s ALLLLLLLLLmost great” choice from among the single-entry “checkbook register” programs; Banktivity is in this category too. I like much about the UI (although Moneydance’s split-entry UI is super-overloaded and IMO confusing). But all of these programs suffer from the same problem, which is that checkbook-register accounting is inherently error prone and, once you’ve made a mistake, is difficult to recover from. I can’t count the number of times I began using a new personal finance program in earnest and then, 18 months later, realized my books were garbage and had to effectively pick a new “day zero” to fix things up. (Having used double-entry for years now, I’d estimate that my “error rate” is about one mistake, per account, per month. So any software that doesn’t help me find those mistakes IMMEDIATELY is software that is causing more problems than it solves.)

So you want double-entry, because if your finances are sufficiently complicated it’s a requirement to find your mistakes. But, none of the double entry programs do a great job with investment accounts. So basically you’re faced with this Venn diagram, and there is nothing in the intersection of all three circles:

The format is there, it’s called XBRL.

Now convince the software makers to adhere to it.

I am currently going through accounting system change in my office, from Solomon 6.15 (Windows, ancient version) to Acumatica (cloud based accounting for businesses). I’ve been through a few accounting system migrations in my IT career, but most too ancient to bother mentioning. But in every case we never ported all data, just month closing balances for the previous 2 years, vendor information, and the like. But never entries. In many cases we had to redesign the chart of accounts to work well with the new system, though also a good chance to streamline our systems. I will be so happy that I will be able to retire our single Windows server after migration is done, we will keep the old system running for 18 months for looking up historical information. Otherwise we will depending on the monthly spreadsheet exports for historical information.

ARISE, necro’d thread! Adam, I want to zero in (<— SEE WHAT I DID THERE) on one paragraph from your article:

I bit the bullet and signed up for Xero and have spent the last month exploring it. There is actually a way to leverage the invoice/bill workflow in a way that will help you, even in your “Early” plan. It has to do with the free Hubdoc subscription they give you.

So just to recap, reconciliation on Xero matches transactions you enter into the system with the transactions that come from your bank feed (or OFX import). Probably right now, especially for the Apple Card transactions, Tonya spends time matching transactions or else entering the data anew with the bank feed/OFX transactions. Just about every time I go to reconcile I think to myself “I think I created most of the transactions I needed to know about”, and every time I am wrong.

The trick is that Hubdoc, in addition to letting you generate invoices from OCRd receipts, will also generate payments. So now for 90% of my transactions, the workflow is:

(1) Buy a thing.

(2) When the receipt shows up in my email, forward it to a special address at Hubdoc (which has already been connected to Xero). Forget about it until later when I can log into hubdoc and do a bunch at once.

(3) When I start looking at the forwarded receipts, Hubdoc pulls out about half the info I need (notably usually the total spend, but often the vendor name, etc).

(3)(a) If this is the first receipt for this vendor, I have to enter a little bit of Xero-specific data (what account to charge it to etc)

(4) Click “Publish”. The transaction goes into my Xero ledger without my even having to log in.

For future transactions from the same vendor, you don’t even have to enter the Xero-specific data, because Hubdoc remembers the settings for last time.

When the transaction comes in from the bank feed or OFX, the matching transaction is already entered, and you just click “OK”. And as a bonus, your original receipt is attached as an image. This workflow is clearly “meant” for invoices and bills, but it works just fine for normal payments, and using it has substantially decreased my error rate (in part because the receipt in question is actually on the screen while I’m categorizing it, so no looking back and forth between windows or the like).

Hope this helps!

Interesting! Kudos on the research here, and thanks for all your input into this topic.

You are correct that I download the Apple Card statement from Wallet every month and then import the OFX into Xero. It’s more annoying than a linked account, but not terrible.

(I export from Wallet into a Google Drive folder using Files, and then Google Drive Desktop on my Mac brings the file to the Mac where I can import easily. The hardest part is renaming the file since Apple’s default naming wouldn’t sort reasonably: they use

Apple Card Statement - October 2019.pdfand I change that to2019-10 Apple Card Statement - October 2019.pdf.)What I’m not quite understanding in your Hubdoc technique is what that gets you beyond what the OFX export/import provides. That’s likely because we use the Apple Card pretty much only for purchases from Apple, so it gets Apple Music and iCloud+ and any hardware purchases we make. Since the payee is always the same, I’ve had to make rules to say that $14.99 goes with Apple Music and $9.99 goes with iCloud+, but then it’s just a matter of clicking OK to reconcile the transactions.

So if I’m guessing correctly, your Hubdoc technique would provide additional information for Xero to recognize transactions more accurately than it does on its own? We could theoretically use that with our business Visa card, which is imported automatically. I haven’t felt like I was doing an unreasonable amount of categorization on those transactions—the first one is always an issue, but after that, Xero remembers them. Even there, most of them are recurring fees like our hosting bills and software subscriptions.

I’ve had that naming issue too, and I wish they would fix it (and/or provide bank feeds, but baby steps I guess…)

The technique I’m proposing isn’t actually life-changing, but more of a linear quality-of-life improvement. Pre-hubdoc, my flow for the Apple Card looks like this:

(1) Download transactions at end of month.

(2) Import OFX to Xero.

(3) Look at each transaction.

(4) Click “Ok” for the recognized easy repeating transactions.

(5) For the remainder, find receipt and/or remember what it was, and ‘code’ it to the right account.

If all of your transactions are already recognized by Xero, then I don’t think Hubdoc gets you much more on top of what you are already doing.

For me, however, although many of my transactions are repeating, enough of them are left over after step (4) that step (5) is annoying - I have to go find the right receipt at worst 29 days after I generated the expense. With hubdoc, the flow looks like this:

(-1) As I generate an expense, forward the receipt to my hubdoc email and forget about it.

(0) Right before reconciling, code the receipts in hubdoc. You don’t have to go looking for the receipt because it’s right there on screen.

(1) Download transactions at end of month.

(2) Import OFX to Xero.

(3) If you did it right, every transaction in Xero is reconciled by just clicking “ok”, because it’s already coded.

The one other thing hubdoc does that doesn’t matter much to me but is important to some businesses is extracting exactly how much tax was paid on a given receipt. But for me the secret sauce is mostly just the convenience of having the receipt in front of me while I’m coding it and pulling out the business name automatically.

I would use a Folder Action for this. (Select a folder and choose

Services > Folder Action Setup…from either theFindermenu or the ctrl-/right-click contextual menu.) You’ll need to create a script to do the renaming, how you do this depends on what you’re most comfortable with. It could be done in pure AppleScript, or you could call sed from the script, or any Unix scripting language.Once you have your script and set it up as a Folder Action on the folder in Google Drive, whenever you add a file to the folder by exporting from Wallet, the script will run and automatically rename it for you.

Good! I see what you’re doing now, and I think it’s a clever approach. It isn’t likely to help me much due to how we use the Apple Card, but I think others could very much benefit from it.

Doh! Of course. I’d probably do this with Hazel, which is what I tend to rely on for folder-based stuff. I hadn’t even thought of it because I’m starting the process from Wallet on the iPhone and saving to Files on the iPhone—I wasn’t thinking of it as a Mac task. I hadn’t even thought about using Shortcuts (and now that I look, it doesn’t tie into Shortcuts at all).

This is definitely a deal breaker for Account Edge. Thank you so much for pointing this out.