Evaluating Your iPhone 11 Purchase Options

If you decide to buy an iPhone 11 or iPhone 11 Pro (see “Apple Announces iPhone 11, iPhone 11 Pro, and iPhone 11 Pro Max,” 10 September 2019), you may be puzzled by the dizzying array of purchase options that Apple offers when you check out.

Trade In, Trade Up

During Apple’s September 10th event, Apple retail chief Deirdre O’Brien mentioned Apple’s new Trade In program, though the details were vague. I was also puzzled because Apple has offered a trade-in program for a few years, called Trade Up with Installments. I’m not sure we covered it here at TidBITS, but it was announced alongside the iPhone SE back in 2016. As far as I can tell, the new Trade In program is the same as the old one, apart from the name.

Apple will also let you pay for the phone in installments outside of the iPhone Upgrade Program, but again, this Apple iPhone Payments program isn’t new, just better advertised (here’s Mashable talking about it in 2017).

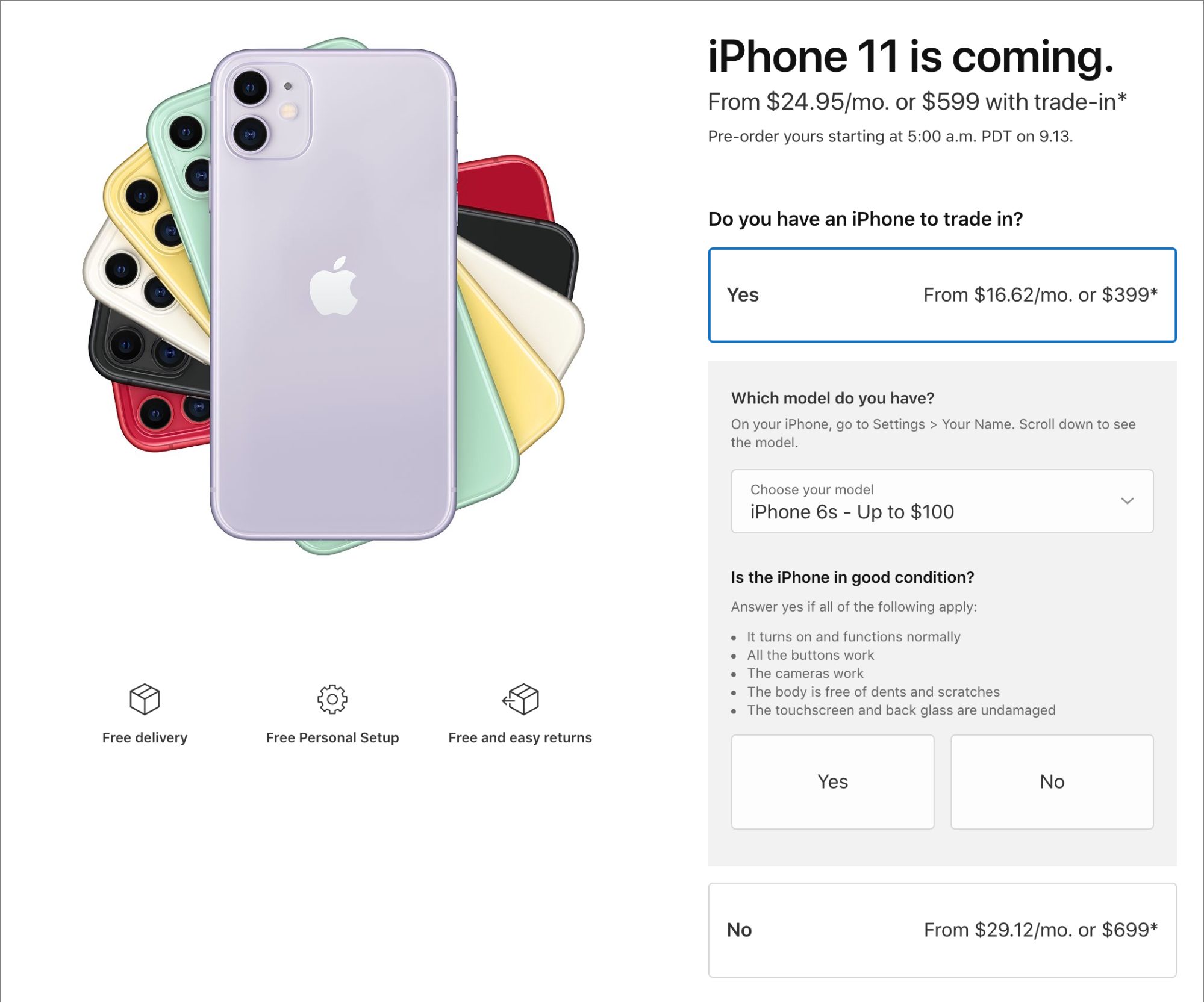

If you run through the steps to buy an iPhone 11 now, you’ll first be asked if you’d like to trade in an iPhone. If you click Yes, choose a model to trade in, and confirm that the iPhone is in good condition, Apple will factor your maximum trade-in value into either your total purchase price or your monthly payment, depending on which option you pick.

There are a couple of catches. One is you have to ship your old iPhone to Apple before you can get a firm trade-in amount. Apple makes this easy by sending you a trade-in kit with a prepaid shipping box. Once you have the kit, you have 14 days to return your old iPhone to Apple. Apple will inspect your iPhone and, if it’s in satisfactory condition, the company will either credit your payment method or your monthly bill, depending on whether you paid for your iPhone in full or if you chose the Apple iPhone Payments program.

Note that you might not get the full amount—that’s why Apple says “up to” some amount. If Apple feels that your assessment of the iPhone’s condition was overly positive, it might knock off some of the promised trade-in value. However, in my experience with the iPhone Upgrade Program, Apple hasn’t been excessively particular.

Payment Options

Let’s focus. If you choose to trade in an iPhone, you have two payment options:

- Apple iPhone Payments: Pay off the iPhone over 24 months, with the trade-in value credited.

- One-time payment: Pay the full amount now, minus the trade-in value.

If you’re not trading in an old iPhone, you have additional options:

- Apple iPhone Payments: Pay off the iPhone over the span of 24 months.

- AT&T or Verizon’s device payment programs: Pay the device off over 24 months, except this time you pay your carrier, not Apple. Note that if you pay AT&T directly, your iPhone will be locked to AT&T until it’s paid off.

- Apple iPhone Upgrade Program: Pay your iPhone off over the span of 24 months, with an option to upgrade after 1 year. Unlike the other three options, AppleCare+ is included, which accounts for the higher monthly fee than the other two installment plans.

- One-time payment: Just get it over with already and pay in full.

Which should you choose? Here are some things to consider.

The payment programs are interest-free.

Whether you choose a carrier’s payment plan or one of Apple’s, they’re all interest-free loans. Some people mistakenly think Apple charges interest for the iPhone Upgrade Program due to the higher monthly fee, but that’s because AppleCare+ is rolled in. If you’d rather pay the whole amount upfront, that’s fine too, but there’s no disadvantage to choosing a payment plan apart from having to account for the transaction every month.

You can save 3% if you purchase with an Apple Card.

If you have an Apple Card, remember that you get 3% cash-back with every Apple purchase (see “How to Get the Most from Your Apple Card Benefits,” 14 August 2019). If you buy the iPhone upfront, you’ll get the 3% the day after your card is charged. Otherwise, you get 3% the day after every monthly payment. So for the base-model $699 64 GB iPhone 11, you would receive a $20.97 discount (not counting tax).

It’s best to avoid AT&T Next if you want an unlocked iPhone.

If you buy an iPhone through the AT&T Next monthly payment program, you’ll be among a tiny minority of iPhone users in the United States who are stuck with a carrier-locked phone. Apple says:

Nearly all iPhone models sold on apple.com and at the Apple Store are unlocked. This means they aren’t tied to a single carrier. The exception is when you buy an iPhone with AT&T Next. It will be tied — or locked — to AT&T.

If you might want to change carriers or—more likely—travel overseas where local SIM cards provide better service rates, you definitely want an unlocked phone.

Do you want AppleCare+?

Every purchase option lets you buy AppleCare+ separately, either at the time of purchase or up to a year later. And instead of a one-time payment that limits coverage to 2 years, you can now opt to pay for AppleCare+ in monthly installments, in perpetuity, or at least until Apple can no longer service the iPhone. Paying for AppleCare+ for too long makes no financial sense since at some point the payments would get you a new iPhone. Regardless, the iPhone Upgrade Program rolls the AppleCare+ price into the monthly payments for an iPhone, so it’s a bit more convenient.

Do you want to upgrade every year?

The downside to the Apple iPhone Payments program is that it doesn’t offer an annual upgrade option. The iPhone Upgrade Program and the carrier upgrade plans both let you upgrade after 1 year of payments, which could be useful if next year’s iPhone has features you find compelling.

But what if you don’t want AppleCare+?

If you want to pay monthly and have the option to upgrade every year but don’t want AppleCare+ for some reason, your best bet is one of the carrier upgrade plans. But I don’t see why you wouldn’t want AppleCare+. It’s cheaper and better than the carrier’s insurance plans, and iPhones are constantly at risk for breaking. If you buy into an upgrade program without AppleCare+ and break the phone after a year, you would be on the hook to buy a brand-new one, and you won’t have a functional phone to trade in to offset the cost.

I can’t decide! Pick one for me.

Go with the iPhone Upgrade Program. Here’s why:

- It’s an interest-free loan. You could pay for an iPhone upfront, but why hit your cash flow when you could spread out the cost for no extra money?

- You get 3% cash-back if you pay with the Apple Card.

- AppleCare+ is included so if something goes wrong or you break the iPhone, it won’t be terribly painful.

- You can upgrade after 12 months or keep the iPhone after 24 months. Of course, if you upgrade, you reset to another 24-month commitment, but the amounts should be much the same as if you bought the first iPhone outright—with AppleCare+—and traded it in the next year.

If you’re locked into the Apple ecosystem—and we suspect that if you’re reading this, you are—it’s hard to go wrong with the iPhone Upgrade Program.

Last night I used the Apple Store app on my iPhone 6 to set up the trade-in, payment program, and iPhone 11 purchase. It ran a credit check to pre-approve the payment program. This morning at 5am all I had to do was click “complete purchase”. I don’t remember the exact wording because it was 5am and my eyes would barely focus. On the first few tries I got a message saying the trade-in program wasn’t currently available and to try again later. But after five or so minutes of trying it went through and I went back to sleep. My new phone is supposed to show up on the 20th. All-in-all it was very fast and convenient. It even let me set up a Siri shortcut to check my order status.

I ended up going for the payment program instead of the upgrade program. I (obviously) don’t need to upgrade frequently and I’ve (knock on wood) been really lucky with my screen so I don’t want to pay for AppleCare+. I’ve only had one cracked screen since my iPhone 3GS.

I can’t believe I’ve been using the same phone for six years. Now I’ll have to read back through all the TidBITS articles about new iPhone hardware to remind myself of all the new stuff that’s been added since then. And drink a toast to my headphone jack as I box my iPhone 6 up for the return.

I think Josh’s article sounds very reasonable, but I have to admit I still don’t like the idea of paying off a new iPhone with a plan. Interest or no, I think there’s something to be said for the type of financial freedom you obtain when you don’t have unnecessary debt or obligations. I can pay for an iPhone upfront. Is there an advantage to paying it off over the course of 24 months? What I imagine is a situation where I manage to destroy the phone. Now I’ll be paying off a device that doesn’t even exist anymore. Feels just outright cringe-worthy to me.

Ironically, I would definitely use such a plan for a work Mac. That’s a $3k+ investment I know will run for at least 2-3 years and experience tells me is not prone to being destroyed (repairs sure, but not outright loss). I’d be more inclined to buy that on a 12/24-month installment plan (especially one that’s zero APR) than an iPhone.

I’m not convinced about the trade-in either TBH. Take for example my old 64 GB iPhone 6. Apple would give me $60 for it. Not a big chunk compared to the cost of a new iPhone. Now while that old 6 has little market value, it has a lot of value to me personally in that it is my insurance that if I never need my new iPhone serviced and Apple’s turn-around goes beyond a few hours, I’ll have a spare phone to bridge a couple days. That peace of mind is to me worth more than the $60 Apple would give me for it. I guess the counter argument would be that you could always buy a brand new iPhone to use essentially as a loaner and then return it within 14 days for full refund. Apple is indeed absolutely great about that.

Even if you do have the funds to pay for something in a single lump sum, it can make sense to go for monthly installments: the key concept here is “opportunity cost:” you can only invest the money you have, once, so you should try to maximize the return you get from all possible investment of a given amount.

If you pay full price, the money is — obviously — instantly gone.

If, however, you have an option to pay with monthly installments at 0% interest, you could put some of the money into an account that pays you interest, and just transfer each monthly installment from that account to the seller.

However small the return on that investment would be, you’d still always effectively pay less than the full price tag for the product you’re buying (assuming, of course, that the transfer, etc. would not incur any fees.)

The iPhone 6 was released in 2014, five years ago, not six. Still a pretty good run

Hehe, that’s certainly true in theory. In reality, my checking account currently offers 0.01% interest. Over 24 months, that makes 10¢ profit on the money I’d spend towards a new iPhone. Not quite worth the effort. Now of course my super low-expense ratio ETFs make 6% per year on average, but that estimate isn’t really honest either, since the only reason my earnings average that high is because I can afford to leave those ETFs there for many many years (until I plan on retiring actually). If I know I have to have access to those funds on shorter time scale such as 24 months, I can’t assume those kinds of gains are realized.

The opportunity cost is of course a real thing and your argument is certainly valid, but I would go so far as to claim that on a comparably small purchase like this, with considerable risk of loss of the entire investment (I manage to drop my brand new iPhone down the gutter), in practice I just don’t see a significant enough benefit. I do, however, get a warm fuzzy feeling knowing that I don’t have another creditor on my balance sheet when I pay it in full. Your milage may of course vary.

Your milage may of course vary.

I’m still using an iPhone 5 , so almost 7 years. I am looking closely at the iPhone 11 Pro though.

, so almost 7 years. I am looking closely at the iPhone 11 Pro though.

That would explain why I couldn’t believe it. I was counting years by model (6S, 7, 8, X, XS, 11) but I forgot that the 8 and X were released the same year. I should have double-checked with Mactracker before I wrote that.

I was counting years by model (6S, 7, 8, X, XS, 11) but I forgot that the 8 and X were released the same year. I should have double-checked with Mactracker before I wrote that.

A loss is a loss, whether you paid in full or in installments; perhaps it would feel worse to be paying installments for a phone you don’t have anymore.

Again, feelings. My wife’s phone was paid off in installments to Verizon (zero interest), it was a nice feeling when her phone bill went down; from then on, however long her phone lasts, it’s like getting it for free.

If the zero interest phone installments are paid through the phone bill and if one routinely keeps as much money as possible in an account that earns non-negligible interest (a number of online savings accounts are at 2% or more), it takes no effort to earn some more interest rather than pay for the phone in full. With the two options, pay in full or in installments, either can bring positive or negative feelings depending on your perspective but only one of them will also bring, say, twenty bucks you wouldn’t otherwise have.

Meh. I’ll just stick with my 10th Anniversary SIM-free iPhone 10, thank you very much.

I’m on T-Mobile, which wasn’t covered in the list of carrier upgrade options. They offer the standard two year no interest purchase plan, but their trade-in allowances are more generous than Apple’s for older phones. My iPhone 7 is worth $350 at T-Mobile, as is everything up to the XR. The XS is worth $500, and the XS Max $550.

One reason not to sign up for AppleCare is that some home policies and some credit cards cover phone damage. For instance: