You Can Now Export Apple Card Statements to Quicken and QuickBooks

When Apple launched the Apple Card, it came without any way to export your transactions such that you could import the data into a personal finance app—all you could get out was a PDF. Apple started to rectify that glaring lapse at the beginning of the year by adding the capability to export transaction data in CSV (Comma Separated Values) format (see “Apple Card (Finally) Gains CSV Statement Export,” 23 January 2020).

However, CSV format wasn’t sufficient for many personal finance apps. In February 2020, Apple added support for OFX (Open Financial Exchange) format. It was a somewhat troubled release, with TidBITS Talk participants trading tips on how to edit exported files to get them to import properly into various apps. Apple worked out the kinks over the next few months, and the complaints died down.

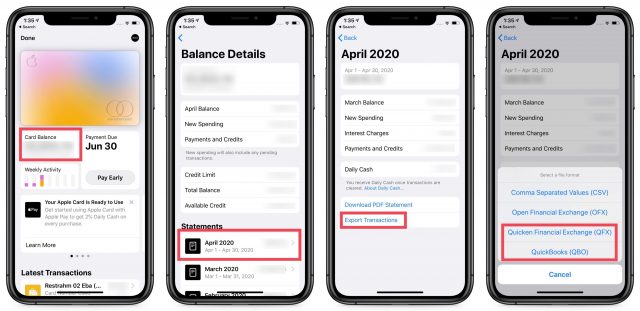

Now Apple has extended the formats available to Apple Card users even further by adding support for Quicken’s proprietary QFX (Quicken Financial Exchange) format, which is an extension of OFX, and the QBO format used by Intuit’s QuickBooks. Here’s how you export those formats:

- Open the Wallet app on your iPhone.

- Tap your card balance.

- Under Statements, tap the desired month.

- Tap Export Transactions.

- Choose either Quicken Financial Exchange or QuickBooks. Comma Separated Values and Open Financial Exchange are still options.

- Choose the destination from the share sheet. The easiest ways to get them to your Mac are probably AirDrop (your Mac might be an AirDrop shortcut at the top of the share sheet), which will send the exported file to your `~/Downloads` folder, or Save to Files (pick a location in iCloud Drive).

For something that’s human-readable, you can still download your statement as a PDF. In Step 4 above, instead of tapping Export Transactions, tap Download PDF Statement.

Here’s how you can use the various formats Apple Card can now export:

- QFX: Import into Quicken by choosing File > Import > Bank or Brokerage File.

- QBO: In QuickBooks, choose File > Utilities > Import and then Web Connect Files.

- OFX: Import into any app that supports this format, like Banktivity, Moneydance, and You Need a Budget.

- CSV: Open in any spreadsheet or import into an app that supports CSV import and lets you map import fields appropriately.

- PDF: File for later reference or print; it’s not structured data that you can import.

If anyone has figured out how to automate this process with Shortcuts, let us know!

Now if only Apple would let multiple people in a family share an Apple Card. Other common requests include the capability to download transaction data without waiting for a statement and support for other countries. How else would you like to see Apple improve the Apple Card experience?

Lack of Qucken support is pretty much what’s kept me from getting an Apple Card. (Well, I guess also that I don’t really need an Apple Card…) So this is nice, but every other credit card I have lets me pull transactions into Quicken with their one-step update, and it looks like Apple Card still won’t do that. So Apple Card is a little more tempting now, but still not great.

other financial institutions let you download transactions whenever you want to. it appears that apple only lets you download an entire statement after that statement has closed. not very useful for keeping track of spending as it occurs

I’ve been wanting to get an Apple Card, but 3 things are holding me back:

Lack of support for my wife and I to share one card (and see each other’s transactions). Every other card can do this.

No extended warranty/extended AppleCare.

No built-in envelope budgeting for those that use one card for everything.

I live in UK and have been waiting to get one. Still no date when it would be available here.

Come on Apple give us some information

Carol

Yep, that’s my suggestion for how to improve Apple Card. There’s a whole world outside the USA Apple!

Same here in Ireland. Looking forward to it.

Re Quicken wanting to new account - the thing to do is open the second drop down list and select the account you want the data added to - presuming you already have an Apple Card account.

Family accounts we be thoughtful and welcome. My wife charges as much on our American Express as I charge on the Apple Card.

I guess I can live with only adding the transactions once a month since I can see them daily or oftener on the iPhone.

When I request the download I send it to dropbox. Since I had done that previously it went to the correct folder in dropbox when I downloaded the QFX file.

That being said I don’t understand the reluctance to allow downloads as desired.

It everyone uses something like Quickbooks or Quicken. Some of use on line services and the Apple Card doesn’t work with those at all.

I would like to have the option to export transactions by a defined time period, i.e. I now need to export each month.

My 2 biggest issues are (in order):

Thanks to this article, I’m now able to import AC transactions directly into Quicken. Woo hoo! Many caveats, as have been mentioned, but it basically works. There is a first-time setup where Quicken will prompt you to link the new source to an existing account (or set up a new one), and it’s not obvious it is talking about the Apple Card, but since that’s the only new source it’s easy enough to deduce.

The real mystery to me is why this has been such a clunky road for the normally tres elegante Apple. My guess is that it has to do with their really odd decision to have Goldman Sachs as the issuing bank. GS only started dabbling in the Consumer Banking market a few years ago, and they likely just didn’t have the software or infrastructure in place to interface with Quicken and the like. So we get to be their Guinea pigs on that journey. In that case, all I can say is, “Oink!” (I know Guinea pigs aren’t pigs. Work with me here.)

I guess I should be be used to Apple somewhat arrogantly deciding what features in my life I don’t need anymore. I got an Apple Card to finance my new MacBook Pro not realizing that I would not be able to automate Quicken downloads with this lame card. This is something I can do with every other aspect of my financial life – credit bards, PayPal, my investment accounts – absolutely everything. I’ve been able to do this for decades.

Apple so arrogantly pronounced their card as better – because it’s designed by Apple. No, Apple, you’re wrong. This card is lame. I will take advantage of the free interest, but I won’t be adding a single other transaction to this card. And when I’ve paid off the card, I close it.

Maybe if Quicken was a shiny new port that Apple had designed it would be better supported. Or is Apple struggling financially and couldn’t find the resources to support something every single other financial institution in the world, just about, can support.

Come on Apple, earn your arrogant pronouncements. Or are transaction downloads the new headphone jacks?

It probably has everything to do with using Goldman Sachs.

The Apple Card does have some quirks. For example, compare the monthly statement for the Apple Card with ones from other credit cards. The other statements all show a card number associated with your account (the same as on the physical card); the Apple Statement shows no such number, only your name and Apple ID In fact, the numbers associated with Apple Pay for each device, the optional physical card, and non-Apple Pay Internet payments are all non-permanent and are not key fields for identifying the account. As grantcv1 noted, you cannot set up an automatic import of the statement to your financial software.

However, I have never wanted to have such a link. I view it as a security risk to have any password associated with the connection stored with a 3rd-party or in 3rd-party software. So I find it totally adequate for the Apple Card to provide a file in .qfx format that can be imported into the computer’s financial program.I use Moneydance, rather than Quicken, but find he process works as well for the Apple Card as for all my other credit cards. By the way, the process also reveals the account uses a 19-digit hex field as the unique, unchanging identifier.

I presume that no one has figured out how to automate the downloads or, failing that, to specify a date range (other than a month) for a download.