Apple’s Q3 2021: Still Making Money Hand Over Fist

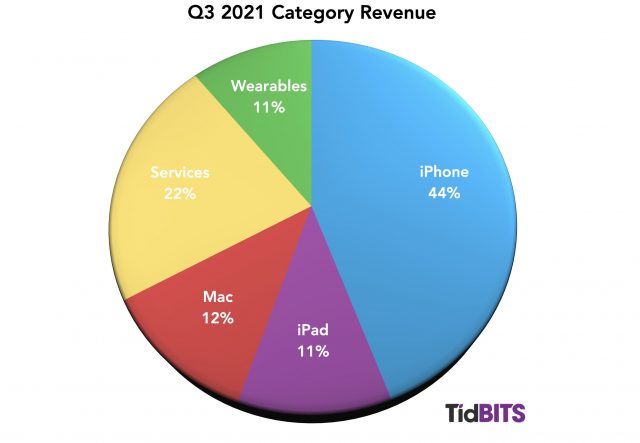

Even as the global pandemic grinds on, Apple continues minting money at a feverish pace. Reporting on its Q3 2021 financial results, the company has announced profits of $21.7 billion ($1.30 per diluted share) on revenues of $81.4 billion. Its revenues were up 36% compared to the year-ago quarter, with profits up an immodest 93% (see Apple Q3 2020 Breaks Records While the World Burns, Next iPhone to Be Fashionably Late, 30 July 2020). Apple reported all-time records in every geographic sector in which it does business and significant gains in every product category it reports; the phrase “all-time high” kept recurring in CFO Luca Maestri’s description of the quarter’s results. Ted Lasso doesn’t have to work very hard to “Believe” with results like these.

Apple CEO Tim Cook said Q3 2021 marked a new revenue record for the June quarter. He described a growing sense of optimism among the American public, boding well for future results, but he cautioned that a new wave of COVID-19 infections caused by the Delta variant could be a setback. In addition, he expressed some concern that foreign exchange rates and supply constraints could also slow future revenue growth. Offsetting those worries are signs of healthy growth in emerging markets, such as Brazil, Chile, Mexico, Poland, India, Thailand, and Vietnam.

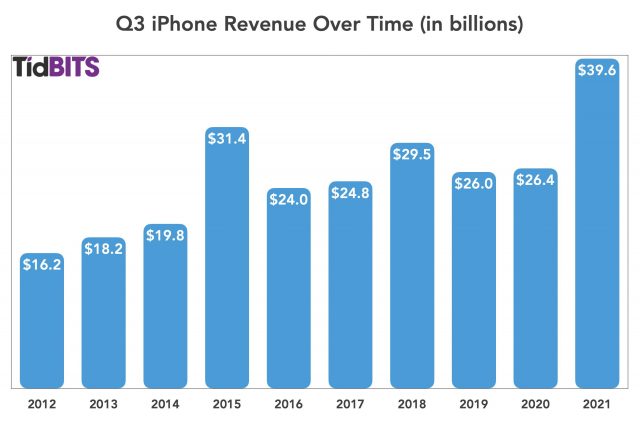

iPhone

Q3 iPhone revenues shot up an impressive 49.8% year over year, from $26.4 billion in Q3 2020 to $39.6 billion this quarter. iPhone upgrade revenues achieved (here’s that phrase again) an all-time high for the June quarter. Cook noted that the introduction of 5G capability helped spur the demand for new iPhones and went on to say that 5G adoption worldwide is still in its early stages, auguring well for the product line in future quarters (see “Understanding 5G, and Why It’s the Future (Not Present) for Mobile Communications,” 11 November 2020).

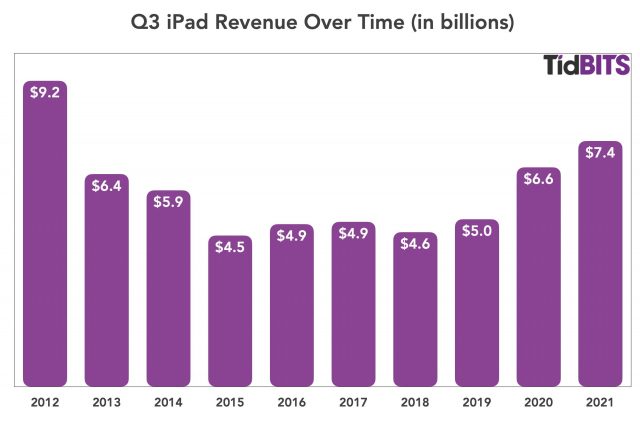

iPad

The iPad brought in $7.4 billion in revenue, handily beating the $6.6 billion it brought in a year ago, an increase of 11.9%. You would have to go back to 2012 to find the sole June quarter in which iPads brought in more revenue than this year. With new iPads introduced only recently (including a high-end iPad Pro that shares the same M1 chip as the latest Macs) and with more on the way, coupled with the possibility of continuing pandemic-related lockdowns that could spur continuing demand for the devices for remote work, the iPad’s financial future looks rosy.

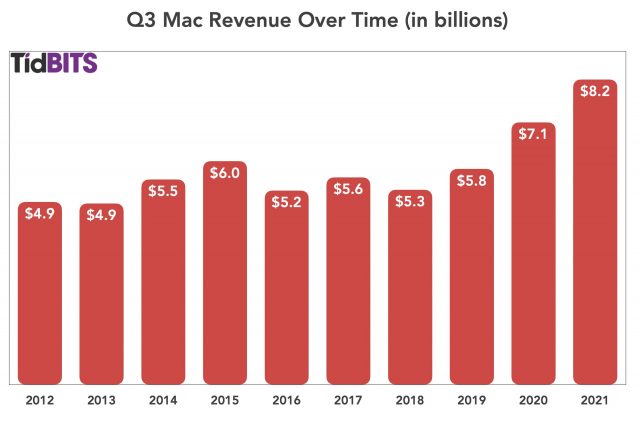

Mac

Apple’s Mac products also exhibited strong growth, with a year-over-year increase of about 16%, from $7.1 billion in revenue in Q3 2020 to $8.2 billion this quarter. Cook said this was a new Q3 record for the Mac, thanks to the new M1-based iMac.

“It is remarkable that the past four quarters for Mac have been its best quarters ever,” said CFO Luca Maestri. Maestri later added that the combined sales of the iPad and Mac equals the size of a Fortune 50 company, and customer satisfaction for both is over 90%. Maestri also noted a significant uptick in the adoption of the MacBook Air among corporate customers—given that the M1-based MacBook Pro doesn’t have much over the M1-based MacBook Air, we’re not surprised.

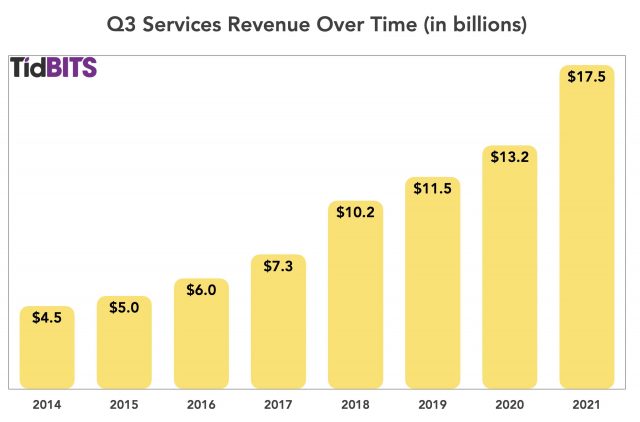

Services

Services experienced an impressive 32.9% year-over-year increase in revenue with $17.5 billion in revenue this quarter compared to $13.2 billion in the year-ago quarter. Cook said this was an all-time Services record, and he dropped in a mention of Apple TV+ and its 35 Emmy nominations as one contributor to the category’s success. In fact, many Apple services broke revenue records, either quarterly or all-time, including AppleCare, Apple Music, and the App Store.

Maestri boasted that the various Apple services now have more than 700 million paid subscriptions, up 150 million from last year. He credited much of the growth in this category to entertainment-hungry customers during the pandemic lockdowns.

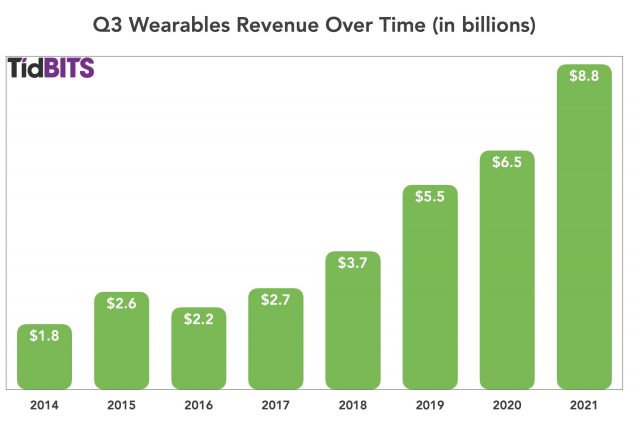

Wearables

The Wearables category revenue increase was even larger than Services, up about 36% over the category’s year-ago quarterly results. The Apple Watch, AirPods, and other wearables brought in $6.5 billion a year ago and $8.8 billion this quarter. Cook said this was a new Q3 record for Wearables, which also includes accessories like the new AirTag. With a new model of the Apple Watch on deck later this year, this category is likely to continue its upward revenue trajectory.

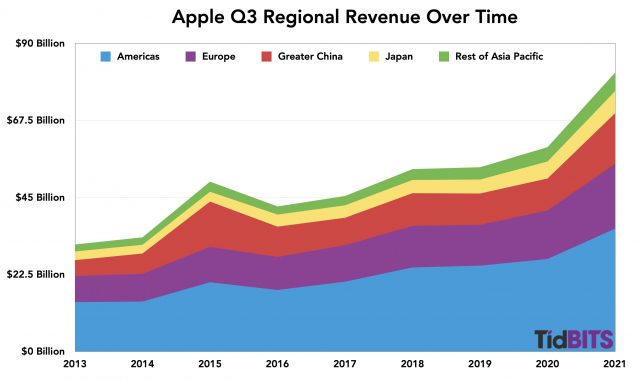

Q3 2021 Regional Performance

Apple saw impressive year-over-year growth in all five of its regions and set a new June record for Greater China, thanks largely to the iPhone 12:

- Americas: 32.8%

- Europe: 33.7%

- Greater China: 58.2%

- Japan: 30.2%

- Rest of Asia-Pacific: 28.5%

Add in the previously mentioned signs of growth in its emerging markets, and Apple should continue to post healthy worldwide revenues in the months ahead.

An Uncertain Future

Apple is trying to remain optimistic, and certainly, the company has no reason to be pessimistic—at least about its own health: Apple is shattering records and has $194 billion in the bank. But the specter of COVID-19 loomed large over this quarter’s investment call.

In a slight return to normalcy, Maestri offered guidance for the September quarter, something Apple has not done since the beginning of the pandemic. Apple expects double-digit revenue growth in the next quarter, but less growth than in Q3 due in part to the impact of foreign exchanges. Services growth will also appear slower because Q3 2020’s lockdowns made for greater contrast with this quarter. Finally, the most alarming harbingers of future revenue slowdowns brought up during the conference call were anticipated supply constraints.

Cook said of the supply constraints:

The majority of the constraints are of the variety that others are seeing. I would classify it as industry shortage. We do have some shortages in addition to that where the demand has been so great and so beyond our own expectation that it’s difficult to get the entire set of parts within the lead times that we try to get those. It’s a little bit of that as well. As I said before, the latest nodes, which we use in several of our products, have not been as much of an issue. The legacy nodes are where the supply constraints have been, on silicon.

In plain English, the chip shortage that’s affecting the entire supply chain is looming over Apple. While Apple said it was able to mitigate those issues in Q3, it’s looking less likely in Q4. But if anyone is up to the task of working through a supply chain hiccup, it’s Apple CEO Tim Cook, who, despite whatever shortcomings he may have, is a proven master of supply line management.

And yet, the price of Apple stock fell.

The CDC reversed its mask policy late in the day yesterday because of the currently exploding number of Covid cases, and the rapid spread of the particularly virulent Delta variant. The disappointing numbers of people who continue to refuse vaccinations, and the number of states that won’t issue mask mandates or encourage vaccinations did not change for the better, were not encouraging news either.

The stock market doesn’t like bad news, and this very bad news most probably overwhelmed Apple’s good news. A 2% drop that happened just after the CDC made the announcement an hour or two before the market closed would not be unexpected given the circumstances. A lot of other stocks fared a lot worse in that time period, and the companies that make masks and other protective equipment bounced up.

I wouldn’t read anything into – it always tends to fall at the results announcements, no matter how good.

Yeah, @jcenters and I were discussing that a bit during editing—it’s hard to say that stock prices are rational reflections of much these days.

And of course, Apple is paying dividends now, so there’s another way that shareholders benefit apart from selling after a price increase.

https://investor.apple.com/dividend-history/default.aspx

Stocks tanking after announcements is not unusual.

Why?

Market analysts have expectations about what a company (any company) will do. They buy and sell in advance of announcements, based on these expectations.

When the announcements happen, there will be a round of buying or selling based on whether the information announced was better or worse than those expectations.

That’s the critical point. If the company makes a billion dollars profit, but the analysis were expecting 1.2 billion, there will be a sell off. Not because the news was bad but because there was a lot of buying prior to the announcement based on an expectation that didn’t happen. The stock got inflated beyond reality because of the expectations and now it drops back to where it should have been. Which is why it is called a “correction”.

On the other hand, if the same company announces the same billion dollars profit, but the analysts were only expecting 0.9 billion, then there will be a lot of buying after the announcement. Again, it’s not because of the announcement itself but because the stocks were being held back by expectations that proved lower than reality.

This is why the stock market is considered “forward looking”. It rises and falls not based on what has happened but based on what investors expect will happen in the future. And when the reality proves to be different from the expectation, the market “corrects” itself - up or down, no matter whether the news is objectively good or bad.

Sure. Except… Apple easily beat all forecasts:

Revenue: $81.4 billion vs $73.8 billion expected (+10.3%)

Earnings per share: $1.30 vs $1.01 expected (+28.71%)

iPhone revenue: $39.57 billion vs $34.5 billion expected (+14.7%)

Services revenue: $17.49 billion vs $16.3 billion expected (+7.3%)

Mac revenue: $8.24 billion vs $7.99 billion expected (+3.13%)

iPad revenue: $7.37 billion vs $7.13 billion expected (+3.37%)

In this case, it’s not what they did, but what they say (and don’t say) they’re going to do:

Analysts like detailed forecasts and increasing growth. Apple isn’t doing the first and forecasting not doing the second, so their shares are down.

(Those are quarterly numbers above. Apple had revenue of $81.4 billion in just three months. The mind boggles.)

I read the whole presentation, and to quote Luca Maestri:

“Given the continued uncertainty around the world in the near term, we are not providing revenue guidance, but we are sharing some directional insights assuming that the COVID-related impacts to our business do not worsen from what we are projecting today for the current quarter. We expect very strong double-digit year-over-year revenue growth during the September quarter. We expect revenue growth to be lower than our June quarter year-over-year growth of 36% for three reasons.

First, we expect the foreign exchange impact on our year-over-year growth rate to be three points less favorable than it was during the June quarter. Second, we expect our services growth rate to return to a more typical level. The growth rate during the June quarter benefited from a favorable compare as certain services were significantly impacted by the COVID lockdowns a year ago. And third, we expect supply constraints during the September quarter to be greater than what we experienced during the June quarter.

The constraints will primarily impact iPhone and iPad. We expect gross margin to be between 41.5% and 42.5%. We expect opex to be between $11.3 billion and $11.5 billion. We expect OI&E to be around zero, excluding any potential impact from the mark-to-market of minority investments and our tax rate to be around 16%.“

The company’s forecasts aren’t what drive the market. It’s investor expectations, which are based on many more factors than the company’s forecasts. Analysts working for major investment companies and media outlets have quite a lot of influence - often more than the company’s own forecasts.

If a company forecasts $1B profit, but investors expect $1.2B (for whatever reasons, right or wrong), the market will converge on a price based on the $1.2B expectation. If the company later announces a $1.1B profit, they beat their forecasts, but fell short of investor expectations, so there will still be a downward correction.

Similarly, if investors were expecting $0.8B (believing the company won’t meet their forecast), the market will converge on a price based on that prediction. If the company then announces a $0.9B profit (falling short of their prediction, but exceeding investor expectations), there will be an upward correction.

Not sure we should really be continuing on about stock prices, but the entire tech sector was down that day, not just Apple, due to supposed changed expectations for the entire sector that the economic recovery may be extended longer due to higher coronavirus infections perhaps leading to people being more reluctant to return to full pre-pandemic activity. This was different guidance from what was priced into tech sector stocks, so it drove the sector down. It wasn’t necessarily a reaction to Apple’s results at all. In fact, perhaps Apple may have been down more that day if they hadn’t yet reported the quarterly results and next quarter’s expectations.

Apple’s stock prices are considered very important to the overall economy. Apple has been considered an extremely safe, very low risk place to stash cash as well as being a solid long term investment. Apple stuff has been selling well and reported profits, have but Tim Cook did mention that although Apple’s supply side has been chugging along nicely, there is a chance there could be problems going forward. But the stock market is focused on the future, and there’s a significant chance that supply side, shipping and maybe a looming recession will affect Apple’s sales in the future.

The stock market has been in a bear market lately and suffering overall so far this year, and it looks likely that inflation might be a continuing problem. But the prognosis from the financial powers that be is still that Apple is a very smart investment:

No reliable advisor should be telling you to “stash cash” in any single company stock. And no, blog articles, even from respected web sites, are no substitute for good financial advice.

Investing in any single company, even one like Apple, should be considered strictly speculative, not something you should do with any money you can’t afford to lose. There is far too much unpredictability in any market to make this a good idea, compared to multi-security funds like mutual funds and ETFs.

Find good low-cost funds that track with your investment goals (a good advisor who knows your goals is invaluable here), so your money will be spread out across hundreds or thousands of companies. This way you won’t be facing disaster if one or two of them collapse. And no company or government is ever “too big to fail”.

Trying to “beat the market” is ultimately doomed to failure. No investment advisor or fund manager has been able to do this consistently over long periods of time, even though we read plenty of news articles about those that have gotten lucky over short periods of time (1-3 years). Your best bet isn’t to try and beat the market, but to mimic the entire market.

Yes, we’re currently in a downswing, but it won’t last forever - it never does. Don’t panic and start chasing risky investments because of it. If your financial plan is solid, stick with it. If you’re not sure it is, consult with an advisor. Don’t invest money you need to spend on expenses. And buy shares while the market is down, so you can profit when it recovers in a couple of years (if you are contributing to a retirement plan at work, you’re already doing this).

This isn’t at all what I, or the article I sourced, said, meant or intended to imply. It’s about the fact that Apple stock has continued to perform exceedingly well in either bull or bear markets over many years, and is considered to be a relatively safe investment. It’s considered coming close to being as safe as stashing cash in a bank account, and Apple stock is more likely to increase in value in the short and long terms.

I thought it would be interesting here because Samsung, Alphabet/Google, Facebook, Dell, Sony, Netflix, etc., etc., aren’t doing as well in the stock market.

P.S. I don’t own any Apple stock, though it is included in a mutual fund I invest in.

Folks, this is a year-old thread about Apple’s Q3 2021 results, so I’m shutting it down.