How I Learned To Love Quicken Deluxe and Give Up on the Past

I couldn’t remember when I first installed Quicken to manage my personal and small-business finances. It seems like I’ve used it forever. But after a recent long-delayed update to the current version, Quicken Deluxe, I can now pinpoint the time: mid-1998.

After 23 years of using older versions of Quicken, including Quicken 2007 since its paradoxical release in 2006, I’ve finally severed my cord to the past: to PowerPC and Intel processors, to outdated record formats, and to clunky manual entry of transactions. I waited so long, however, that I wasn’t forced to give up anything in the process.

This is my journey, and if you’re still on Quicken 2007, it’s one you can take too.

Quicken 2007 Was Old When It Was New

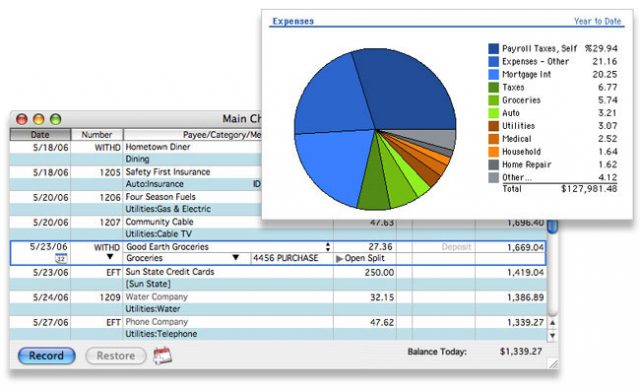

When Intuit, Quicken’s original owner, released Quicken 2007 for what was then called Mac OS X, it was a major step forward for Mac users in synchronizing online accounts and producing financial reports. Quicken 2007 included and improved on several bookkeeping needs I had and still have:

- Transaction-based entry

- Hierarchical categories (like “Business:Hardware:In-state” to mark purchases on which I paid sales tax, or “Income:Consulting:Conferences”)

- Financial institution transaction syncing and automatic (or at least heavily assisted) reconciliation

- Highly customizable reporting to extract lists of transactions or summaries of income and expenses corresponding to city, state, and federal tax guidelines

- Separating personal and business transactions by using categories to assign any transaction to any purpose

But Quicken 2007 was already behind the times in 2006! Apple had already begun its transition from PowerPC to Intel chips, and Quicken 2007 had only PowerPC code in it. Intuit never released a true Intel-compatible version of its flagship software but somehow pushed out a hacked-together version that sidestepped the need for Rosetta (see “Intuit Releases Quicken Mac 2007 OS X Lion Compatible,” 8 March 2012). After years of excuses, the company released an entirely new app, Quicken Essentials, that was so stripped down as to be essentially… useless.

Intuit’s attempts to reimplement the full capabilities of Quicken 2007 never quite hit the mark; see “Quicken 2015: Close, But Not Yet Acceptable” (2 October 2014). I regularly updated that “2015” app version and even bought some upgrades to see if Intuit had added what I needed.

At various times from 2014 to the present, I also tried Banktivity, Mint, Moneydance, Xero, and others. None met my requirements, though many came close. Close wasn’t good enough: if I was going to shift away from a two-decade-old system, I wasn’t willing to give up functionality.

Through macOS 10.14 Mojave and the end of 32-bit apps, Quicken 2007 limped along with a surprising series of minor updates that allowed it to continue to function mostly unimpaired.

And that’s how I found myself in early 2021 with the digital equivalent of a bulging shoebox of old receipts, unsure of how to move forward in a way that would save me time and frustration. Fortunately, Quicken was a step ahead of me—and a step ahead of where I thought it was.

Lost in the Desert, but an Oasis Looms

I continued to run Mojave on my 2017 27-inch iMac even through the release of macOS 11 Big Sur for a few reasons. Two of those were Quicken 2007 and Mailsmith, a text-only email program I’ve used for 20 years. A third was the poor performance of the iMac’s Fusion drive, which I eventually fixed with an external SSD (see “An External SSD Gave My iMac a New Lease on Life,” 9 April 2021).

Once I added the SSD and upgraded to Big Sur, I had the performance necessary to run Mojave within a Parallels Desktop virtual machine. That let me keep Quicken 2007 and Mailsmith running while I sought replacements.

Before I settled on any, my iMac bit the dust in the most expensive way possible. A local shop traced the problem to a failed motherboard. At a cost of several hundred dollars, it made no sense to replace, so I opted to purchase an M1-based Mac mini to act as my anchored office computer. (The M1-based 24-inch iMac didn’t impress me enough, and I wanted two 27-inch monitors.)

The move to M1 left me in a crisis. How could I keep running Quicken 2007? I was in the middle of an overwhelmingly busy month, so I punted and set up a virtual Mac. I chose MacStadium, a co-location service for people who need remote Macs, which was offering a first-month discount. (There are other virtual Mac options, including some at Amazon Web Services, but none are priced for “using a single app for a few hours a month.”)

In an effort to find a new-to-me Mac for Quicken 2007, I searched eBay for a 2012-era Intel-based Mac mini that could run Mojave, was inexpensive enough to make sense to purchase, and wasn’t a total slug. I found and purchased a 2012 model with 4 GB of RAM and a 500 GB hard drive. In its stock configuration, it was terribly slow, but once I installed Mojave on an unused 256 GB USB 3.0 SSD I had on hand, it turned into a pretty zippy single-purpose Quicken 2007 appliance. After a quick configuration via a monitor, I set it to wake on network access and used exclusively via screen sharing.

To keep this Quicken 2007 appliance out of the way, I used a Humancentric Mac Mini Mount ($17.99) to attach it to the underside of my desk. (The mount has screw holes spaced for VESA mounting, so you can attach a Mac mini to the back of a monitor, too!)

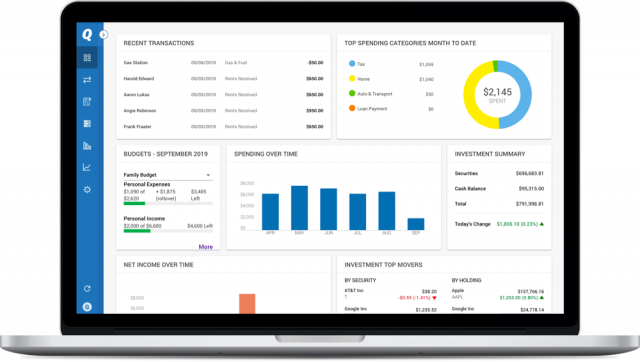

After posting a photo of my hidden Mac mini, an online acquaintance said I should check out the latest Quicken Deluxe. A few years ago, Intuit sold Quicken to a private equity group, H.I.G. Capital. Instead of destroying the product, the firm breathed new life into it, seemingly by shifting to a software subscription model.

Quicken Deluxe costs $51.99 per year, but search for discounts—I paid $34.39 for my first year by clicking through a search-engine ad. There’s no free trial, but the company offers a “30-day money-back satisfaction guarantee.” I made the purchase, installed the software, tested it out quickly, and found to my chagrin that Quicken Deluxe finally had everything I needed. Sadly for all my extra effort, it may have had it as far back as 2019! I wish I had been paying more attention.

My next task was to convert my old data and bring myself up to speed on the changes.

The (Quicken) Deluxe Route to Big Sur and Beyond

First off, I wanted to import my Quicken 2007 data. I was resigned to the possibility that I wouldn’t be able to convert a 14-year-old data format with 20-plus years of data, but I held out hope that it would work. Quicken Deluxe requires a round trip through a cloud server for Quicken 2007 format conversions, which it warns you about since your data will leave your computer.

It took several failures before I sorted out what was going wrong because Quicken Deluxe’s errors didn’t help. Quicken 2007 can run on a macOS system that has an HFS+ or APFS startup volume, and its data file can be stored on either kind of filesystem. But you cannot correctly copy the Quicken Data file from an APFS volume. (It seems to use some outdated package format that relies on HFS+.)

After finding this answer online in a forum, I temporarily installed Quicken Deluxe on the 2012 Mac mini volume on which I had Quicken 2007. That let me avoid copying the data files from APFS and start the conversion.

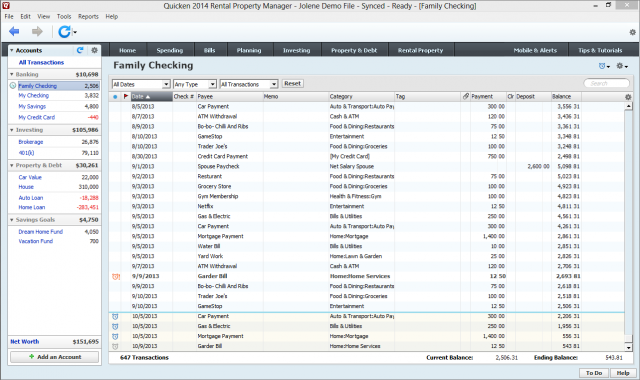

It took about half an hour to convert and import tens of thousands of transactions, but it succeeded. In Quicken Deluxe running on my M1-based Mac mini, I can pull reports dating back to 1998, and all my accounts and categories remain intact. I lost only Quicken 2007 custom reports, which I can’t complain about when everything else came through.

The next task was setting up online synchronization of accounts. Banks, credit card companies, and other institutions had maintained support for Quicken 2007 for many years, but synchronization and export features began to fall away around 2015. I had shifted to entering transactions manually—a horrible pain, but I had no alternative.

I spent nearly two hours working through all my banking, debit, credit, investment, and retirement accounts until everything synced correctly with Quicken Deluxe. The app offers a few ways to set up synchronization; I started with Quicken Connect (also known as Express Web Connect), which uses a secured login. This worked in all cases. Another option, Direct Connect, may require paying a financial institution a monthly fee, but then you can use Quicken Deluxe for direct bill paying, too.

Of all these accounts, only a Citi credit card failed to match existing transactions and duplicated the last year’s worth of downloads. This was an easy problem to fix because Quicken Deluxe tags the source of transactions in a column that can be sorted—downloaded ones use a little green ball. I was thus able to delete those duplicate downloads quickly. I had a few other tweaks to make in other accounts, where I used Quicken 2007’s split function to break up one transaction into multiple categories or transfers that the downloaded financial data didn’t match, but it was quick to resolve.

One bump I hit applies to any transaction-tracking app that performs these syncs. Some institutions require a two-factor authentication code every time you sync rather than occasionally or after you validate a particular computer or network. I had three accounts in that category: PayPal (separate personal and business accounts) and a Bank of America credit card. Quicken Deluxe handles this modally, so it’s a tedious process. The app tries to log in, recognizes it needs a code, asks you for the code, you enter the code, it validates it, repeat, repeat. Because it’s modal, it winds up stealing a minute or more. To avoid this wasted time, I disabled automatic sync on these three accounts because they have relatively little activity and it’s easy enough to trigger them to sync manually.

Finally, I began to re-create my needed reports. Quicken Deluxe has a lot of reporting power—much more than Quicken 2007, unsurprisingly—but the developers could improve a few aspects. Tweaking certain settings renames the report, which is generally unwelcome. And performing an operation across the most recent year’s worth of transactions—several hundred in my case—takes far too long for something that’s clearly database-driven. I should have to wait seconds, not a minute, particularly when I’m configuring a report and every change incurs the same computational churn time.

But it was all worth it. Just two weeks into using Quicken Deluxe, I’ve already saved a couple of hours keeping up to date. Over the course of a year, I’m somewhat embarrassed to admit, I might save a cumulative 40 to 80 hours. The Quicken 2007 time hit was particularly severe for quarterly and annual local tax filings and assembling material for our accountant for federal taxes. Quicken Deluxe’s better reporting will let me pull a precise report instead of multiple reports I had to consolidate through a spreadsheet.

The Quickening

Will the roughly $50 I pay every year for the rest of my Quicken-using life—plus regular bumps up in that price—be worth it? Absolutely—saving even an hour or two a year would. Saving a week or two of time I could spend earning money? Sign me up! Oh wait, I already am.

Now if only someone wanted a 2012 Mac mini suitable for under-desk mounting. I’ll even throw in the external SSD!

I went through a similar process when Rosetta died thus ending PowerPC emulation. I auditioned several Quicken replacements and decided that Moneydance was adequate for my needs. It was a bit week on reporting and it would not interact directly with my bank and credit card accounts, but it handled transactions in a very similar manner to Quicken and also could support investment accounts. I’ve stuck with Moneydance over the past 10 or 11 years with only a few hiccups.

I’m always somewhat mystified by a requirement to be able to live sync credit cards and bank accounts to financial software. As long as I can download a qfx file, Moneydance does a great job of importing it, even remembering the applicable account. It’s nice not to have the credit card account login information stored in the app. I’ve never attempted to sync or download bank account information as I like to enter those transactions when I initiate them, not when the exchange of funds occurs. I find it easy enough to reconcile those accounts from monthly statements.

I’ve been using Quicken since it came out. Currently use the subscription (Home and Business) for two businesses and home. I find the ability to quickly download and reconcile accounts (recently improved even more so) to be very useful for me. It makes doing taxes very easy.

David

If you’re virtualizing, you might consider the real (Windows) version of Quicken. I’ve been unimpressed by Intuit/Quicken Inc./H.I.G.’s commitment to Mac data conversion integrity since I tried to convert to the 2000 OSX beta, with periodic unpromising repeat attempts. (I’m still using VMware on Intel, to which I happily switched from early versions of Parallels.)

Glenn and others, can you comment on reports? I use the Income Statement in 2007 for my accountant to have a high-level overview. In my initial checking of the newer versions, I didn’t see a similar report nor a way to create it.

And the comment about APFS solves a mystery, I think, that I’ve had for almost 6 months about why someone had an issue with their 2007 data file not being backed up properly via Time Machine (and then restored). I’ll have to test their data on an HFS+ disk to see.

Cheers,

Jon

I highly customized all my Quicken 2007 reports, so I am not sure precisely what Income Statement did. Quicken Deluxe lets you select all the same parameters (plus more) as in Quicken 2007, so you can choose income only, pick the accounts, pick the time period, and even exclude intra-account transfers noted in the report to avoid adding $ that were just transfers among your accounts (instead of inflows).

But you cannot correctly copy the Quicken Data file from an APFS volume. (It seems to use some outdated package format that relies on HFS+.)

The idea that any application would depend on the low level format of the underlying drive is totally bizarre to me! I’m sure some ‘software architect’ thought this was A Good Idea… But I guess it’s A Good Thing Quicken has been divorced from Intuit (a company that I refuse to do business with for their business practices…)

(As a side note, every time I’ve ported software, it got better. Porting brings out latent bugs and invalid assumptions.)

It still seems bizarre to me. It’s possible that it’s an outdated PowerPC-based package format—it’s not worth diving that deeply into it—but it was really baffling and frustrating until I found the wisdom of other people who had diagnosed it.

I don’t know the Apple API, but I’d suspect you’d have to -really try hard- to “accomplish” file-system dependent storage.

As far as I know, the only big feature HFS+ has that APFS doesn’t is the ability to create hard-links to directories (a feature created in order to support Time Machine and not ported to APFS because APFS-based Time Machine uses snapshots to accomplish the same thing more elegantly).

I suppose Quicken might be using internal hard links to directories in the package. If they are doing that, then they must have jumped through several hoops to make it happen - normal APIs don’t allow it. It’s supposed to only be for Time Machine.

The only other HFS+ “feature” I know of is that it allows filenames with characters that are undefined UNICODE code points. APFS rejects these characters. I think the rules for normalizing UNICODE filenames is a bit different. An app’s internal data files really should not be using names where this would be an issue. If they are, I would love to know why.

As a workaround, I assume you could create an HFS+ disk image, mount it, and store the Quicken data file there.

Huh… Not supporting ‘hard links’ would break POSIX compatibility. I checked the manpage (man ln) and there’s nothing on the Big Sur manpage to indicate that hard links are not supported in APFS per the POSIX specifications.

In POSIX (traditional Unix), hard links have some useful properties, including relative atomicity in the file system. An old ‘trick’ for doing a lockfile is to create a hard-link to a file (e.g. ln file file.locked) so you can test for the existence of file.locked before you write to it. When the wright is finished, you remove (unlink) ‘file.locked’

(doing hard links on directories, as opposed to traditional files, is a whole 'nuther question. If that’s supported, it’s via a privileged operation. The problem is the chance to create infinite loops when traversing the file system.)

I came across this and thought it might interest someone. I know nothing about it, and do not use it, but it looks interesting. https://www.gnucash.org

All Unix systems support hard links to files, on compatible file systems. These include all the file systems commonly used by Unix platforms, including BSD’s FFS and Linux’s extfs. The most notable modern file systems that don’t support them are the various flavors of FAT.

See also: Comparison of file systems - Wikipedia

Hard links to directories is a novel feature that Apple introduced in order to support Time Machine. It is only supported on HFS+ volumes and requires special permissions. I don’t know of any other Unix-like system where they are supported in any form.

Actually, at least on BSD and DEC ULTRIX, “superuser” could do hardlinks to directories. I wrote some code that depended on that, and I had to swear on a stack of system manuals that I would NOT introduce a cycle in the file system as a result!

Interesting article, thanks @glennf – though I have no use for Quicken myself, I find details of software migrations and system limitations interesting (which I realise is odd!). However, one thing I didn’t understand is the following… Early on, you say:

But then you talk about how you recently ran Quicken on MacOS 10.14 Mojave for several years. I thought that the ability to run PPC apps was removed several OS versions ago (after Snow Leopard?). So how was it possible to continue running Quicken 2007 in Mojave?

It’s a curious story. Quicken 2007 was such a critical app for Apple to continue to have available, they allowed Intuit…to embed parts of Rosetta inside Quicken 2007 as a sort of wrapper around the app via the seemingly minor updates that appeared after Rosetta was no longer part of macOS. Truly, truly weird.

Wow, that is wild. Learn something new every day!

Learn something new every day!

Intuit released Quicken Mac 2007 “Lion Compatible” in 2012, which you must have been using if you’re still running Quicken 2007 on Mojave.

What’s interesting about this is first Intuit claimed that Quicken for Intel would never happen because it too many man-years of work. And then suddenly, it did happen. There are rumors of Apple proving some help but I’ve never seen definitive information on what Apple actually did. There’s nothing obvious in the Quicken 2007 package. (One rumor I heard implied that Apple provided a way for Quicken to read its priopriatary database format, that must have been problematic for the migration from Snow Leopard to Lion.)

And Quicken Financial Life for Mac was previewed in 2009, and was even more useless.

Here is where I lost you. As far as I know, Quicken 2007’s only issue with APFS is that the automatic backup doesn’t work. (The reason is that Quicken is making an incorrect assumption about file ordering on POSIX file system calls. They got away with it with HFS+ but not with APFS.)

Another limitation is that it still uses Resource forks, which are supported by macOS on APFS, however there are rumors that there are problems with resource forks in Monteray or maybe it is Big Sur.

My two cents: I’ve been using Quicken for Mac since Quicken 98, and still think there are a lot of things that Quicken 2007 does much better than the current Quicken. The key deficiencies are in ease of data entry, investment transactions, and reporting. But online transaction and stock price downloads in Quicken 2007 has been pretty much dead for some time. I had forgotten how much easier it is when Quicken auto-downloads the transactions. And the new Quicken does have some useful new features, such as being able to automatically query online statements so it knows how much your next bill is.

I went through a lot of acrobatics in attempting different ways of copy what seemed to be a perfectly ordinary file, including using ZIP, FTP, SMB, Dropbox, etc., and all these copies failed in one way or another until I read the description of the HFS+/APFS problem. There’s a lot of discussion as to the cause.

Ultimately, my only successful path was installing Quicken Deluxe temporarily on the Intel Mac mini running Mojave and then migrating the Quicken Deluxe data file. It may or may not be worth investigating further, but it does seem tied up with HFS+. Maybe a weird artifact of its code base.

Yes, I think Quicken 2007 has some more refinement and features and ease of use than Quicken Deluxe in 2021, but Deluxe has fortunately matured to hit all the points I need. I was able to create a report a few days ago that I use for quarterly city and state filing for my two separate small businesses (one, writing; the other, publishing), and then compare it against my records from previous quarters in Numbers where I’d used Quicken 2007’s reports. I found a few discrepancies, but they were fortunately all related to report configuration. Once resolved, the reports I pulled had identical results to the Quicken 2007 reports, which was key!

I wonder if it wasn’t where Quicken 2007 was, but where New Quicken was installed.

We know that Quicken 2007 is 32-bit so won’t run on Catalina or later. And new Quicken (let’s just call it Quicken 2021) is 64-bit so it can. But, the Quicken migration program used to convert from Quicken 2007 is also 32-bit, so it won’t run on Catalina.

So let’s say you upgrade your computer to Catalina, buy Quicken 2021, then try to convert your old data file. How can it convert?

The answer is that in that case, Quicken transmits your Q2007 data file up to a cloud server run by Quicken. The cloud server runs the migration utility on some older version of macOS, then the resulting converted file is downloaded back to your Mac.

I’m wondering if something in that process is what caused your migration difficulties.

(One might wonder why it is that the migration program is still 32-bit, and furthermore, no Q2007 data conversion bug has ever been fixed, at least none that I reported. My suspicion is that Intuit didn’t give the new Quicken company the source for the migration program – the program that reads the Quicken 2007 data file and creates the intermediate conversion extract file. I also find it suspicious that the new Quicken company doesn’t seem to ever use Quicken 2007’s internal algorithms as a guide to enhancing Quicken 2021’s weak spots. Maybe they don’t have the source for Q2007 either.)

I switched from Quicken 2007 to Quicken Deluxe a year ago and have accepted it more grudgingly. A major reason for my change was that my bank shifted to a new format for qfx files which Quicken 2007 could not import. Another was that I didn’t want all my financial data in a dead-end format.

Importing was painful and all the damage to my investment and retirement funds was not immediately obvious. While the totals came out right, the history before the import is gone. I can recover data from other financial records (e.g. when we bought an appliance so we can decide if it’s worth repairing), but individual transactions are gone, so Quicken can’t tell me what were my holdings in 2005, or how my investment accounts have changed since then.

I have yet to find much of anything useful for retirement-planning and related issues. It may be well hidden in the online files, but I’m finding it hard to track Minimum Required Distributions or other retirement income for tax purposes.

The default categories Quicken uses when important transactions are rigid, annoying and only minimally customizable. Multiple levels of coding can be somewhat useful, but I don’t need or want all of them because they don’t match what I’ve been doing for years, making comparisons impossible. Automating downloading of categories from credit card companies is convenient, but I have to change many of the categories because they are wrong or useless. Quicken has an option for automatically associating a payee or payment source with a particular code, but some payment sources – notably ebay and Amazon – put codes identifying individual transactions into the payee field, and Quicken thinks that means a new payee.

Quicken does seem to be still tinkering with the new version, and I hope it eventually will help with the retirement issues. Right now it’s close to useless in that area. I have found the online Help of little help with much of anything. Features like importing categories from transaction files make it hard to customize to match your accounting preferences. Sometime its selections or defaults seem downright dumb, and sometimes I worry Quicken may be losing things. It’s useful, but I wouldn’t say that I love it.

Unix has had hard links to directories for a long time, maybe since the beginning. In fact every directory in your system has 2+n hard links to it—the link from its parent,

., and all the..'s in its subdirectories. There used to be/etc/linkand/etc/unlinkcommands to allow creating and deleting hard links to directories on the command line (limited to root of course, being so much code assumes.and..are the only things that introduce loops in the file system “tree”.)I went through something similar a couple of years ago. I ran a number of packages in parallel for a month or so, downloading (or entering) transactions in all of them, reconciling everything at the end of the month in each, etc. When I hit a showstopper or something that just worked better elsewhere in one, I dropped it, until the final one remaining was Quicken Deluxe. Not that it’s perfect, I have a whole list of things I’d like to see changed in it, but it’s better for my needs than any of the others I tried.

I’m primarily a PC user but provide technical support Macs. I’m still using Quicken 2000 on Windows10! LOL I stopped upgrading when they charged $60, didn’t import prior data, and that was back in 2002. 2000 does everything I need. Account management, balancing, forecasting, basic reports. It doesn’t work perfectly, but it works well enough.

I too made the switch from Quicken to MoneyDance. It’s a bit short on some features but it works with Macs.

I recall Quicken was originally a Mac product, then went Windows and forgot about Macs. I struggled with Quicken for a while but it was worse being a Quicken user outside the US as the local Australian reseller of Quicken was absolutely not interested in supporting any Mac users of Quicken especially in facilitiating downloading anything Australian banking. I had to get the Canadian version to work with Australian taxes.

In reading this review of Quicken, I find myself saying that nothing has changed with Quicken and I made the right decision to move to MoneyDance.

$60/mo is priced for “using a single app for a few hours a month"??

I believe I recall using Quicken on the Apple ][.

Wow! If only Apple had allowed general use of that capability, since Lionetta never materialized.

If only Electron technology existed back then to ease cross platform woes.

No. From article:

The entire quote is

which reads to me as “none of the other options are priced for using a single app for a few hours a month, unlike MacStadium.”

Thanks for this coverage.

I used Quicken for many years starting around 1993(!), when it was feature rich and almost bug free. I watched Intuit make it continually more buggy and effectively abandoned it, until I decided to jump ship. I think some coverage at tidbits(??) may have been what helped me find SEE Finance, which rescued me from that mess.

But I’m not thrilled with it these days and need to get a paid upgrade to work with Big Sur. So Quicken Deluxe has me intrigued.

My main question is: will QD import everything from SF?

That feels like a strained reading, but you understand me now.

I still use Quicken for Mac 2007 Lion Compatible, but as a QIF bridge between my primary desktop finance application and two other finance applications. Here is my story.

I used Quicken for Mac (Q4M) for years on my Macs and Standalone’s PocketQuicken (PQ) on my PalmOS devices. When the iPhone came out and the App Store opened, I expected an iOS version of PQ to be released but it never happened (Intuit refused to support iOS and cancelled Standalone’s license to make PQ). Thus I had to search for a replacement. I ended up using the late Hardy Macia’s PocketMoney (PM) on my iPhone (he had it for NewtonOS originally) with QIF import from Q4M. Later Hardy released PocketMoney Desktop (PMD) with PocketMoney Sync for WiFi syncing between the Mac & iOS versions. Then tragedy struck with the passing of Hardy in May 2013. PM limped along but was eventually bought by a Swiss Italian who promised a vastly improved version. Well he lied and the “new” version is just a licensed copy of the iCompta app.

OK, I tried Quicken 15 or 16 but it wasn’t as good as Q4M2007 plus it did not have a fully functional iOS app (it was read-only). I tried the latest version of Quicken last fall but it STILL didn’t have a fully functional iOS app, plus it was now subscription only. The latter makes it totally dead for me. So I went looking again.

I finally settled on two Mac applications that ALMOST match PocketMoney: iFinance and the ORIGINAL iCompta. However, they have problems with QIFs exported from PMD so I export from it, import into Q4M2007LC, then export a QIF from it and then import that one into both iCompta & iFinance.

My iMac can’t go past MacOS 10.13.6 (High Sierra) and iOS 14.4.2 was the last version of iOS that will run PMiOS so I refuse to update my iPhone past it. Fortunately there is a developer who is writing a close version of the original PMiOS that will run on newer iOS versions. If I have to replace my iMac with a newer version, I’ll be forced to use just iCompta, iFinance, or both full-time.

I looked at it but it doesn’t have a fully functional iOS version.

I only need to balance my checkbook and I manually enter each check. So, after eons using Quicken, SEE Finance has worked fine for me. It took a little getting used to, but my CPA son told me where to find things.

The register is almost as tight as Quicken and data input is easy. There’s no “Congratulations” when you balance the register. Just a gloriously simple “equal sign.”

If your requirement truly is nothing more than balancing a checkbook, you can do that with a simple spreadsheet. I’ve been using Excel for this for a long time. My sheet has 12 columns, modeled after a paper transaction register:

A: Date. The date I wrote the check, or the date where the transaction is scheduled to take place (for electronic transactions)

B: Cleared. When the check cleared or the date the transaction is posted on the bank’s web site. I typically log on to my bank’s web site every day in order to see what posted that day. I update the spreadsheet rows based on what I see.

C: Check number. I use short text codes for other kinds of transactions, including

ATM,BP(electronic bill payment),DDS(direct deposit),DEBpre-authorized debit/ACH,FEE, andINT(interest)D: Description

E: T. I put a “T” in here for tax-deductible transactions, so I can quickly search for them

F: •. I put a "•* character in here after I see the transaction posted on the bank’s web site

G: √. I put a “√” character in here after I see the transaction on my monthly statement.

H: Debit. Dollar amount for any debit (check, payment, etc.). Blank if the transaction is a credit.

I: Credit. Dollar amount for any credit (deposit, interest, etc.). Blank if the transaction is a debit.

J: Balance. The running balance. Computed as the value on the previous row, minus the debit column, plus the credit column.

K: • Balance. The running balance, only counting rows where there is a character in the “•” column. Computed with an “if” statement. If the “•” column is blank, copy the value on the previous row, otherwise compute it like the balance (previous row, minus debit, plus credit).

This lets me see the running balance of only the transactions that have posted to the bank’s web site.

L: √ Balance. The running balance, only counting rows where there is a character in the “√” column. This lets me see the running balance of only the transactions that have been reported on my monthly statement.

When I reconcile my statements, the procedure is pretty simple:

I can also reconcile against the inter-statement values on the bank’s web site doing the same thing with the “•” column (F).

To make it a bit easier to browse the table, I keep the table sorted by Cleared, then Check No, then Date then Description.

I create a separate file for each calendar year (with year-straddling transactions appearing in the year where the transaction cleared).

I realize that financial apps like Quicken do a lot more than this, but if you really don’t need to do anything more than balance a checkbook, a simple spreadsheet like this is quick and easy. And it’s pretty much free, since everybody can get a free spreadsheet app (Apple bundles Numbers with Macs and you can download LibreOffice).

I too was impacted negatively by the demise of Quicken back in 2007… What a feeling of absolute betrayal! Without going into my long saga to find a better finance app, after thoroughly testing several options over a 2 year span, I finally found “iBank”. I would not go back to Quicken if you paid me.

iBank’s name was changed maybe 4-5 years ago to “Banktivity”. It is without any doubt on my part THE MOST EFFECTIVE AND ROBUST personal finance software I have ever seen and used in 30 years. It is kept up to date, has excellent tech support and offers a relatively inexpensive subscription service that enables me to access my account and manage our rather complicated finances on any device (iphone, ipad, and my M1 Macbook Air). I give it 5 STARS.

Glenn, I’m a bit late to this conversation, but I wanted to comment on how similar my experience with Quicken is to your own, from early adoption of Quicken 98 through the 2017 Lion update, and right down to a late-2015 iMac with a failing Fusion drive (recently replaced with a 4TB SSD while awaiting Apple’s new, notional prosumer large-screen iMacs). It can indeed be difficult to give up on the past, especially if one is a long-time Mac user like me.

In my case, I’d been aware for some years that Q2007 would soon become more and more difficult to run (it was already becoming tough for me to read its unconfigurable, tiny register text), and I knew I had no interest in maintaining a separate CPU or partition for the purpose.

I’d been keeping an eye on the features-list updates from Quicken’s new owners. It was a relief to see that they seemed to be listening to user requests for “new” features to get implemented (I had a relatively short list of my own must-haves), and that they also had a relatively clear roadmap which they were being disclosive about.

I’d looked at alternative utilities, but like you, decided that I’d gotten too accustomed to Quicken’s larger set of features. Everything else seemed either incomplete or oddly designed.

Once those features seemed to be well in place, I bought in. That was in December of 2018. Thanks to my work schedule and other commitments, I didn’t actually import existing data to it until the middle of the following year, and it took another year of learning the new UI and cleaning up the imported aberrations before I started cautiously keeping two sets of books, as identically as possible.

At the end of 2020, I decided that 2007’s increasingly failing WebConnect capability and limited data-set capacity were too much to put up with, and that I’d become comfortable enough with Deluxe to rely on it entirely. My 2007 database is now a fixed archive of transaction history. Any remaining feature gaps I could complain about in Deluxe are more likely a result of my not yet having found their counterparts than actual omission on the developers’ part.

Many thanks for this article.

I read in the article, “At various times from 2014 to the present, I also tried Banktivity, Mint, Moneydance, Xero, and others. None met my requirements…”

I’m curious…what were those requirements?

Earlier in the article, there’s a bullet list of what Quicken 2007 did for me. I should probably have been more explicit in saying—“i.e., that list above”—but that’s what I meant.

Some of the packages I tried were poor or didn’t support at the times I tested them having a mix of personal and business accounts, some didn’t provide summary and transaction reports that could be derived from hierarchical categories set for each transaction, some didn’t support all my financial institutions.

I would get in some cases about 90% to where I wanted and then realize I was sunk. Xero, for instance, is very powerful, but business focused, and I found its configuration through the web just to test it out so frustrating and cumbersome that I gave up—and that didn’t include the issue that I believe I couldn’t have imported my old transactions.

The joy in this conversion is that Quicken Deluxe includes pretty much everything I need; the transition had a few hiccups, but once solved have not been a problem; and I can pull the tax and other financial reporting I need. I was able to build a report and test it against previous spreadsheets I’d assembled for paying quarterly taxes and they matched exactly. A good sign!

I think that my question got lost in my reciting my history of dealing with financial apps, but I’ll ask it again here: why do people feel that Web Connect (the ability to have the financial app directly link to bank and credit card accounts) to be vital?

I find it to be a security risk to have the connection information maintained in the app.I’ve never had a problem downloading the data in Quicken format and then having the app merge the data into the appropriate account. Having payments not automatically upload for my register does result in a slight bit of duplicate activity as I must manually activate my bank’s payment facility and, essentially duplicate entering the bill pay information. However, if something goes wrong, it’s much easier to troubleshoot and identify the concerned parties than if the app automatically submitted it.

So, again, I curious why some folks find Web Connect essential?

Mostly to avoid repeating tasks that a program does well and I frequently fumble. Gathering data for daily review from sixteen individual accounts is a task Quicken does well.

I honestly prefer to enter my data as well, although when in a rush the web connect comes in handy.

I bought Quicken a few years ago to try out. Data entry was so archaic that I gave up on it pretty quickly. There were a number of others things I didn’t like, but that was a big one for me. Enter, tab and a lot of other things didn’t work the way I expected them to.

The subscription model is a HUGE turn off for me as well.

There was a time where I thought it would be great to be able to record receipts on my phone and have them sync to Quicken when I walked in the house, but I no longer think that. I am pretty sure I used that Palm extension someone mentioned, many many years ago.

I’m still using Quicken 2007 on a Sierra machine.

Diane

Quicken tracks retirement investment, mortgage, credit cards, personal, and business accounts for me, and I have access to my children’s various accounts (they are minors) to which I transfer allowance and we manage educational spending. So I accumulate 100-200 transactions a week. It was getting to be quite a burden manually! Downloading files is ok, but I am managing about 25 accounts (although not at 25 institutions), so the web connection option is invaluable for my purposes.

While I think there’s a point of risk introduced here, I don’t find it sufficiently worrying compared to all the other points of risk I can’t control!

I hate to keep accumulating them, but I was burning honestly in the $1,000s a year of my billable time (or my private non-working hours) with the previous versions.

Once we got through initial setup with Xero, it has been a joy to use for business accounting. But it wouldn’t be appropriate for personal accounting—among other things, it doesn’t support retirement accounts.

I suspect that how much Web Connect is a requirement or not depends on how many accounts and transactions one has. A few and it’s not that big of a deal to enter everything by hand. Glenn’s level I can see it being necessary. I’m somewhere in between, and could probably live with entering every transaction manually, but downloading them saves a bit of time, and also is more accurate.

On the security risk, there is some. However, Quicken stores login information in the keychain, so those passwords at rest are as secure (or insecure) as everything else stored in your keychain. Further, many financial institutions have a separate path to log in to download transactions that Quicken uses, so if you turn on 2FA, Quicken will still be able to download transactions but if someone manages to steal the login information, the most they could do is download transactions, not the stuff you’d do through the normal web login (transfer money, buy and sell securities, etc.) So IMO, the security risk is pretty low, but obviously others may feel differently.

This is an excellent point. My credit union, most credit cards, my retirement fund, etc., all have a 2FA requirement that is IP/device locked. So if someone grabbed my Quicken file and so forth, they would still need either my authentication app or phone # to log in elsewhere. Even if Quicken poorly secured the logins, my credit union and a few other financial sites are very very sensitive to “fresh” logins, so they would likely have to validate through 2FA, too.

Not with regard to Quicken, but with Xero, anyway, I consider the automatic connections to be access to the “truth.” I don’t assume there could be errors in the statements, and I’d hope that error handling would reduce the chance of mistakes (I accidentally re-uploaded an old Apple Card statement to Xero and was helpfully told that it had already been imported). But statements just don’t feel as connected to the real data behind the scenes.

In the end, the simple fact is that for me there’s more significantly more effort in downloading and re-uploading statements, which I’m forced to do with the Apple Card because there’s no automatic access to that account. It might be on the order of only 5-10 minutes per month, but there’s an additional cognitive load (I have to remember to do it each month) too. If that were scaled across all my accounts, it would have a non-trivial impact on my time.

There’s always a security question in such situations, but I don’t hear frequent reports of people having their accounts hacked through automatic connection technologies like Web Connect. It may have happened here and there, but if it were commonplace, I think we’d all know. My belief is that banks protect that sort of access really well, since exploits would be an existential problem.

I’ve been a Mac Quicken user since 1996. I distinctly remember waiting with bated breath for the Quicken 2007 release so that I could finally upgrade beyond Snow Leopard.

I made the jump from Quicken 2007 to modern Quicken in early July 2021. In my case, I had no choice as the Q2007 database went unstable and became easily corrupted. I used a recent stable database backup(!) for the conversion process.

In fact, I had been preparing for this transition since September 2020 when I purchased a Quicken subscription. I performed several trial runs to see how well the conversion would work and how the new interface and reporting compared. I had stayed with Mojave on my 2018 MBP specifically so that I could run the Q2007 database conversion locally (upgrading to Catalina or Big Sur requires a remote conversion as @glennf discussed). I was convinced that the conversion worked, but I still preferred the look and feel of Q2007 and the familiarity of common operations and reporting that kept me efficient. So, I continued to use Q2007 fully aware that I would abruptly run out of runway as soon as I needed to move to (in my case) Big Sur.

The irony is that the conversion in July did not go as smoothly as those trial runs last year. Quicken had advanced a major version to v6 during that time. When I ran the (local) conversion with v6, the primary checking account was completely unreconciled with ramifications for several other accounts. My first reaction was that I was either doomed to start from scratch (going forward) or that I would have to invest untold hours making corrections without any certainty of success in the end.

Fortunately, all was not lost. After digging into the account, I noticed some double accounting associated with a mortgage refinance. I recalled having issues with that account not properly entering monthly payments (principal & interest didn’t adjust automatically for each month). Amazingly, I was able to delete just ONE month’s double entry transaction of the old refinance payment (the 1st payment), and the checking account updated to match the original Q2007 database perfectly. Having an engineering background, it was as close to MAGIC as I’ve ever felt a software program has accomplished. Those with a huge time investment in their respective Quicken databases can appreciate how much of a relief that was for me. It’s as if a massive domino rally reset itself after fixing a single domino. Glorious.

I still miss the charming personality and familiarity of Q2007, but I recognize that progress in this case requires compromise. I’m thankful that Q2007 was a remarkably solid performer well past it’s expected lifetime, giving modern Quicken enough time to mature into a useful alternative on the Mac.

PJ

For anyone interested in switching away from Quicken, there is a long list of alternatives, including some that are free, here:

Macintosh Accounting Software

http://www.macattorney.com/accounting.html

Item#4

One more comment… here is a link that compares Banktivity to Quicken.

For me the best part of Quicken was that it looked like my checkbook. Quite honestly the multi-pane model of modern software is unintuitive and works poorly with my cursor control devices, especially my Wacom pen. I love being able to move through the windows of my different registers without having whichever one I was using close. Mail comes up as a list. I don’t use Tabbed browsing in Safari, and iTunes is a big PITA because if I touch an alphabet key to move through a list of “songs”, half the time it is in the wrong column and I find my list of playlists moving instead of the list of “songs”.

Despite working with later versions, which seem just plain ugly, for my own accounting I’m still using 2007, and hanging on to my mid-2012 MacBook Pro.

There are too many other pieces of subscription software involved in moving on, and at my age I’m not sure it’s worth it anyway, but connectivity issues hover about in the background, especially with peripherals.

Well, I’m not the only one looking, apparently. Still looking for some type of formal migration analysis:

I went through the same process several years ago. I started with Quicken on Power PC in 1993 and I still used Q2007 on Mac. I resisted upgrading my OS but at the same time I knew the writing was on the wall and also tried a number of alternatives. I paid for iBank once since I think it was the closest option but still was awkward for me and just didn’t work.

In 2015 I bought the updated Quicken Mac and fully switched and other than a few hiccups in transferring account data (easily solved with a few investigations/comparisons of data discrepancies) the process was pretty painless. The conversion process for all the other alternative programs had the same issues or even more for me (mostly adjustment balances with no categories). Quicken Mac provided the better conversion for my data.

When the subscription model came out (2017?) I hesitantly signed up. I am not usually a fan of this pricing model, but the new Quicken team have used the revenue to continually improve the product which I am happy to see. I am a happy customer now.

I do still miss the easy Net Worth and Income/Expense options from the Q2007 version, but there are alternatives in the other parts of the current version.

I too have made peace with the new Quicken but miss one q2007 feature: easy transaction export and import. My partner and I both maintained separate q2007 files; To prepare annual tax report I exported transactions out of each of our two Quicken files - and then imported both transaction exports into a new Quicken file - from which I built the consolidated reports for the accountant. Can’t find a way to accomplish the same result in the new Quicken Deluxe…

Under the hood, Xero is just a general ledger, so depending on your needs you can still track your retirement accounts on it (although it won’t necessarily be able to have a bank feed to them). I’m happy to expand on how one might do this if you’re interested.

I’ve ranted about this elsewhere, but I do find the insistence on being able to keep old (meaning, say, more than 5 years old) transactions “live” in your personal finance software mystifying. If I really want to keep that stuff for that long, exporting to a spreadsheet is more appropriate than keeping myself chained to any one program’s file format, IMO. I treat my personal finances like a business in that respect - at the end of the year, I close everything out, run the reports, put them in secure storage, and then begin the new year as a new accounting period. I’m not saying I would intentionally throw out old transactions just for the sake of throwing them out, but I definitely wouldn’t let “But how will I know how much I paid for a slice of pizza in 2003” keep me from changing to software that works better for me today.

It’s a bit like the opposite of boiling a frog (although apparently that is a myth). I only realized that I’d left all my transactions captive somewhere when it was too late. I could have exported or run reports to extract data and I did. I have a number of business and personal debt spreadsheets that have salient data.

But it does sometime happen that I need to remember if we had certain work done or who a contractor is or if we paid someone back an amount we promised in full. Being to scan 20+ years of data is far better than 5+. And unlike paper records, which I have rarely had to take recourse to over the last many years—typically only to find car loan or mortgage details I’d forgotten—it’s several times a year or more frequently that I look for this kind of old transaction-related data.

As you say this, though, I think I will do a full report dump to have offline at the end of future years. Because a PDF is easier to search if I don’t need to generate a customized report, but am just looking for one thing!

Yes, this is exactly the realization that most people don’t reach, and it sounds like you just hit it:

(1) If you need the reports, you can just print / save those off and refer to them as needed (and in fact, you really don’t want to update a report 6 years later - you want it frozen).

(2) If you need the transactions, even in the facehuggeryiest software you can typically still get a CSV (or as you say, PDF) out. And it’s as easy to search for “ConsultingLLC” in Numbers or Excel or your PDF reader of choice as it is in Quicken (I in fact will claim it’s easier.)

I think one other psychological thing that keeps people locked into one tool is they like seeing a chart that goes back 10, 15, 20 years or whatever – but if you’ve run the reports, it’s easy enough to roll those up in a spreadsheet and do them there, too.

Maybe I’m the only one who cares about converting from SEE Finance to Quicken, but I learned a few things today:

Quicke Deluxe for Mac can ONLY import from QFX. That is what the Quicken rep confirmed.

SEE Finance can ONLY export as QIF or CSV.

So that sucks.

So then I wondered if there is some middleware that could convert from QIF to QFX, and I found this:

Certainly would be worth the $20 if it works, although it’s pretty lame that between the two apps, there is no overlap of these long-time basic formats. I don’t know if I should worry that this ProperSoft app can be trusted to not spy on my financial records and harvest data.

I also don’t know enough about the formats to know if migrating from QIF to QFX is lossy; am I going to lose data?

It really would be nice if I didn’t have to go through all these shenanigans. Quicken doesn’t have a free trial, but they have a 30 day money back guarantee.

GnuCash can import QIF, and the price - free - makes it mostly harmless to give it a shot.

Generally what I’d say is that for both personal finance and accounting software, file formats are a mess. No one is trying to make things awful, but they basically are and always will be, because different systems have different data models and QIF is less a file format than a series of vague suggestions about how a file might be organized, maybe. This is part of where my “Don’t migrate, archive and switch” recommendation that I made to Glenn comes from. Even if Quicken seemed to import those QIFs, your confidence that it imported your last 10 (or whatever) years of data correctly should be very low.

My general advice for anyone considering a switch in finance software - no matter what software! - is:

(1) Pick a cut-over date.

(2) On the cut-over date, export your existing transactions to CSV and stick it in a spreadsheet. When you want to look up any transaction before that date, you’ll use that. Generate whatever reports (balance sheet, income statement) you need for your records.

(3) Set up your account structure and opening balances in the new software. Other than that, start fresh.

If you’re not sure you want to switch, you can run them side by side for a while. But of course, that’s a lot of work! At one point this year I was running 4 systems before I settled on the one I’m going with, because I’m very foolish.

Thanks, I’ll try it! Or at least look up the feature list!

Sorry, but no! That completely sucks! Sure if your legacy data is truly trapped on an island of incompatibility, then you have no choice. But otherwise, what a horrible downgrade of productivity. Imagine searching for a transaction and you can’t remember how many years back it goes. Now where do you find it? And forget writing reports that go back in time.

Same reason I will never split my 1.4TB photo library into smaller ones if I can avoid it. Same with my music library. Everything.

At work I actually have to archive old email going back decades into various archives. What an unmanageable headache finding anything!

Ever since Quicken went to a subscription mode that killed it for me. I don’t mind paying once for an app and occasionally for updates but I refuse to pay a monthly fee for them. Time to move on to another app.

My meta-point is “I guarantee you, it totally is.”

You find it in the plain text (or spreadsheet) log that you exported; even if you’ve migrated 10 times (I hope not), each time you appended the exported data to your plain-text(-ish) transaction log. All migration data goes to the same place. The only date you have to remember is “This was the last time I switched” which will normally be self-evident.

Just to hammer this point home: You’re not keeping a bunch of separate plain-text logs labeled “Finances 2002-2004” “Finances 2005-2007” and so on. You have one file called “Previous Transactions” that contains everything. If all you care about is literally being able to search for a transaction, then you can just append the CSV export from each migration to it and now you can use any text editor, or even just

grep. If your own sense of neatness won’t allow you that (because each export will have slightly different field orders, etc in CSV) then you can import each CSV export into a spreadsheet and put “Organize things so the columns match” on your to-do list.Either of these is both easier and less error prone than the import path you are going down right now. I have never seen a significantly large QIF import go perfectly. Never. But there’s a good chance you won’t discover the fact that you imported some field wrong for months or years.

Well, Glenn said “ It took about half an hour to convert and import tens of thousands of transactions, but it succeeded.”

But I agree that there could be flaws that were not noticed. But exporting to CSV itself would need more evaluation before I trust it. Does it include all the metadata? How does it handle double entry accounting (moving money between accounts?) In general, what flaws would a migration have that claimed success that a CSV would not have?

Earlier this year I did a QIF export and import from Moneydance to See Finance, transactions going back to 2000, and the only thing I had to do was set initial balances for accounts that existed prior to 2000. (Moneydance didn’t export the initial balances in the QIF file.) Good enough for me.

I was shocked it went so well, and I don’t technically need all my data since about 1998, but it is useful to look at earnings and sources of revenue and expense across that period! I was really more concerned about last year and this one. Or, maybe more precisely, about the last seven years of data, since I have mostly electronic records for that period and audits can go back that far.

It’s yearly and I hate to keep accumulating them. But I’m watching updates appear weekly with fixes and improvements, and before Quicken 2007, I believe I would pay for an update every 1 to 3 years as they improved the product. Because I use it for personal and business accounts, and because the new Quicken is shaving so much time off my previous manual processes, the annual cost is totally fine in my case.

I’m with you on the subscription model. After years with MacMoney then the various Quicken versions including Q2007 forever, I was ready to try another option. Then I tried Quicken Deluxe in 2020 and since then I am very pleasantly surprised. Like Glenn said, they really seem attentive to updates and fixes and it does everything I need. I’ve been a heavy Quicken Direct Connect user since that feature was offered and just about a month ago I was shocked when Wells Fargo dropped their $9.95 monthly fee for using QDC with them. I do all bill pays though the register and all accounts are on auto-reconciliation. Fast, accurate and reliable.

Glenn, Thank you!, Thank you!!! I’ve been using Quicken since it first came out and have an old iMac (27" Mid 2010 running OSX 10.8.5) with version 16.2.4 of Quicken as only one of two application on it. These two apps (the other being The Print Shop - V4) will not run on my Mac Mini 2018 running Catalina. And the reason for the purchase of the Mac Mini was because the iMac has a serious problem (probably the mother board) and is too costly to repair. I’ve been stuck.

Now, after reading your column, I had hope. I did a backup of the latest data on my iMac in Quicken. Transferred the file to my Mac Mini. Purchased “The New Quicken” and installed it. Then started it up and held my breath with I pointed to the file so Quicken could “do its thing”. It took less then 5 minutes to convert the file to the new format.

I’ve since made a few transaction without any problems and tomorrow I plan on doing a Reconcile.

I’ve noticed it is “smarter” than the old Quicken (it knows of all the “vendors” I’ve used) and displays them very nicely.

Once I’ve done a reconcile I’ll let you know how it went.

Again, from the bottom of my heart; Thank You! Now if you could only find a replacement to my Print Shop (I’ve got over 200 greeting cards and 30 or more envelopes that I use on a regular basis). I’d really not have to redo any of them.

Be Safe, Al

Hi Dave!

Quicken supports importing QIF files. When you create a new Quicken file, the “Let’s get started” screen asks you to choose from several options, including “Start from a .QIF file exported from another application”

The online help has more info: - Getting started

You can export the contents of your Quicken file to a “Quicken Transfer File” (QXF) by choosing the File > Export > Quicken Transfer File (QXF) menu item. If you do that for both of your Quicken files and get 2 QXF files, you can then create a new Quicken file and import the QXF files into it.

Wow! I was pretty clear with the Quicken rep that I was screwed because of this lack of a common format, and they insisted QFX was the only option.

What version of Quicken are you speaking regarding? Maybe QIF import was available for some versions but not others?

Correct me if I’m wrong, but GnuCash can’t do direct downloads of transaction data?

If so, that’s a deal breaker. Free is great, but that’s downright dark ages. Quicken was doing direct downloads back in the 90’s over a modem :-)

The current Quicken app (the “subscription” product, versus the non-subscription yearly products Quicken 2017, Quicken 2016, …) has always supported QIF import. (It was introduced in a mid-cycle update to the Quicken 2015 product, I believe.)

The subscription Quicken app was version 5.1 when it was first released in late 2017. The current version is 6.3. (The version number was changed from 5 to 6 when the system requirements changed in late 2020 to require macOS 10.13 and later.) As long as you have an active subscription, you can automatically update to new releases when they come out. If your subscription expires, you can continue using Quicken, but you can’t use connected services (downloading transactions from banks, syncing to mobile or web apps) or install updates that were released after your expiration date. (This is similar to the non-subscription yearly products like Quicken 2017, which would be supported for 3 years after their initial release.)

A point of clarification, the current version of Quicken only supports import of QIF files when creating a new Quicken file. Once the Quicken file is created you cannot import or export transactions into Quicken via a QIF file.

That’s a great point. It’s primarily intended to be accessed by making a new file via File > New and choosing the option to start from a QIF file.

If you really wanted to get the QIF into an existing file, you could create a new file, import QIF into it, then export it to QXF, and import that QXF into your other file.

QIF is a very old file format, and I think there were ancient agreements between banks and Intuit that the banks needed to pay Intuit and switch to the better OFX format in order to keep supporting transaction download into Quicken, and QIF wasn’t intended or allowed for that purpose. That’s one reason its utility is limited to starting a new file: so it can’t be used to continually import transactions from a bank and bypass the use of OFX, for example.

(The world has changed since then, though. Probably time to revisit such deliberations!)

Hi Chris! Hm. Different feature sets between the subscription version and the annual dated versions? News to me, thanks for that. Also for the qif > qfx tips… Sometimes I really like thees interweb.

Update!

I decided to take the plunge back to Quicken based on that link that says it takes a QIF import. No free trial, but the 30-day return policy seemed good enough.

I did a QIF export of “transactions with categories”, whatever that means, from SEE Finance. I then imported that to Quicken Deluxe. I forget how long it took, but it succeeded. I believe the dialog box said it might be 300,000 some transactions.

Looking in there, I do see dozens of historical accounts; probably everything I ever had going back to my 1993 days with Quicken. I had to re-hide all the closed ones; tedious but once-and-done. I also had to set up my online banking direct connects, but that’s all working now, too. My list of custom Categories are all there, which are important for tax purposes for my rental property. I’m sure I’m going to have to set up a bunch of “QuickFill Rules” from scratch to compensate for the corresponding feature from SEE Finance.

It looks like it’s going to work fine.

It feels good to be back using a product that is managed by more than a single person. I hope Quicken doesn’t start getting buggy and marginalizing Mac users again, which is why I originally left.

SEE Finance’s limited feature/OS-compatibility combinations are the reason I haven’t upgraded my main Mac to Big Sur. So that feels good to have that obstacle behind me.

Thanks to @Chris_Campbell and @glennf for the nudge!

Hi Jaxon!

Yeah, as time goes on, the feature set grows. There are no more annual dated versions: the last one was Quicken 2017, which is no longer supported. The subscription app was introduced after Quicken 2017 and gets new features as time goes on. (No more having to wait for the next annual release, the features are released as soon as they’re ready.) Here’s a link to the release notes archive for every version of the subscription app: https://www.quicken.com/support/subscription-release-quicken-mac-release-notes

Thanks for all the info. Does anyone have any experience updating quicken 2004 or 2005 ? I am currently using that ancient version, on an old MacMini, have tried the 2015 version and some of the alternatives and found them unacceptable, but would like to modernize. I also would like advice on exactly how to set up a spreadsheet to hold exported CSV or QIF data. When I’ve tried that I get a total mishmash, probably because I am lacking the technical expertise of many on this forum,

If nobody here has advice, you can also try the Quicken forums. They seem to be full of helpful people.

Thanks. I will do that. Still hoping someone here has some thoughts, too,

I find having Quicken download most of our accounts is a big help. (A few we haven’t gotten to work yet, for various reasons.) We don’t run as many transactions as Glen, but the type on some of the bills is so damn small that I find it hard to read. We also have my business, rental property, and we’re starting to get into retirement income. I like getting quick updates on credit cards because we’ve had fraud and mischarging problems in the past. We never were tempted to try using Quicken to access our bank account. Our small local bank has excellent customer service that I have gotten used to.

One big reason I keep all transactions going back 20 years “live” is when I have to look up things like when did we buy an appliance or do repairs on our rental appliance. When a dryer died a couple of weeks back, a quick check showed that we bought it in 2005, so it wasn’t worth repairing if it wasn’t easy. It’s also valuable to have a log of who did what repairs.

For historic records, I would recommend printing annual reports. Keep the PDFs on your computer (backed up to external storage like a USB drive or encrypted cloud storage) and file paper copies in a cabinet. This way you won’t lose the information if something should happen in the future where you can no longer run the software.

I print annual records to PDF too, and your remind me that I should figure out how do get the records I want from Quicken 2020. However, annual records are not helpful if you aren’t sure what year you did something, like buying a new appliance. That’s when a Search on a large archive of live transactions can save a lot of time over looking through many annual files.

Trying to print out records from Quicken 2020 proved an educational experience. Simply put, I can find no report that offers to show a full year of transactions from the whole file, or all past transactions. It is possible to export all register transactions to a CSV file that can be opened by Excel, but it does not export “Hidden” accounts, such as closed credit card accounts which may still have important information not duplicated elsewhere. I don’t have time now to dig down to see if there’s something hidden somewhere or to fiddle with options to try to find a way around that limitation. I hope I’m missing something. If there is no work-around, it would be a serious limitation.

Chris, I opened my q2017 file a few days ago and the app offered me an update. Don’t remember the version number but IIRC I got another update back in Feb or Mar ‘21…

The last version of Quicken 2017 was v4.8.6, and was released in December 2019. If you were running an earlier version, you would have been prompted to update to the latest available (4.8.6).

BTW, when you install an update for any app that uses Sparkle as the updating mechanism, the previous copy of the app will be moved to the Trash. Which is handy in case you need access to it! (You could go into your Trash and see what version of Quicken 2017 you were using before the update.)

I don’t think there were any updates in 2021, but you will periodically get prompted to upgrade to the subscription app at a discount, which can look a lot like an update prompt. (Those discounts can sometimes be substantial; if you ever want to see the current upgrade offer, you can choose the Quicken > Show Current Offers menu item in Quicken 2017 or earlier.)

Happy Apple Event Tuesday!

Beg pardon, Chris - I’m on qDeluxe v6.3.2, not q2017. Yet another version with its own feature set, or just another name for the Quicken subscription product?

Enjoy Cali Streaming~

Starter, Deluxe, and Premier are different subscription tiers, which enable different features. But they all use the same “Quicken” app, which is currently version 6.3.3.

More info about the different subscription tiers is on the web site: https://www.quicken.com/mac/compare

Starter doesn’t have 12-month budgets or investment accounts; there’s not much difference between Deluxe and Premier other than adding bill pay services for any bank account and a special phone number for priority support. There are bigger differences between tiers for the Windows version of Quicken. (BTW, the subscription lets you use Quicken on whatever platform you want: Mac, Windows, iOS, Android, web. If you’re curious about Quicken Windows, you can try it out in Boot Camp, Parallels, or VMware, or run it without emulation via CrossOver, even on Apple silicon I think. Sign in to Quicken Windows with the same Quicken ID you use in Quicken Mac, no extra purchase necessary.)

Double-checking — I have 2017. Can I trial Deluxe in parallel without deleting 2017 in case I want to go back to it? Maybe importing a backup copy into the trial Deluxe? I do keep my Quicken data on an external drive so I imagine it is safe if I trial with a backup that I can put on my desktop before import. My current Quicken data goes back to 1993 and I don’t want to lose it, as others have mentioned, to track down things like appliance purchases.

When I upgraded from 2007, Quicken Deluxe just read from the old data file into a newly created one, leaving the old one alone, and I can still launch and run 2007 with the old data file if I want, so I’d imagine it should be the same for 2017. It wouldn’t hurt to have backups (which you want anyways), and to upgrade from a copy of your old data file, but I don’t think it’s necessary.

Yes, Quicken will import a copy of your Quicken 2017 file, and leave the original untouched. “Quicken” and “Quicken 2017” are two completely different apps from macOS’s point of view, and they won’t interfere with each other. You can even run them both at the same time, and compare them side-by-side…

Thanks. I’ll give it a shot.

I looked at SEE Finance but the lack of a direct Mac <->iDevice WiFi sync capability made it DOA.

I looked at Bankitivity but two things made it DOA: lack of a direct Mac<->iDevice WiFi sync and it is subscription only.

SEE Finance 2 syncs quite well between my wife’s and my Macs and my iPhone, using iCloud. That’s not direct WiFi of course but good enough for our purposes. Note though for the Mac to Mac sync I have to make a trivial file change (add/remove a tag) to force the sync.