Apple Revenues Drop 4% in Q2 2024, with Bright Spots from Services and Mac

Reporting on its financial results for the second quarter of 2024, Apple announced profits of $23.6 billion ($1.53 per diluted share) on revenues of $90.8 billion. Darkening those large and highly positive numbers is a 4% decline in the company’s revenues compared to the year-ago quarter (see Apple’s Q2 2023 Slightly Down on Exchange Rates and “Macroeconomic Conditions,” 5 May 2023), marking the fifth revenue drop in the last six quarters.

Apple had anticipated weaker results because the company enjoyed higher revenues last year as it made up for pandemic-related supply shortfalls. CEO Tim Cook pointed out that if that one-time revenue infusion were taken out of the year-over-year comparison, this year’s second quarter would have seen slightly higher revenues than last year’s. Q2 2023 was also one week longer than Q2 2024.

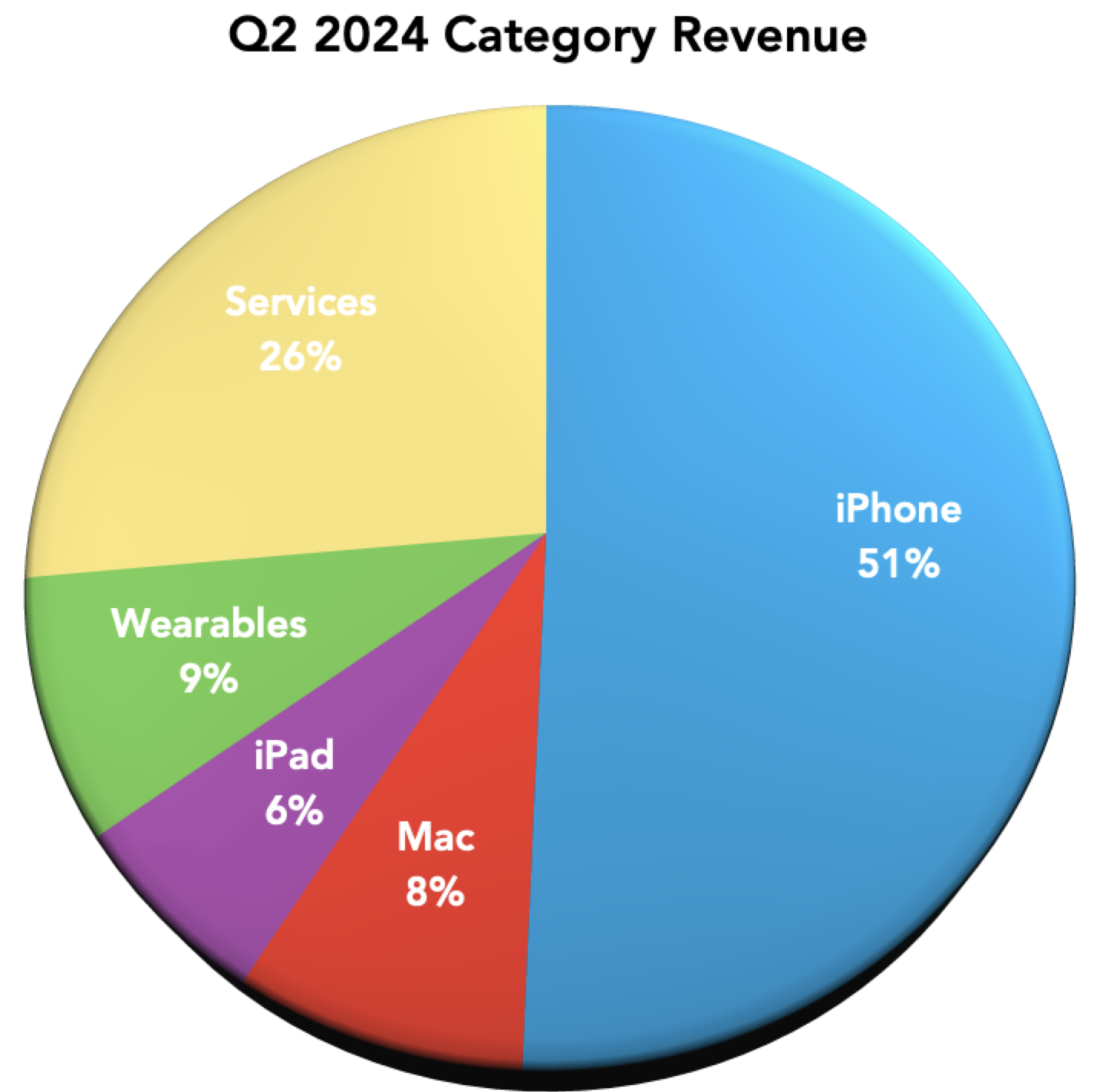

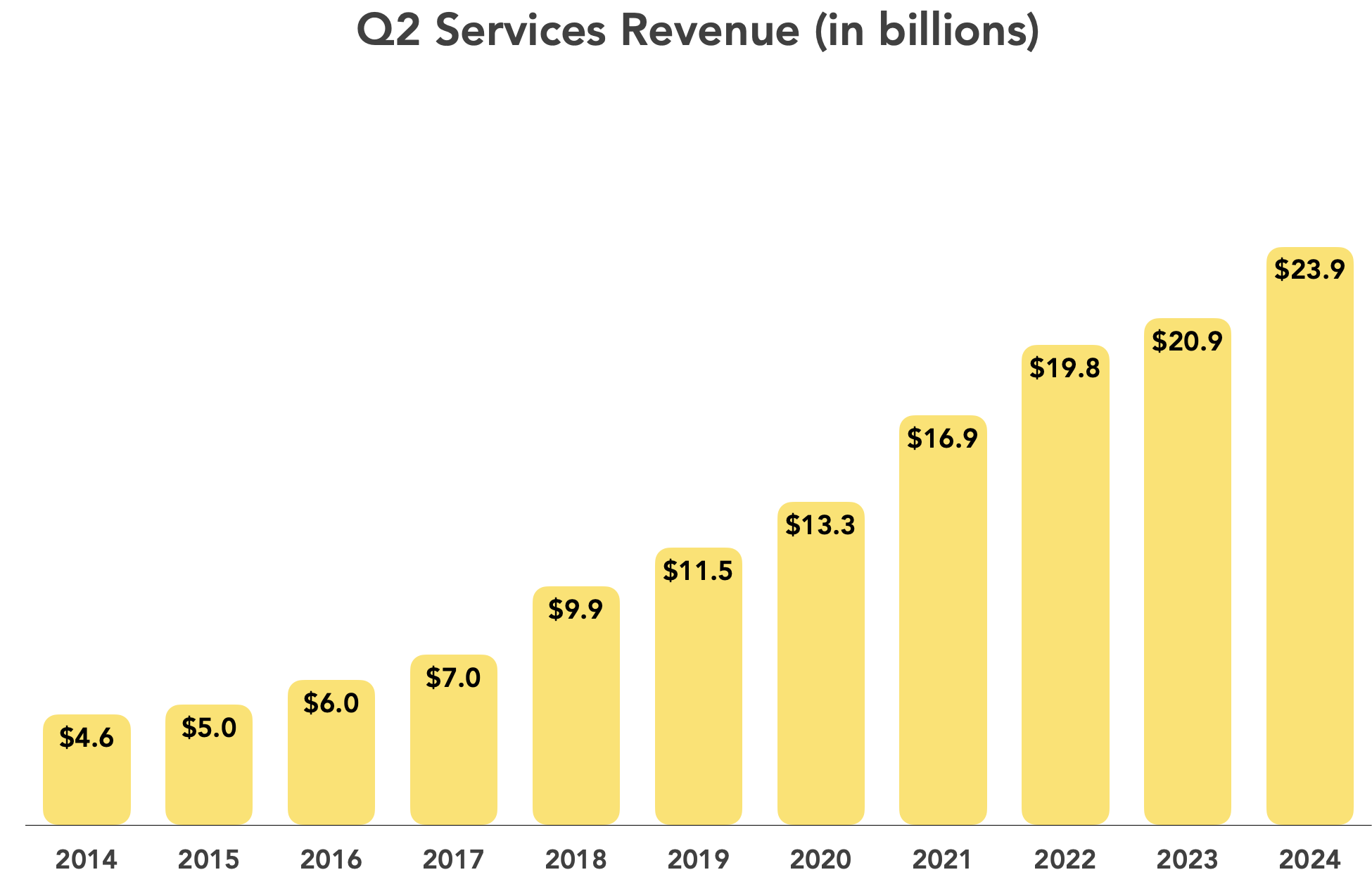

The star segment of the quarter’s revenue report was Services, which grew 14% over last year’s results and accounted for 26% of Apple’s overall revenues. The Mac was also a bright spot, up almost 4% and maintaining its 8% share of Apple’s overall revenues. The other three segments were all down significantly, to the point where the iPhone’s share dropped to 51% of revenues, down from 54% last year and 58% last quarter. Apple’s emphasis on Services is looking like an ever-smarter business move.

iPhone

When discussing its Q2 2024 iPhone revenues, Apple repeatedly used the term “difficult compare” because Q2 2023 enjoyed a sales bump due to the company fulfilling pent-up demand from COVID-related supply chain disruptions. Cook also took pains to note that Apple still saw iPhone growth in mainland China, where the two top-selling smartphones were the iPhone 15 on the low end and the iPhone 15 Pro Max on the high end. Nonetheless, iPhone sales were only $46 billion, down 10.5% from the year-ago quarter.

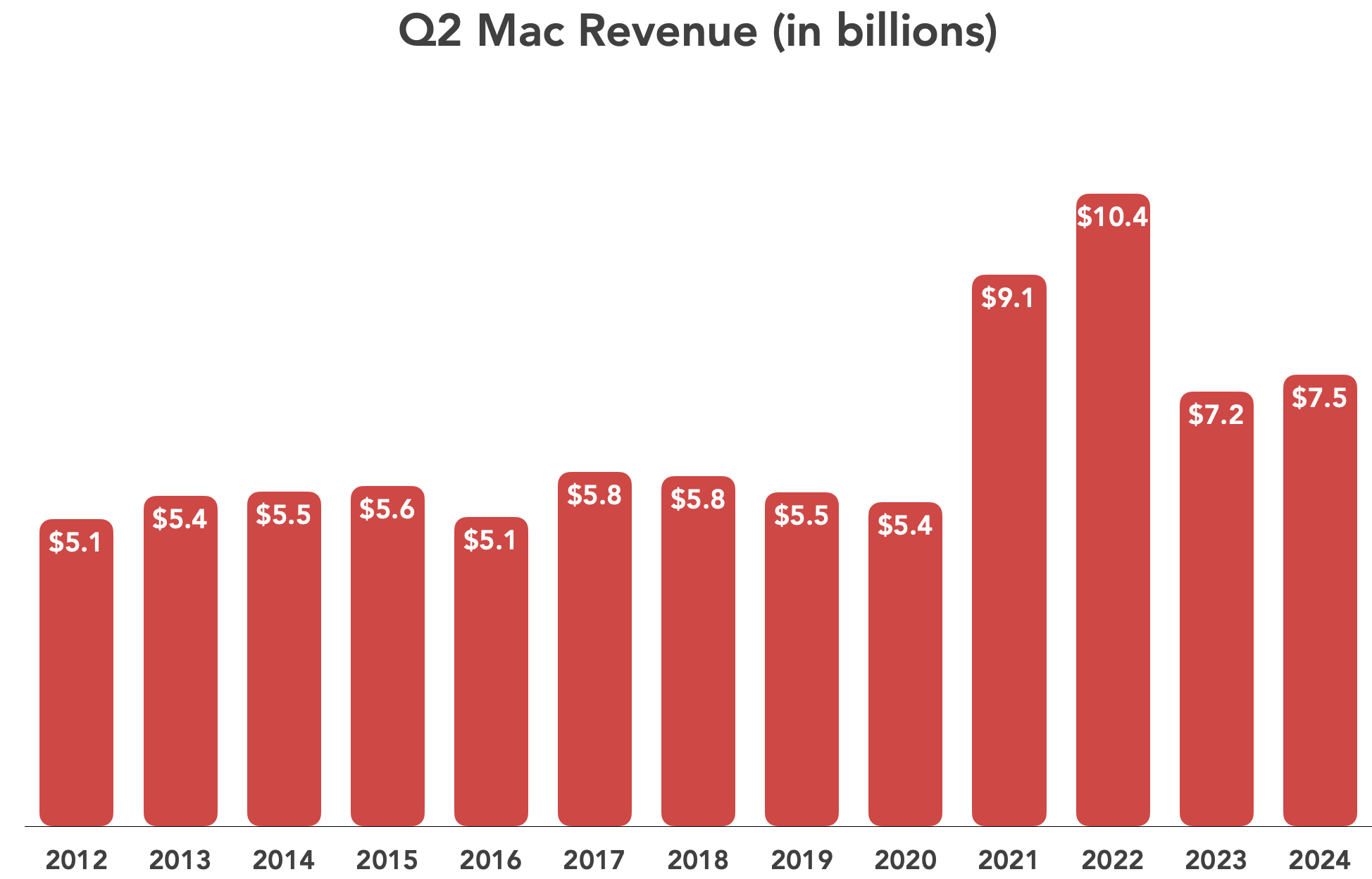

Mac

Apple’s Mac revenues grew 3.9% from the year-ago quarter to $7.5 billion, thanks in large part to the release of the M3 models of the 13-inch and 15-inch MacBook Air (see “New M3 MacBook Air Models Can Drive Two Displays,” 4 March 2024). We’re not surprised—those Macs are compelling to anyone buying their first M-series MacBook Air, and the only reason they might not trigger more upgrades is that the M1 and M2 models are still sufficient for most people. With more Macs being upgraded to the M3 chip—or possibly a rumored M4—this year, it seems likely that Mac sales will remain healthy.

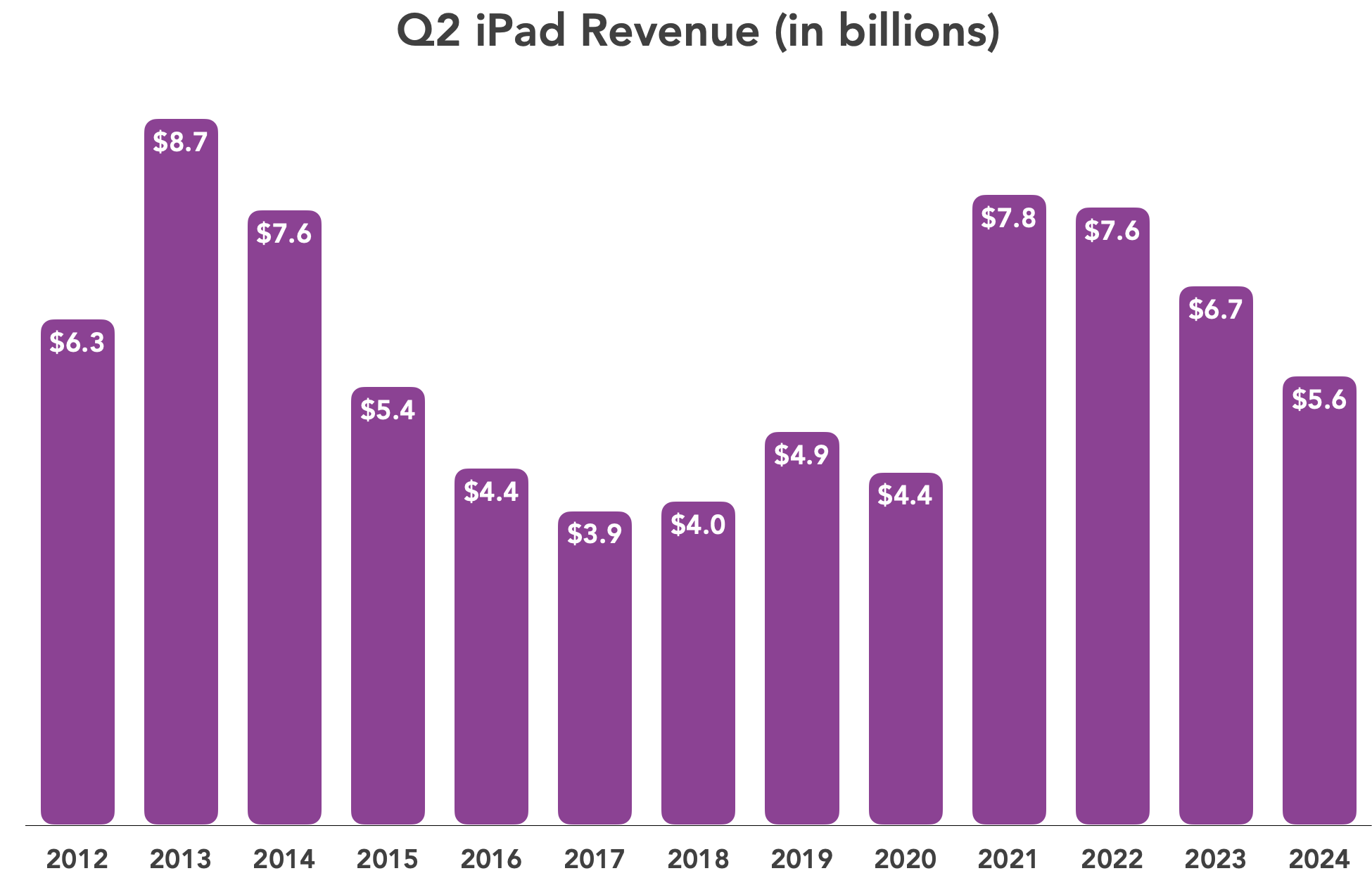

iPad

It has been a long time since new iPads emerged from Cupertino, which goes a good way toward explaining why iPad revenues continue to fall off a cliff. However, Cook expects that decline to end next quarter, possibly to the point of double-digit revenue growth, as new iPads reach the market (see “Apple “Let Loose” Event Scheduled for 7 May 2024,” 23 April 2024). Even though iPad revenues declined 16.7% over the year-ago quarter, Apple pointed out that the installed iPad base is at an all-time high. (Which raises an obvious question: wouldn’t the installed base of nearly any current product always be at an all-time high? The alternative would require that more iPads were being discarded than purchased, which would seem true only of a product on its way out, like the iPod was for some years.)

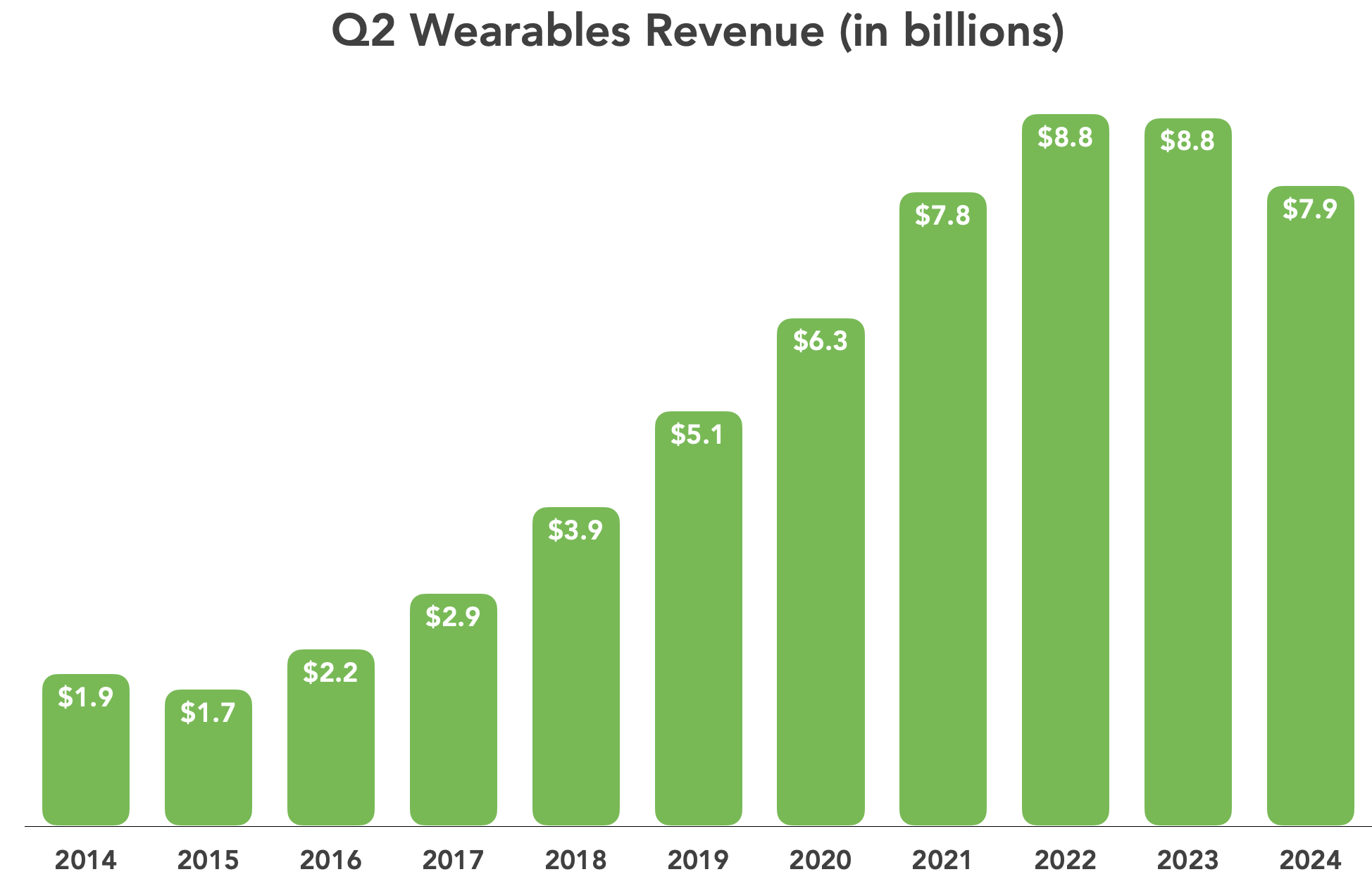

Wearables

Second-quarter Wearables revenues fell for the second year in a row. However, where Q2 2023’s revenues dropped less than 1%, this year’s revenues fell by a painful 9.6%. Cook attributed the drop to another “difficult compare,” although it’s unclear what he was referring to, given that both of the last two years saw Apple Watch and AirPods releases in September. The only advantage we can see for Q2 2023 was the February 2023 release of the second-generation HomePod, which seems unlikely to have goosed the numbers that much (see “Second-Generation HomePod Supports Spatial Audio, Temperature/Humidity Monitoring, and Sound Recognition,” 18 January 2023).

Although Cook praised the Vision Pro, he said nothing about how well it was selling, and it doesn’t seem to have made a significant impact on the Wearables revenue. He did refer several times to strong enterprise customer interest in the product, but only time will tell if that is merely wishful thinking or a sign of coming growth in the product’s sales.

Services

Apple’s push to sign as many people as possible up for its collection of services is paying off. While overall hardware sales were down significantly despite the Mac’s gains, Services grew by a whopping 14.2% from the year-ago quarter, contributing $23.9 billion to Apple’s revenues. As for continuing revenue in this segment, Apple noted that paid subscriptions experienced double-digit growth during the quarter, and subscriptions are a revenue gift that keeps on giving. With Apple’s ever-increasing reliance on Services revenue, it’s hard to see the company raising the free storage level for iCloud accounts from the paltry 5 GB it has been at for years.

Regional

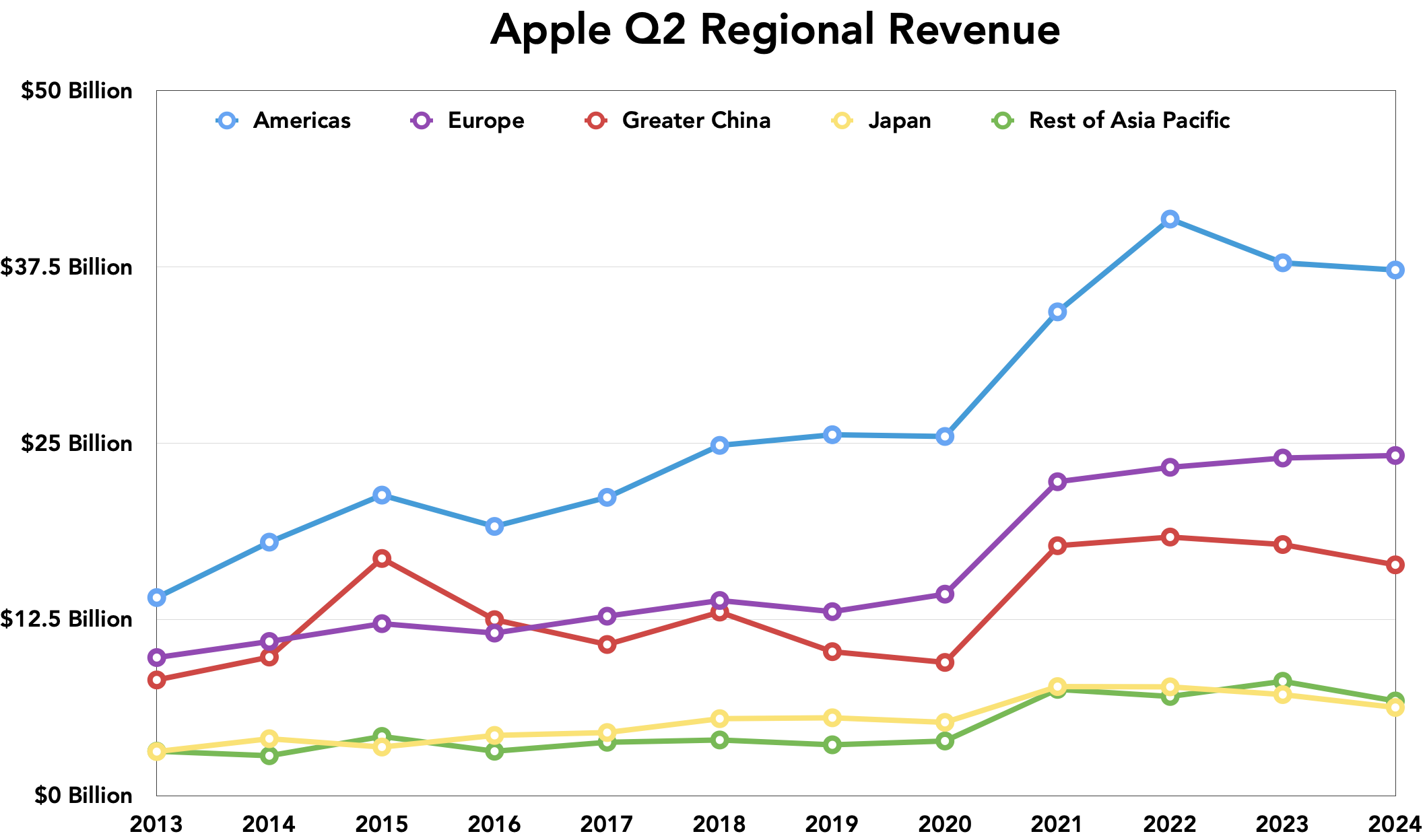

Apple’s regional results were a mixed bag, with some regions—the Americas and Europe—providing generally steady or growing revenues, while others—Greater China, Japan, and the rest of Asia Pacific—showed declines. The declines may be less related to Apple’s products than to regional economic concerns, with a slowing Chinese economy contributing to Apple’s revenue declines there. Cook mentioned that several emerging markets, including India and Indonesia, produced record quarterly results. Given the new European Union rules (see “The EU Forces Open Apple’s Walled Garden,” 29 January 2024), Apple faces changes in how its app stores will operate in those countries, but Cook said it is too soon to determine how those changes will affect Apple’s European revenues in the coming months.

John Gruber of Daring Fireball became curious about what countries were included in the Europe segment and discovered that it actually includes all of Europe, Africa, the Middle East, and India. Greater China includes mainland China, Hong Kong, and Taiwan, and Indonesia is in the Rest of Asia Pacific, along with Australia and presumably New Zealand.

What’s Ahead

Next week, Apple will introduce new products—almost certainly iPads—and its Worldwide Developers Conference is only a month away, with both events certain to affect Apple’s revenue mix. Apple seems confident enough in its future to have authorized an additional $110 billion for share repurchases and has raised its quarterly dividend yet again, but whether that is a vote of confidence or an attempt to put a good face on doubtful prospects remains a question that only time can answer.

As an Apple customer who isn’t a stockholder, I’m ambivalent to the fact that Services is the driving force behind their growth. I’d much prefer they were crushing it with their hardware and software. Admittedly, their hardware is probably the best it’s ever been. But as much as I love my iPads, I’m getting frustrated by the limitations of iPadOS. I still can’t paste as plain text.

If revenues are down why did the stock price jump by almost 6% on Friday?

Probably because people were expecting it to drop more. (The stock was priced by investors based on a worse result than what Apple reported.)

It’s known as a “correction”. Buyers and sellers set a price (via the various kinds of orders sent to the exchange) based on what they think the company will announce.

If the announcements end up being better than expectations (even if they are bad to the extreme of all-time record lows), the stock price will rise. This is because the price had previously been depressed by the expectations, and after the announcement, the price “corrects” itself to where it would have been had the expectations been more accurate.

Similarly, if the announcements end up being worse than expectations (even if they are good to the extreme of all-time record highs), the stock price will lower. Again, this is because the price had previously been inflated by the expectations, and after the announcement, the price “corrects” itself to where it would have been had the expectations been more accurate.

The fact that there was bad news on Friday, but the stock price went up simply means that leading up the announcement, the investment community had expected the news to be even worse, and it was already priced based on that expectation. But after the announcement, the price “corrected” itself up, since the reality wasn’t as bad as expected.

But they are. Apple said the iPhone is getting 99% satisfaction ratings and I think the Mac was at 97%. For the vast majority of people, Apple’s products are the best.

The problem is that Wall Street wants high growth. The fact that customers are happy with their Apple products means they don’t need to buy new ones, which means less growth. Services has consistently been growing in the double-digits and Wall Street likes that, so it gets the focus.

I like that Apple doesn’t make disposable tech, but quality stuff that lasts. That’s value. When that changes, I’ll get rid of my Apple stock as that will be a sign the company has lost its way.

Also, there had been rumors/“reports” of iPhones sales being down 19% or more in China and Tim Cook said sales in “Urban China” were actually up slightly. In other words, problems in China had been exaggerated. That helped boost the stock.

The entire market rose on Friday with the expectation of rate cuts from the Federal Reserve. Apple itself was also helped by a record share buyback announcement. See Reuters reports.

My interpretation of “iPads going off a cliff” is more positive: it may just reflect the life cycle of iPads. I bought my first iPad in 2012 and my second in 2022, after the first became too slow (and did the same for my mom’s iPad). A lot of people seem to be doing the same thing.

It would be more tempting to buy a Mac if I knew it could be upgraded - at least with (extra) NVME-discs.

Low repairability and upgradeability with few ports equals a short lived and not so enviromental friendly dongle computer.

But it is profitable!

Yes, and what good is it to swap PVC for other plastics that are more degradable and become micro plastic sooner?

When I read how Apple divides up the world, initially I was very surprised with Apple’s alternative reality.

But then Apple is American and Apple is Californian and Apple is ivory towers, and so the alternative Apple geographical schema is not all that surprising.

It’s okay - I am not American. I understand.

While I agree that Apple’s hardware is absolutely fabulous these days, I don’t believe a 99% satisfaction rating in the slightest. More than 1% of people will get confused and answer any question “wrong.”

I should have thought that was obvious it was triggered by a massive (largest in history) buyback of AAPL stock which as a shareholder I heartily approve of. The $110 billion buyback is greater than the individual market cap of over 400 companies in the S&P 500.