Chart by Josh Centers

iPhone Down, Services and Wearables Up in Apple’s Q3 2019, Apple Card to Arrive in August

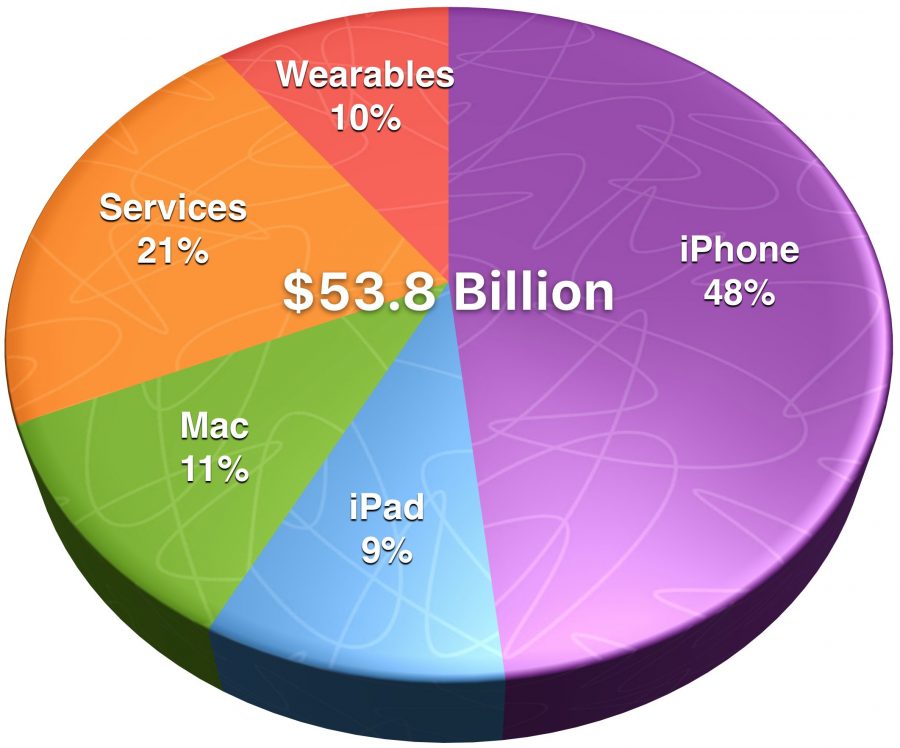

Reporting on its Q3 2019 financial results, Apple has announced net profits of $10 billion ($2.18 per diluted share) on revenues of $53.8 billion. The company’s revenues were up slightly at 1% compared to the year-ago quarter but net profits were down by 7% (see “Apple’s Q3 2018 Results Break Records Again,” 31 July 2018). Apple CEO Tim Cook said:

This was our biggest June quarter ever—driven by all-time record revenue from Services, accelerating growth from Wearables, strong performance from iPad and Mac and significant improvement in iPhone trends.

Apple’s financial picture was brightened by a successful quarter in China, which Cook pinned on the confluence of a VAT reduction in China, “pricing action” on Apple’s part, and Apple’s launch of trade-in and financing programs in its Chinese retail stores. Cook also cited strong App Store growth in China.

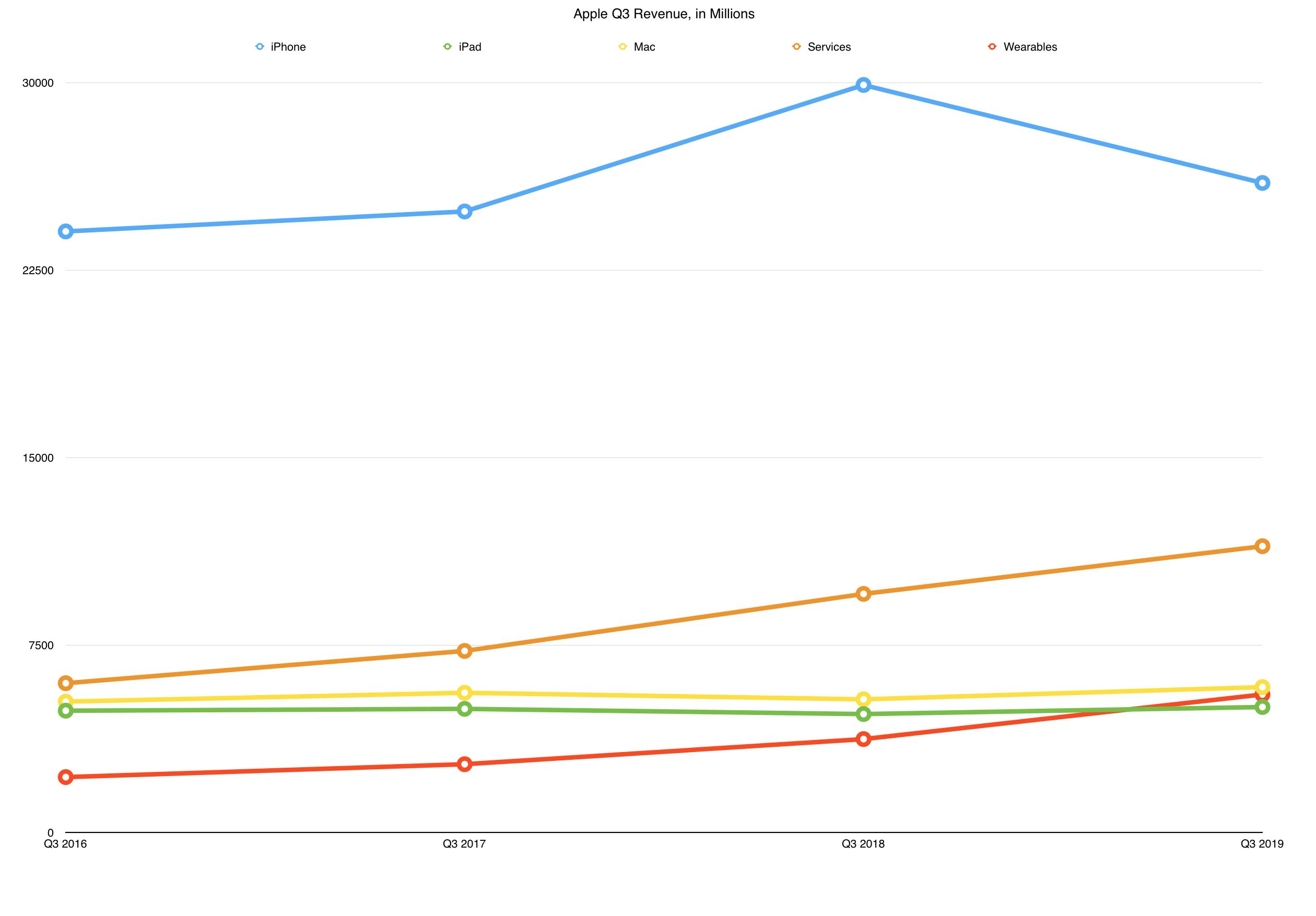

To no one’s surprise, Apple’s iPhone sales fell well below the sales figures posted for the same quarter last year, bringing in $25.9 billion in revenue compared to last year’s $29.5 billion, an 11.8% decrease. The iPhone accounted for only 48% of Apple’s revenues in Q3 2019, the first time since 2013 that the iPhone has accounted for less than 50% of Apple’s revenues. This decline would have been far more alarming had other revenue categories not moved in to take up the slack.

Apple’s Mac business appears to be healthier than ever. Mac sales exceeded the product line’s revenues from a year ago by 10.7%, with Apple taking in $5.82 billion compared to the $5.26 billion last year.

The company’s focus on the iPad in recent months also seems to be producing welcome revenue results, with iPad sales raking in $5.02 billion compared to the $4.6 billion in the year-ago quarter, an increase of 8.39%.

Apple’s increasingly important Services businesses continue to pay off handsomely as well. Services revenue grew 12.6% for the quarter compared to last year’s results. The category, which includes software, storage, and media revenues, brought in $11.5 billion during the quarter, more than the combined iPad and Mac revenues.

Filling in some details about the Services category’s rise, Apple CFO Luca Maestri noted that Apple now has 420 million paid subscriptions, a source of ongoing revenue that bodes well for the future. He also noted increases in the “attach rate” for AppleCare, which is also a profitable business, assuming, of course, that Apple product quality doesn’t decline significantly.

Cook took advantage of the quarterly results call to announce that Apple Card, Apple’s upcoming credit card, will arrive in August, and that it is currently being beta-tested by thousands of Apple employees. When the card becomes available to the general public, it will generate yet another stream of revenue. (See “Apple Card: More Than Just a Credit Card,” 28 March 2019)

Apple’s smallest products notched the largest percentage increases in revenues: the Wearables, Home, and Accessories product category (which includes devices like the Apple Watch, watch bands, AirPods, Apple Pencils, and all of Apple’s various cables and dongles) saw its revenue numbers soar by 48%. The $5.5 billion that the category brought in now puts it on the same level as Apple’s iPad and Mac product lines. Tim Cook noted that 75% of Apple Watch buyers last quarter were new purchasers, evidence that the device is becoming increasingly attractive to consumers, and he said that the Wearables business is now as large as a Fortune 50 company. Cook also remarked on another indication of this category’s growth: Apple TV viewership has increased 40% year-over-year, even before the slate of new Apple shows and channels arrive later this year, a sign that the streaming media device is far from languishing. (See “Apple Reveals Its Vision for TV,” 26 March 2019.)

If you’ve been following Apple’s quarterly reports over the past couple of years, the decline of Apple’s iPhone business coupled with the rise of both the Services and Wearables businesses should come as no surprise, which is why Apple has been so aggressively introducing new services like Apple News+, Apple Card, Apple TV+, and Apple Arcade.

With hardware revenue inevitably leveling off, Apple’s best recourse for growth is monetizing its existing installed base. That’s good news for Apple investors, as it shows forward-thinking leadership: many companies begin to march toward irrelevance when sales of their core products tapered off. But many Apple users may be less enthusiastic, as we will be increasingly expected to hand Apple more money on a monthly basis to get the most out of our Apple devices.

I guess you could call it a success that losing revenue at a rate of -4% is better than the last quarters where revenue was shrinking at -20%.

But I would not consider -4% revenue in a trillion Dollar market “success”. The iPhone has apparently lost a lot of appeal in China. A market Tim always tried to convince us was the most important for Apple.

China’s economy has been suffering, and the situation is unlikely to improve in the near term:

https://finance.yahoo.com/news/chinas-economy-weakened-further-july-034952883.html

To put Apple’s results into perspective, consider what Samsung, the world’s biggest smartphone manufacturer, just announced yesterday, especially:

“Profit in its smartphone business slumped by nearly 42% to 1.56 trillion Korean won ($1.32 billion).”

https://www.cnn.com/2019/07/31/tech/samsung-stock-earnings/index.html

Think about how bad Samsung’s numbers would have been if they had released the folding phones before sending some to reviewers. Samsung’s mobile communications division has historically been marginally profitable, and there have been quarters when the division has lost money.

Samsung’s total profits dropped 56% and revenue dropped 4%, which isn’t good news either.

Add in the tariff/trade situation between the US & China, and Apple going from -20% to -4% is a very significant improvement, as Michael and Josh described in the article. China is a market of tremendous growth opportunity for Apple in the long term, which is why Tim continues to frequently emphasize this. I’ll bet it’s why he’s even mentioned possibly developing special models for the Chinese market, and I’ll bet he’s working on Movies+ and expanding other services for China and other markets as well.

:D Nice try. The iPhone is assembled in China. iPhones sold in China (yeah, those that decreased by 39% during the last three quarters) are not affected by tariffs. Nope, the iPhone is doing bad in China all on its own, no tariffs necessary.

Ironically, the iPhones sold in the US that are affected by Trump’s trade war are doing quite OK. I’m used to marketers trying to spin things, but when the spin flies in the face of facts it’s just silly.

I got the terminology wrong. Apple and other foreign based companies are subject to a value added tax in China, not tariffs. Because of recent cuts in the VAT in April, Apple and others were able to lower prices in China:

“On the same day China’s government cut value-added taxes by a modest 3%, Apple today slashed the Chinese prices on some of its key products by nearly 6%. Initially reported by CNBC, the price drops are the latest in a series of measures meant to reposition Apple’s iPhone and computer lineup for growth in the challenging market.”

https://venturebeat.com/2019/04/01/apple-slashes-iphone-ipad-and-mac-prices-in-china-after-small-tax-cut/

Tiffany, Louis Vuitton, Mercedes, Gucci and other luxury brands also cut prices due to the VAT, but most did not make as big a reduction.

Breaking news:

Just in time for the annual unveiling of tne new iPhones.

Exactly. But Apple of course passes on the VAT to customers as every other company does. So when the Chinese reduced their VAT the iPhone price actually went down, by quite a bit actually. But that’s the kicker. Because despite reduced sticker prices, iPhone sales were lower again. That’s how bad it’s doing in China right now.

Good luck, Tim, trying to take on $200 Android phones that are all Chinese consumers need since essentially they use two apps that deliver all the content and functionality within. Those people don’t care about eco systems, services, or any iCloud shenanigans. I’d never try to go after that market, but then again, I’m not the guy who tied the future of my trillion $ company to an oppressive single-party planned-economy dictatorship. In his defense, a lot of western companies made the same mistake so he’s in good company.

Arguably, if you want to grow beyond a certain size or just maintain a certain growth rate, you have to engage with China in a big way. I think that’s why most big firms have done so, regardless of the political or business issues with working in China.

Not sustainable. What do you do when China saturates? How do you inflate your growth rate then? India? Sure. But then? That’s just not sustainable. If you know you’re going to run into this issue earlier or later, you could still consider attacking it before you get in bed with one of the most evil dictatorships.

But again, this is not on him only. He’s in perfect company along with a lot of other big western companies. Which is why eventually a lot of them will be in trouble. Some already are. Just ask Airbus how long it took China to launch Comac after Airbus revealed their processes and tooling to them.

Tim hasn’t yet tried anything of the sort, or even anything resembling the sort. I haven’t heard or read any rumors about it either. Even with the price cuts, prices of iPhones in China are still higher than they are in the US. As of March, when the VAT reduction will kick in, the prices in China will go down a little more.

“While different stores are discounting by varying amounts, the discounts mean that, for example, Suning is selling the iPhone XS 64GB to 8599 yuan ($1,282) versus $999 in the US. Similarly, JD.com has discounted the iPhone XS Max 256GB down to 9999 yuan ($1,490.50), versus $1,249 in the US.”

The 3% VAT cut will reduce prices, but probably won’t make iPhone prices cheaper than what is charged in the US.

that are all Chinese consumers need since essentially they use two apps that deliver all the content and functionality within. Those people don’t care about eco systems, services, or any iCloud shenanigans.

This a very unfair and biased assessment of the Chinese market, which is very technology and education oriented and has rapidly growing middle and high income segments. Per capita household income has been rising for decades. And the % of university graduates with STEM degrees far exceeds those of the US:

“The leading competitor is China, whose political leadership understands only too well how important STEM leadership is for global leadership. The World Economic Forum calculates that China had at least 4.7 million recent STEM grads as of 2016; India had 2.6 million as of 2017; the U.S. pulls in at third at 568,000. That puts us about equal with India for STEM grads per population (1:516 ratio for Indians and 1:573 for Americans); but well behind China’s 1:293 ratio.”

Sales of high end luxury products, such as jewelry and cars, continue to grow in China.

“China jewelry market size soared from RMB470 billion in 2013 to RMB721 billion in 2018, with the CAGR of 15%, ranking third in the world and next to USA and Japan, making China be the one with the most vigorously growing jewelry and jade industry worldwide. It is estimated that China jewelry market will be worth at least RMB900 billion in 2025.”

“Due to obvious consumer attribute of gold, gold consumption is expected to grow steadily. In 2018, the real consumption of gold in China totaled 1,151.43 tons, up 5.73% year on year. Of which, gold jewelry and gold bar consumption reached 736.29 tons and 285.20 tons, up 5.71% and 3.19% year on year, respectively. With the ever more obvious consumer attribute of gold jewelry, gold jewelry consumption is weakly related to gold price fluctuations. Anyhow, gold jewelry consumption will keep steady growth amid consumption upgrade and stronger spending power of residents in low-tier cities.”

And luxury retailers are opening stores throughout China at a rapid pace:

“Targeting high-end markets, world-renowned brands represented by Cartier, Tiffany and Bvlgari open shops chiefly in first- and second-tier cities. In the fierce medium- and high-end market, the influential brands are Chow Tai Fook (Hong Kong), Chow Sang Sang (Hong Kong), and Lao Feng Xiang (Mainland), CHOW TAI SENG (Mainland), CHJ Jewellery (Mainland) and MINGR Jewelry (Mainland).”

The industry leaders with strong channel competence will be more advantageous. Chow Tai Fook, Lao Feng Xiang, and CHOW TAI SENG, as the three giants, each added more than 300 new stores in 2018, while small- and medium-sized peers are on the slide."

Despite the recession, luxury cars are also selling like gangbusters:

“According to a report by the Chinese Automobile Manufacturers Association, overall sales fell 1.7 percent while luxury sedans grew 18.8 percent and premium SUVs 3.5 percent. Calculated in total units, in the price segment over 300,000 yuan (US $44,000) about 1.16 million vehicles were sold last year. All major manufacturers of luxury vehicles, including Mercedes-Benz, BMW and Audi, reported positive figures in November”

It’s a good thing you’re not wearing Tim Cook’s shoes; Apple would have died a very quick and very painful death if it had turned its back on developing what is probably its market of greatest growth opportunity.

You got yourself all wrapped up in a knot here because you interpreted that statement entirely wrong. It has nothing to do with Chinese education or capabilities (no need to lecture me how many top scientists come from China, they’re my Cal faculty colleagues). You should read up on WeChat. The point is it’s an app that provides users with other “apps” and services within so that many users hardly leave that app at all. They don’t need iCloud or Apple Pay if WeChat (which they’d use anyway for eg. messaging, like What’sApp) already offers that kind of functionality and much more for free. Their ecosystem — regardless of Android or iOS — is Tencent. And in that world nobody needs a $1400 phone because the $300 one will do exactly the same stuff just as well. It’s about the software.

You should read up on WeChat.

I have been keeping my eyes and ears open on WeChat for years, as I have been doing with Tencent, its parent company, and Alibaba, Tencent’s closest competitor. It’s my day job to know something about stuff like this. I know WeChat allows “mini apps” to run within its apps and has its own store. But as of now, WeChat does not have an operating system. WeChat still requires iOS or Android to run, though there are rumors about a We Chat OS, (esp. if you read the Stratechery blog, which I do). And I don’t doubt that an OS might be somewhere down the road. But this will be more of a problem for Huawei, Oppo, and other bargain basement hardware phone manufacturers than Apple.

The point is it’s an app that provides users with other “apps” and services within so that many users hardly leave that app at all.

Though I remember that many high end retailers, like Tiffany, have been advertising on WeChat in China, they don’t sell products on WeChat. Probably Apple advertises in WeChat too. Tiffany has had stores in major cities in China for many years, but they are only just getting ready launch an online store for the China market sometime this year. Vuitton and Gucci already have their own successful online stores in China:

https://www.businessoffashion.com/articles/news-analysis/louis-vuitton-sees-demand-in-mainland-china-picking-up-steam

However much Tiffany and other high end retailers such as financial services, fashion, furniture, etc. spend to advertise to a very select and precisely targeted of very high net worth individuals in WeChat, they are extremely unlikely to attempt to sell their products in online or physical retailers that also sell toilet paper, dog food, and roach and ant killer. Tiffany doesn’t sell stuff in Walmart or Dollar General either.

The $300 phone won’t have a decent display, run as quickly, have good sound capabilities or a decent camera as an iOS or Android device. Putting business and trendiness aside, iOS has big advantages in gaming. Huawei, Oppo and other Chinese mobile phone manufacturers that target low to middle income consumers have a lot more to worry about than Apple.

BTW, if you watch the movie “Crazy Rich Asians” you’ll see plenty of iMessages sent back and forth with iPhones, including many with iMessage emojis. I do remember one character using a Samsung phone. And the director recently shot a short on an iPhone that’s getting lots of publicity:

https://www.wired.com/story/jon-m-chu-short-film-shot-on-iphone-xs-max/