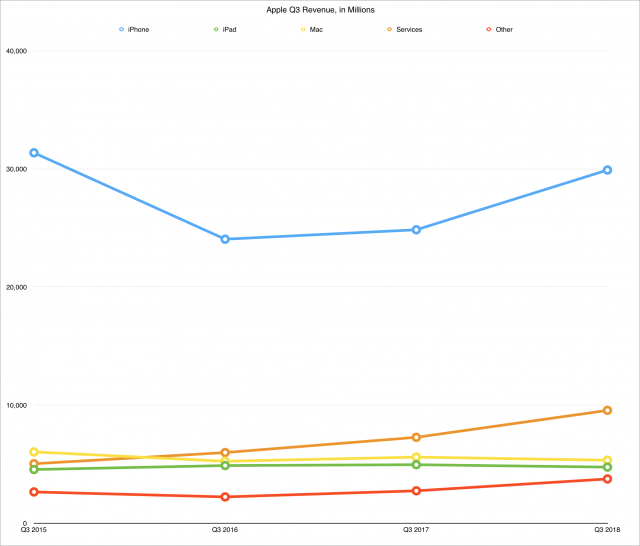

Chart by Josh Centers

Apple’s Q3 2018 Results Break Records Again

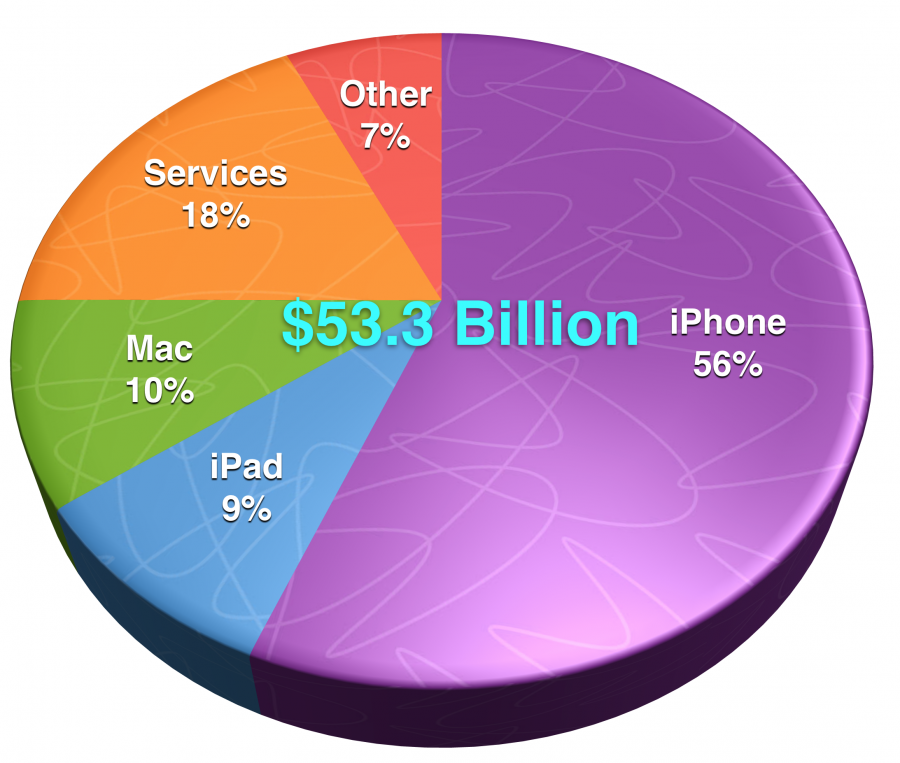

In what Apple CEO Tim Cook called the company’s “best June quarter earnings report ever,” Apple reported net profits of $11.5 billion ($2.34 per diluted share) on revenues of $53.3 billion in its third fiscal quarter of 2018. Those revenues are up 17% compared to the year-ago quarter (see “Apple Posts $8.7 Billion in Profits for Q3 2017,” 1 August 2017), and profits are up 32%.

The lion’s share of Apple’s revenue, $24.5 billion, came from the Americas, followed by Europe at $12.1 billion, China at $9.5 billion, with Japan ($3.9 billion) and the rest of the Asia Pacific region ($3.2 billion) bringing up the rear.

“Our Q3 results were driven by continued strong sales of iPhone, Services, and Wearables, and we are very excited about the products and services in our pipeline,” Cook said.

iPhone

The iPhone did well this quarter, with a year-over-year revenue increase of 20%. Much of that increase can likely be explained by the high price of the iPhone X, given that the number of iPhone units sold increased by only 1%. The iPhone now accounts for 56% of Apple’s business, bringing in $29.9 billion this quarter alone. Unsurprisingly, the iPhone X was once again the most popular phone.

iPad

iPad revenues were down 5% year-over-year, although Apple experienced a 1% uptick in units sold. That was likely due to the opposite of the iPhone situation because Apple’s most recent iPad release, the $329 sixth-generation iPad, probably accounted for more of the share of the tablet sales mix than the higher-priced iPad Pro line.

Mac

Mac unit sales were down a more substantial 13%, with 3.7 million Macs of various types sold, although higher average per-unit prices led to a revenue decline of only 5% when compared to Mac revenues a year ago. Looking forward, the launch of the new MacBook Pro models late in the quarter may translate into better performance for the Mac category next quarter. Nonetheless, Mac market share worldwide is up, and Apple says that 60% of Mac purchases last quarter were by newcomers to the platform.

Other Products and Wearables

The vague Other Products category, which includes the Apple Watch, Apple TV, AirPods, Beats headphones, iPod touch, dongles, connectors, and other things, also had a healthy quarter, with a whopping 37% year-over-year revenue increase. Wearable revenues (headphones and watches) were up over 60% year-over-year, thanks in part to the ever-popular AirPods. “AirPods continue to be a runaway success, and we continue to sell them as fast as we can make them,” said CFO Luca Maestri. Cook also noted that Apple Watch sales rose dramatically.

There hasn’t been much Apple TV news lately, but Cook mentioned that cable provider Charter would be offering Apple TVs to its nearly 50 million US households later this year. Charter will also release a Spectrum app for Apple TV (which makes one of this article’s authors happy—or, at least, optimistic). During the analyst’s questions, Cook mentioned his excitement over Apple’s media creation plans, including the company’s partnership with Oprah Winfrey. However, he was coy about the specifics of what Apple is doing, remarking that he was “not ready to talk about it today.”

Services

All that said, the revenue star of the report (Cook even called it “stellar”) was Services, which took a big leap—a 31% increase in revenues from last year’s quarter—making it Apple’s second-largest revenue segment behind the iPhone. Services accounted for 18% of Apple’s quarterly revenue, nearly equaling the combined revenues from iPads and Macs. The company predicts a similar Services revenue improvement next quarter.

Services brought in more than $9.5 billion during the quarter, with subscriptions becoming a significant part of the revenue mix: Apple now has some 300 million active subscribers, and more than 30,000 apps offer subscriptions. Additionally, the App Store has generated twice as much revenue as Google Play so far in 2018. Apple Music saw 50% growth over the past year, and Cook said he saw opportunities to “grow the market” even more in the future. He also reported that AppleCare revenues grew at their highest rate in 18 quarters.

Apple Pay use continues to expand and will be embraced by 7-Eleven and CVS later this year. If you do a double-take at CVS adopting Apple Pay, that’s because it fought Apple’s digital payment offering for years (see “CVS Launches Apple Pay Competitor,” 15 August 2016). Cook also mentioned a healthy increase in Apple Pay Cash use, a service that Apple introduced late last year (see “How to Use Apple Pay Cash for Person-to-Person Transactions,” 7 December 2017).

Reading the Tea Leaves

Looking at these results, a few realities about Apple’s present and future become clear:

- You’ll likely end up paying more for Apple products, since the success of the iPhone X has allowed Apple to continue breaking records while unit sales stagnate.

- Don’t look for significant Apple investment in less expensive products like the iPhone SE and Mac mini.

- Expect to see more and possibly higher-priced services from Apple, as services become an ever-larger slice of the Apple pie.

All told, the latest results, combined with the company’s $247.3 billion in cash, suggest that Apple should be able to remain in business for at least another quarter or two.

I notice that the first paragraph of the article mentions, and links, Apple’s net profits of $11.5 billion for this year’s 3rd quarter, and $8.7 billion for last year’s quarter 3. My calculator says this is a 32% increase. That figure seems to be absent from your article, and it took me a while to understand and track down the 17 percent increase that is mentioned in the same paragraph.

Thanks, we’ve added that percentage and will include it in future articles.

Here’s an interesting take on part of why Apple is so successful financially.

Interesting article. I am bothered by the report that Apple is slow in paying its suppliers. My employer is the opposite.

One item left out is Apple’s investments in buying equipment for its suppliers. While a lot or all oof manufacturing is outsourced my impression has been that Apple will buy equipment for its suppliers if necessary. And Apple doesn’t seem to to jump from supplier to supplier to save a few $$$.

Apple is also bringing more development (esp. chips and batteries) and manufacturing in-house. I remember reading a few months ago Apple purchased a big load of a source material to stockpile for batteries as Chinese manufacturers were driving the price up. I’ve also read rumors about Apple looking into developing their own screens.

I was a little perturbed by that as well—we’ve always made a point of paying everyone both promptly and on the schedule promised, and the good relationships that has engendered always seemed like they’d be more worthwhile than the use of the money for a little longer.

Then again, we’re not working in the millions or billions of dollars. ;-)

As long as the vendors have agreed to that payment schedule, I have no problem with it.

I recently read a book about early Silicon Valley and it had a lot about the start of Apple, particularly about Mike Markula and all he did. One thing I noted was that Mark was impressed with Steve Jobs’ cleverness at getting vendors to give him 90 days to pay – which enabled him to get the parts for the Apple I, build computers and sell them, and then pay the vendors – without having to get loans or have a lot of capital to invest.

Of course, Apple is no longer in such a desperate situation, but if the vendors are okay with it, then Apple has the right to do it.

Thanks, Adam. An interesting article indeed.

What has me troubled is this section.

Subscription models to generate predictable revenue. Great for Apple and their stockholders. Sucks for me as a customer.

In the old days Apple had to make great Macs and great software to get me back to buy another Apple product. Now, they try to get me locked in by a “walled garden ecosystem” or by ensuring that somebody would lose all their beloved playlists if they switch to say Spotify. Bottom line, whereas good products used to motivate people to remain customers, now the product quality is no longer the main driver, it’s trying to create a situation where the customer doesn’t really have a realistic alternative to staying “locked in”. Not exactly a situation you can expect to foster most innovation.

Indeed, although I do think a little less of companies that achieve their success in part by taking advantage of smaller companies that don’t have negotiating leverage. That’s one of the reasons with Take Control that we always paid our authors royalties monthly for the sales in the previous month—as the larger entity in the situation, it would have felt exploitive for us to earn interest on the royalty money for 3 months (the industry standard) before paying it out.

Yep. I’ve written a lot about this over the years, and as a user, I don’t like it either. But from the perspective of the company, as the article says, the walled garden strategy is extremely powerful, which is why Apple is far from the only company to use it. All the tech giants do in some form or fashion.

It sucks for me as a customer too, and I totally hate it. But Microsoft, Adobe, and so many other competitive companies moved very successfully to subscription models. My feeling was that stuff like Excel, Word, Photoshop, Illustrator, and so many applications have evolved so much over the years that there no longer many earth shattering features they could build in that would incentive businesses and consumers to upgrade every year or two. And as more and more companies and many consumers moved to cloud storage, getting cloud and app tech support 24/7 is a good thing.

Another big benefit for businesses of all sizes is that the subscription model facilitated expansion to other lines of business. Adobe built Marketing Cloud, a very highly regarded analytics, ecommerce and data and production management suite. (The production stuff pretty much crippled a very nice client I worked with for years.) Microsoft is also growing is moving into Human Resources (one of the reasons they bought LinkedIn), customer relationship management, media management and more.

Neither Apple, Pandora, YouTube, or any other competitor in the streaming music space has any obligation, or even the motivation, to enable the growth of Spotify. And btw, The more free or paid subscribers Spotify has, the more money it looses. Unless they radically change their business model, IMHO, they were doomed from day one.

In addition to leading in innovations in communications and music, Apple continues to very diligently to further disrupt the entire entertainment industry. They are working hard to disrupt transportation, wellness and health, robotics and more. Recent announcements about ARKit, Home, fitness tracking, etc., etc. have been keeping TidBits writers very busy.

Apple has thrived because it moved into new lines of business. People aren’t upgrading their personal computers as often as they used to because they are able to do more and more with mobile devices. I quoted something else from this article earlier this week:

https://www.thestar.com/wsj/technology/2018/08/01/diverging-fortunes-high-prices-propel-apple-sink-samsung.html

Just a day earlier, Samsung announced its smartphone profits cratered, as fewer buyers were willing to shell out the nearly $1,000 the South Korean company wanted for its flagship Galaxy S9 handset. Its average smartphone sold for about $220 in the most recent quarter, analysts said, brought down by the lower-cost phones it sells alongside its pricier iPhone competitors.

The results illustrate the diverging fortunes of the world’s most profitable smartphone companies as they sweat out a contracting industry with fewer buyers eager for the latest gadget.

Apple, whose stock was up more than 4% on Wednesday, has navigated the slowing market by leaning on its premium brand, new features and exclusive operating system to command record prices—even as unit growth barely grew, analysts say. But Samsung’s price increasing didn’t stick, as flagship Galaxy S9 sales slipped and unimpressed consumers turned to lower-priced devices from Android rivals.

Adding insult to injury, Apple appeared to gain market share from Samsung during the second quarter, with iPhone share rising to 12% from 11% from a year ago as Samsung dipped to 20% from 22%, said Neil Mawston, an analyst with Strategy Analytics.

I agree with that. I guess that’s ultimately what I’m bemoaning. Apple is extremely successful as a company. And that apparently justifies doing what “everybody else is doing”. And so in that sense Apple has now become one of the “bullies”.

For me as a customer that’s a loss. As a customer I was better off when Apple was thinking different, when Apple was the computer company for the rest of us so we had an alternative to bullies like MS. Now where is that alternative? And while I dearly miss Apple in that role, the stock market loves them for essentially having become the bigger and better MS. And since the stock market is always right, it’s no surprise Apple’s continuing along that path.

I feel your pain. It would be a good thing if Apple were a nicer company in more ways. They do fairly well in some, such as by emphasizing privacy, but there are definitely ways in which being rich and powerful lead to forms of exploitation.

It would be a good thing if Apple were a nicer company in more ways. They do fairly well in some, such as by emphasizing privacy, but there are definitely ways in which being rich and powerful lead to forms of exploitation.