Seven Head-Scratching Features from WWDC 2022

Had Apple’s WWDC keynote taken place in person, it’s easy to imagine the live audience breaking into applause for some of the previewed features. We would have applauded for everything we wrote about in “Ten “It’s About Time” Features from WWDC 2022” (6 June 2022). Then there would have been the points where a presenter’s script said “<pause for applause>” but would have been greeted by a silent crowd wearing puzzled expressions.

Not all of these features are necessarily bad, though some are, and others are just inexplicable. They’re WTF—what the f…eature was Apple thinking?

Apple Pay Later

Two-thirds of Americans live paycheck to paycheck, and now Apple wants to help them buy more stuff they can’t afford with Apple Pay Later, which splits purchase prices into four interest-free payments. Which you have six weeks to pay off. Yes, you read that correctly; you must pay off your Apple Pay Later purchases in six weeks, making us wonder what the point is. We could see wanting to space out payments for an expensive purchase like an iPhone or Mac over 12 months, especially if you urgently need to replace a machine. But we don’t see how Apple sticking its toe in the Buy Now, Pay Later industry helps users make smart financial decisions, and it’s not a good look for Apple. What’s next? Apple Payday Loans?

Focus Filters

Focus was the most confusion-generating feature of iOS 15 (see “Apple’s New Focus Feature May Be Overkill,” 20 January 2022), so we were hoping for an overhaul in iOS 16 that would reduce complexity. Sometimes Apple doesn’t get it right the first time and has to iterate the next year. Instead, Apple has doubled down and made Focus even more convoluted than before. In iOS 16, you’ll be able to add Focus filters, which let you display only relevant content, hiding entire calendars, email accounts, Mail accounts, Messages conversations, and Safari Tab Groups. Imagine the support questions:

- “Why has my Gmail account disappeared on my iPad?”

- “Where do my browser tabs keep going?”

- “I was talking to my spouse in Messages, but now it’s gone!”

Making things even worse will be a personalized setup experience that suggests relevant apps, wallpapers, and widgets, along with the new capability to silence notifications from apps and people. Typical users already don’t know why their devices act in certain ways, and these Focus features will make the Apple experience even more unpredictable. If you’re willing to accept responsibility for Focus preventing you from receiving an important notification or hiding data, go nuts, but for most people, we recommend configuring Focus only for Do Not Disturb (while sleeping) and Driving.

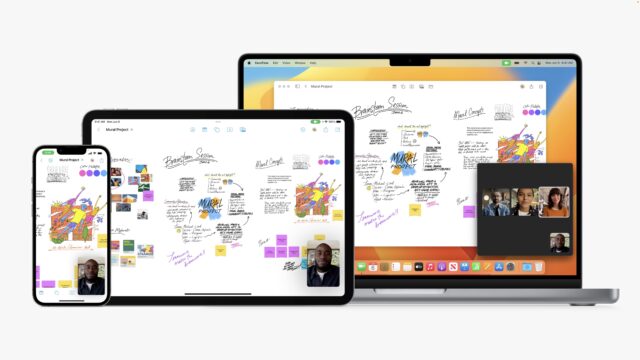

Freeform

Apple previewed a new digital whiteboard app called Freeform that it said would ship sometime before the end of the year. (In other words, don’t be surprised if it doesn’t appear with the initial releases of macOS 13 Ventura, iOS 16, and iPadOS 16.) There’s nothing inherently wrong with digital whiteboarding—it’s a huge category with entries from Google, Microsoft, and a slew of other companies—but why would Apple bother to get into the space? Only the most Apple-centric business or school would look to an Apple tool in favor of the Google or Microsoft productivity suites that dominate group collaboration scenarios. Anyone who does want to go beyond the standard tools already has a wide selection of alternatives. What can Apple bring to the table other than demo whiteboards that are way prettier than any competitor—or user—would ever create?

Next-Generation CarPlay

During the keynote, Apple put quite a bit of effort into demoing a massive update to CarPlay. Apple envisions that cars of the future will use screens for the instrument cluster and environmental controls, not just the infotainment system as today. As such, the next-generation version of CarPlay will enable users to reconfigure what information displays on each screen, customize the look, and more.

The only catch? Cars that support it won’t start appearing on the market until the end of 2023, which means that it could be another few more years—or more—before this level of CarPlay support is commonplace. Why is Apple talking about this years before it will be a reality, especially given how infrequently most people buy cars? We presume Apple is trying to establish its credentials in the car market ahead of the eventual release of the much-rumored Apple Car. Or perhaps Apple’s looking for an onramp into the automotive world by licensing a full carOS to carmakers?

Plus, this vision of CarPlay raises some important questions about car interfaces. It could be good if you could take your custom interface from car to car (especially rental cars), but will CarPlay surface everything that the car’s native interface can do? (We presume that cars will still have native interfaces, even if they’re equally screen-based.) And, to raise the usual bogeyman, what if your phone crashes or runs out of power while you’re driving? CarPlay is a great add-on, but we’re not sure we’d want to rely on it for safety-related features.

Customize Spatial Audio with TrueDepth Camera

This announcement came and went fairly quickly, but it had us scratching our heads immediately. The idea, it seems, is that spatial audio sounds more realistic if it can take into account aspects of the physicality of the listener that affect their perception of space. Apparently, this is a thing—called Head-Related Transfer Functions—and by capturing data using the iPhone’s TrueDepth camera, Apple could personalize the otherwise average HRTF that combines data from thousands of people. We’re not arguing that this is possible, but is spatial audio that big of a deal, and will personalizing make enough difference to justify training your iPhone (much less Apple’s development effort)? We have plenty of ideas for things Apple could do that would have a greater impact on more users—see “Five Enhancements for Future Apple Operating Systems” (19 May 2022).

Handoff for FaceTime

We hope that this feature—handing off a FaceTime call from one Apple device to another—was easy to implement because it’s hard to imagine it getting all that much use. Apple’s pitch sounds attractive but doesn’t make much sense under scrutiny. Who is going to get a FaceTime call while out of the house and then manage to keep it going while juggling keys and opening doors, setting down packages, and taking off shoes and coats, all so you can get to your Mac, wake it up, and transfer the call to a computer with a worse camera? (It’s marginally more understandable if the iPhone automatically invokes Continuity Camera to become your Mac’s webcam in the process.) We’d just hang up and call back. The main win here would seem to be switching an iPhone FaceTime call you’ve received while sitting on the couch to a Mac or iPad with better seating ergonomics, which is nice but not world-changing.

Safari Shared Tab Groups

Safari’s Tab Groups have never done much for us. Browser tabs are ephemeral items—we open and close hundreds of them every day—so there’s no benefit in organizing them. Worse, Tab Groups don’t even work well. If you have a tab group selected and then click a URL in another app, Safari responds by creating a new window for that tab instead of combining it with the current window’s uncategorized tabs. Plus, on one of my two Macs, when I accidentally close a tab in a Safari Tab Group and immediately press Command-Z to bring it back, it returns for a second or two and then disappears again, with no option to use Undo again. That doesn’t instill confidence.

Since the initial release of this article, we’ve heard from people who find Tab Groups useful, so our opinion certainly isn’t universal. But if you’re in our camp and want to work with a set of Web pages in a way that has more permanence, put bookmarks in a Favorites folder and Command-click it to open them all.

In this year’s operating system updates, Apple said we’ll be able to share Safari Tab Groups with friends so that everyone can add (and presumably close) tabs in the group while working together. It’s possible to construct a use case for why a group might want to put together a set of Web pages, but if you’re going to make that effort, wouldn’t you want some permanence, so one person’s accidental click or Command-W doesn’t destroy the tab for everyone else?

We’re not just being curmudgeonly here—many of the new features that Apple has slated for macOS 13 Ventura, iOS 16, and iPadOS 16 sound great—but when there are still plenty of potholes that need fixing, it’s frustrating to see Apple focus time and effort on ill-conceived features that we doubt will get much usage.

My comments. May not be right, but hopefully plausible:

Freeform

I was particularly interested in this one. Not because of the concept of a shared whiteboard. As you wrote, that has been done by several vendors. But I was particularly interested in making the whiteboard a space that appears to be infinitely scrollable and infinitely zoomable (up to the limits of memory and bandwidth, of course).

This reminds me quite a lot of the Zooming User Interface (ZUI) concept that Jef Raskin was working on via the Zoomworld component of the Archy system.

The idea being that you eliminate the whole concept of files and file systems, instead having an infinitely-zoomable/infinitely-scrollable canvas on which to place content. Important stuff is large (and hence readable when zoomed-out) with less important stuff being smaller (and hence only readable when zoomed in on it).

The idea is that spatial memory combined with robust search capabilities should make it easier to find content than current systems involving files and folders.

Although not identical to Zoomworld, Freeform seems to be an implementation of that concept, with each whiteboard being a complete ZUI-based content management system.

Depending on how much capabilities Apple decides to place into these Freeform documents, it could become the next truly great thing. Imagine, for instance, if you can insert data tables and scripting to one - you’d end up with a modern Hypercard-like environment.

I don’t know exactly how far Apple plans on taking this, but the concept really grabbed my attention.

Handoff for Facetime

This looks like a critical component if Apple is trying to position FaceTime as a tool for business meetings - competing against Cisco WebEx and Microsoft Teams.

It is common (at least where I work) where someone will schedule a virtual meeting (via Teams at my job) and some people will call in from their mobile phones, either with the Teams mobile app or by dialing a voice-bridge number. They often do this because they are traveling at the time the meeting starts. When they arrive at their destination (home or work), they then connect to the meeting from a computer and hang up the phone - which can often be awkward and often results in them going off-line for a minute or so during the transition.

With handoff, this can (in theory) be seamless. At least if the person is transitioning to an Apple device.

Shared Tab Groups

Shared tab groups also fill a similar role. Everybody uses screen sharing during these meetings, but in many cases, the screen being shared is a web browser. But when that is done, everybody can only see the part of the page the presenter is showing - because it’s his screen that’s being shared.

He may send URLs to the participants in a chat window, so others can view the sites and scroll/link to related pages that are not being presented, but that’s a bit awkward. And it also means that if you visit a related page and want to share it with the rest of the group, you’re posting more URLs to the chat, which others need to explicitly open to visit.

With shared tab groups, you can simply let the meeting share the group. Everybody sees the tabs that everyone in the group is visiting. So if you want to point something out, you can simply open a new tab with that content and tell others to switch to it.

Handoff for FaceTime

I have actually wished for this more than once. When someone calls me on FaceTime, it rings to all my logged-in Apple ID devices, and the one at hand may not be the one I want to take the call on. Common pattern:

So if I could answer FT on any device, then hand it off to the device I really wanted do the call on, that would be great!

Oh, I definitely want hand off for FaceTime. My mom has a hard time hearing on the telephone, but, strangely enough, she hears FaceTime calls really well (though Zoom, not so much.) I’m sure it’s because she can watch us speaking and do lip reading, or cues like that.

But there have been many times when she’s called and I’ve had only my phone and watch (or only my watch, worse) and have scrambled to get to my iPad to answer the call, because that seems to work best for these calls. With hand off I could answer on my phone (or watch) and then transfer to my iPad a lot more casually.

And I really do like the filtered focus feature. I think they’ll be better for more advanced users. And just this morning my wife was asking how to get the phone to automatically reply while she is driving, but she does still want to get the messages to show in the car (which integrates with Siri and reads them to her, though it’s not CarPlay.) The ability to allow messages through except for blacklisted people (rather than the current whitelist you need to do) will be better for her.

I agree with Adam about just about all of these. But my response to the CarPlay presentation was more like sheer terror–I have enough trouble keeping my eyes on the road with a modest 6" screen glowing beside me, not to mention the difficulty of using a touchscreen with nowhere to support my wrist. Maybe a focus filter will help.

I have to admit, though, that the Customize Spatial Audio thingy fascinates me. HRTF is indeed a thing in our daily perception of audible “space” and directionality, but no one that I know of has ever tried to make a feature of audio reproduction. It could be as startling as the first time you heard stereo. I can’t wait to try it.

Why is CarPlay being introed at least years before it could appear? Well, it’s the Developer conference and developers are going to be the ones who will need to implement that feature, and do development on apps so that when it does hit the market those apps are ready. I wish Apple had more things that were in the 1-2 year window so developers could do the baseline implementations and explore a bit before it just drops and they have 3 months to add new features before the new version drops and users say “why isn’t that new feature ready yet?!?”

In fact, a lot of these things aren’t just for the Apple implementations, but for multiple applications, so while it may not be huge this year they could be more useful over the next year.

FaceTime Handoff would be useful in classroom situations, allowing a change from the instructor camera to an iPhone focused on the experiment or moving around a gallery, and back again. I use phone handoff with a HomePod when I get to the office just so I can do other things while having a conversation. Also handy in the kitchen. Using FaceTime handoff would be similarly useful, and hopefully more seamless than hanging up and calling again.

Freeform would let people on an existing FaceTime call get up and running without running out to another app (MS whiteboard, Teams, Zoom-who has what account). We use FaceTime all the time as a deaf to standard for 1:1 support calls, and having a quick way to make a diagram is going to be useful as it becomes widespread.

I’m eager to see where the other developers takes these features.

Good for you, Adam. Somebody needs to point out when the emperor is naked.

Apple Pay Later – The thing that puzzles me about this is how Apple makes money on it. I guess maybe it’s just that it might encourage people to use Apple Pay more often so they get the transaction fee?

Focus Filters – The complexity of this makes me sad. Also, why would I want to change the wallpaper for a mode where the whole point is to focus on something else – probably not even use your device?

Freeform – I use Muse, which is likely more feature-rich than what Apple is rolling out. Hard to say, as Freeform was just just an aside in the keynote. If this sort of thing interests you, I recommend checking out https://museapp.com

Tab Groups – I completely agree that tab groups are a mess and too easily ruined.

Sure, but it’s pretty hard to develop for a platform that you won’t even be able to see in the real world for several years. And it’s not as though cars have a lot of flexibility when it comes to third-party apps. CarPlay seems to be mostly about mapping and audio at the moment, and it’s hard to see that much else being appropriate while driving.

I pretty much agree with everything, except Apple Pay Later/BNPL. Here’s an interesting article on BNPL. It can actually allow people to buy stuff without using a payday loan. Of course it can also allow people to buy stuff they might not have bought if BNPL wasn’t available to them, but there’s very little in finance that can’t be abused or misused in some way, including credit cards (and cash can be stolen, etc). But also, Apple didn’t invent it, they’re just adding an increasingly popular payment rail to their existing supported payment rails, which doesn’t seem unreasonable.

I don’t know. I’ve been in literally thousands of business meetings, and none have been via Facetime, and while people do fumble the handoff, they usually learn quickly, and even when it happens, it’s not a big deal. Meetings being sidetracked talking about the latest movie or tv show, or someone working remotely having their neighbor fire up their lawnmower, etc., have wasted orders of magnitude more time in meetings than someone leaving a meeting for a minute then returning (for whatever reason). Also, do any of the the other big meeting systems (WebEx, Teams, Meet, Zoom) allow this sort of handoff? If not, I’m not sure how critical it is.

I’ve been thinking along these lines for years. Distracted driving is a huge cause of accidents, but it’s usually blamed on phone use (to the point that it’s illegal a lot of places to use a phone while driving, at least not hands free). I’ve often wondered, how many accidents are caused by people fumbling with their in car control systems (which have notoriously bad UX)? And then think of the last time you fumbled around with your iPhone trying to figure out how to do something, then think about doing that while driving a car.

Late fees. Interest on late payments.

I’m just going to pick up on two of these:

Next-Generation CarPlay

Environmental and engine diagnostic features/convenience settings have been screen-based for several years. Our two Honda vehicles (a CR-V and a Ridgeline, both 2019 model year) have everything on screen, with rudimentary physical buttons whose feedback comes from the screen.

Like almost everything about Honda’s infotainment systems, they are poorly organized in practice. If Apple can do it better with CarPlay (and I suspect they can), this is good news.

Handoff for FaceTime

Case 1: I answer a FaceTime call on my Watch. Audio only. I hand it off to literally any of my Apple devices with a screen and I’m already way further ahead than I was.

Case 2: I answer on my iPhone. My spouse wants to join in. Nice camera, but awkward. We move in front of our iMac with a 27 inch screen and an external webcam, and again, much much better and didn’t have to disconnect.

I don’t get the “juggling housekeys and phone” scenario, because I’d just hang up and call back too.

Similar thought crossed my mind.

Some of this stuff feels like a solution in search of a problem (share tab groups). And just because Google or MS does something, should never be a reason to also do it. There should be a solid use case—and it’s not like they didn’t have enough good stuff to talk about

Me, I’d prefer to see Apple finally fix iCloud Safari sync before they try to add more stuff to sync.

And next-gen CarPlay: Good. Luck. With. That. Show me just three car manufacturers who eagerly await some outside non-automotive company to swoop in and commandeer there UI, thereby inserting themselves between said manufacturer and their customers. It took forever to get basic CarPlay into most cars, and yet we still see several non-negligible holdouts. But here we are, Apple flaunting their wildest dreams in front of the world as if this thing had any legs outside of Apple. Perhaps this was just a lot of marketing (and perhaps indeed to remind people to keep obsessing about Apple Car rumors), but reality in say the most-sold makers’ cars in the US (or Europe for that matter) in the next few years? Fat chance.

I suspect that Apple is aiming to expand its financial services portfolio. And like other credit and loan services, they charge a % fee to participating retailers, so this isn’t a total freebie. They’ve been working with Goldman Sachs and Mastercard for years, and maybe this is another opportunity for all the partners and retailers to acquire more users, and acquire valuable user and retailer information.

A question…will this service be in the US only, or will Apple expand it to other countries?

It occurs to me that the next-gen CarPlay may be coming out of Apple’s efforts to develop their own car? If this new CarPlay is going to be a user interface for an putative AppleCar, then they might figure that it’s a good idea to roll it out early so people have a chance to get used to an Apple interface for all things driving.

This is a good idea, and it looks like Elon Musk is considering adding CarPlay for Tesla:

They’re not doing either of those, they’re eating such costs. And they earn by charging merchants, when a buyer uses it. It’s limited to just $1K too, and is a US-only feature.

https://9to5mac.com/2022/06/13/apple-bnpl/

Yes, I’m with David on all three of these points.

I’ve been using Miro as a shared whiteboard/feedback spot with my photography students, it’s excellent and it has emerged as a shared file space which was far more usable and interesting to navigate, leave comments on, re-arrange and group than a shared Dropbox or OneDrive folder. I had begun to think of the infinite canvas as a more interesting metaphor than the desktop. I see huge potential here for a future OS interface.

Handoff, please, now… Teams handles this excellently, I have often had a Teams (audio!) meeting while on the move using my iPhone and ended up at my desk and resumed on my Mac all seamlessly handled. I get tired holding phones up and my iPad in a stand or my iMac is far better for lengthier chats.

Shared Tabs will be great for our upcoming ‘application to College’ season… Already my wife and I and our kids use shared Notes for Christmas lists and so on. I share Maps location groups when we are heading off on vacation or for trips with them too. Shared Tab Groups will be great for all of these.

Any thoughts on Customize Spatial Audio, Tommy?

Well, I’m loving Spatial Audio on the songs that are mixed for it, I’m definitely curious about it improving.

Sony announced if for the Playstation 5…kinda. Not much seems to have come of it since. Apple having the LiDAR built into so many iPhones and iPads certainly makes the setup process something I could imagine to be better than the “send us your ear pics” plan. PS5 features: Sony reveals an audio upgrade with a very weird requirement

Quite a number of questions and incorrect information about the Pay Later service in this thread. Here’s an article that provides more information: Apple digs into its massive pile of cash to fund new Pay Later service | Ars Technica

Key points are: no interest to users, transparent to merchants, Apple controls information (so better privacy), limited to “smaller” purchases, no hard credit checks, no late fees. Hardly a payday loan. Not as bad as a credit card purchase, even. Somewhere along the way people got so afraid of usurious credit practices they wrote off all credit as evil and we lost the ability for people to look at whether something is a good credit offering or bad. This is free money offered as a convenience for customers of luxury products. The interface they showed off also seems like a good dashboard for keeping track of your spending and financial planning. Whether you are budgeting and saving for a future purchase, or budgeting and paying off a purchase is pretty similar in a 0% APR situation. Similar skills at play.

As for why, well, making a product you offer more appealing to convince consumers to use your product instead of competitors is a pretty tried and true strategy. And if customers love Apple Pay they will not want to switch to a phone/watch that does not offer it. Seems pretty straight forward.

The improvements in spacial audio using the camera?

It’s probably a byproduct/feature of the coming AR capabilities.

Interesting discussions on Apple Pay Later. Now that Apple is directly engaging in lending services, I wonder if it might attract even more scrutiny from regulators, especially financial ones.

I am not in the US, so Apple Pay Later is not available to me; but I wonder how useful the service is if it is available.

I personally think it is quite a hassle to use even though it effectively offers “free credit”. I use sinking fund arrangements to save up for large purchases, and fund small purchases using “line-item” budgets. Since the limit is $1,000, it seems to be mostly for the latter.

Adding one more layer to the payment process (Apple Pay Later pays for purchase → Pays Apple later) makes tracking expenses and reconciling budget quite a bit more laborious. If I need to use Apple Pay Later to bridge a purchase because of liquidity issue, I will be very worried if $1,000 presents a problem!

I will be glad if Apple offers a way to manage budget and sinking fund allocations (and encourage good financial habits), but that seems not to be in its interest.

Regarding Apple Pay Later, as someone in their mid-sixties I’m guessing this isn’t aimed at me. We pay for everything on credit cards and the entire balance gets automatically paid by the bank at the end of the month (paying zero interest). We get flights for the frequent flyer miles which more than covers the very low annual fee.

On the other hand, my mid-twenties daughter has used AfterPay in the past. She wasn’t even sure why she used it as she has a good job, a solid bank balance and still lives at home with us. She said she’d probably just use AfterPay again if she needed rather than switch to Apple’s offering - primarily because she’s used it before. If Pay Later works without additional set up I imagine she’d consider it.

Of course, we’re in Australia so at this stage it’s all academic.

Some of these items are valid criticisms, but I think others fall into the bucket of features that don’t match your way of working, but others find great value in.

Tab groups stands out as an example of the latter to me – it’s one of my favourite features of MacOS 12, and has become embedded in the way I use the web. And I know several other people of who this is true as well. It’s precisely because they’re not permanent like bookmarks that they’re useful. (I do agree that the behaviour when clicking a link in another application is annoying though.) Shared tab groups will be very useful to me for certain situations, and I imagine for millions of others too. So I’m thrilled to see them expanding on it, and I think they absolutely should be evolving the feature.

Handoff for FaceTime is another feature that I was surprised to see included in this article. I run into this problem all the time, certainly in over 50% of my FaceTime video calls. Either on my end or the other end, someone starts on one device, then wants to switch to another one with a bigger screen, or the battery runs low, and we have a little dance of hanging up and calling back which sometimes isn’t smooth and always disrupts the conversation. FaceTime handoff was definitely a “finally” moment for me when watching the keynote (similar to mark unread in Messages). This is a genuine and frequent annoyance, and it’s going to make FaceTime calls a lot more convenient.

These days when I buy almost anything from Apple I use their monthly (price/12) or (price/24) payment plans. Why not? Interest free, part of my income is guaranteed (unless Congress shuts down Social Security), I have assets that I can use to quickly pay off the remainder if necessary. The payments show up on my Apple Card bill which automatically gets paid off at the end of the month. There’s no downside for me. I don’t personally have trouble managing credit or buying large items on impulse, so I’m not worried that I’d abuse Pay Later. I’m not sure that I’d actually use it, though, for something outside of the Apple Store.

One caution when using this: I had the same thought when I bought my mom an Watch. It was free via my Apple credit card, so why not do it? Then I noticed that this reduced the amount of credit available to me (which makes sense), which was reported to credit agencies and dinged my credit score. I paid it off in full and my score promptly went up!

So just be aware that this kind of interest-free delay could impact your credit score (if that’s important to you — I was refinancing house at the the time and it was for me).

By the same token, all these buy now pay later schemes claim to not hit your credit, but what they often don’t mention is that also means paying off in full and in time will do nothing for your credit score. Unlike a CC.

Apple Pay Later isn’t a head scratcher for me because I’ve been in places where such a system is commonplace. In my wife’s native Colombia, for instance, you’re routinely asked “¿Cuantas cuotas?” when paying with a credit card in a brick-and-mortar store. That means: “How many payments?” This is pretty much identical to Apple Pay Later, but it’s been around for ages.

Wow, could I not disagree more. This kind of patronizing attitude toward those with financial difficulties never ceases to amaze me. “Let’s take options away from poor people so they don’t abuse them! It’s for their own good!”

I can’t tell you how many times something like this would have been a lifesaver. “I can’t pay my electric bill right now; it’s about to be shut off!” “Just put it on Apple Pay Later, and pay it off when your paycheck comes in, with no interest!” This is absolute genius, and is going to make a lot of people’s lives better.

As for Shared Tab Groups, what I’m hoping for is that you’ll be able to generate a link to a tab group, so I can invoke it with Shortcuts or whatever. It’s a real lack in the current setup.

No need to get agitated. It’s a fact that overly easy access to credit creates an incentive for people to live beyond their means. There’s no wonder places that make getting credit easy also end up having people overburdened by debt. And we here in the US know how bad on average we are with savings and rainy day funds. If you save just a little bit today, you won’t need BNPL tomorrow.

Now that said, I have no doubt that there are plenty of people who can use this stuff responsibly. That doesn’t change there’s certain groups that cannot and they can become a serious problem, not just for themselves, but also for society at large, including all those people who never wanted anything to do with easy credit in the first place. And naturally, to them that’s not OK. Maybe that poster was a bit stern in their wording, but in principle I don’t think there’s anything terribly wrong with pointing out that there’s a fine line to walk here. Not just for Apple of course.

I agree 100%, and I think that rapidly rising inflation and higher interest rates will make it even more difficult, and probably impossible, for many responsible consumers to immediately shell out cash for recent purchases, including food, gas and electricity. Apple probably won’t be making much money at all from this service, but they will be building up good will among consumers who use Apple products and services. It looks to me to be less expensive and aggravating than accumulating credit card debt and/or loans can be. And Apple’s timing on this new service is very good.

Certainly it is the case that just about anything can be abused, if people wish to do so, and some people have great difficulty behaving responsibly. But this is the equivalent of saying, “Apple allows Apple Pay to be used at liquor stores! Alcohol is abused by many. This is not a good look for Apple.” Or, of course, providing a credit card at all, or, indeed, having attractive products for sale which people might buy even if perhaps they can’t afford it (guilty!).

However, it does not seem to be the case that, say, payday loans, which were called out in the article, seem to do more harm than good, even for just those “certain groups" (i.e. poor people) which you would think would be damaged by them: https://reason.org/wp-content/uploads/files/payday_lending_regulation.pdf

In a perfect world…you’re probably correct…but there will be many people that get into even worse financial trouble with this. Doesn’t mean it’s a good idea or a bad idea…just that some it will help and others it will hurt…and iMao will hurt more than it helps by being used thoughtfully.

Came across a different perspective from Jano le Roux (@janoleroux on Medium). He’s of the opinion that Apple Pay Later, Freeform, Passkey, and Tap to pay will “wreck” (his word) 15+ startups.

Though they are not startups, companies like PayPal and Klarna are probably not at all happy about Apple Pay Later either. My guess is that they, and their stockholders, are probably going to the bathroom in their pants. There are a lot of people who own iPhones, iPads and Macs out there.

Jason Snell has a bit on the CarPlay announcement as well now…

According to this survey, 42% of people who used BNPL services ended up making late payments and 23% regretted using them.

The psychology of debt is interesting. We are wired to avoid pain, and paying cash is painful. BNPL and other tools to delay upfront payment short this circuit, making it easier to purchase items on impulse for immediate gratification.

We also value money differently as time horizon changes, and people with poor financial literacy often could not evaluate time value of money properly. Couple this with the incentive to avoid immediate pain, it is not surprising that many people prefer to stretch out their payments over longer period of time, despite potentially much higher total payment (e.g. additional interest) and opportunity cost (e.g. additional income from alternative use of funds such as investments).

Earlier discussions touched on the argument that some BNPL services are interest-free, and so do not cost anything. This might sound tautological, but there is an important cost that we do not take into account - the cognitive load of managing debt. At worst it might impair cognitive performance and lead to a host of psychological problems. It might also distract one from spending time more productively, for example deploying funds to profitable investments instead of managing the complex debt- and cash-flow arrangements.

https://www.pnas.org/doi/full/10.1073/pnas.1810901116

I’ll bet that a large fraction of that 42% simply forgot to make the payments.

Good point, and one result of the cognitive overload is that they forget to pay. You can avoid that by setting up automatic bill payment, but that still takes some time and effort. BNPL companies are betting that some fraction of customers are going to forget. I wonder what the breakeven point is for them.

I suspect (and if someone knows of a study that supports or contradicts me, please let me know) that there are two kinds of people using credit.

The first is people who are able to and are careful to not spend beyond their means. If something is expensive, they will save until the money is available.

For these people, all forms of credit (aside from big purchases like a car or a home) is a matter of convenience. To avoid needing to carry large sums of cash or mail cheques. Especially when stores frequently don’t want to deal with any payment form other than plastic.

For these people, a credit card with a suitable limit is just fine. They pay off the card in full every month and never pay interest. For them, BNPL might be convenient from time to time, but it ultimately doesn’t offer anything that a credit card doesn’t offer and has some major drawbacks (some of which we’ve already mentioned here).

The second category are those that use credit to buy things they wouldn’t otherwise be able to buy. Whether this is for necessities (to get through hard times) or for spending above their means, these people may not be able to pay off the entire balance every month.

These people tend to carry balances from month to month and they pay interest charges. For them, credit cards are a bad deal, because the interest rates are very high and can get insanely high if you miss a payment or two.

For these people, BNPL seems like a good deal because it’s (usually) zero-interest. But ultimately, that won’t solve the real problem if they are spending more than they can afford (whether or not the reason is justifiable). If they can’t get on top of the debt, it is going to end badly, no matter what the credit mechanism may be.

According to this article I found, credit card delinquency rates are typically 3-5%, occasionally spiking up to about 10%.

So why is BNPL so much worse? I think it’s because people in the second category (who are having problems with credit cards) are flocking to it, believing that it is a safer alternative. And people in the first category (who don’t have credit problems) don’t see any reason to use it. If your product is disproportionately attracting the worst credit risks, you probably should expect to see numbers like these.

The very reliable Motley Fool recently published extensive research conducted among American adults via their Ascent division about BNPL users and usage. There’s a ton of interesting information and analysis on their website. Here’s just a very few reasons why I think Apple was motivated to launch a BNPL service:

The Ascent, the research unit of the Motley Fool, “surveyed 2,000 Americans in 2020 about their buy now, pay later The company then followed that survey with another in March 2021, with the results showing an almost 50% growth in BNPL in less than a year.”

“Buying electronics is the most common use of buy now, pay later, with 48% of users saying they’ve used it for that reason.”

“ 61% of buy now, pay later users would rather use a BNPL service offered directly from the retailer they’re buying from than going through a third party.”

And “Buy now, pay later users aged 18 to 24 are the most likely to pay $250 or more per month when they have a BNPL payment.”

Study: Buy Now, Pay Later Use Declines for Third Straight Year | The Motley Fool.

And “62% of BNPL users said BNPL could replace their credit cards.”

*Buy now, pay later usage growth was largest in the 18 to 24 (62% growth) and 55+ (98% growth) age groups between July 2020 and March 2021.“

There’s a lot more interesting stuff in the article.

I suspect you’re right - there are two kinds of people using debt. There’s the pre credit card people and the post credit card people.

I come from the former. I’m mid-60s and grew up before credit cards - the only way you could buy something was to have the money. Yes, you could get a loan but it was a long, painful exercise which normally required an interview with the bank manager. We learnt to save and value money. The simple rule was if you didn’t have the money you didn’t buy it.

Then there’s the latter - like my young adult kids. They’ve had credit cards all their life and BNPL is just another ‘thing’. They rarely have any issues because I’ve drummed into them the importance of respecting their earnings and understanding the difference between good and bad debt.

They do however, exhibit a far greater impatience that we ever did as kids - they want ti now and their enthusiasm for spending sometimes needs tempering.

I wish financial literacy was taught in schools, it would be far more valuable than some of the things I learnt (log tables, quadratic equations etc).

Turning to Apple Card for just a moment:

0% interest (equal payments) installment purchase plans for Apple equipment and accessories are structured to go out of their way to keep the customer from accidentally making a late payment.

I currently have a MacBook Air M1 and two iPhones on installment plans that all started at different times. On the first of the month, the Wallet app notifies me that my Apple Card statement is ready, and I see a single amount for what’s due from the 3 installment plans. I can choose to pay it now or pay it some time before the due date at the end of the month (and since I’m maximizing cash flow, I push it out to a couple of days before the due date). Pushing it out puts up a dialog that asks me when I want to pay the minimum, and the dates offered do not go past the due date.

I can easily pull up details on each of the 3 installment plans, which have helpful subject lines like “Monthly Installment (11 of 12)”.

The only way to mess this up is willfully. It’s psychologically difficult to screw it up by accident.

I would hope that BNPL would work similarly to this model. If it does, then most of the concerns that have been rightly raised here would be addressed, and it would be in line with the mission statement that Apple expressed about remaking the credit market model.

I would add a third category…people like my bride and I who use our fee free and cash back Navy Federal Credit Union card as a bill consolidation service. We pay for almost everything with a single card and it’s our default ApplePay card. The bill gets paid in full online when it comes in. We’ve been doing this for many years now and write very few checks a month…6 or 7 typically maximum…and use very little cash as well. Even for something as simple as a couple of burgers from McDs…wave the watch at the terminal and then it’s a single payment once a month at billing time.

Fortunately…our financial position keeps us from having to worry about the buy something we can’t afford option…but back in the day when we had smaller salaries we occasionally split Christmas spending or vacation spending across 2 months for cash flow purposes…but it’s been probably 25 or 30 years since we did that.

This is essentially how we live. We use our credit cards as a tool, not as a method of buying because we don’t have the funds. The outstanding balance is paid in full automatically so we never pay interest. We’ve been able to travel extensively with the FF miles we’ve accumulated. It’s also an accurate record of spending when required for tax time.

It’s rare these days to have more than $50 in my wallet and it can last several weeks. I do keep $50 in my iPhone’s case for emergencies (flat battery, no wallet etc).

I think it was calion’s point that there are a lot of people in America who have no choice about living beyond their means, who don’t have any surplus cash to save, and that it’s patronizing to tut-tut them for being poor. If it’s a choice between having the electricity disconnected and using credit to pay it off until a paycheck arrives, well, at least Apple’s not charging interest.

Nobody here is saying that there aren’t people in dire financial straits.

But it is equally unfair to claim that everybody carrying a large balance is doing it because they have no other option. There are quite a lot of people who habitually spend more than they can afford on things they don’t need and then get in big trouble if they lose a source of income or when inflation rises or when interest rates go up. Things like BNPL won’t help these people - it will likely end up making their problems worse, because their problem has nothing to do with who is issuing their line of credit.

The discussion had focused pretty much exclusively on “people who spend more than they can afford on things they don’t need” and it’s a useful corrective to think as well about people who aren’t in that situation but are living lives of financial precariousness. Lecturing them about saving a bit every month or not carrying a credit balance does seem patronizing, because that’s not an option, and Apple’s solution is better than payday loans at usurious interest rates.

One thing that might be worth keeping in mind here is that Apple Pay Later isn’t a general-purpose way of spreading out expenses. It won’t be an option for most people, and it won’t be available for all expenses.

First, it’s only available to those who have Apple Pay, which by definition is only those who own Apple devices. That’s a lot of people, certainly, but still a subset. Only 24% of US iPhone users use Apple Pay. Plus, the need for an Apple device likely restricts the audience to somewhat higher-income people given that it’s always possible to spend less on an Android phone or Windows or Chrome OS computer.

Second, while Apple Pay Later is available for anything you’re buying with Apple Pay, that probably doesn’t include rent, electric bills, and many other hard-to-avoid expenses. It likely would include gas and groceries, since it’s fairly easy to find stores that allow Apple Pay for both. And given the cost of gas these days, I could see someone needing to fill up a tank and spread out the cost, knowing that if they can just get to their job, they’ll be able to make enough to pay off the bill.

A single-card approach is convenient, but after having cards compromised several times some years back, I’m always wary of having only one payment method available.

My experience with excess charges makes me wary of automatic payment. Billing screwups can happen; the worst I have seen was an $8000 overcharge by gas company after an estimated bill. If you want to use it, be sure to keep enough money in the bank to allow for unexpected fluctuations in billing.

Agreed. I try to avoid automatic bill-pay. The only exception in my case is with my TV provider, since I get a significant discount using it. But the automatic payment is via my credit card, not my bank account.

For any bills where it is possible (credit cards, mortgage, a few others), I use my bank’s bill-pay system to make the payments. For many, the bills are sent electronically to the bank, but in all cases, I need to manually schedule the payment via the bank’s web site or mobile app. So I always have the ability to catch a problem before the payment is made.

I don’t know about your local electric company, but I know none of my local utilities (electricity, gas, water) take any form of credit card. Cash/check/ACH transactions only.

It’s also (currently) only going to be available in the US.

I disagree. There should be discussion of people spending on things they wouldn’t normally purchase as that’s exactly the scenario that BNPL affords. There are also people who will be struggling and BNPL may offer a better option than a traditional credit card. As I said in an earlier post, we use our credit cards as a tool and if people can use it to avoid hardship that’s great.

No-one is tut-tutting or patronising people doing it tough. I grew up in a very poor household and know exactly what it’s like to struggle for every cent.

We have multiple credit cards and multiple accounts with different banks for exactly this reason.

That reminds me that our bank does allow you to set a limit on automatic payments, and I have done that for AT&T Mobile. I had to raise the limit after we changed our service, but it’s a good feature to set for regular bills. That’s more difficult to do for credit cards because your bills can vary widely if you use them to pay for things like buying appliances or car repairs.

Rather than set a limit on my cards, I have my accounts send me alerts (via text message and e-mail) for a variety of events, including any charge over $100 and any charge from a foreign country (regardless of amount).

I get alerted as soon as the charge is made. If it’s unexpected, I have a few days to investigate and (if necessary) dispute the charge while it’s still pending.

I also log on to each card’s web site every evening, just to make sure there’s nothing unexpected present that I might have missed.

I have the exact same thing set up for my bank accounts as well as my CCs.

Any charge comes in above a certain limit I set and I get an SMS telling me about it. I have to admit, I have yet to see such a text message alert me to a bogus charge without my bank’s fraud protection also kicking in and sending me a text, calling me on my phone, and alerting me through their app. It’s all a bit involved, but when it comes to fraudulent charges, I admit I’d rather be safe than sorry. As a Cal faculty member, I was also fortunate enough to be exposed thanks to UC’s stupidity such that my SSN, DOB, email, phone, and postal address all got leaked to the dark web not long ago. I know by now I cannot afford to take these things lightly. It’s a mess, but on the positive side it serves to me as a strong reminder how serious we should be taking privacy and financial security measures.

Thanks also @Shamino for that mention of daily checks. I thought I might be the only one who’s anal enough to check his bank and CC accounts daily (after getting up at 5am and making coffee, usually one of the first things I do). It’s a drag and at times I wonder if it’s a bit neurotic, but at least it’s nice knowing that I’m not the only one who spends 10 min of his day trying to make sure I haven’t just become another fraud victim.

Not the only one (or two) … me three.

We have the same for anything over $200. I have a feeling the banks down here (Australia) do it by default. They’re also fairly good with suspicious or unusual transactions and they’ll call you to confirm their legitimacy. Once my card was suspended until they could confirm a purchase - another good reason to carry multiple cards.

Quicken Deluxe updates its records regularly, so you can use it to check all your bank accounts, credit cards, investments and Paypal account. They don’t get my bank information instantly, but it’s easier than having to check everyplace separately. I also watch for payments from people who pay me, e.g., clients for whom I work, a self-published book on Amazon, and eBay sales.

I think by this reasoning, Apple should stop selling products altogether, because people who can’t afford to will buy them and get themselves into financial trouble.

Certainly some people make poor decisions. That’s not a reason to deprive them of options. More options allows the possibility of better decisions, even if some people have lessons to learn.