TidBITS#1340/03-Oct-2016

We kick off this issue of TidBITS by revealing a subtle feature of macOS 10.12 Sierra that can help make your Desktop a neater place. ScanSnap scanner users who have been putting off a Sierra upgrade can likely move ahead now that Fujitsu has published full details of the conflicts, which turn out to be easily avoided. If you’re perturbed by how the iPhone 7 said sayonara to the headphone jack, Josh Centers reviews four affordable wireless audio solutions to ease the sting. Finally, Glenn Fleishman looks at three iMessage apps that let you send money to a friend via Messages in iOS. Notable software releases this week include Default Folder X 5.0.7 and Airfoil 5.1.2.

Align Windows in macOS 10.12 Sierra

Apple has made much of macOS 10.12 Sierra’s notable features, like Siri, Picture in Picture, and the capability to unlock your Mac with your Apple Watch. But our favorite new feature — automatic window alignment — wasn’t advertised by Apple at all, and it’s so subtle you may not even realize you’ve used it.

You move windows in Sierra just as you have since 1984, by clicking and dragging a window’s title bar (or status bar). In Sierra, however, if you slow down briefly when the edge of the window you’re dragging meets the edge of another window, the first window stops moving and aligns perfectly with the second window unless you force it past the edge. It doesn’t matter which sides you’re aligning.

This trick is particularly handy in the Finder, where you often want multiple windows open. But it should work with windows from any app, and even windows from different apps. That lets you simulate the side-by-side look of Split View without messing with full-screen mode.

Sierra’s window alignment also kicks in when you’re resizing windows, which, remember, you can do from any side of a window. Slowly drag the edge of one window to the edge of another to lock it in place. Or, if you’re expanding one window that’s next to another, window alignment makes it easy to match their heights.

The windows on my Mac have never been so neatly arranged!

If you want to position your windows precisely without aligning them, you can bypass Sierra’s window alignment code by pressing and holding Option as you drag the window.

ScanSnap Conflicts with Sierra Easily Avoided

In “ScanSnap Users Should Delay Sierra Upgrades” (20 September 2016), we warned users of Fujitsu’s ScanSnap scanners to avoid upgrading to macOS 10.12 Sierra, based on the company’s dire predictions of potential data loss. Happily, it turns out that Fujitsu was just playing it safe until its engineers were able to pin down the exact conflicts, and they turn out to be far more minor than previously predicted.

In its updated notice, Fujitsu (a TidBITS sponsor) now outlines three activities that ScanSnap users should avoid when running in Sierra:

- Do not use ScanSnap Organizer, ScanSnap Merge Pages, or CardMinder.

- Do not use Excellent mode when scanning A3 (11.7-inch by 16.5-inch) documents. Fujitsu explicitly says that no image data will be lost nor any blank pages produced when scanned content is saved in Letter (8.5-inch by 11-inch), Legal (8.5-inch by 14-inch), A4 (8.3-inch by 11.7-inch), or smaller sizes.

-

Do not use the following functions in either Quick Menu or the application: Scan to Print, Scan to Evernote (Document), Scan to Evernote (Note), Scan to Google Drive, or Photos.

For those looking for more information, Fujitsu has produced a detailed guide to all of the problems, complete with the operation in question, the color mode, the paper size, the image quality setting, and workarounds.

Practically speaking, if you use a ScanSnap scanner, you should verify that your scanning workflow doesn’t rely on an affected aspect of the ScanSnap software or A3 scans in Excellent mode. If not, you can safely upgrade to Sierra.

Four Affordable Wireless Audio Solutions

The iPhone 7 is available now and already in the hands of early adopters. But many readers have expressed concern over the lack of a headphone jack in the iPhone 7. In a post-announcement poll taken by Toluna Quicksurveys that included TidBITS-specific questions, 44 percent of respondents said the absence of a headphone jack would require them to change their habits. (For more on that, see “iPhone 7 and 7 Plus Say “Hit the Road, Jack.”,” 7 September 2016.)

Apple claims the future is wireless, even though it bundles wired Lightning EarPods with the iPhone 7. However, Apple would be more than happy to sell you a $159 pair of wireless AirPods when they debut in late October, or a pair of the new W1-equipped Beats wireless headphones. (See “W1-powered AirPods Usher in a New Era of Wireless Audio,” 7 September 2016).

Wireless headphones are nothing new, and The Wirecutter offers well-vetted suggestions for nearly every situation. For now, though, I’d like to focus on three specific use cases that new iPhone 7 users may be wondering about: converting existing headphones to wireless, affordable wireless adapters for the car, and an inexpensive solution for fitness buffs.

Make Any Headphones Wireless — By far my favorite gadget in this roundup is the Antec AMP SmartBean, a Bluetooth receiver with a headphone jack that works with any audio device that connects via a 3.5mm headphone plug, such as headphones, speakers, and car stereos. It sells for around $25 on Amazon.

The SmartBean is not much bigger than a quarter, and it’s about the weight of two quarters. It sports a clip you can use to attach it to your belt, handbag, or car visor.

The SmartBean features a built-in lithium-ion battery, recharged via a Micro-USB connection, which lasts for 6 hours on a single charge. The reported standby time is 130 hours, so it’s easy to keep it with you at all times.

If that’s not enough battery life, you can use the SmartBean while it’s charging, but the SmartBean turns itself off when you plug it in, so you’ll have to turn it back on. It takes 2.5 hours to recharge fully.

It includes a built-in microphone for phone calls, as well as buttons for Play/Pause, volume, and Previous/Next track. However, if you keep the SmartBean on your belt, the microphone probably won’t do much good.

Its volume controls are a bit different than most Bluetooth volume controls in that they don’t adjust the volume on the transmitting device, but instead on the SmartBean itself. I like having this level of control, but you might want to set your iPhone’s volume to maximum and then turn it down on the SmartBean.

I didn’t test the built-in microphone, because there’s no way to initiate calls from the SmartBean. The in-line remote control on Apple’s EarPods doesn’t work with the SmartBean, and the controls on the SmartBean can’t activate Siri. Holding down the Play/Pause button on the SmartBean dials the last-dialed number, a quirk that also apparently happens on Android phones.

I tested the SmartBean with three pairs of headphones: standard Apple EarPods, the professional-grade Sony MDR-V6, and the Beats Solo 2. I switched between wired and wireless connections with these headphones and couldn’t discern a difference in audio quality.

I did hear a slight delay in audio transmission while monitoring my voice for a TidBITS podcast recording, but I didn’t notice it while listening to music or watching movies. I also used the SmartBean with my Sony MDR-V6 headphones for a couple of podcast appearances with no problems.

The SmartBean supports multipoint pairing so you can pair two devices to it at the same time. However, as with all multipoint Bluetooth devices, doing this often causes more problems than it solves, so I recommend repairing with each device with which you use the SmartBean. Thankfully, pairing is as painless as possible for a standard Bluetooth device.

Despite the usual quirks that seem to come with every Bluetooth device, the SmartBean is a valuable companion for the dawn of the wireless era.

Go Wireless in the Car — The SmartBean is a flexible solution if your car has an auxiliary input jack, but what if it doesn’t?

If your car has a tape deck, you could connect a SmartBean to a common cassette adapter, or you could opt for a solution recommended by our pal Peter Cohen: the ION Bluetooth cassette adapter, which sells for about $22. Yes, that’s right, just pop this cassette adapter into your stereo and you’ll have a wireless connection. It runs off a rechargeable battery that offers about 4 hours of battery life. I haven’t tried it myself, but it’s a neat hack.

Many of us drive cars produced after the cassette era, but before auxiliary jacks and Bluetooth were standard. The easiest solution for folks like us is an FM transmitter, which hijacks a radio station to send audio to the car stereo.

I’ve owned many FM transmitters, most of which were garbage, but I like the $35 Bluetooth-enabled GOgroove FlexSMART x2 so much that I bought one for my wife’s car and one for mine. It also features an aux-in port for people whose devices do still have headphone jacks.

I like the GOgroove FlexSMART x2 for a variety of reasons. It plugs directly into your car’s cigarette lighter socket, so there are no batteries to worry about. The FM transmitter is powerful. Most FM transmitters suffer from interference even in unused portions of the radio spectrum, but the GOgroove FlexSMART x2 can block out even the most powerful stations in my area.

The GOgroove FlexSMART x2’s flexible neck enables it to fit in just about any car. It also features a USB charging port. Just plug in an available Lightning cable and you’re all set. (I like the Anker PowerLine+, which is Apple-certified, cheaper and more durable than Apple’s cables, and comes in many colors and lengths.)

The one potential downside of the GOgroove FlexSMART x2 is that it can’t automatically scan for open frequencies. However, I’ve never found this to be a reliable feature in other FM transmitters. You’re better off using an online tool like Radio-Locator to find an open frequency in your area.

Like the SmartBean, the GOgroove FlexSMART x2 supports multipoint pairing, letting you connect two devices at once. This feature works better on the GOgroove FlexSMART x2 than on the SmartBean and enables you and your significant other to share a car with little friction.

Inexpensive Exercise Earbuds — A lot of people need music to work out and prefer wireless headphones to eliminate snagging problems. But you may not want to spend much on fancy headphones that could be smashed, lost, or stolen at the gym.

TidBITS reader Floyd Bloom first pointed me toward the SoundPeats QY7 headphones, which go for $19.99 on Amazon. However, reader Dennis Swaney suggested a cheaper alternative (I’m hesitant to say “knockoff,” because a lot of companies make QY7 headphones, and I’m not entirely sure if there even is an original) on eBay, the generic QY7 Bluetooth Headset, which sells for $9.49, including shipping. I had to try it. (From now on, when I refer to the QY7, I mean the generic pair

I bought on eBay.)

The sound quality is lousy. Listening to the QY7, you’d be forgiven for thinking that the lead singer of your favorite band had fallen down a well. However, when you’re working out, audio quality is often the least of your concerns.

Let’s look at the QY7’s virtues outside of price. They’re extremely lightweight. The battery is rated for 2–3 hours of music, 175 hours of standby, and a charge time of 2 hours. Unlike the AirPods, the two buds are connected via a wire, and the QY7 comes with several different tips and ear loops so you can adjust the fit.

The QY7 aren’t audiophile-grade earbuds, but for less than $10, there’s minimal risk to tossing a pair in your gym bag.

We totally understand if the disappearance of the headphone jack is making you anxious, but there are good wireless solutions out there, and they don’t have to be expensive — you could buy all the products I’ve reviewed here for under $100.

Do you have a favorite Bluetooth audio device? Let us know in the comments!

Circle, Square, and Venmo: Payment Apps Let You Pay via iMessage

It was easier to pay a friend back for lunch 17 years ago than it is now, at least if you had a Palm PDA. That’s finally changing with the release of iMessage apps that allow peer-to-peer (P2P) payments directly within Messages. Integrating payment into Apple’s iMessage service solves several of the largest problems with paying P2P: addressing a payment to a recipient and making it easy for the recipient to collect it whether or not they already have an account.

We’re still in the early days of iMessage apps, but two prominent payment apps have added iMessage integration: Square Cash and Venmo. A third, Circle, was launched on multiple platforms by entrepreneurs with deep Internet roots. Oddly, PayPal hasn’t yet updated its app to support iMessage payments, but the company often lags putting improvements in its native software.

The Shape of Payments — In 1999, PayPal — then a product of a company called Confinity, headed by one Peter Thiel — launched a personal payment system on the Palm platform. After you registered on a Web site, you could send a payment via a Palm device’s infrared transceiver. It was ahead of its time and didn’t last long.

PayPal persisted beyond in-person payments. eBay bought the company in 2002 because it drove a ton of the auction site’s transactions, but it later spun PayPal off in 2015. Until relatively recently, PayPal was the powerhouse of P2P payment, especially across national borders. When I ran an electronic periodical, The Magazine, PayPal was the only reliable and sensible way to pay contributors outside the U.S. and Canada, since it charges tiny fees and complies with banking rules in 202 countries across 25 currencies.

But challengers have risen, all trying to score a piece of a roughly trillion-dollar-a-year global market for moving money between individuals — almost $600 billion of that is in money sent home by foreign workers alone. Before these new companies appeared, most of PayPal’s putative competitors charged fees to move money around, and those fees could be significant when shifting cash across national boundaries. PayPal charges nothing for most personal transactions within or between the U.S. and Canada using a PayPal balance or withdrawing from a bank account, and collects from 0.3 to 3.9

percent for transactions crossing other international borders, sometimes with an additional fixed surcharge. The upstarts typically operate only in the United States, and emulate PayPal in having no fees for personal transfers. Circle is so far unique in also including UK residents in its system.

These P2P payment systems are distinct from business-focused credit-card processors, like Stripe (for apps and Web sites), Square (for in-person retail transactions), and dozens of others. Credit-card processors enable merchants to participate in the global payments network; they charge about 3 percent of every transaction, plus another 30 cents when it’s not face-to-face. Anyone can get a Stripe or Square account, but then you’re subject to all the limits and rules present in those systems. (Square operates both credit-card services and P2P payment services as separate parts of the same business: the former is just Square; the latter, Square Cash. Each requires a separate account.)

These new P2P payment services face a challenge relative to credit cards and PayPal: signing up enough people that they become a preferred alternative to other payment methods. Once they have substantial user bases, they can then tap into the small-business retail market and eventually expand to work with big businesses, which are more lucrative arenas. In such a scenario, the P2P service would charge the merchant around 3 percent of the transaction. That’s comparable to credit-card fees, but these P2P services have fewer restrictions and are easier for merchants to work with. Plus, these debit-based P2P services may appeal to people who never use credit cards.

Some payment outfits have tried to solve the problem of acquiring a lot of users by paying bounties. Venmo used to offer $5 for new account signups to both the referrer and the new user, and Square once offered $10 each way and still offers $5. That’s expensive, but necessary to build a network. That’s where iMessage apps can help.

Chicken, Meet Egg, or Vice-Versa — If someone tries to send you money with one of these systems and you don’t have an account, you get an invitation and instructions on how to sign up to receive the money. An email or text message explaining how to give up personal financial details may seem dubious, even if you know it’s coming. A few years ago, I tried to pay a friend via a service offered by my credit union that would deposit money into the recipient’s bank account. But between the weird message sent by the service and my friend not wanting to give her banking details to a random site, we chose a different method.

These new P2P payment services are easier and more familiar than my credit union’s system, but there’s still friction. iMessage integration breaks through the chicken-and-egg problem. When you receive a payment notice via iMessage:

- You’re getting it through Messages, which gives it the patina of trustworthiness you assign to that blue-balloon text.

- A person ostensibly known to you sent the message, or you’re already having a conversation with them.

- The link to install the app, if you don’t have it, points to Apple’s App Store, which adds trustworthiness.

- Instead of sending you to a Web site via an email message, a P2P iMessage app lets you sign up within iOS, a generally safe environment.

Before we get started with the experience, let’s go over the limits and costs for personal use of the three services we tested: Circle, Square Cash, and Venmo. (Is Circle’s name a joke on Square? We don’t know, but Circle obtained circle.com, while Square uses squareup.com for its main site and cash.me for Square Cash.)

All of these services keep a balance for you, like a savings account. You have the option with each to transfer your balance out to a linked account that accepts deposits or credits, which can happen automatically (called “sweeping”) or on request. Here are the details:

- Circle charges no fee to receive payments from bank accounts and debit cards, but it might charge you to receive credit-card payments. Circle holds your money until you withdraw it to a bank account, credit card, or debit card — a second factor code is required to withdraw amounts over $30. You can only deposit into your Circle account up to $300 per rolling seven-day period initially, but with verification, you can request a limit of up to $3000 per week. That limit doesn’t apply to receiving payments from others. You can spend up to the total that’s held in your Circle balance. There’s no limit on withdrawing funds. Circle works with U.S. and UK Visa and MasterCard credit

and debit cards and U.S. bank accounts. (Circle also supports sending and receiving Bitcoin, which is a whole other kettle of fish and beyond this article’s scope.) - Square Cash has no fees when you deposit money from your debit card and it charges a flat 3 percent for adding funds to your account via credit card. You can withdraw money automatically, and withdrawals are free with a wait of 1 to 3 days, or cost 1 percent if you want an instant transfer. There’s a $250 a week outbound payment limit to other Square Cash customers, unless you verify your name, birth date, and the last four digits of your Social Security number, which can raise your limit to $2500 (in most states, Square says). The app includes a virtual credit card that lets you spend from your account balance with sites that accept only

credit card payments. Square supports only U.S. cards and customers. - Venmo charges no fees for your inbound transfers from bank accounts, debit cards, and prepaid cards, and withdrawals are free, but only offered to a bank account. Credit card payments incur a 3 percent fee. Venmo has different limits for unconfirmed accounts and accounts confirmed with the last four digits of your Social Security number, your birthdate, and your ZIP code. Unconfirmed accounts can send payments up to $300 in a rolling seven-day period, and withdraw up to $1000. Confirmed accounts can send up to $3000 (in one

or more payments) plus spend up to $2000 at Venmo-supporting merchants in the same rolling period, and withdraw up to $20,000 in sums of no more than $3000 each. Like Square, Venmo is available only for U.S. residents.

Show Me the Money! — With each of the services, you can set up an account either via the service’s app or associated Web site, but you need the app installed and logged-in to proceed.

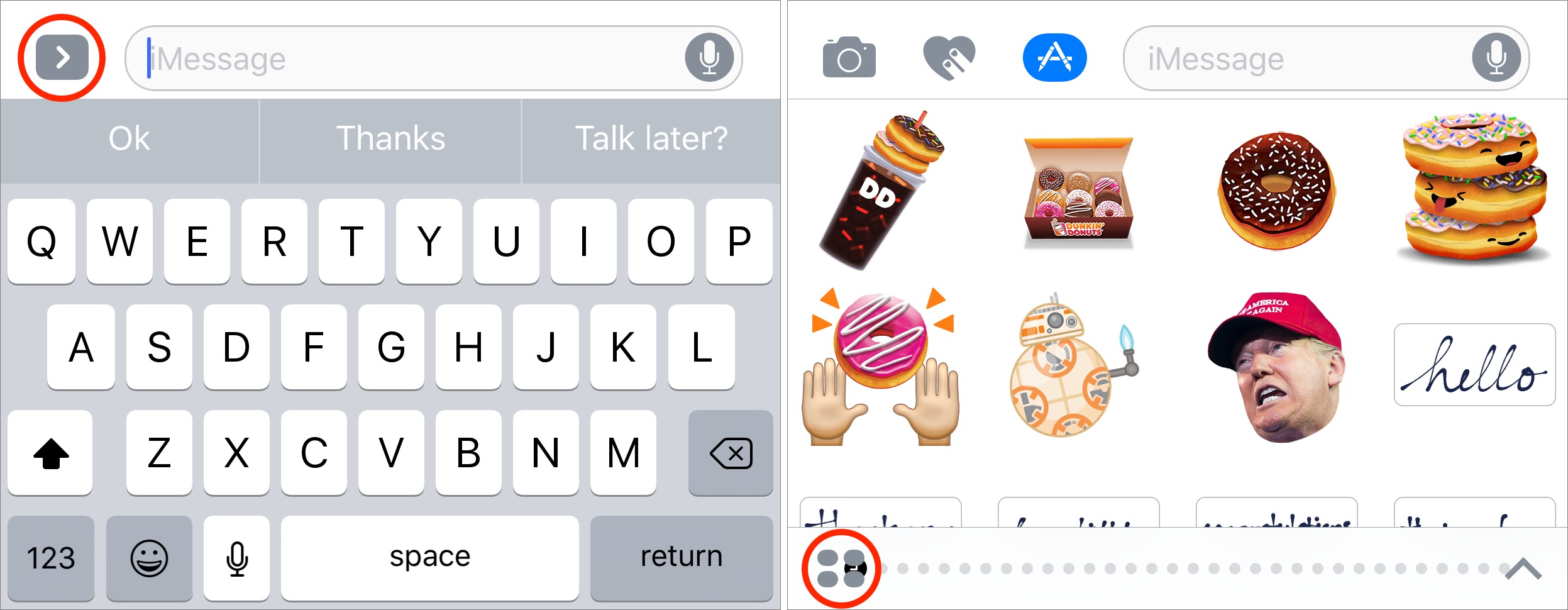

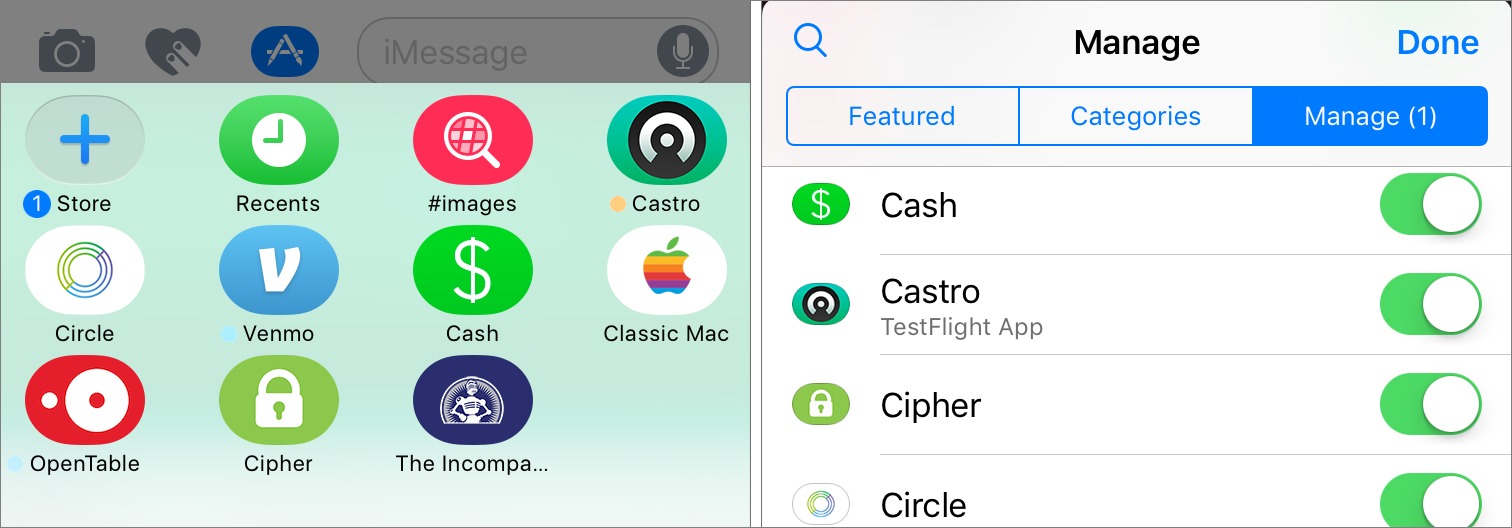

Once it’s installed, you must activate it in Messages to send payments. This works the same as any other iMessage app:

-

- In Messages, tap any conversation, and then tap the App icon. (Tap the right-pointing arrow next to the message field if the App icon isn’t showing.)

-

- Tap the “show apps” icon in the lower-left corner, which looks like a two-by-two grid of gray ovals.

- Tap the Store (+) icon.

- Tap the Manage tab.

- Tap the switch next to each app you want to appear.

- Tap Done.

- Tap the “show apps” icon again, and swipe between pages until you find the app. Tap it to open it in Messages.

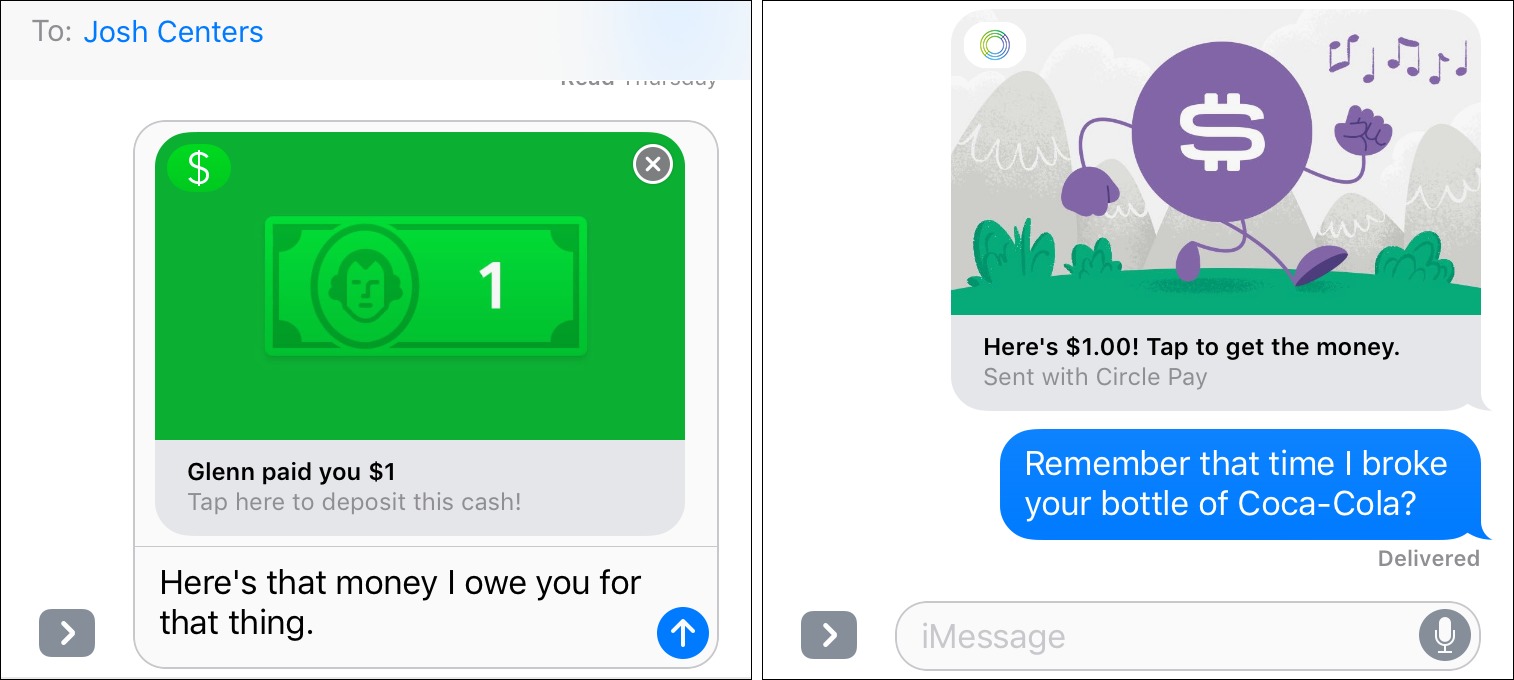

TidBITS Managing Editor Josh Centers and I tried Circle, Square Cash, and Venmo. Circle and Square are both straightforward, showing a field in which you can swipe to select payment amounts and, with Circle, one of the supported currencies. Circle lets you send any amount by penny increments, down to $0.01, and then tap Send. Square Cash focuses on whole dollar amounts — you have to tap an App button to pay to the penny, which is odd, since I expect many people will use this feature to split bar and restaurant bills. Tap Pay to send the payment.

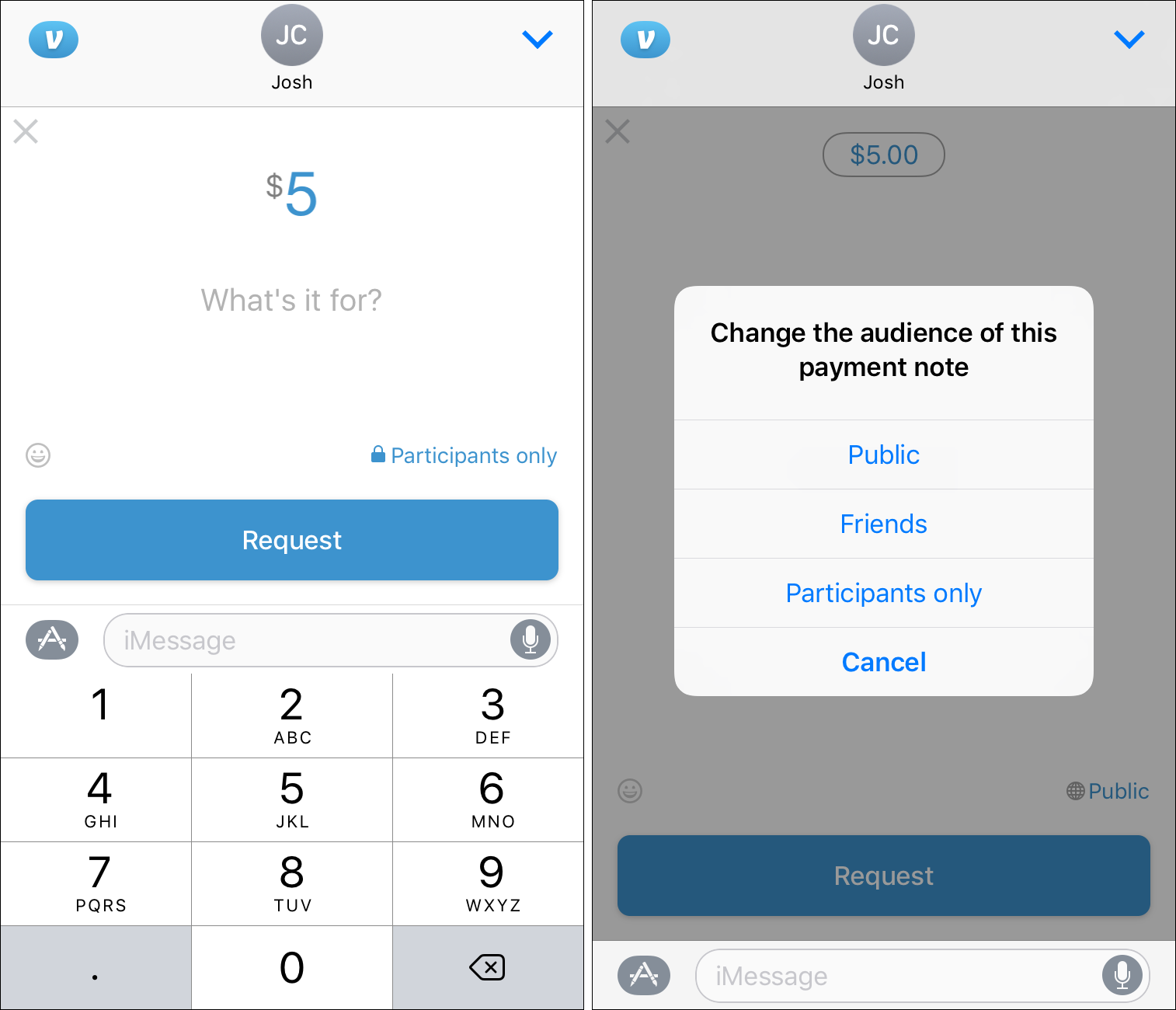

Unfortunately, Venmo hasn’t optimized its iMessage app to the small screen size. You have to tap one of two buttons, Request or Pay, both of which result in the same full-screen view. Tap the down arrow at the upper right to reduce the view, and Venmo stops working until you tap the up arrow to zoom it full screen again. The company needs to make a more Messages-appropriate view, rather than shoehorning its full app approach into that space.

Venmo also has the strange notion that small payments you make should be public record by default — that’s right, Venmo posts the participants and the amount of the transaction to a public stream. I have no idea why this would be desirable. Maybe to prove to others that you’re honorable? You can avoid this oddity — in the Pay view, if the tiny link above the Pay button says Public or Friends, tap it to switch to Participants Only.

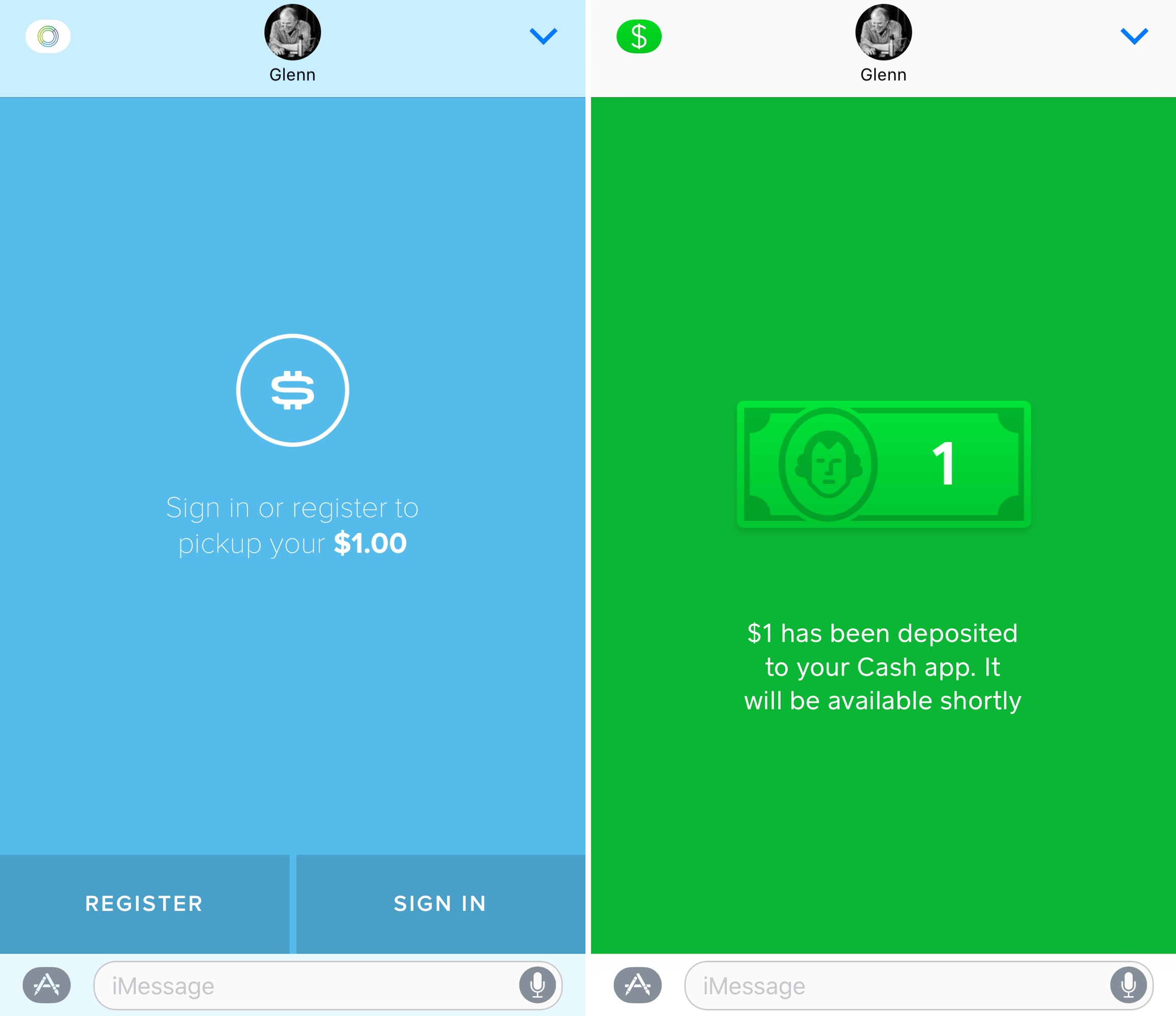

A recipient of any of these three payment messages gets the nice capsule view designed by the app maker: Circle is jaunty, Square bland, and Venmo boring. The receiver taps the part of the lozenge that explains they need to tap, and this launches the app, if it’s installed, or takes that person to the App Store to retrieve it.

All three systems worked well. I had already set up Square Cash and Venmo, and added Circle weeks ago. Josh had to set up Venmo and Circle and had no problems. Venmo is more awkward than the others, but it has been popular for years, so you may have more friends and colleagues already using it.

You can theoretically use Square Cash and Venmo with Siri, by saying something like, “Send $1 to Josh Centers using Square Cash.” (You must first enable each app for use with Siri via Settings > Siri > App Support. Circle doesn’t yet work with Siri.) In my testing, Siri couldn’t do this. With Square Cash, it said I had to open the app. With Venmo, it just said it couldn’t. You can also say, “Send $1 to Josh Centers” and Siri will prompt you with eligible apps. Josh had no problems sending money via Siri, so perhaps there’s something wonky with my iPhone.

Do These Services Solve a Problem? — I’ve hoped for the return of the Palm’s PayPal-style system for years. I long resented PayPal, because of how difficult and poorly maintained it was, in addition to the terrible way it treated merchants. But since eBay spun it out, PayPal’s Web site has improved, and the horror stories have abated, so I was surprised when PayPal didn’t leap into Messages on day one. Given its enormous user base, it will be interesting to see what the company eventually offers.

Square Cash has been my top pick for personal payments since it launched, and I’ve used Venmo willingly when I’ve needed to work with people who had committed themselves to that system. Circle is a new entry, but its multi-currency approach and desire to expand beyond the U.S. and UK make it an interesting option for people working and playing across borders.

Having these payment apps inside Messages simplifies making person-to-person payments, because you don’t have to look up recipient addresses or explain to people how to receive cash. They also make it easier to be notified of and receive payments than it was in the days of standalone apps or (horrors!) email notifications and Web-focused systems. Next time you need to split a restaurant tab with a friend, give one of them a try!

TidBITS Watchlist: Notable Software Updates for 3 October 2016

Default Folder X 5.0.7 — St. Clair Software has released Default Folder X 5.0.7, resolving a crash that occurred at startup with macOS 10.12 Sierra. The Open/Save dialog enhancement utility also corrects problems related to handling minimized Save dialogs, brings back a hidden preference that makes file dialogs start in the topmost document’s folder when exporting or printing, and fixes a bug that could cause an inoperative file dialog to be left on the screen. ($34.95 new, $14.95 upgrade from version 4, TidBITS members save $10 on new copies and $5 on

upgrades, 8.1 MB, release notes, 10.10+)

Read/post comments about Default Folder X 5.0.7.

Airfoil 5.1.2 — Rogue Amoeba has released Airfoil 5.1.2 to correct a problem where connections to Apple TVs running tvOS 10 would drop after approximately 4 minutes, as well as to banish an erroneous “No buffer space available” message that would appear in macOS 10.12 Sierra. The wireless audio broadcasting app also improves detection of speakers that have disappeared from the network, fixes a bug that displayed pixelated album artwork, and makes adjustments so FaceTime can be captured in Sierra. Additionally, Airfoil now requires Instant On to capture audio from iTunes due to changes made in iTunes 12.5 (a prompt

will appear if needed). ($29 new with a 20 percent discount for TidBITS members, $15 upgrade, 14.1 MB, release notes, 10.9+)

Read/post comments about Airfoil 5.1.2.

ExtraBITS for 3 October 2016

In ExtraBITS this week, Apple legend Bill Atkinson explains why he’s excited about having Siri accessible via the forthcoming AirPods, The Intercept reveals a potential privacy loophole in iMessage, and Aetna is making a big investment in the Apple Watch.

Why Siri and the AirPods Excite Bill Atkinson — Bill Atkinson, the legendary developer behind the original Mac’s QuickDraw graphics system and classic Mac apps like MacPaint and HyperCard, has been waiting for Apple’s forthcoming AirPods for years. Back in 2011, he gave a Macworld Expo presentation in which he explained why Siri belongs in your ear, which the AirPods will provide. Atkinson cites the Jane artificial intelligence in Orson Scott Card’s “Ender’s Game” series as a model for Apple to follow. As for the future of Siri on

the AirPods, Atkinson says, “Within a few years it’s going to be able to do lots of things: It will hear everything you hear, it’s going to be able to whisper in your ear.” For the moment, though, he’s realistic about Siri’s capabilities. “Siri is a bit of a joke now; it doesn’t really understand the meaning of conversations,” Atkinson admits. “That’s going to improve.”

Apple Logs iMessage Contact Phone Numbers — Apple touts the end-to-end encryption and overall privacy of its iMessage service, but Sam Biddle of The Intercept reveals a loophole: when you enter a phone number to start a conversation in Messages, the app contacts Apple’s servers to find out whether to send the message via iMessage or SMS. The problem is that Apple’s servers currently log the contact number, the date and time, and your IP address (which could disclose your general location). Apple has verified that it keeps these logs for 30 days and will

give them to law enforcement if compelled by a court order. We hope these revelations will encourage Apple to reassess the privacy implications of this system.

Aetna to Promote Apple Watches to Employees and Customers — In an initiative to improve the health of its employees and customers, health insurance company Aetna is buying Apple Watches for its nearly 50,000 employees and will be offering subsidized Apple Watches to select large employers and individual customers in the upcoming enrollment period, with the remaining cost to be paid via a monthly payroll deduction. Aetna will be providing iOS apps to simplify and improve the healthcare process through care management and wellness, medication adherence, and health plan

information and decision support. In addition, Aetna app users will be able to use Apple’s Wallet app to check their deductibles and pay bills. If implemented well, Aetna’s program could improve healthcare, reduce costs, and enhance the company’s ratings with its millions of members.