Apple Weathers the Storm to Shatter Records in Q1 2021

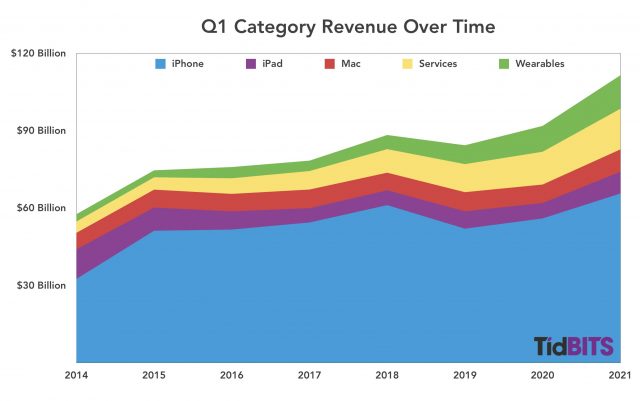

Apple continues to ride high on uncertain seas. Delivering its Q1 2021 financial results, Apple announced profits of $28.8 billion ($1.68 per diluted share) on record revenues of $111.4 billion. The company took in 21% more than it did in the year-ago quarter, with profits up 35% (see In Apple’s Q1 2020, iPhone Rebounds and Wearables Soar, 28 January 2020).

Apple CEO Tim Cook seemed almost apologetic about Apple’s success in a crumbling world, kicking off the quarterly investor call with an outline of the company’s various charitable efforts, such as its recently announced racial equity initiatives (see “Apple Launches New Racial Equity and Justice Initiative Projects,” 13 January 2021), its long-standing partnership with Product Red, and a pledge to invest $350 billion in the United States economy.

But that financial success could not be ignored: the company saw double-digit growth in all of its product categories and in all the geographic sectors it serves. Even FaceTime had an up quarter: Cook said that Apple handled the highest number of FaceTime calls ever over the holiday season. He also said that the quarter saw 1.65 billion Apple devices activated.

iPhone Results

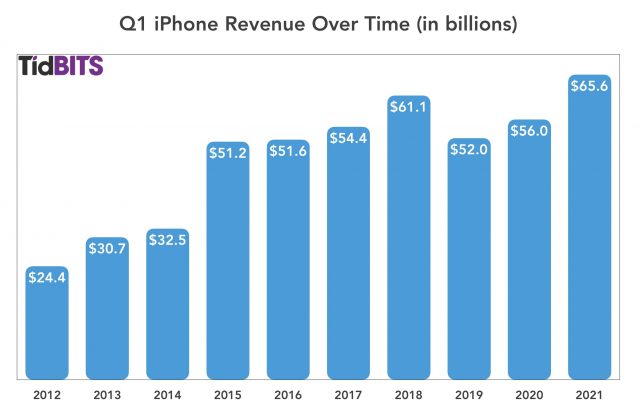

Apple saw a 17.2% year-over-year increase in iPhone revenue, up $65.6 billion from $56 billion in the year-ago quarter. CFO Luca Maestri specifically called out the iPhone 12 Pro and 12 Pro Max as big sellers, and he said that iPhone 12 customer satisfaction ratings were at 98%. Maestri said nothing about the iPhone 12 mini and rumors that its sales have been disappointing—nor did analysts ask him about that.

One interesting benchmark: by the end of the quarter, users had activated over one billion iPhones.

Mac Results

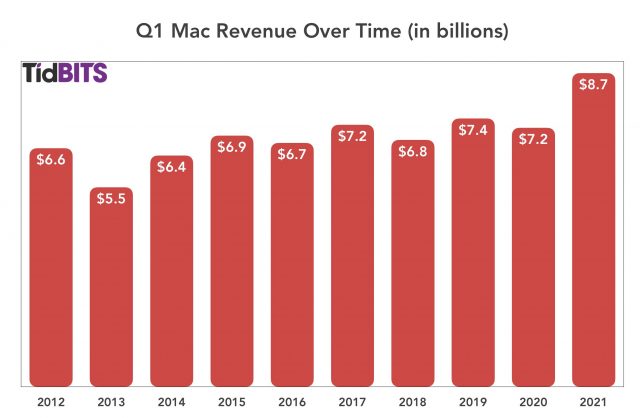

The Mac line saw a 21.2% year-over-year revenue increase, which Maestri credited to the new lineup of the MacBook Air, MacBook Pro, and Mac mini powered by Apple’s new M1 chip. The Mac brought in $8.7 billion in Q1 2021, up from $7.2 billion in Q1 2020. Mac sales rose in all geographic sectors, and he noted that Macs were achieving an average 94% customer satisfaction rating. Taking into account Apple’s relatively low market share in the personal computer market, the vibrant sales performance of the new M1-based Macs led Cook to predict a rosy future for the venerable product line.

iPad Results

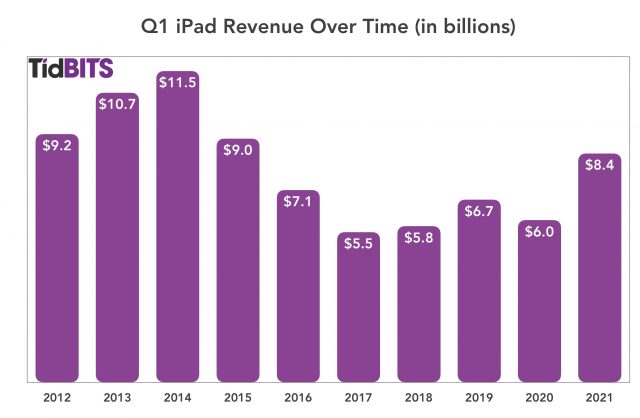

The iPad had an outstanding quarter, with an almost startling 41.1% year-over-year revenue jump, bringing in $8.4 billion in revenue for Apple, up from $6 billion in the year-ago quarter. Cook ranked the iPad product line as the best Apple has ever had, pointing out that some people were purchasing the devices to serve as replacement laptop computers, while others were buying them in addition to laptop or desktop devices. The need for remote computing devices during the pandemic certainly contributed to the product line’s quarterly success. However, Cook also mentioned the effect of increasing sales in the education market, with iPad school deployments in Japan and Germany being the largest ever.

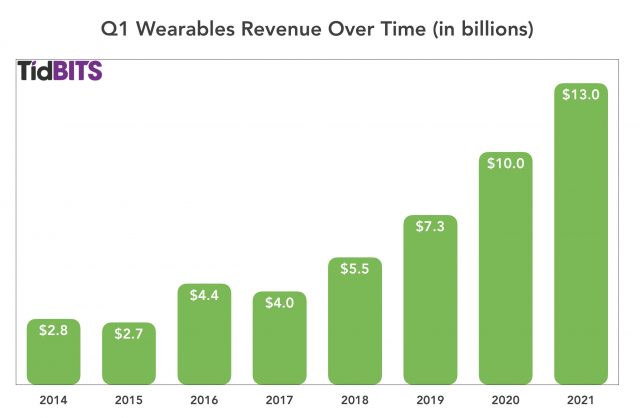

Wearables, Home, and Accessories Results

Apple’s miscellaneous bucket of Wearables, Home, and Accessories also did very well, with a 29.6% year-over-year revenue increase. At $13 billion in revenue, the category was $3 billion above the year-ago quarter. AirPods of all types, including the new high-end AirPods Max headphones, boosted the category’s results with extremely strong demand during the holiday season (“Apple’s One Last Thing for 2020: AirPods Max,” 8 December 2020). Despite the new headphones’ $549 price tag, Cook said that supplies would be limited for the foreseeable future. Cook also praised the strong sales of the new softball-size HomePod mini, which lists for just $99.

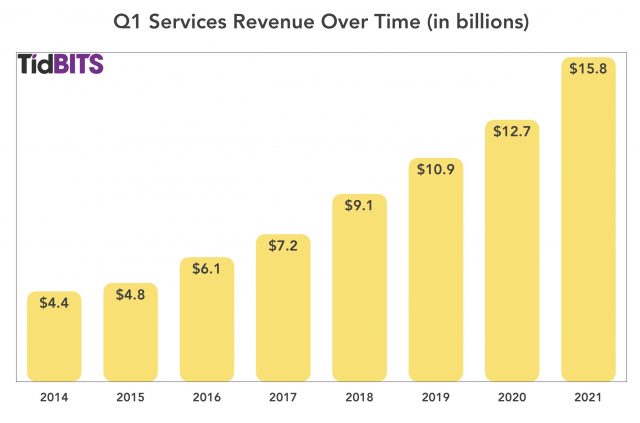

Services Results

The Services sector, which has been surging in recent quarters, also performed admirably, posting a 24% year-over-year revenue increase. Apple gave much credit to the new Apple One service bundles, along with Apple Music, iCloud, and other services. App Store subscriptions also rose. However, Apple probably can’t credit Apple TV+ much, as most of its customers are still on a free trial, now extended for a second time, through July 2021. Services brought in $15.8 billion this quarter, compared with $12.8 billion in the year-ago quarter.

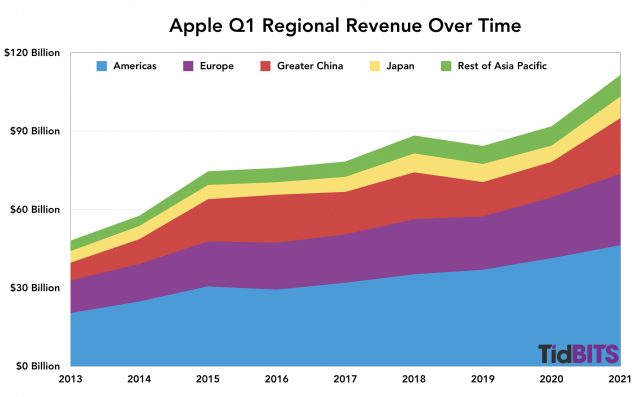

International Notes

Apple’s sales increased in all geographic sectors. Business in China was especially strong, showing 57% revenue growth, which Cook credited in part to the introduction of the 5G-capable iPhone 12 line. Cook said that 5G networks are well-established in China so the demand was already there—though he was quick to point out that it wasn’t just iPhones and 5G affecting Apple’s China results: Mac and iPad sales there exceeded “company averages” as well.

Sales in Japan also grew during the quarter, with revenue increasing by 33.1%, thanks in part to record iPad demand there. Rounding out the list, Europe saw 17.3% growth, the Rest of Asia Pacific grew 12.3%, and the Americas increased by 11.9%.

Cook noted opportunities for growth in both Latin America and India. Although sales in the latter region have doubled in the last year, he described Apple’s market share there as low enough to offer plenty of headroom for growth.

Apple Can’t Even Give Its Money Away

Can anything slow the Apple juggernaut? For a few months, it appeared that Apple had cooled down, but even in the midst of the COVID-19 pandemic, the company is back to smashing records and dazzling investors. Every participant on the quarterly call began by heartily congratulating Tim Cook. In fact, the praise was so effusive and repetitive that, if you were only half listening, you might have thought he’d just had a baby.

Interestingly, one of the few areas in which Apple seems to be failing is in its mission to give its cash hoard away. In its Q1 2021 press release, Apple said, “We also returned over $30 billion to shareholders during the quarter as we maintain our target of reaching a net cash neutral position over time.”

Despite giving away $30 billion in the past quarter, Apple now has a cash stash of $195.57 billion, which is actually up 2% from a quarter ago. The company literally can’t give money away fast enough. Perhaps it could consider sending stimulus payments to every Apple user.

Or at least increase the free iCloud storage tier from the embarrassingly small 5 GB.

Even though the stock price is down in after-hours trading, as an investor I’m delighted with the quarterly numbers! Long-term outlook seems positive to me.

To be fair, the entire market dropped quite a bit yesterday.

And Apple is still the world’s most valued brand:

I love the last line. Apple is surging ahead in so many aspects but that free storage tier is still embarrassingly stagnant.

Also, in regards to the AppleTV+ free trial, I got a notice that the end of my free trial got extended from February to July. I haven’t seen this on any of the Apple blogs I follow. I can’t be the only one who got this.

Me too! I think it’s maybe going to most users.

Google gives away a lot more storage space so they can collect a lot more data to better target and sell advertising. Amazon also has a bigger free tier than Apple for the same reason. Smugmug bought Flicker so its free tier could be more competitive in the ad market. Although you might not see see ads on Smugmug, tracking and selling your information to third parties is how and why they stay in business:

“ We may allow others to serve advertisements on our behalf across the Internet and to provide analytics services. These entities may use cookies, web beacons, mobile device identifiers, and other technologies to collect information about your use of the Services and other websites, including your IP address, web browser, pages viewed, time spent on pages, links clicked and conversion information. This information may be used by SmugMug and others to, among other things, analyze and track data, determine the popularity of certain content, deliver advertising and content targeted to your interests on our Services and other websites and better.”

Nope, it’s everyone. I updated the article to add that specifically.

@MMTalker, I don’t see Apple’s free tier size as being a competitive issue with Google, Amazon, Microsoft, etc. I see it as failing to provide the basic functionality that’s necessary for users to understand the value of iCloud services, such as backup and iCloud Photos.

Not too sure what this metric actually means.

I’m assuming it’s individual activations since the original iPhone. I’m certainly not a serial upgrader (just moved to a 12 Pro from a 6s) but with replacements I’ve done six of those which puts it down to below 200 million individual users.

Looking at our children, six activations seems well below the median.

No, that’s current activations. There are 1.5B active iOS devices, 1B of them iPhones. Not all are the latest devices, of course.

Ah - OK. That makes more sense. Thanks

I’m guessing again that many households will have multiple activations. We’re a two-person household with four iPhones (!) and a Watch - so it’s probably hard to draw any real conclusions.

And they’re not all phones. For instance, at my home there are three iPhones (me, my wife, my daughter), two watches, an Apple TV 4K, an iPod Touch and an iPad all active. (And an Apple TV Gen3, which may or may not count as an iOS device).

Plus several inactive devices which Apple may be counting because I haven’t wiped them: two more iPads and two more iPod Touches.

All of which makes me wonder how useful this metric actually is?

Sure - 1 billion sounds very impressive, but it doesn’t actually mean very much does it?

It depends on what you’re doing with that market. For instance, an app developer is looking at it as a potential market for selling their app or service – and that’s a huge market, even if the reality is slightly smaller due to some people having multiple devices. Same with advertisers, iPhone case and accessory makers, etc.

Apple is looking at it it as a source of service revenue (potential subscribers of Apple Music, ATV+, etc.). With some of those devices owned by the same person or in households with family subscriptions, the actual potential subscribers is lower, but still a huge number and shows that Apple’s services still have a lot of room for growth (lots of people don’t have subscriptions yet) which is what Wall Street is wanting to know about.

And keep in mind that 1B number is just iPhones – when combined with other iOS devices the number is more like 1.5B.

For a single company to have that many customers, and considering Apple’s customers are considered premium and more likely to spend money on accessories, apps, and other services, that’s a massive market – basically a collection of the best customers on the planet. (For comparison, while the market for Android users is several times larger than Apple’s, Apple’s App Store brings in 2x the revenue. That means those 1B iPhone owners are worth more than 3B Android users.)

Seems impressive to me.

This is true, and it also is big part of what locks customers into Apple’s ecosystem. For developers, Apple has a comparatively small range of screen sizes and varieties for iOS devices. Though I’m not anything resembling a developer, I think this is another plus for Apple. And If someone owns an iPhone and an Apple Watch are they likely to switch to an Android phone or watch? Or someone who owns and loves AirPods or Pros?

It does if you’re Apple, a stockholder, or some marketing/advertising suits looking to make a buck off of what are likely affluent people.

If you’re a user simply looking for a better experience and more stable software that lets you do things the way you like it doesn’t mean a whole lot. Especially not when we know that companies like Google and Apple will make sure to inflate these numbers using every trick in the book.

At least in the US, the smartphone/tablet world is essentially a duopoly. Devs need no incentive to develop for either platform, they have no choice. Users need no incentive, because everybody is already going to be on one or the other, and both systems are making it harder and harder for people to actually vote with their feet.

IMHO what this really boils down to (again in the US, not worldwide) is each side trying to peal off an attractive customer from the other here and there. A pissing contest between two tech giants. Nobody needs to tell me that I as a user have a dog in this fight or stand to win anything from it. I would likely win something if there were actual hard fought competition among a dozen or so competitors, but these days it seems hardly anybody really wants that.

Blackberry is still alive and kicking, though just barely. They recently announced a soon to come OS upgrade and new models:

And remember how Amazon’s Fire phone was going to immediately conquer the world? Fire tablets are still alive, but the phones couldn’t attract buyers, even though Amazon repeatedly dropped prices and tried system upgrades.

And Samsung did develop its Tizen OS to run on all its mobile devices and spent big bucks promoting and advertising it extensively, but just about nobody bought the phones. They are now using it for their not very successful Apple Watch rivals:

Motorola, etc, etc. did develop operating systems. I think Ubuntu still exists, though probably just barely. Not only is it very expensive to develop an OS, it is extremely expensive to constantly upgrade it and monitor and respond to safety issues as well as to support. And app and game developers won’t develop for an OS that has limited acceptance in the marketplace. It’s survival of the fittest in the mobile communications world.

But do not despair, Facebook is developing its own OS that will run on top of Android:

To be fair, this number was shared in Apple’s quarterly financial earnings call, the audience for which is largely Wall Street analysts and press, particularly the financial press. I didn’t listen to the call personally, so I can’t speak to exactly why @jcenters and @mcohen decided to share it in the article, perhaps other than it’s an awfully large number. Perhaps they have some additional thoughts.

As Adam said, it’s an awfully large number. It also reflects the size of the market to which Apple can sell its storage, app, and media services.

I think the billion + number is indicative of Apple continuing to maintain the lead it established in 2007 among premium mobile phones in the global marketplace, as well as the lead it continues to maintain in online purchasing. And think about how iPhone disrupted so many other categories, including but not limited to cameras and film, watches and alarm clocks, maps, shopping, banking, advertising, entertainment, desk and wall calendars, etc., etc., etc. And if it wasn’t for iPhone, there would probably would not have been an Apple Watch, or Air Pods. iPhone continues to be a major contributor to Apple’s position as a multiple industry disruptor that continues to innovate and deliver top of the line hardware and software that people will pay a premium for.

I also think the one billion installed base will also help sell not the very secret products that Apple has in development, including glasses and/or headsets and autonomous vehicles. And Tim Cook did report that new iPhone sales in the quarter represented replacement iPhone purchasers as well as switchers. Personally speaking, I find the billion + to be fascinating.