Apple Q1 2023 Revenues Slowed by Exchange Rates, COVID, and Inflation

For only the second time in the last decade (see “Apple’s Q1 2019 Results: iPhone Bad, the Rest Good,” 29 January 2019), Apple has reported first-quarter revenues that have fallen below its results from the year-ago quarter. To be clear, that’s not a loss—Apple still raked in billions of dollars in revenues and profits, just a little less of each than it did this time last year.

In its Q1 2023 financial results report, Apple announced profits of just under $30 billion ($1.88 per diluted share) on revenues of $117.2 billion. The company’s quarterly revenue results are down 5% compared to the year-ago quarter, with profits down 13.3% (see “Apple Posts Record-Breaking Q1 2022 Despite Supply Constraints,” 27 January 2022).

Apple CEO Tim Cook said that the overall revenue drop had three main causes:

- Foreign exchange headwinds: These “headwinds” have to do with currency exchange rates against the strong dollar as Apple buys materials and sells products, but Cook took pains to point out that, on a “constant currency basis,” quarterly revenues would have been up 3%, rather than down 5%. Being a global business can be tricky.

- COVID-19–related constraints: China’s zero-COVID policy caused significant lockdowns that prevented Apple’s subcontractors from producing sufficient iPhone 14 Pro and iPhone 14 Pro Max models, significantly delaying ship times. Cook said those manufacturing constraints have now eased. Lockdowns also caused retail sales in China to drop significantly in November, but sales recovered in December.

- Challenging macroeconomic environment: It’s hard to argue with what Apple is up against here, including inflation, the Russian invasion of Ukraine, and, as Cook put it, “the enduring impacts of the pandemic.”

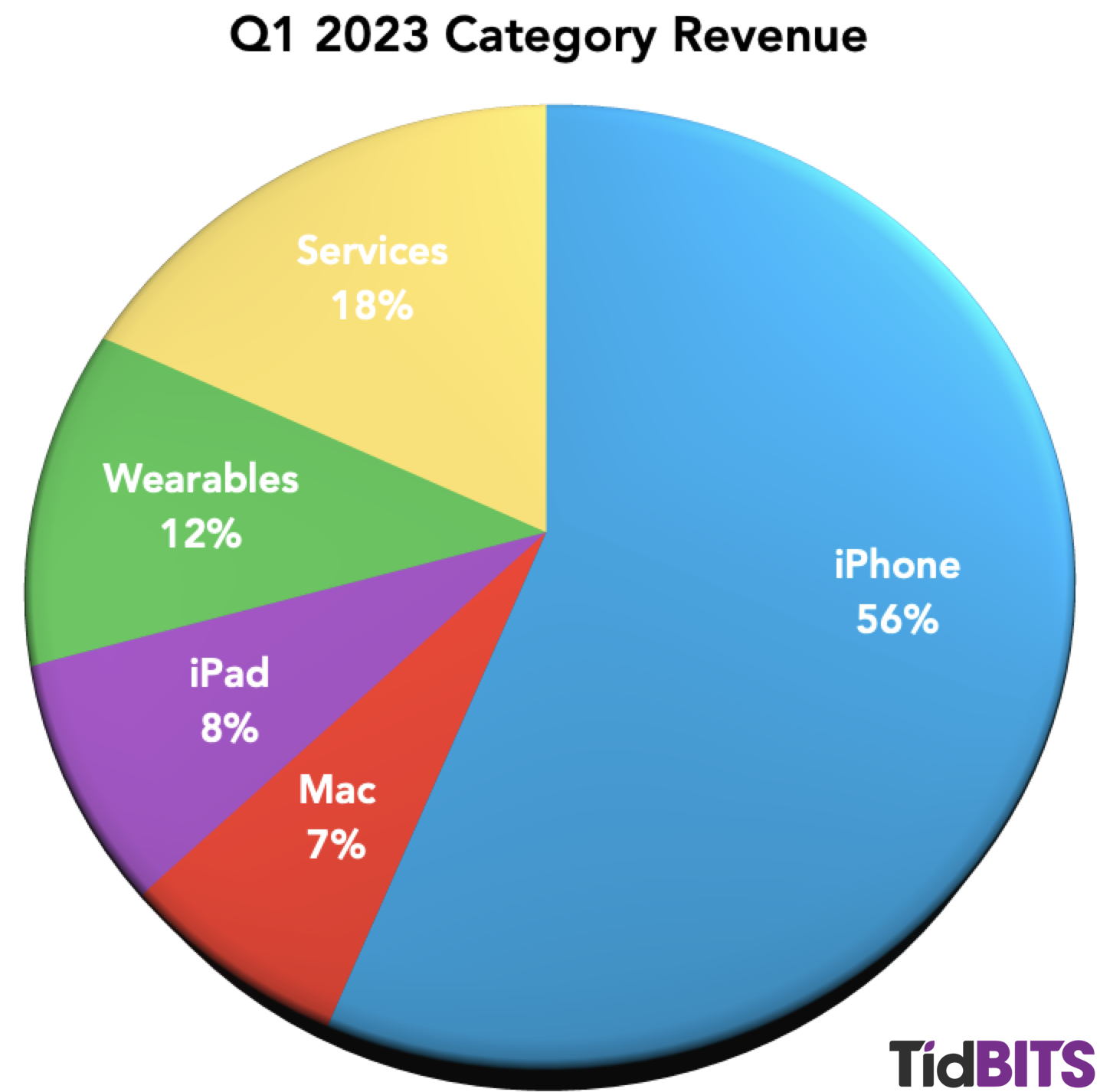

Overall, the iPhone remained the engine of Apple’s revenue train with 56% of revenues, but that was down 2% compared to Q1 2022, with Services taking over that part of the pie. Wearables remained flat at 12%, and the iPad and Mac made up the remaining 15%, though they flip-flopped by 2% from last year’s first quarter, with the iPad gaining and the Mac dropping.

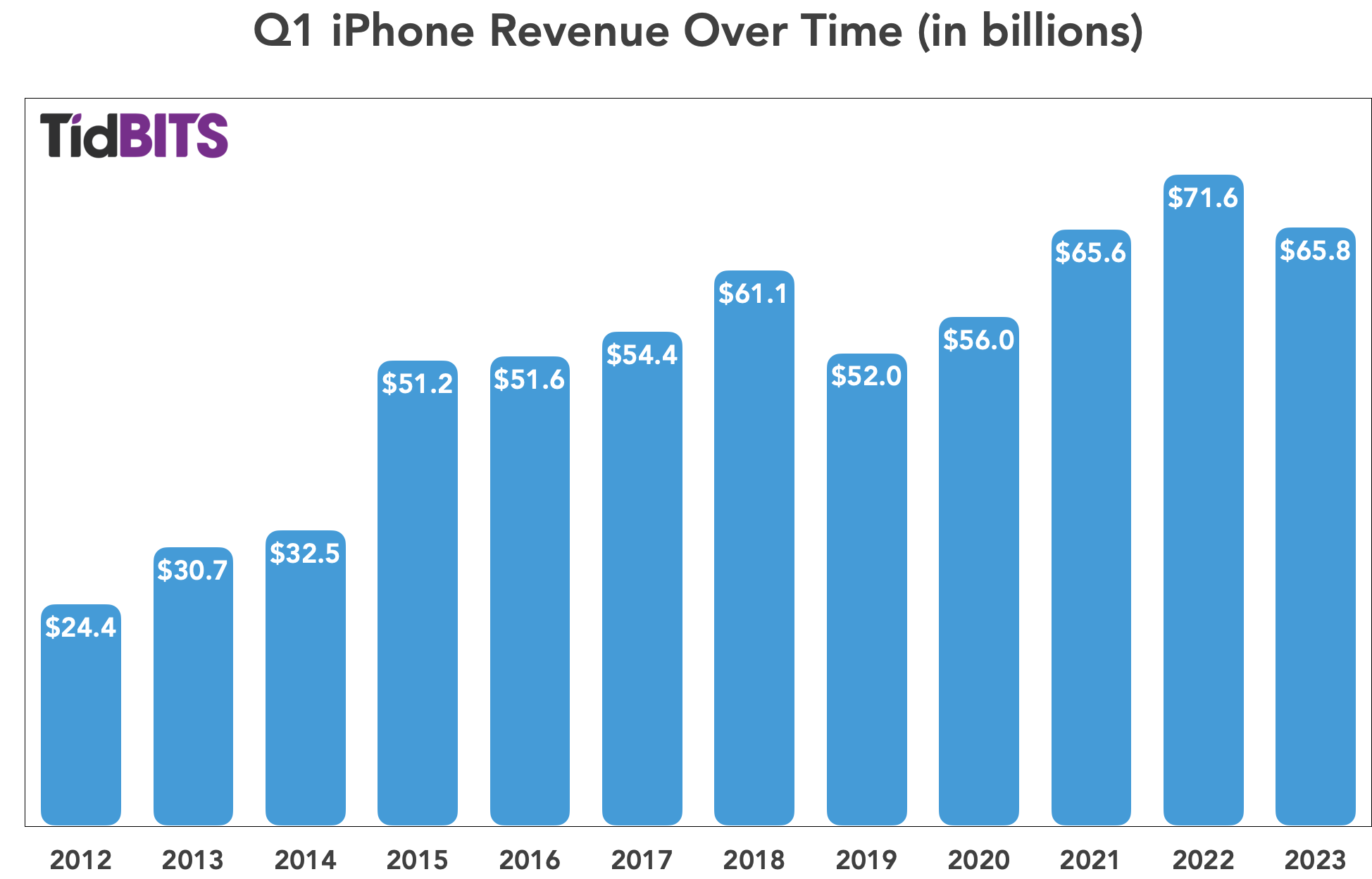

iPhone

iPhone revenues were depressed compared to last year’s first quarter figures largely because Apple had fewer to sell. Supply chain problems especially affected the costly iPhone 14 Pro and iPhone Pro Max, which have reportedly been more popular than the less expensive iPhone 14 and iPhone 14 Plus. We must note, however, that the first-quarter revenue figure this year is still the second-highest ever in the quarter.

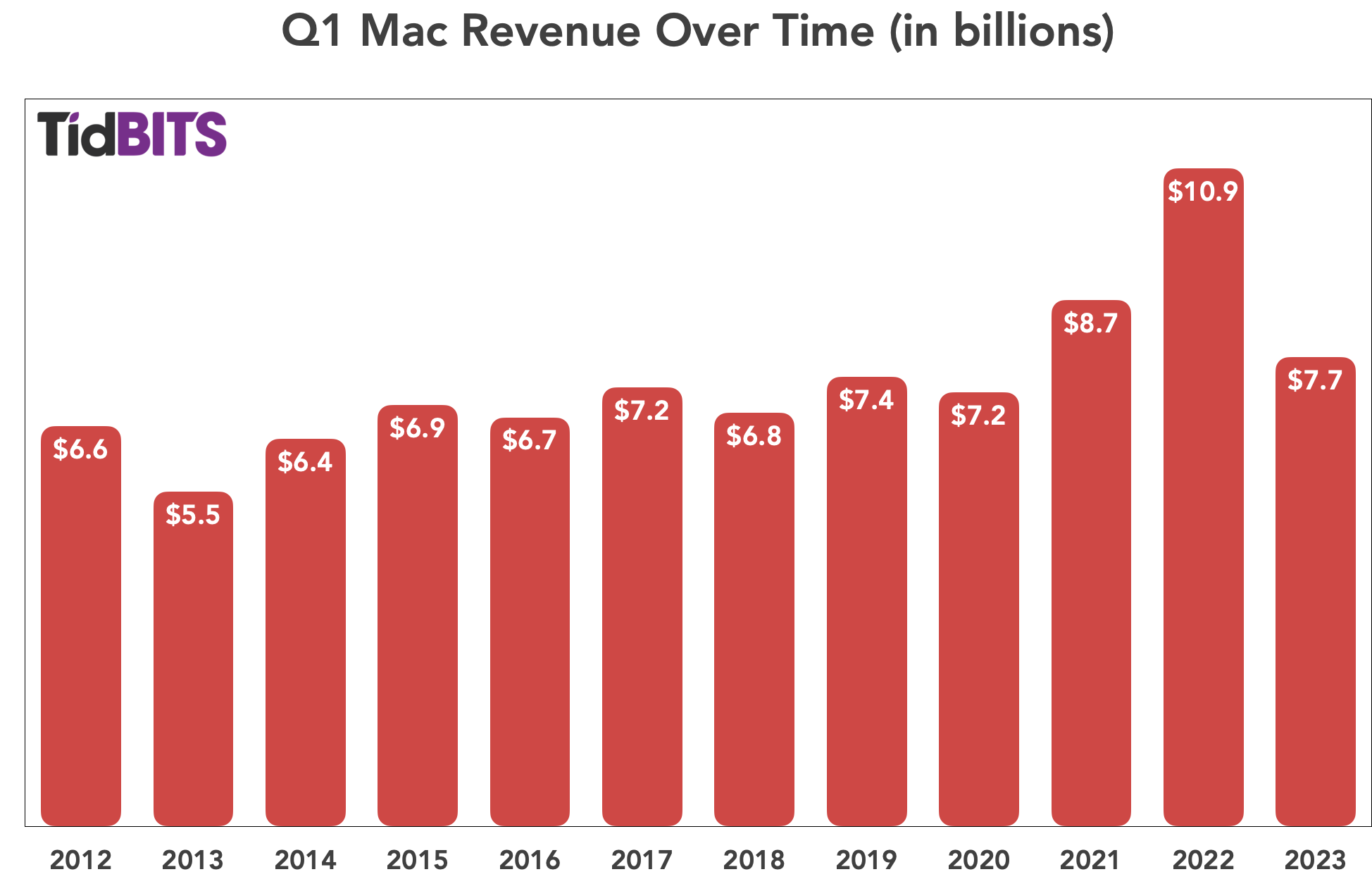

Mac

Mac revenues suffered badly compared to last year’s first quarter figures, dropping 29%. Sad though the news is, it surprised no one: last year saw the launch of the 14-inch and 16-inch MacBook Pro models with the new M1 Pro and M1 Max chips. Those expensive machines proved extremely popular with those looking for even more power than offered by the smaller M1-based MacBook Air and MacBook Pro models that preceded them. Apple had no new Macs last quarter, and worse, plenty of people were probably waiting for the M2 Pro and M2 Max MacBook Pro models that shipped just a few weeks ago (see “New Mac mini and MacBook Pro Models Powered by M2 Pro and M2 Max,” 18 January 2023). Apple expects to see Mac sales challenges in the short term, as it shares in the current sales contraction affecting the general computer market, but Cook said that Apple’s new chips and healthy installed base leave Macs strategically well-placed as that market improves.

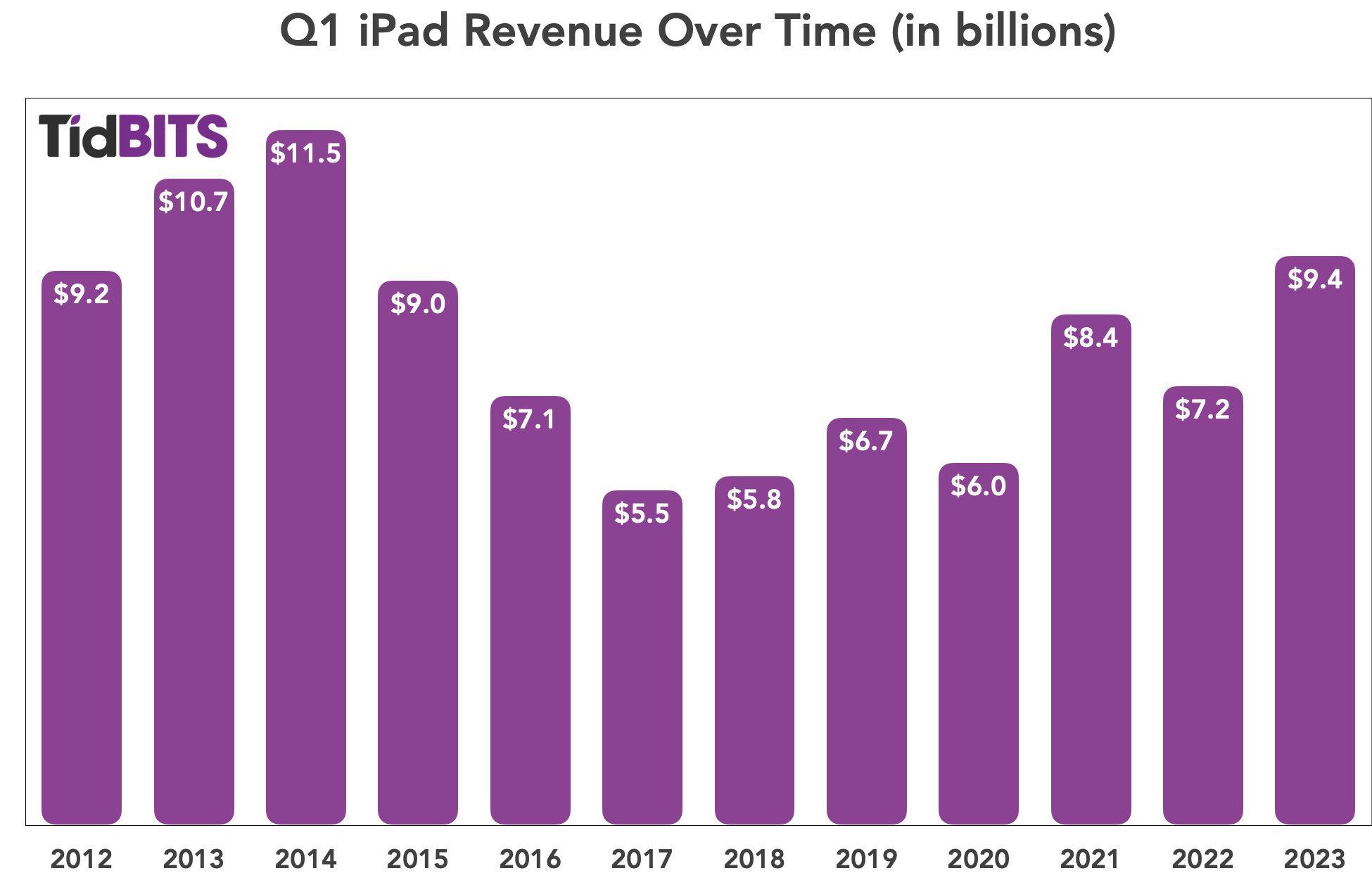

iPad

Somewhat unexpectedly, the iPad had a stellar quarter, with revenues up 30% over last year’s first quarter. Apple said the growth was due in part to the release of the tenth-generation iPad and M2 iPad Pro models driving demand. Plus, in Q1 2022, iPad sales were hit hard by supply constraints, whereas Apple was able to meet the demand for new iPads this year.

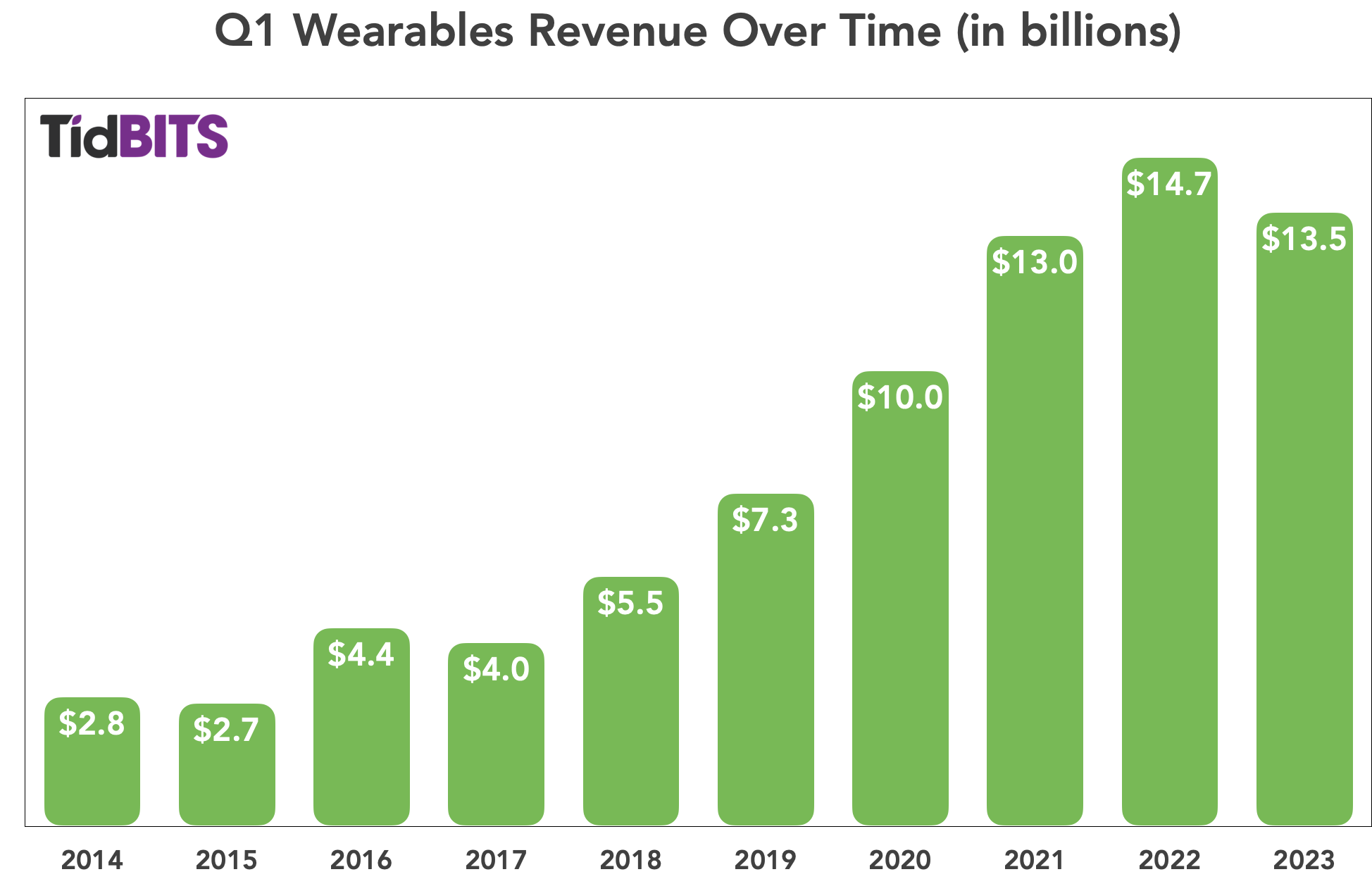

Wearables

This category includes everything from Apple Watch bands to cables to HomePods (the category appears as “Wearables, Home and Accessories” in Apple’s Consolidated Statement of Operations). Though quarterly revenues were down 8% year-over-year, Wearables still managed to achieve its second-highest Q1 revenue since the category appeared. With the success of the Apple Watch and the return of the second-generation HomePod, a rebound seems likely.

Services

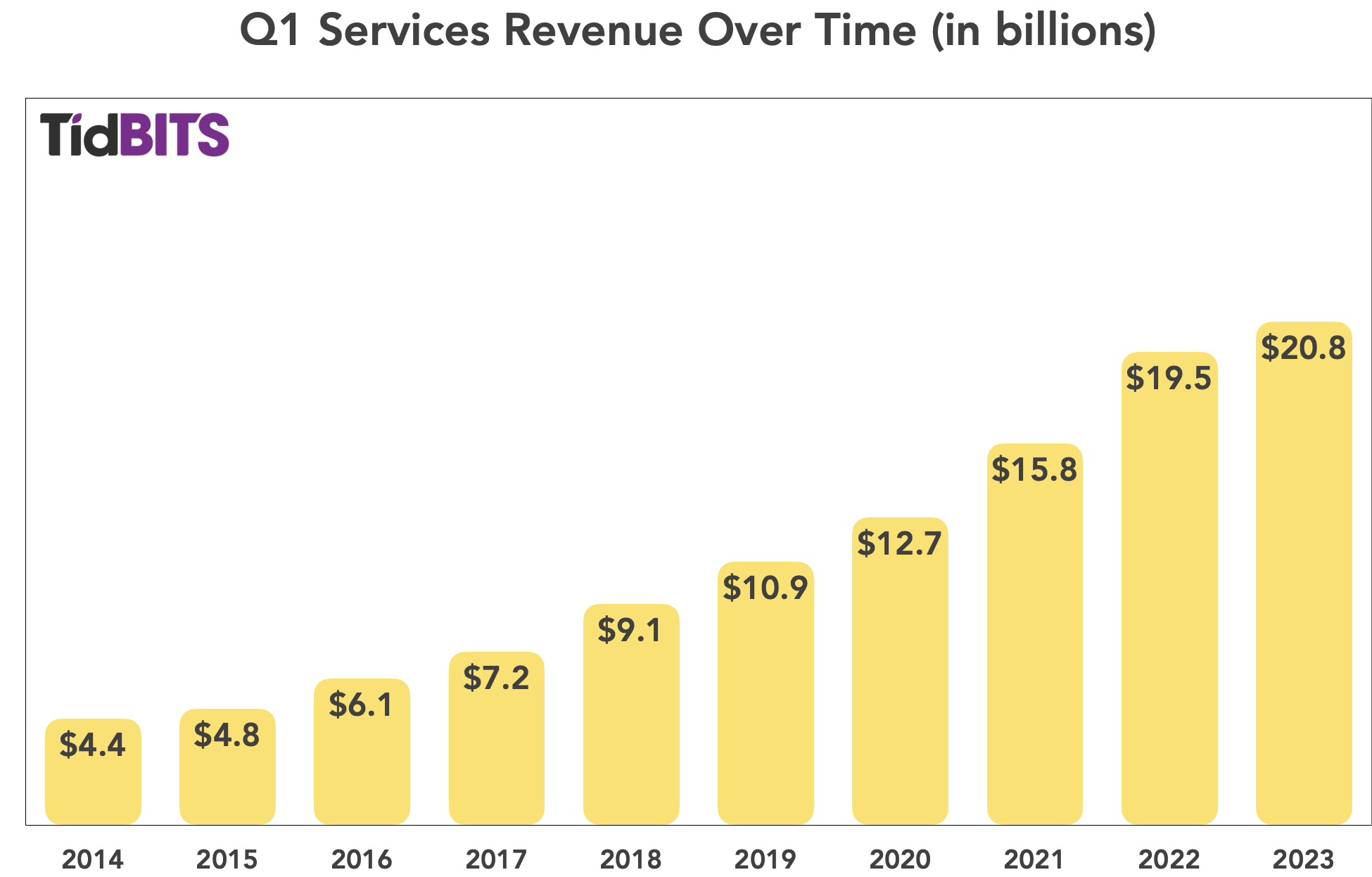

Another bright spot in Apple’s earnings report came from Services, which grew more than 6% year-over-year. Services revenue hit all-time records in the Americas, Europe, and the rest of Asia-Pacific, and set a Q1 record in Greater China. On top of that, cloud services, payment services, and music hit all-time revenue records, along with Q1 records for the App Store and AppleCare. The importance of Services in Apple’s overall revenue mix is clear—the category isn’t affected by supply constraints and enjoys a 71% gross margin, compared to the 37% gross margin for physical products.

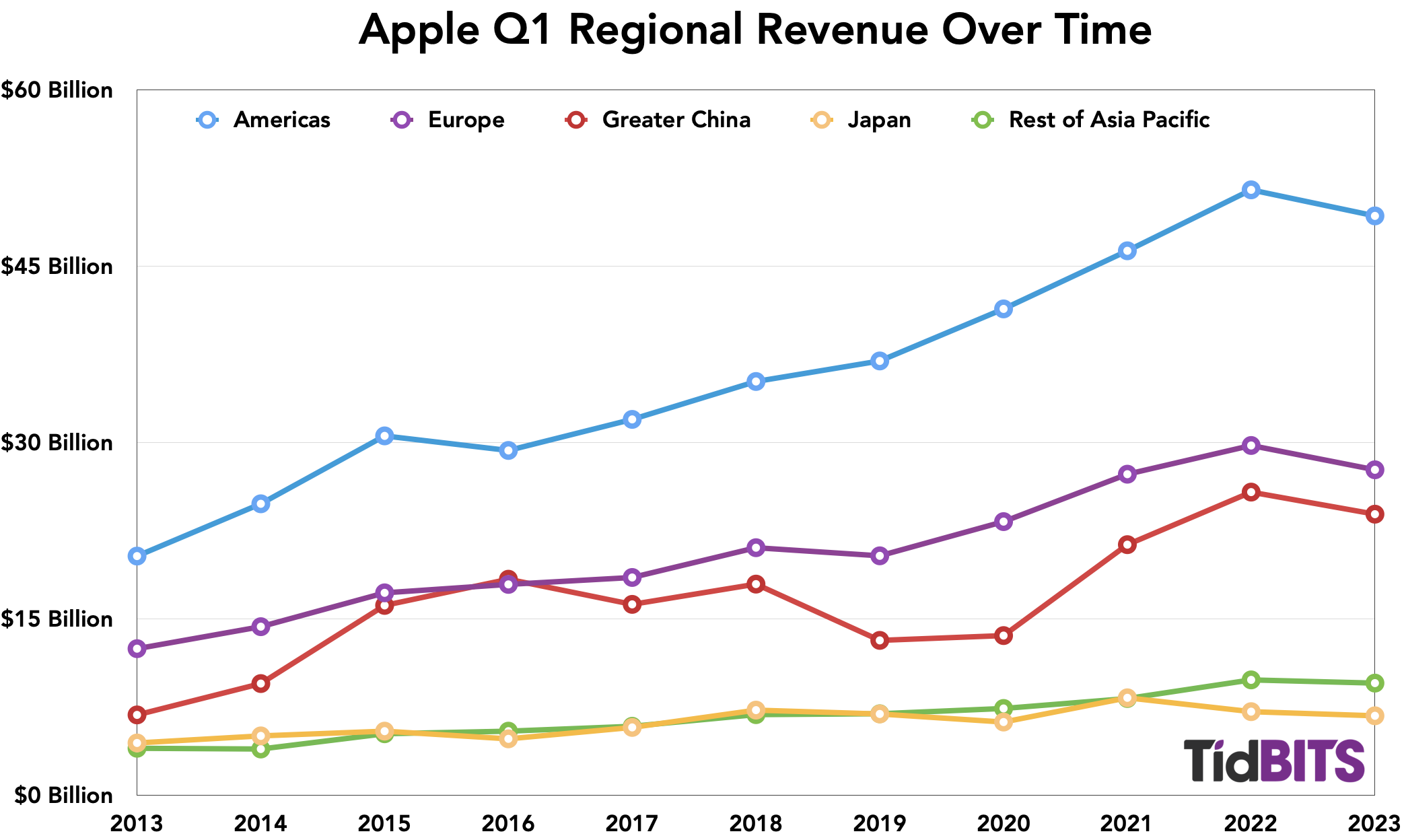

Regions

Although Apple saw revenue declines in all geographic segments, led by drops of 7.3% in Greater China and 7.0% in Europe, Cook pointed out some individual bright spots. Apple set all-time revenue records in Canada, Indonesia, Mexico, Spain, Turkey, and Vietnam, and Q1 records in Brazil and India, two huge emerging markets.

Lurking behind Apple’s prospects for the future is a milestone the company reached this last quarter: Apple now has 2 billion active devices roaming the Earth, up 150 million in the last year. Moreover, Apple has doubled the number of its devices in use across the planet in just 7 years. As Apple CFO Luca Maestri noted, the growth of the installed base drives the growth in Apple’s Services revenues, and Services revenue growth was one of the brightest spots in Apple’s quarterly report, thanks in large part to the number of active subscriptions reaching 935 million.

Finally, Apple’s bad-but-not-that-bad first-quarter results need to be viewed against the performance of the rest of the tech industry. For example, Apple is the only tech giant not to announce major layoffs in recent months (see “Apple Avoids Big Tech Layoffs, Other Tech Giants Focus on AI,” 20 January 2023). Apple may have been facing, and may well continue to face, strong headwinds, but it seems better able than most to tack into them.

Oh my, how terrible it is to only make $30 Billion in profits over 3 months. It’s a wonder I could be so happy working for non-profits for 53 years.