Apple Is Now an Antifragile Company

For over two decades, “APPLE IS DOOMED” was a common refrain in Internet discussions. Originally, it was meant in a literal sense, but once Apple was well on the road to becoming the tech titan it is today, the saying was parroted back, soaked in irony, as a rebuff to naysayers. But lurking behind those rebuffs was the very real concern that Apple was too dependent on the iPhone and that someday the world would move on, causing Apple’s business to come crashing down.

That dire prophecy seemed like it might be coming true toward the end of the last decade when Apple revised financial guidance due to lower iPhones sales in China. Apple first seemed to be running out of steam starting in Q1 2016 (see “Apple’s Q1 2016 Sets Records, but Just Barely,” 26 January 2016). The next quarter began the rockiest period of Tim Cook’s Apple (see “In Q2 2016, Apple Sees First Revenue Decline in 13 Years,” 26 April 2016) dotted with ups (see “Apple Sees Apparent Return to Growth with Q1 2017’s Record Results,” 31 January 2017) and downs (“iPhone Sales Kept Sinking in Apple’s Q2 2019,” 30 April 2019).

The cascading crises of 2020—with retail store closures, a shuttered Apple headquarters, and broken supply chains—were the ultimate test of Tim Cook’s leadership. In short, Apple not only survived, it’s once again shattering records (see “Apple’s Q3 2021: Still Making Money Hand Over Fist,” 27 July 2021). Mac sales are stronger than ever and have been setting records for the past four quarters. After a nearly decade-long slump, iPad sales are higher than they’ve ever been apart from their 2012 peak. The iPhone 12 continues to be a smash hit near the end of its product cycle. Services and Wearables both continue stratospheric growth.

Tim Cook has transformed Apple into a truly antifragile company that actually improves under adversity.

Fragile, Robust, and Antifragile

To understand antifragility, we need to delve into a bit of philosophy, specifically that of Nicholas Nassim Taleb, author of the Incerto series, the most notable entries being The Black Swan and Antifragile. Taleb’s central thesis is that bad things happen unexpectedly—the so-called “black swan events”—and he proposes that society needs to build systems that can survive or even grow stronger after unexpected setbacks.

Taleb puts systems into three categories:

- Fragile: Prone to break under stress

- Robust: Resilient against stressors

- Antifragile: Actually improve under stress

Imagine a heavy, cast-iron kettlebell. If you put it on top of a paper cup, it crushes the cup. Put it on top of a concrete block and the concrete block supports it just fine. But if you lift that kettlebell repeatedly (with good form), you will get stronger. The paper cup is fragile, the concrete block is robust, and your body is antifragile (even if it doesn’t always feel that way).

Robust Apple

First, let’s examine the ways in which Apple is robust. Many questioned, and still question, why Steve Jobs, ever the artist, chose a bean-counting supply chain wizard like Tim Cook to lead Apple. But the events of the past year have proven once and for all that Jobs knew what he was doing.

Have you tried to buy a PlayStation 5 or an Xbox Series X? Good luck, they’re still hard to get. No one can produce enough chips. The same goes for automobiles. Automakers have had to choose between producing cars with fewer features or not making them at all.

Apple hasn’t had this problem. You can walk into an Apple store right now and pick up an iPhone 12 or an M1-based Mac. Apple CFO Luca Maestri had warned in the company’s Q2 earnings call that Apple was expecting supply chain constraints, but in the Q3 call, he briefly mentioned that Apple had worked around them. He warned of more severe constraints in Q4, but knowing Apple’s habit of underpromising and overdelivering, I’m betting that it won’t turn out to be a major problem. Even if I’m wrong, I guarantee that Apple will be in a better situation than other silicon-dependent manufacturers.

Apple can do this because it spends billions well in advance to secure the parts it needs—precisely what the auto industry didn’t do. Apple reported that it plans to spend over $38 billion in manufacturing purchase obligations this quarter, up 26% from last quarter. Analyst Ben Bajarin said it’s due to Apple locking in its chip supply. Other manufacturers have been caught with their pants down while Apple guarantees its chip supply.

https://twitter.com/benbajarin/status/1420390071795032070?s=21

Another bold and prescient move was Apple’s decision to dump Intel in favor of its own ARM-based processors. With the switch to Apple silicon well underway, Apple is no longer at Intel’s mercy and doesn’t have to compete with other PC manufacturers for CPUs. Apple can take its designs directly to foundries like TSMC and buy up manufacturing capacity in advance. It helps that the M1 chip has already proven to be superior to Intel’s offerings in almost every way, driving record Mac sales.

As a result of this supply chain mastery, Apple can chart its own destiny. But the company also has an often-overlooked secret weapon: the nearly $200 billion in cash it keeps on hand. Financial “experts” have often derided or even loudly protested Apple’s cash holdings, insisting that money could be invested elsewhere or given to shareholders, but when Apple needs $38 billion to secure its product pipeline, it has the money ready to slap on the table. (Taleb, not a fan of experts, says of them in The Black Swan: “The problem with experts is that they do not know what they do not know.”)

Finally, Apple has a global reach unmatched by most competitors, most notably in China. Regardless of how you feel about Apple sellings its wares there, China’s early recovery from COVID-19 helped bolster Apple’s last few quarters. At the same time, when sales fell in China (see “Apple Warns of Lower Revenues, Blaming Slower Sales in China,” 3 January 2019), Apple’s strength in other regions buffered the hit.

Antifragile Apple

Apple is robust in that it tightly controls its supply chain, stockpiles the cash to do so, and has a global reach, but let’s look at how Apple’s diversified product line makes the company antifragile.

Most quarterly Apple investor calls are pretty dull. The only time they’re exciting—albeit for all the wrong reasons—is when Apple has a bad quarter. But this week’s Q3 2021 call was fascinating because so much of the discussion surrounded Apple’s COVID-related challenges and how the company was responding to them.

The key exchange was between Morgan Stanley’s Katy Huberty and Apple CFO Luca Maestri. Huberty asked if Apple was helped or hurt by the pandemic. (Thanks to Jason Snell of Six Colors for transcribing the call.)

Maestri’s responses and other comments during the call illustrated Apple’s antifragility. Most of Apple’s 500-plus retail stores, along with many of its partners’ stores, were shut down for much of 2020. Maestri said sales of the iPhone and Apple Watch were hurt by the store closures because those are more complex transactions in which customers need assistance. But more people working and learning from home created a boom in iPad and Mac sales. (We first saw this pattern emerge in “Apple’s Q4 2020 Marks Record Revenues but Lower Profits as Mac and iPad Boom,” 29 October 2020.) In other words, while some of Apple’s product lines may have been hurt by the pandemic, others actually benefited.

Store closures also hurt the AppleCare part of the Services business, and a slowdown in advertising hampered Services revenue. But those downturns were more than offset by a boom in the entertainment aspects of the Services segment (Apple Music, Apple TV+, etc.) due to lockdowns and restricted entertainment options. Again, some services were down, but others were way, way up.

Apple has not just a diverse portfolio, but a diverse portfolio of strong products backed by both physical and online distribution options that keep revenues balanced even in the toughest times. A brick-and-mortar retailer like Dollar General would be devastated by store closures, but for Apple, the slack was easily taken up by its online store. Netflix lives or dies by its subscriber figures, but a dip in extended warranty subscriptions would be mitigated by a music service, original video content, fitness service, and even a credit card. HP is nothing without PC and printer sales, but the Mac could coast along if necessary thanks to Apple’s other product offerings.

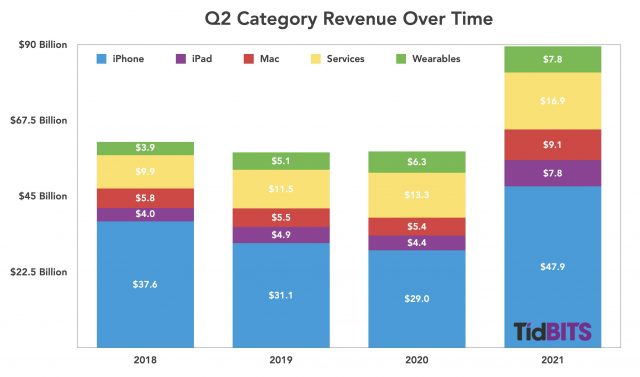

Even the iPhone, the linchpin of Apple’s renaissance, doesn’t make or break the company, as shown in the tumultuous Q2 2020, when the Services and Wearables category pushed Apple to very slight growth despite declines in every other category (see “Apple’s Q2 2020 Was a “Very Different Quarter” Than Expected,” 30 April 2020). The company can monetize the millions of existing iPhones with services and accessories, and then bolster its financial results with Mac and iPad sales.

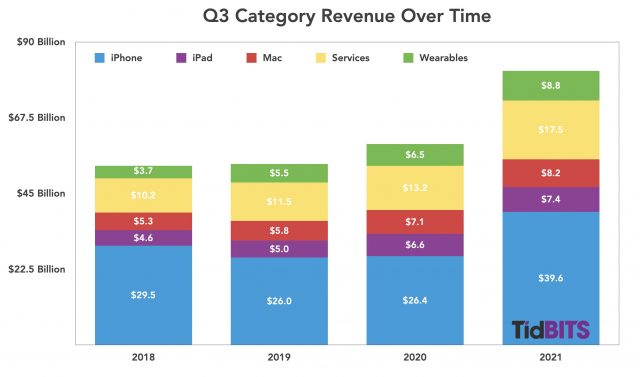

The charts don’t lie: the stressors of COVID-19 only made Apple stronger (see “Apple’s Q3 2021: Still Making Money Hand Over Fist,” 27 July 2021). It’s not as though Apple cratered in Q3 2020 and Q3 2021 only looked good by comparison. The bars on the chart rose just a bit in Q3 2020, and then exploded in Q3 2021, towering over every previous Q3.

Forever Apple

Apple is robust because of securing its supply chain, and it’s antifragile thanks to a diverse mix of strong products. Does anything threaten mighty Apple? A few concerns:

- Government regulation: It seems increasingly likely that Apple may run afoul of regulators in some aspects of its business, particularly the App Store, but diversification should prevent that from being catastrophic.

- Post-Cook leadership: Tim Cook is 60 years old and will likely want to step aside in the next 5–10 years. It’s unlikely Cook will pick an incompetent successor, but he could choose someone who’s a bit too conservative.

- A fight over Taiwan: Many of the world’s chip foundries are in Taiwan, including those of Apple partner TSMC, and increased tensions with China could cut into Apple’s semiconductor supply. This is a global political issue that extends well beyond Apple, and governments around the world are already working to reduce reliance on Taiwan (see Part 1 and Part 2 of an analysis by The Diplomat).

- The zombie apocalypse: Even zombies need iPhones.

That said, Apple’s performance in 2020 and 2021 shows why I’m not worried about Apple’s future. As far as I’m concerned, APPLE IS DOOMED jokes are dead, even ironic ones. Apple may not always do what we want, but it does what it needs to survive—and thrive—even in the worst of times.

How did Tim Cook show his leadership qualities last year? What decisions did he take?

What is the difference to other companies? How is Apple more or less robust than Google, Facebook or Microsoft?

The article is rather vague.

I don’t think you can limit it to decisions he took last year. As the article points out, a lot of the reasons for Apple’s resiliency was that from decisions it took earlier on.

The ones mentioned are:

Taleb, not a fan of experts, says of them in The Black Swan: “The problem with experts is that they do not know what they do not know.”

I wonder if he applies that analysis to himself?

There’s been a pretty consistent tenor to the articles in the media criticizing Big Tech. They seem to view the economy as a zero-sum game, where profits in Big Tech come at the expense of “the little guy” somewhere. That is patently not based on economics, but it’s certainly a ‘populist theory’ that gets a lot of clicks. (One can argue that Amazon takes away sales from ‘brick and mortar’, but that argument doesn’t make sense for Apple, Facebook, Google, Netflix or Microsoft.)

And on Taiwan, I was surprised to see a “Made in Malaysia” label on my new M1 Mini.

All excellent points. There wasn’t much Cook could do on the spot other than close stores and offices and try to weather things out. The aspects of Apple that made it antifragile had been established years and decades in advance, starting with Jobs and built upon by Cook.

@deemery That’s a more complex topic for another time. They’ve all cut into smaller businesses in one way or the other. The question is whether it was through vastly superior competency or underhandedness.

I’d like to add to this very insightful continuum:

Expanding hardware lines and services, like iMac, Watch and Fitness+, iPod, iTunes and Music, acquiring Beats and building Air Pods and Pro, iPhone, iPad, Home Pod, Arcade, Apple TV and TV+, iCloud, iTunes/Music, and most recently podcast subscriptions. He’s even responsible for stuff like emojis. And he built Apple’s physical and digital stores. And he’s expanded Apple across the globe.

In addition to stockpiling cash, he developed Apple Pay and credit card. But what I think is critically important is that after the death of Steve Jobs, he picked up the ball, ran with it. He didn’t just restore Apple to financial health, he built it into the world’s first one trillion, and the first two trillion $ company, and continues to set standards of excellence across the globe.

Instead of focusing on privacy and security, he could have focused on building out advertising revenue and selling user information to third parties. But he did not, and it is unparalleled among Apple’s rivals.

I think you are correct in the zero sum game, but I doubt if the stockholders and management of companies like Research In Motion (BlackBerry), Gateway, Motorola, Nokia, along with the mobile music and phone units of Sony, LG, etc., etc., would agree about the little guy.

What I find very interesting is that when the Fortnight controversy hit the press, it initially seemed to me that they were the brave little David risking its life against the evil Goliath, Apple. A quick search turned up information that Fortnight is part of Epic Games, one of the largest, most profitable gaming companies in the world. And Epic/Fortnight is owned by Tencent, one of the largest global companies in the world.

Here’s an example of one of their many development initiatives:

https://www.epicgames.com/site/en-US/news/announcing-a-1-billion-funding-round-to-support-epics-long-term-vision-for-the-metaverse

I’m afraid I really don’t know what the point of this piece was. We in Apple fan land knew and know they are doing well. Nobody around these parts seriously doubts the world’s largest company has done well and knows how to look out for itself. I don’t think anybody is worried Tim might have to go bag groceries any time soon. Or was this supposed to be an “I told you so”? I’m really not sure.

Well how is that a big accomplishment when they’re stockpiling $200B? They’d be idiots not to spend what is to them peanuts in order to ensure their supply.

Not saying it wasn’t a good move, but congratulating them for it is as if you were to congratulate an adult for going to the bathroom rather than wetting their pants.

The transition to AS was undoubtedly a good move. But this article fails to investigate the other side of that plan. Apple designs its own chip, but it has right now just one company capable of building it. It has exactly one M1/A14 foundry. If TSMC has a problem at that plant (next time perhaps a bit more serious than today’s issue), Apple could be in trouble. Considering China and its increasingly brazen bully stance towards Taiwan (along with the rest of the world), this risk involves substantially more than just bad weather or contaminated gases. It would be nice to hear how Tim plans on getting TSMC to build AS in a free democratic country not threatened by one of the world’s most atrocious dictatorships. And what’s the due date on that plan?

So in essence, are we to be surprised that a global corporate behemoth that attempts to insert itself in all of everybody’s lives and at all times of the day (Amazon is probably an even greater example here) has managed to ride out the pandemic well while a low-end grocery chain that markets to addicts and poor people faces trouble? Of course Apple did well, but again, is there any subtlety to this point here? “For whoever has will be given more, and they will have an abundance.”, Mathew 25:29. So congratulations, Tim Cook, I guess, for having turned much into more, in a biblical sense.

Re: black swan, personally, I find Taleb a conceited ass. His books meander on forever, full of repetition and redundancy, incredibly annoying to read all the way to the end. He’s marketed the hell out of himself and I certainly give him that, but when all is said and done I find him rather potemkin TBH.

Simon, you’re being entirely too dismissive. None of the things that the article mentions are actually that obvious and, more importantly, in most of the cases there’s active pressure in the other direction. For example:

Well, yes, but the smart decision is to hold onto the cash in the first place. Wall Street has been a drum beat for a decade critiquing Apple for holding onto that much cash, and Apple has steadily ignored them. Are there a lot of other companies holding onto giant stacks of cash?

Your criticism seems to boil down to “Yes, we know Apple is successful, you don’t have to tell us how they’re successful” which is odd.

The goal was to point out to those who don’t pay a lot of attention to Apple’s corporate moves (like stockpiling cash, maintaining both physical and virtual distribution systems, and focusing efforts on different geographic areas) that Apple’s doing really well for reasons that go beyond just the products we all see. And as we know from Apple’s past, quality products aren’t enough on their own.

As far as the reliance on TSMC, it’s already building a factory for that in Arizona.

Stockpiling was a truly visionary move. The powers that be among the auto companies across the globe are neither dumb, unaccomplished, incompetent in their respective fields; nor are they, on average, likely to be incontinent. In addition to cars, computer and mobile devices, home appliances, medical device and drug manufacturers, robotics, television, broadband and broadcast providers, game hardware, cash register and banking equipment,and a host of other manufacturers, are suffering because of chip shortages. Their top level supply side guys are likely to have backgrounds similar to Tim’s, but they don’t seem to have the vision.

Things are so bad that Intel is walking around with their hands out for billions of cash to subsidize building a plant to build chips in Europe:

https://www.reuters.com/technology/intel-seeks-8-bln-euros-subsidies-european-chip-plant-politico-2021-04-30/

Except that plant isn’t geared towards Apple’s latest and greatest. It’s being built for a 5-nm process. By the time the plant goes into production (2024), Apple’s 5-nm A14 and M1 will be 4 year old CPUs. Apple’s current Mac and iPhone CPUs by 2024 are expected to be on a 2-nm process for which a brand new plant is just now being built in, guess where, Taiwan of course. That’s not to say they won’t be manufacturing chips for Watch or AppleTV or older hardware in AZ, but that plant does not look to be what will be making Apple’s high-volume orders for current-gen hardware.

But Apple is far from TSMC’s only customer and not everybody needs 2mm chips. If this factory can take a lot of the load off of the other factories in Taiwan, that will also have a huge impact.

And although it’s taking a long time to get this factory up and running, we don’t know how long it may take to upgrade its equipment to a smaller process in the future. I think it’s safe to assume that it will be faster than starting from nothing.

That’s beside the point. It wasn’t about capacity, it’s about Apple receiving its latest and greatest from a plant that’s not threatened by China. And of course ideally from more than just one foundry (company). Similar to how they otherwise also strive to have several suppliers whenever they can.

TSMC has plans to build six factories in Arizona over the next few years:

https://www.reuters.com/technology/tsmc-says-construction-has-started-arizona-chip-factory-2021-06-01/

They do plan to begin mass production in AZ in 2024. In the meantime, they will continue to build chips for Apple in Asia. This past December, Apple locked in production for the next generation iPhone. And here’s what’s coming in 2022:

“Keep in mind that 3nm chips will not just be for mass producing the A16 Bionic expected to fuel the iPhone 14 series. The advanced manufacturing process may also be used to make chips for Apple’s iPad and Mac lineup, so a large product base means TSMC will have to start trial production much earlier to achieve a healthy yield in the coming months. In related news, TSMC has reportedly started mass production of N5P chips, or the improved 5nm technology for the iPhone 13 line.“

What’s so unusual about Black Swans?

I know the article was focused on Apple, but it’s fascinating to me to see which other companies (particularly in the trillion-dollar-value range) managed for mostly different reasons to have huge revenue increases.

Amazon was severely constrained early in the pandemic, handled infection exposure of its workers’ terribly, did not improve its reputation — and grew and had a huge market cap increase, too! They ultimately did start delivering well again, and proved both we rely on them too much but that nobody else was well suited, either (because they dominate many markets).

I was also thinking “robust” in terms of diversification of product lines. Apple has been very aggressive in expanding its hardware and software offerings ever since Steve Jobs returned to the company. They’ve even moved successfully into financial services. By rolling their own chips, they are, and will be, greatly rejuvenating existing product lines. And there could even be an M2 chip in 2022. Air Tags and New Mag Safe pack are their latest new product introductions. And though they are still badly kept secrets, it looks like Apple is planning moves into transportation, VR/AR in the near future.

Looks like Google is becoming increasingly antifragile as well. Like Apple, they’ve designed their own chip for their upcoming Pixel phones. They’ve been designing their own chips for their servers for a while:

Zombies don’t use Androids at all?

It appears that Apple by now has become a dogma, an American dogma that is.

Believe it or not.

It looks like Apple is the only company not affected by the silicon shortage.

I think that having a CEO with a strong supply chain and operations background in supply chain has a lot to do with it. But I do remember reading that Tim Cook said the chip supply shortage will be affecting Apple down the line.

TSMC, which supplies chips to pretty much everyone, is raising prices 10-20%.

Now GM has had to shut down production due to the chip shortage.

Tesla has started building its cars with chips they designed in house, but they ran into a shortage in Shanghai last month. The chips are are back into production once again. VW recently announced that they will be using chips they designed in a new line of self driving cars:

And Microsoft’s Xbox and Surface are really suffering: