#1459: AirPower canceled, Apple TV+ and Apple Card details, watchOS 5.2 extends ECG

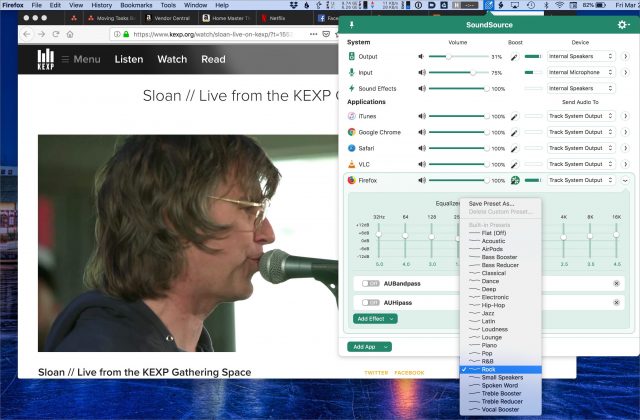

Sadly, Apple’s cancellation of the AirPower wireless charging mat isn’t an April Fool’s joke—everything in this issue of TidBITS is entirely real (or at least obvious speculation). On the plus side, international users of the Apple Watch Series 4 will be happy to learn that watchOS 5.2 makes the ECG feature available in more countries. Finally, we look more deeply at Apple’s announcements of Apple TV+ and Apple Card from last week’s special event. Notable Mac app releases this week include Security Update 2019-002 (High Sierra and Sierra), Safari 12.1, macOS Server 5.8, Apple Configurator 2.9, SoundSource 4.0.1, Default Folder X 5.3.6, Cardhop 1.2, Ulysses 15.2, and Parallels Desktop 14.1.3.

Apple Cancels AirPower, Can’t Take the Heat

Apple’s long-promised AirPower wireless charging mat is history.

Matthew Panzarino of TechCrunch has published a statement from Dan Riccio, Apple’s senior vice president of Hardware Engineering, that says:

After much effort, we’ve concluded AirPower will not achieve our high standards and we have cancelled the project. We apologize to those customers who were looking forward to this launch. We continue to believe that the future is wireless and are committed to push the wireless experience forward.

So that—canceling an announced product—is a first, as far as any of the TidBITS crew can remember. Thumbs up to Apple for acknowledging its failure and not just quietly sweeping AirPower under the rug and hoping we’d all forget about it eventually. Better to cancel a product now than ship something that works poorly—like the infamous butterfly keyboard in the MacBook Pro and MacBook Air—and disappoint customers regularly.

Simultaneously, though, thumbs down to the statement for putting the blame on AirPower itself, as if the product somehow didn’t try hard enough, rather than its cancellation being a failure of Apple management (in promoting something that engineering couldn’t deliver) and Apple engineering (in agreeing that they could build AirPower). And it’s particularly embarrassing that the second-generation AirPods have a picture of AirPower on the box, and iOS 12.2 betas had support for it.

What went wrong? Physics is unforgiving. Last year, Sonny Dickson published an article suggesting that AirPower ran into problems with heat management, inter-device communication, and mechanical and interference issues (see “Apple’s AirPower Wireless Charger: What Happened?,” 17 September 2018). Matthew Panzarino says he heard much the same from his sources.

Given the customer desire for AirPower—in a recent Clockwise podcast, all four participants answered the question of what they wanted to see next from Apple with “AirPower”—I can only imagine that engineers around the world will be tackling the problems Apple was unable to solve. In the meantime, there are numerous Qi-compatible chargers that can charge a single device at a time—see “13 Qi Wireless Chargers for the iPhone Reviewed” (22 February 2018) for those we’ve examined.

How about you? Are you using a Qi-compatible charger that you can recommend to those who had been holding out for AirPower? Share your experiences in the comments.

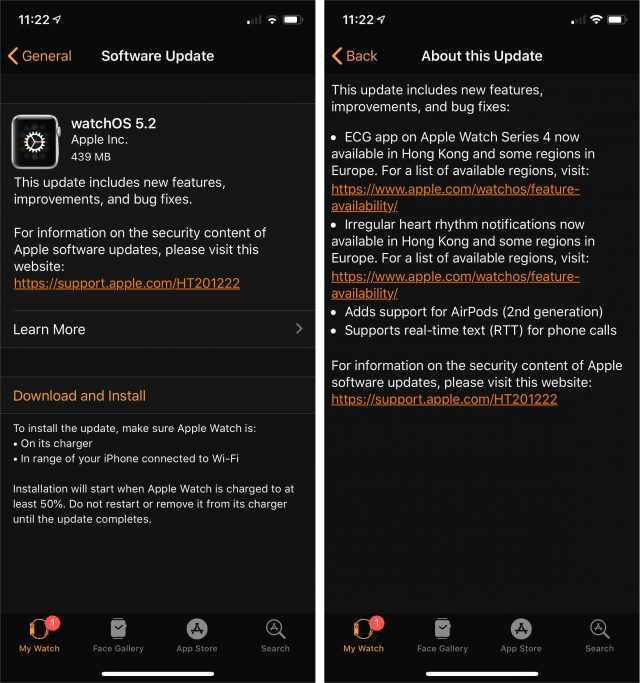

watchOS 5.2 Extends ECG Support and Supports New AirPods

Several days after the rest of its operating system updates, Apple finally released watchOS 5.2, which most notably extends the Apple Watch Series 4’s ECG to Hong Kong and many European countries. Previously, these features were available only in the United States, Guam, Puerto Rico, and the US Virgin Islands, but Apple has now added Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Hungary, Ireland, Italy, Luxembourg, Netherlands, Portugal, Romania, Spain, Sweden, Switzerland, and the United Kingdom. Users of other Apple Watch models in those countries can also now get irregular heart rhythm notifications.

For those who don’t have an Apple Watch Series 4 or aren’t in one of these countries, watchOS 5.2 also adds support for the second-generation AirPods (see “Second-Generation AirPods Gain “Hey Siri” and Optional Wireless Charging,” 20 March 2019) and supports real-time text (RTT) for phone calls.

You can install the 439 MB update using the iPhone’s Watch app—go to Watch > General > Software Update.

Apple Reveals Its Vision for TV

We’ve spent years reading the tea leaves to try to figure out Apple’s TV vision. Every now and then, Apple gives us a glimpse, as it did in 2015 when Tim Cook declared that the future of TV was apps (see “The Fourth-Generation Apple TV Is Coming at Last,” 9 September 2015). Unfortunately for Apple, apps didn’t pan out as the future of TV, so Apple put TV on the back burner until it could come up with a new approach.

Now we know what Apple’s latest TV plan is, and it’s a doozy, consisting of six parts:

- A redesigned Apple TV app focused on services. (Notice that Apple no longer calls it “the TV app,” but “the Apple TV app.”) This new app will also be available on the Mac later in 2019, probably with the next major release of macOS.

- From this new Apple TV app, you’ll be able to subscribe to individual channels, called Apple TV Channels. Yes, à la carte programming is finally here! Initial partners listed are CBS, Epix, MTV, Showtime, Smithsonian Channel, and Starz.

- The new Apple TV app will support existing streaming services like ABC, Amazon Prime Video, ESPN, Hulu, MLB, and NBC. But not Netflix, which undoubtedly sees Apple TV+ as direct competition.

- You’ll be able to watch live content inside the app through partners like DirecTV Now, PlayStation Vue, and Spectrum (see “Spectrum’s Zero Sign-On App Comes to Apple TV,” 23 January 2019).

- Later in 2019, Apple will launch its own streaming service with original content, called Apple TV+, in 100 countries.

- Last, but certainly not least, the Apple TV app will be escaping the confines of the Apple ecosystem. We already knew about Apple’s deals with LG, Samsung, Sony, and Vizio (see “Apple Opens iTunes Video and AirPlay Up to TV Rivals,” 9 January 2019), but Apple has now announced that Apple TV will also be coming to Amazon’s Fire TV and Roku. With that, Apple has covered most of the major players.

Many observers have mixed up the Apple TV app, Apple TV Channels, and Apple TV+. Yes, it’s confusing, but they’re all distinct offerings.

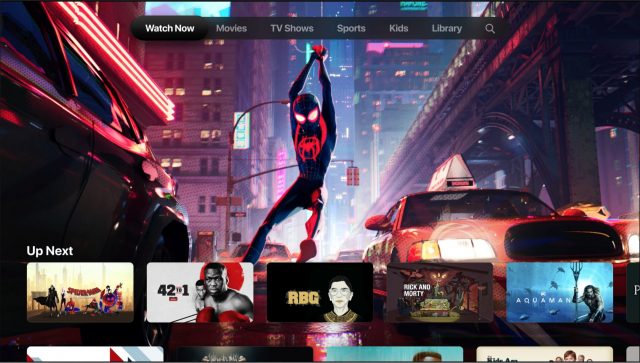

Redesigned Apple TV App

Apple said it would roll out the new Apple TV app in May 2019. We presume it will come with at least some of the new channels and services. Likewise, the Apple TV app for third-party devices will launch about that time, starting with Samsung.

From what we’ve seen of the new TV app, it doesn’t look much different than the old one. You can still use it to access your purchased iTunes movies and TV shows. One nice new touch is a dedicated Kids section, which lets children browse shows by character, much as Netflix has allowed for years.

The new TV app will have a strong focus on personalization. A new “swipe” feature lets you effectively channel surf between shows, the difference being that these shows will be ones that Apple’s algorithms think you will like. We’ll see how well it actually works once Apple releases the app in May.

Apple TV Channels

Apple said very little about Apple TV Channels, merely listing a few partners and emphasizing that you’d be able to pick and choose among them. No mention was made of pricing, possible bundle discounts, or much of anything else.

As a result, it’s hard to say if Apple TV Channels will be interesting, or cheaper than subscribing to the likes of Showtime and Starz separately. At the moment, it looks as though Apple intends Apple TV Channels as merely a front-and-center reminder to Apple TV users that they can subscribe to more content directly (and give Apple a cut).

As with the Apple TV app, we’ll likely learn more in May, and then we should be able to get a sense of whether Apple is providing access to enough of a media library to compete with Netflix.

Apple TV+

There have been endless rumors about an Apple streaming service chock full of the original content that the company has spent a reported $1 billion on so far, and Apple was finally ready to reveal what it has been working on. Well… kind of. Apple showed what amounted to a few short clips from its shows after a celebrity-packed yet awkward presentation that could best be described as “Apple’s upfronts.” Upfronts are annual springtime industry events, dating back to the early 1960s, in which TV networks announce their new shows to advertisers.

Announcing their respective projects were Steven Spielberg (Amazing Stories); Reese Witherspoon, Jennifer Anniston, and Steve Carrell (The Morning Show); Alfre Woodard and Jason Momoa (See); Kumail Nanjiani (Little America); JJ Abrams and Sara Bareilles (Little Voice); Big Bird and fellow muppet Cody (Helpsters); and the all-time queen of daytime TV, Oprah Winfrey (a pair of documentaries). It was a star-studded event that had most technology journalists yawning and scratching their heads, not in the least because, other than knowing that Apple is truly working on these rumored projects, we don’t know much more than we did before.

However, that rollout was aimed not at Apple’s usual audience of technology reporters and aficionados, but at those who work in, live for, and gossip endlessly about what Hollywood calls “the biz”—show business. That industry has been riding a hellacious roller-coaster of disruption over the last few years: just the week before Apple’s event, many entertainment world workers were laid off as Disney’s acquisition of 21st Century Fox became final. People in the biz want to know, “Is Apple for real,” “Is it going to become a major player,” and “Should I send in my resume?”

Apple emulated the traditional show business ritual of the upfront to send a message. Two messages, really. One to the bruised and insecure working people of Hollywood: “We’re here, we have a plan, we’re serious, and we have money.” And another to the Hollywood studios, streaming companies, and others hesitant to do business with Apple: “Don’t want to stream your content with us? We can make our own, and we have Spielberg and Oprah. Now do you want to do lunch?”

We won’t know for at least six months whether, beneath all of the Apple TV+ rollout’s phony tinsel and glitter, there’s real tinsel and glitter, but we’re not willing to bet that there isn’t. On the other hand, a comedy series about 19th-century poet Emily Dickinson starring Hailee Steinfeld and Jane Krakowski? Who gave the green light to that?

Apple TV As Service First, Hardware Second

While Apple’s TV announcements were wide-ranging, there was a central theme: Apple TV isn’t merely a hardware box anymore, but a suite of services that will encompass everything related to TV, including cable and satellite TV equivalents, rented and purchased content, and whatever exactly Apple TV+ will end up being. And that’s reflected in Apple placing the Apple TV app on third-party devices.

In “Apple Opens iTunes Video and AirPlay Up to TV Rivals” (9 January 2019), Josh predicted that Apple might drop the hardware Apple TV entirely. He’s less confident about that now, not so much because of Apple’s TV announcements, but because of the Apple TV’s role in the Apple Arcade gaming service (see “Apple Announces Apple Arcade Gaming Service,” 25 March 2019).

With the point of the Apple TV hardware shifting more toward gaming, we shouldn’t expect a cheaper Apple TV “dongle-type” model anytime soon. Apple could ship a cheaper version without the $59 Siri Remote included (you’d just use your iPhone or iPad instead), but that’s been possible all along and hasn’t happened. But we do wonder now if we’ll see an Apple-branded game controller later this year, or perhaps even a gaming-focused Apple TV model.

In any case, the overall picture is clear: Apple intends to pour significantly more resources into its TV-related services, and those services will be available on the most common TV platforms. However, it will continue to offer the Apple TV HD (the new, blissfully shorter name of the fourth-generation Apple TV) and Apple TV 4K as premium products that add gaming to the mix. That’s a strategy that should make everyone (relatively) happy.

Apple Card: More Than Just a Credit Card

Apple has already made big changes to how we buy things, now that it’s possible to use Apple Pay to check out with a flick of the wrist or a press of a button. And Apple Pay has significant competition, with Google and Samsung promoting their own mobile payment systems, so many transactions that used to require plastic and signatures are now virtual. Apple Pay alone is on track to process 10 billion transactions this year.

Apple’s recent announcement of the new Apple Card service may at first blush seem like just another added feature—now Apple Pay can have a line of credit. But it’s possible that this will impact the credit card industry almost as profoundly as how Netflix affected Blockbuster when it started sending DVDs in red envelopes.

How Apple Card Works

Apple Card is a credit card that lives in your Wallet app, supplemented by an unusual physical card. The application process will be built into the app when Apple Card becomes available in the United States sometime in the middle of 2019—no mention was made of other countries. Apple Card accounts work only for individuals; multiple cards aren’t supported.

Apple Card uses two different methods of payment, Apple Pay and the Mastercard network. As with current Apple Pay transactions, there’s no permanent number associated with your account, and therefore no number printed on the physical card—the Wallet app generates a unique number for every transaction, which happens behind the scenes.

For Mastercard transactions—which you’ll use whenever purchasing from a vendor that doesn’t take Apple Pay—a tap on the card in Wallet brings up your card number, expiration date, and CVV security number. These are assigned when you open the account, but for security purposes, you can recycle those numbers and get issued new ones at any time, right in Wallet.

You’ll need the physical card only when making purchases in person at vendors that don’t accept Apple Pay—the card has both a chip and a magnetic stripe. Left unclear is how the magnetic stripe works when you can change the number virtually. Historically this would require writing the new number to the magnetic strip, but perhaps some networking magic pulls the latest number from Apple Pay at the time of purchase.

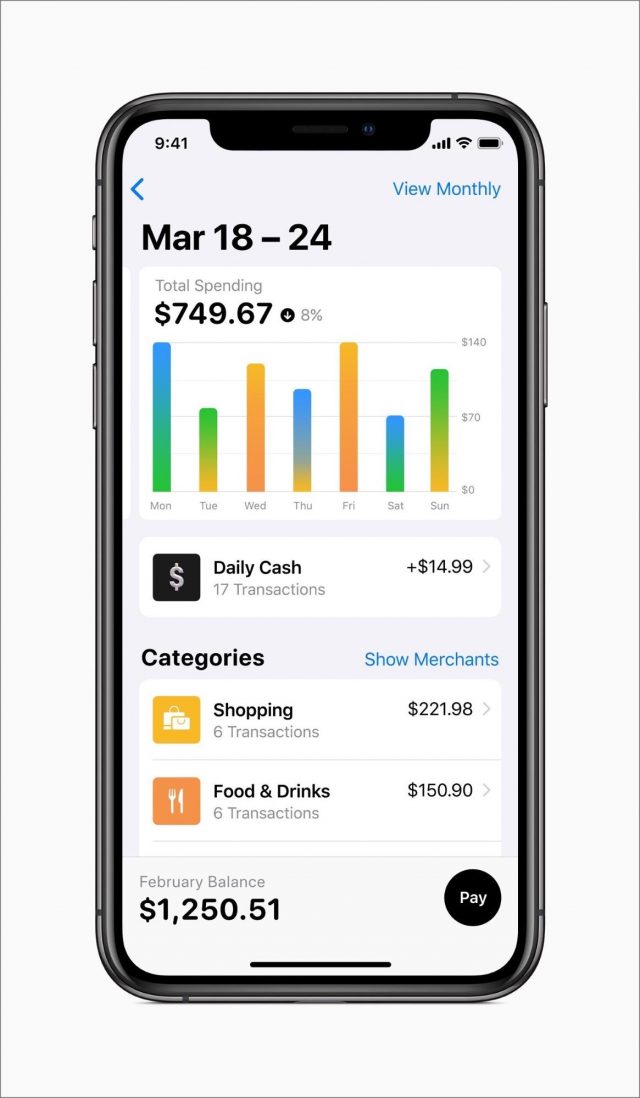

Bring up your Apple Card account in Wallet, and you’ll see the kind of data you’d expect from a credit card Web site, combined with financial analysis and presented with Apple design. The launch screen shows you your balance and available credit, a thumbnail chart of your recent purchases, and a reminder of when the next payment is due. All your purchases are automatically categorized (it’s unclear if you’ll be able to set your own) for grouping in multi-colored graphs so you can see what you’ve spent on restaurants or car expenses. The report also automatically includes weekly and monthly charts and summaries.

It’s at the transaction level that the Apple Card interface has some real wow factor: pull up your transactions, and each one will be clearly described instead of showing the incomprehensible abbreviations that sometimes appear on statements. It even shows logos for known vendors. Tap a transaction, and a map comes up showing you where you made the purchase—good for a reminder of what you purchased, or evidence to dispute a charge.

Behind the pretty pictures, Apple Card’s financial features are quite different from what you may be used to. During the presentation, Apple said that there are no fees, period: no annual fees, no late fees, no cash advance fees, no over-limit fees. Plus, Apple said, and this is worth quoting, “our goal is to provide interest rates that are among the lowest in the industry.” Even if you miss a payment, your interest rate won’t go up.

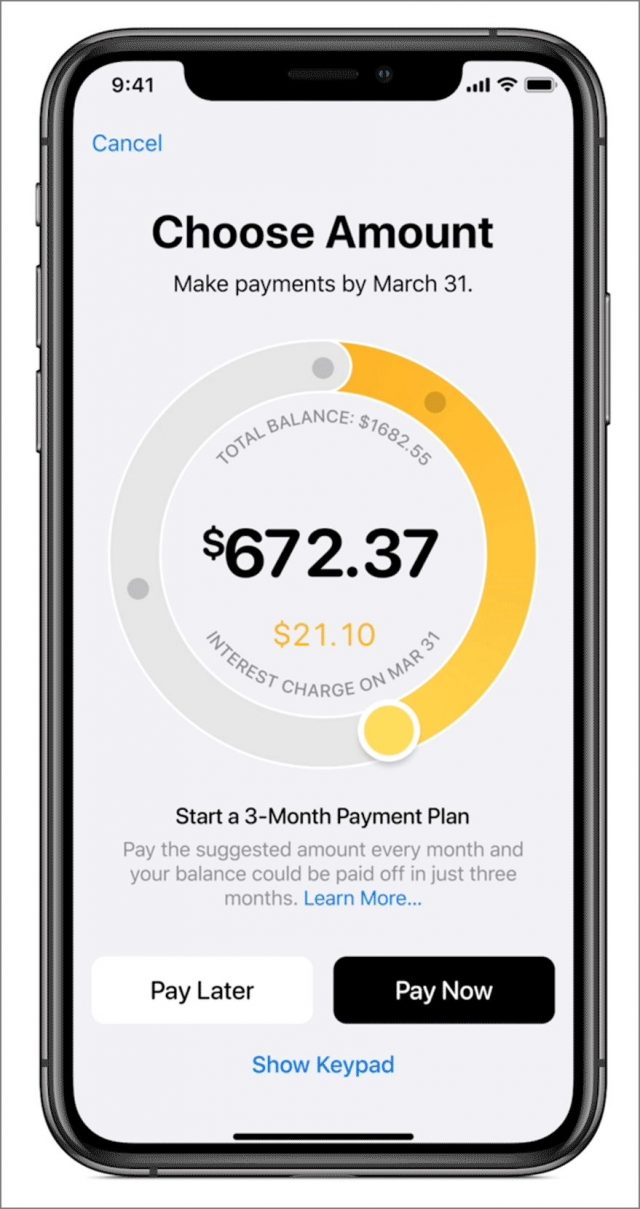

When you make a payment, which you do through the Wallet app, you can use a calculator that lets you set a payment less than the full amount, and shows you what the resulting interest charge will be. Obviously, it’s zero if you pay the full amount every month, but otherwise, you’ll know precisely what you’re being charged to carry over debt. The slider includes suggested amounts to pay: carry a large balance and the circle is red, pay a decent chunk and it shifts to yellow, or pay most or all of it for green. You’ll always know when the payment is due: it’s the last day of the month, for everyone.

The Wallet app will also provide “smart payment suggestions” meant to help you lower your interest charges or manage your money better, such as setting up multiple monthly payments timed to your paychecks. Wallet will prompt you that more frequent payments will lower your interest charges—which implies that interest accrues daily since the more standard monthly accrual method doesn’t lower the interest you’ll owe if you pay a week early.

Instead of points, rewards, or other incentive programs, Apple Card offers cash back—same-day cash back, called Daily Cash. You’ll be credited 3% for purchases with Apple (including the App Store), 2% for other Apple Pay transactions, and 1% when using Mastercard. You can apply Daily Cash to the card balance, use it for any other purpose within Apple Pay, or send to a bank account, and there’s no upper limit on how much you can receive.

Fraud protection is built in by sending you a notification whenever a charge is made, which is commonplace with other credit card apps. But other apps don’t give you a button to tell Apple the charge was unauthorized—Apple claims it’ll then take care of it without bothering you further—and most don’t offer a live 24/7 text chat in Messages you can drop into for any other problems. (Those who do don’t offer Apple’s no-wait promise.) It seems likely that Apple is leveraging the still-in-beta-since-iOS-11.3 Business Chat service. The prominence of the chat suggests that if you prefer to get a human being on the phone, well, good luck.

Their other major security feature is mind-blowing: much as Apple can’t read your iMessage conversations in real-time, the company says that it knows nothing about your transactions, their size, location, or any other metadata. That’s all handled by Apple Card’s banking partner, Goldman Sachs. The Wallet app stores all of this information locally to make graphs and show you the details you want. Apple hasn’t said whether you’ll be able to delete locally stored transaction data for security purposes, but the only way to get to it or any purchase capability is with Touch ID or Face ID. What Apple has done here is create a purchasing platform where Apple itself isn’t part of the loop.

Most likely, this is done with end-to-end encryption from Goldman Sachs servers through Apple to your iOS device. Apple is warranting that Goldman will use your transactional data only for account purposes and will never share or sell it to third parties. That’s a sweeping statement for one corporate partner to make on behalf of another and puts Apple on the hook both for Goldman’s deliberate actions and for any errors or attacks that disclose data. It’s a shockingly user-friendly move in the context of the credit card industry, as is giving up the rich data mine of information that these transactions create. Beyond that, the engineering commitment necessary to present the data Wallet has to process, in a way that exposes none of it to Apple, is stunning for a dozen technical reasons. The privacy promises Apple is making required massive effort, indicating that this is a true company value rather than a marketing maneuver.

How Apple Card Might Change Consumer Credit

In fact, scratch the surface, and there’s quite a lot that’s stunning about these Apple Card policies. What appear to be a few user-friendly features could have massive ramifications.

Purchasing Decisions and Interest Rate Calculations

One key thing to understand about financial technology is that the tools we use affect the purchases we make. If you pay with your watch versus pulling out a card, you’ll buy different things—more accurately, you’ll buy more things because you’re bypassing psychological barriers involved with cash and plastic. There’s a reason Amazon patented one-click purchasing.

Likewise, the data you have affects your behavior. How long do you spend deciding whether to make a $500 purchase and is that more time than it took you to add a $500 option to a $40,000 car? The price of the car inclines you to think differently about the $500—especially if it becomes less of a blip in a monthly payment. This effect is called priming.

The credit card industry is geared around getting you to pay more and to never be quite clear on how much more. Say you buy a $600 item because it’s on sale for $500, and you use a credit card because it’s outside your immediate budget. That amount might cost you $10 in interest each month—carry that balance for a year, and that sale purchase was silly. The $100 came out of the retailer’s pocket and went to the bank (with a little extra), so the bank doesn’t want you to think of it as an added cost for that purchase. It’s just a fee. Meanwhile, you “saved $100” and are inclined by this thinking to do so again in the future.

If you know the basics of personal financial management, you know that this kind of thinking is not merely irrational, it’s dangerous—the slippery slope to crushing debt loads. But this isn’t about rationality. The psychological effects that the credit card industry triggers are hardwired—chimpanzees in primate labs demonstrate the same irrational financial behaviors we do (substituting grapes and sugar water for folding money).

Apple is upending this by dropping all fees and by telling you precisely what it will cost you to underpay your balance. Having that information primes you to make different choices—you’ll know from the slider and suggested payment plans that $500 out of the budget this month is an extra $10 next month, and that same $10 every month until you pay it off.

Consumer advocates have been fighting to force credit issuers to provide this information for years, but the best they’ve been able to get out of regulators are those 40-page pamphlets that no one reads. Their biggest victory to date has been the summary box on every application and acceptance letter. Like an FDA ingredient label on food, it boils down the most salient costs of the card. But a consumer needs non-trivial math skills to understand this information—if your card has a 24.9% interest rate and a late fee of $25, how much interest will be added and what will your balance be in 3 months if you pay off half your balance? This involves compound interest—even math whizzes usually need a spreadsheet to calculate it. Apple Card brings those skills to the masses.

This difference is crucial. Earlier, I introduced good credit practices by saying, “if you know the basics of personal finance management.” The fact is, very few people do. We routinely use credit instruments where calculating interest requires a spreadsheet and knowing how and when to raise a decimal to the twelfth power, in a country that routinely prints a suggested 20% tip calculation on restaurant receipts because people don’t know it means “divide by 5.” It’s not an overstatement to say that some credit card issuers prey on their customers’ ignorance and exploit normal but irrational human behaviors. Apple turns this upside down: Apple Card and Wallet subtly teach you about credit and create virtuous feedback loops that likely improve your behaviors on an unconscious level. It’s the same priming, but on the side of the angels for the first time.

Once Apple starts doing this, the question for every other credit card issuer in the country will become, “Why don’t you?” And because this is part of a free-market competition between private companies, those in favor of minimal regulation of the financial industry can do nothing about it—Apple has moved it from a political issue to a consumer feature.

The Implication of No Fees

Apple gets to look extremely generous with its Apple Card fee structure. It’s a compelling argument to switch from more expensive cards with complicated reward structures to no fees and daily cash back. So one might ask—why? Does Apple hate money?

The answer involves some psychology and some microeconomics. Credit card issuers usually want to find the right customers. Customers who carry no debt are potentially money losers, eating the cost of the rewards and paying no interest, which is why high-reward cards have annual fees. Customers who carry a lot of debt run up huge interest, which is great for the issuers… unless those people go bankrupt. It’s no longer possible to walk away from debt via bankruptcy the way you once could, but credit card issuers still get pennies on the dollar. The sweet spot, toward which these companies herd their customers, is where the credit card issuers are extracting as much profit as possible without pushing too many customers into bankruptcy and turning future revenue into written-off unpaid debt. That’s why there are due dates, minimum payments, and late fees—they ensure a regular flow of income from even the biggest debtors because they are incentivized to avoid more fees.

What’s the incentive to pay off the Apple Card, by comparison? Why even have a due date, if there are no fees for being late? (That is, no additional cost over and above the increasing interest that happens every day the debt is carried. It’s just that the due date isn’t special.)

Here is where Apple gets to exercise its power in an interesting way: miss a normal credit card payment and it costs you money, but miss an Apple Card payment and every Apple device you own might degrade in service. Just as failing to pay for iCloud prevents any new uploads to your paid iCloud storage, Apple could deter you from going into arrears on Apple Card by affecting everything you do with an Apple ID. If you’re paying for other Apple services, you might also lose access to Apple Music, be unable to purchase new apps, or have problems using apps that require ongoing subscriptions. Now consider the free services Apple provides, such as iCloud password and calendar syncing, which could also be suspended at the same time or at a later date for customers who still haven’t paid.

Apple doesn’t need your late fees. Apple could apply pressure in other ways to make sure Apple Card is the first card you pay.

Does Apple Really Intend to Lower Interest?

I am more skeptical about Apple’s claims that it wants to be generous regarding interest. The business of lending money is all about interest. Goldman Sachs isn’t interested in a partnership with a charity.

Part of the answer lies in the unannounced details of what merchants will pay. When you buy something with a credit card, the merchant typically pays 2–3% to the credit card issuer. (That cost is generally built into the overall price of the purchase; it’s why gas stations advertise separate cash and credit prices.) Another smaller deduction is made for the credit card processor—for example, CNN reports that Apple currently makes under 1 cent for each Apple Pay transaction. Multiply by 10 billion transactions, and that’s some nice money. But it’s nothing compared to a percentage of the transaction.

Apple is still the processor of payments that take place over Apple Pay, but it also has a relationship with Goldman Sachs for Apple Card charges. Financial news coverage is saying Apple will now share in the issuer fees that Goldman Sachs receives from the merchant, and maybe other revenue. Let’s assume Apple will make a 1% profit after shouldering business costs and its share of the 2% rebate to cardholders. The average credit card charge in the US is $93, which means Apple makes less than 1 cent on Apple Pay, but 93 cents for whatever fraction of 10 billion transactions end up being paid through Apple Card. That’s a strong incentive for Apple to sign up as many customers as it can safely manage.

Merchant fees also make it easier for Apple to promise lower interest rates to consumers—but there are some indicators in contradiction to the company’s marketing promises. Apple did not announce rates at its presentation, but they are available in the Apple Card fine print: from 13.24% to 24.24% (based on prevailing economic conditions; the range could be different in a few months). The average interest rate for credit cards right now is 17.67%, so Apple’s range isn’t exactly the “lowest.”

There’s one other point to consider regarding interest rates, which is that it will be difficult to know whether Apple lives up to its low-interest promise. As individuals, we can compare the rate offered by Apple against our rates on other cards. But we have no way of knowing whether this is happening across the board—the aggregate data is private. Goldman Sachs has to file various public reports disclosing some operational data, but I can’t determine whether Apple Card interest rates are something we’ll see clearly broken out. (If I find out after publication, I’ll add it in the comments.)

Apple could have gone a different path. Apple Card is issued by Goldman Sachs, but not in New York City. It’s issued by the Goldman Sachs branch in Salt Lake City, Utah. Like Delaware and South Dakota, Utah is particularly friendly to credit card issuers, and by locating their consumer credit arm there, Goldman and Apple can charge higher rates and enjoy less-restrictive regulation than would be the case in New York or California. That location likely predated Goldman’s conversations with Apple, but given the tight integration that must be taking place in this partnership, Apple could have forced a new location and made a binding promise about Apple Card’s rates by issuing cards in a state that caps at a lower ceiling. Draw your own conclusions as to why this did not happen. It’s one of the few things about Apple Card that’s just like every other credit card.

An Even Bigger Picture

One last thing is striking about the sum total of Apple’s announcements, and it has little to do with financial matters. Recently, Senator Elizabeth Warren made headlines by talking about bringing antitrust charges against big tech companies, including Apple. This led to a lot of uninformed comments about how such breakups could never happen. That’s historically inaccurate. Both Standard Oil and AT&T in its “Ma Bell” days were far more integrated and centrally crucial to the American economy than Apple, Amazon, Facebook, and Google are today, and the federal government broke up both. The current political climate is different, but those who think it couldn’t happen again should read the writings of people who said it would never happen to AT&T.

There is no way of knowing how successful Elizabeth Warren will be in her presidential bid, of course, but she’s also a senator, and now that she’s put the idea of breaking up Big Tech into the political marketplace, others are likely to take up the idea or propose parallel options. That doesn’t mean that such a thing will occur, but it does suggest that the concern is not going away, and that in turn puts public pressure on corporate shoulders.

In several ways, the Apple Card announcement paints a much larger target on the company’s back. There are solid technical and business reasons why it’s consumer-friendly for Apple to sell iPhones, run the App Store, and ship iOS apps independent of what’s part of iOS. That’s a case Apple could do well with in court.

But when Apple runs the bank that you use to pay for Apple products or uses its control of Apple Pay to set pricing for Apple Card transactions, that’s when it starts to look like an oil company controlling everything from the well to the refinery to the gas station. Apple is also proposing to sell you TV hardware, connect you to TV providers, and subscribe you to its own TV content—this is already drawing attention, and there’s no technical argument against breaking up such business integration.

Combine this, however, with what I said earlier: the consumer-friendly processes Apple is introducing, without any government intervention, have been a goal of Elizabeth Warren’s side of the political spectrum forever. (And specifically for Warren, who came to politics after becoming known as an economics professor promoting such ideas—she’s the woman behind the creation of the Consumer Financial Protection Bureau.) What Apple announced is a win for consumer advocates, on par with how environmentalists would feel about Exxon Mobil announcing that it would start closing gas stations to replace them with wind power for electric vehicles.

It’s fascinating that just as the American political spectrum is widening in both directions to include discussions of previously “impossible” ideas—and other major markets like the European Union and China undergo their own chaotic political and economic changes—Apple announces that it’s getting into the financial world in a big way. Just as the iPhone blew away every mobile phone with a keyboard, I believe that the Apple Card could mark a similar turning point for consumer finance. First for what customers expect from their financial service providers, second for government action driven by those changes, and finally for the corporations themselves. The more people who use Apple Card, the faster these changes could occur.

Josh Centers

2

comments

Josh Centers

2

comments

Josh Centers

16

comments

Josh Centers

16

comments